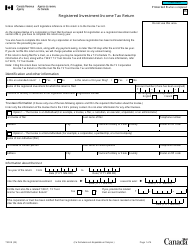

This version of the form is not currently in use and is provided for reference only. Download this version of

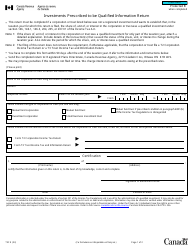

Form T5SUM

for the current year.

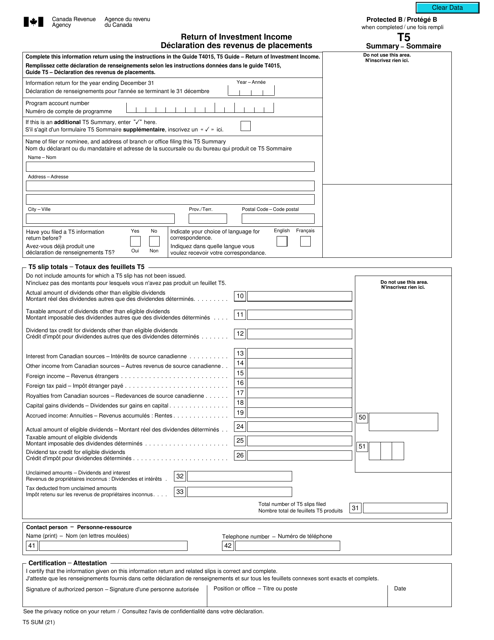

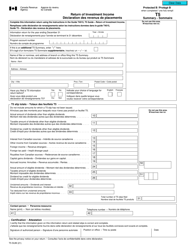

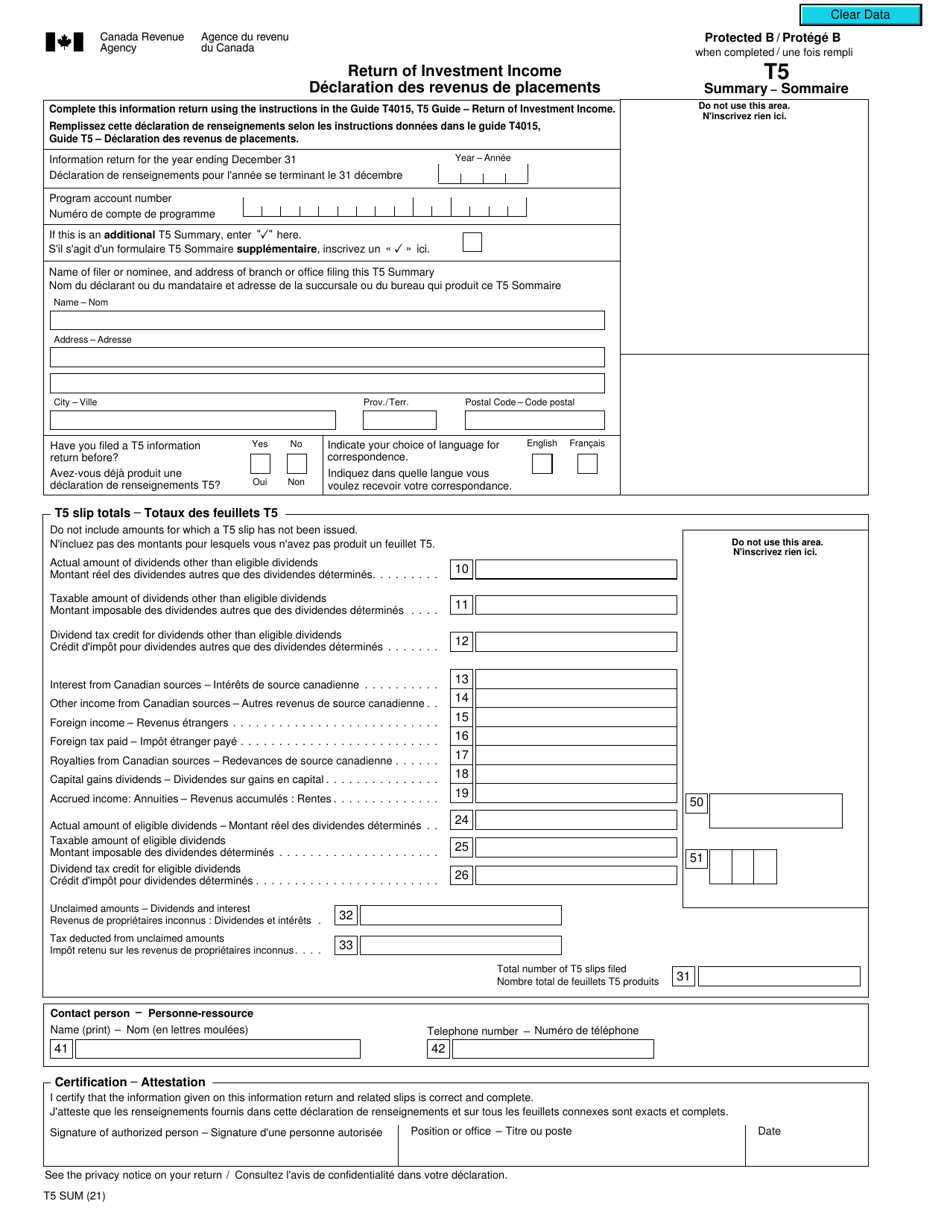

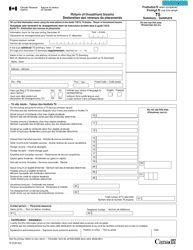

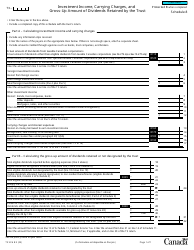

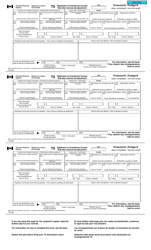

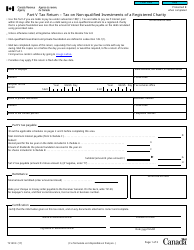

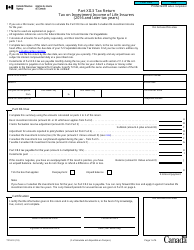

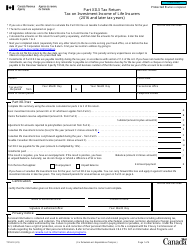

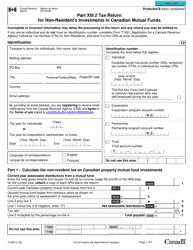

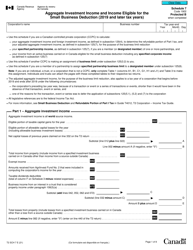

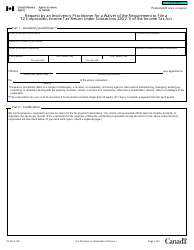

Form T5SUM Return of Investment Income - Canada (English / French)

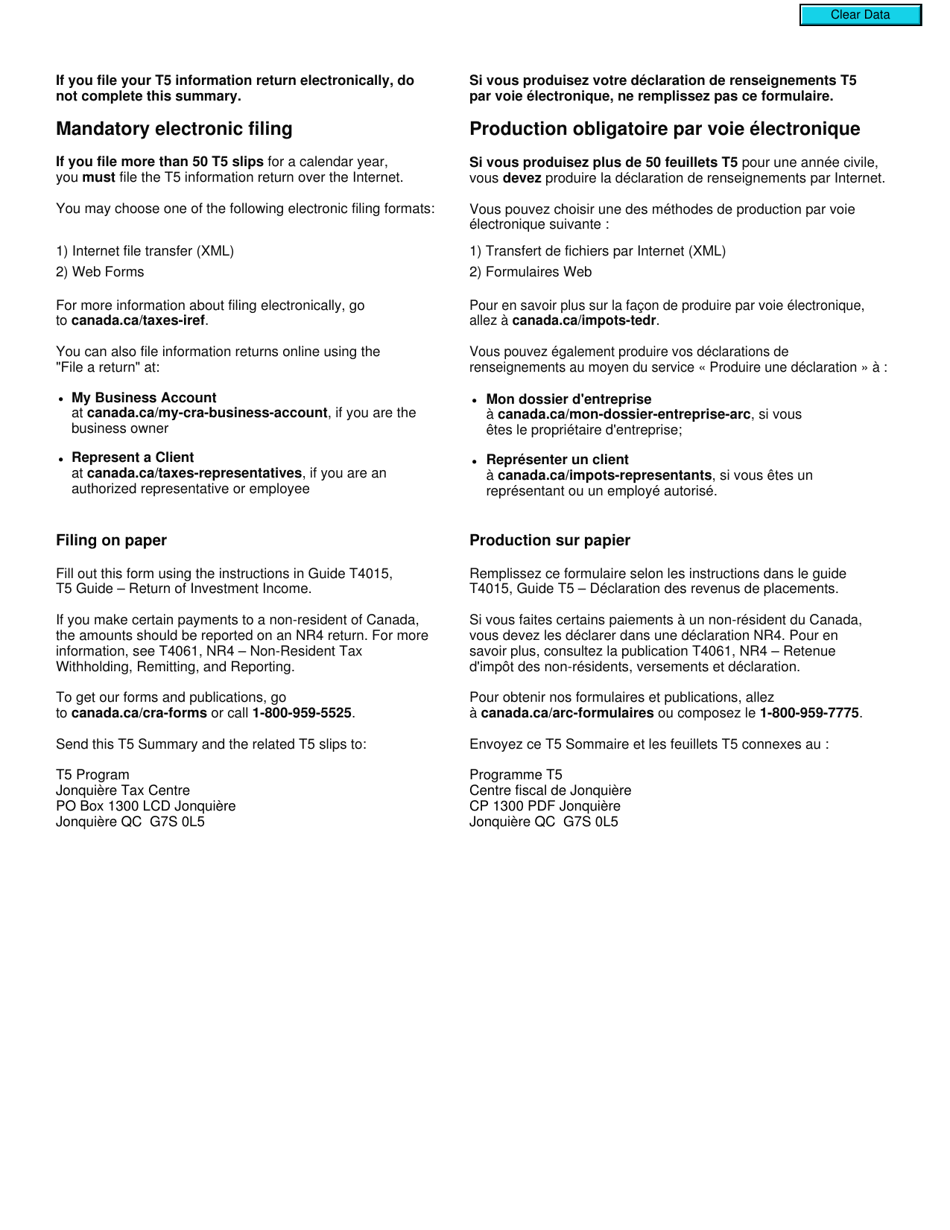

Form T5SUM Return of Investment Income is a form used in Canada to report investment income received by a corporation. It includes dividends, interest, royalties, and other types of income. The form is filed with the Canada Revenue Agency (CRA) to report this income and to calculate any taxes owing.

The Form T5SUM Return of Investment Income in Canada (English/French) is typically filed by the financial institution or investment issuer that pays investment income to individuals or entities.

FAQ

Q: What is Form T5SUM?

A: Form T5SUM is a tax form used in Canada to report investment income.

Q: Who needs to file Form T5SUM?

A: Individuals or businesses that have received investment income in Canada need to file Form T5SUM.

Q: What kind of investment income should be reported on Form T5SUM?

A: Investment income such as interest, dividends, and royalties should be reported on Form T5SUM.

Q: Is Form T5SUM available in both English and French?

A: Yes, Form T5SUM is available in both English and French.