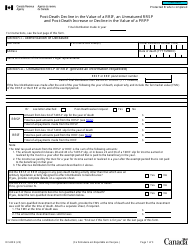

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC249

for the current year.

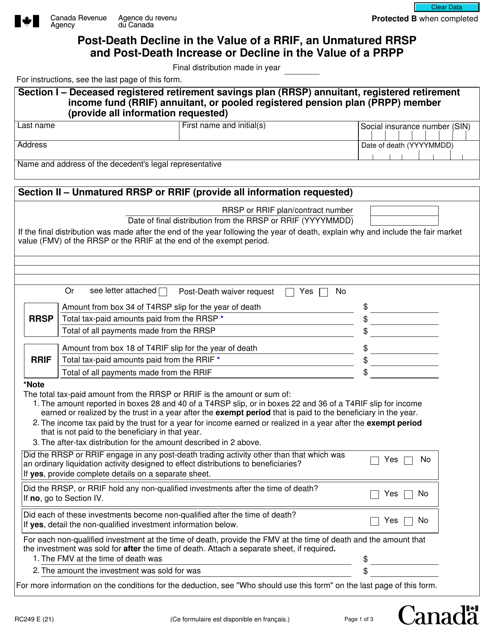

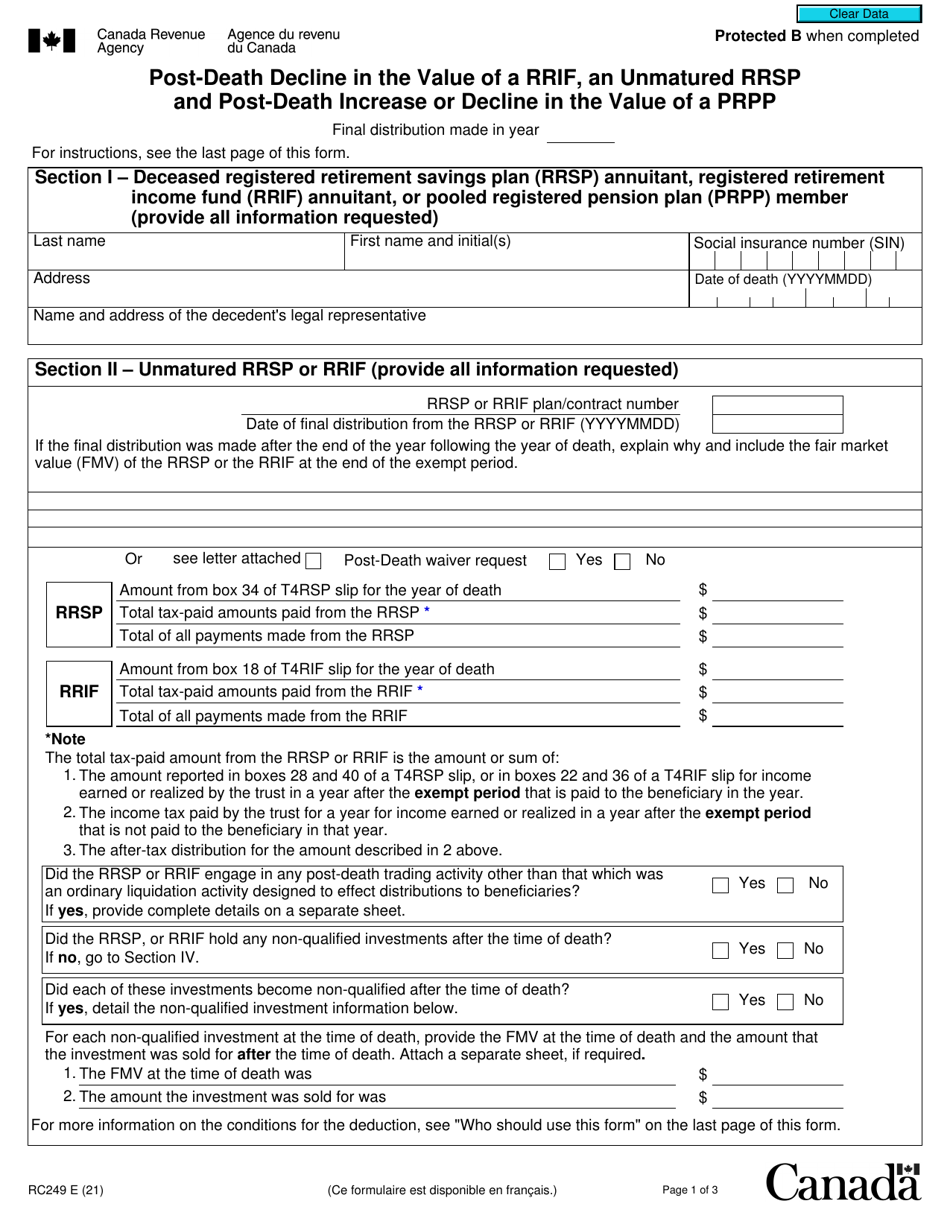

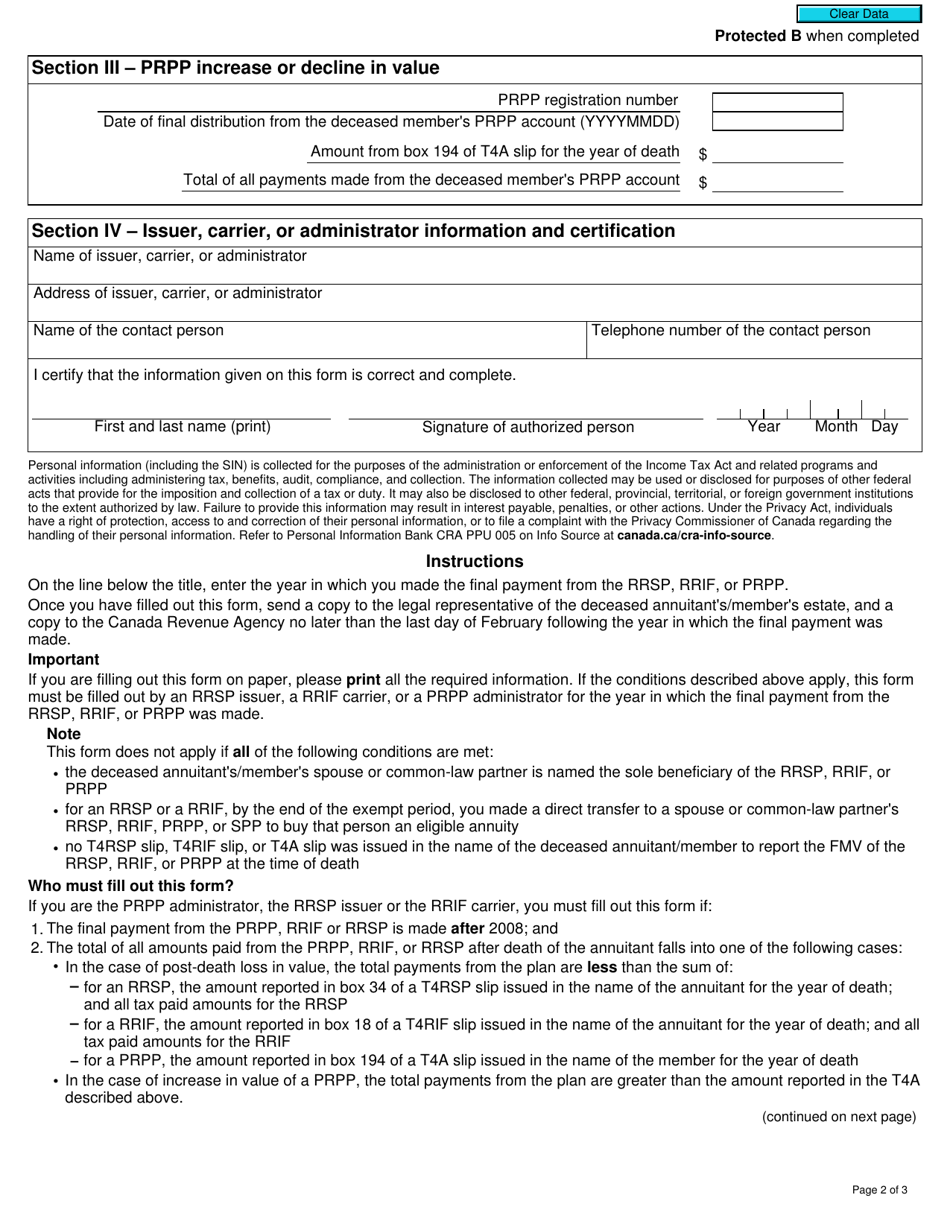

Form RC249 Post-death Decline in the Value of a Rrif, an Unmatured Rrsp and Post-death Increase or Decline in the Value of a Prpp - Canada

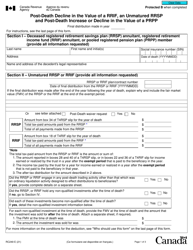

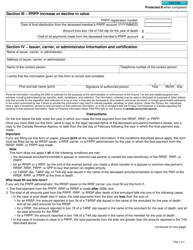

Form RC249 is used in Canada to report any post-death decline in the value of a Registered Retirement Income Fund (RRIF), an unmatured Registered Retirement Savings Plan (RRSP), or a post-death increase or decline in the value of a Pooled Registered Pension Plan (PRPP). It is used by the beneficiary or the estate of the deceased individual to calculate any potential tax implications arising from these changes in value.

The beneficiary or legal representative of the deceased individual would typically file the Form RC249 in Canada.

FAQ

Q: What is Form RC249?

A: Form RC249 is a form used in Canada to report the post-death decline in the value of a RRIF, an unmatured RRSP, and the post-death increase or decline in the value of a PRPP.

Q: What is a RRIF?

A: RRIF stands for Registered Retirement Income Fund. It is a type of retirement account in Canada where you can convert your RRSP funds into a stream of income during your retirement.

Q: What is an unmatured RRSP?

A: An unmatured RRSP refers to a registered retirement savings plan that has not yet been converted into a retirement income stream.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a type of retirement savings plan available in Canada.

Q: When should I use Form RC249?

A: You should use Form RC249 to report any post-death decline in the value of a RRIF, an unmatured RRSP, or any post-death increase or decline in the value of a PRPP.

Q: Why do I need to report these post-death changes?

A: You need to report these changes for tax purposes and to determine any tax liabilities or benefits associated with the post-death changes in the value of these accounts.