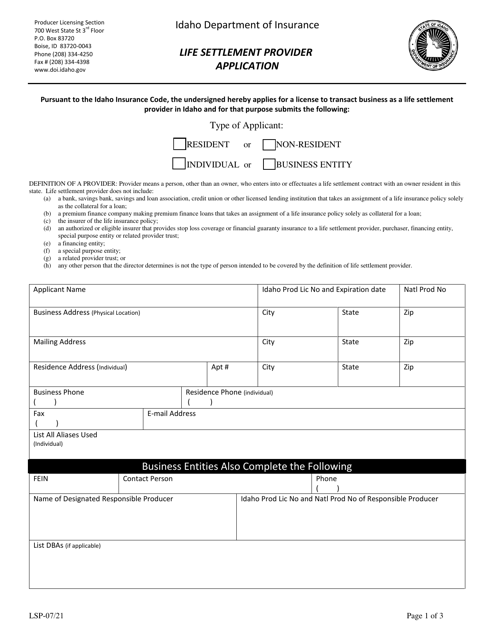

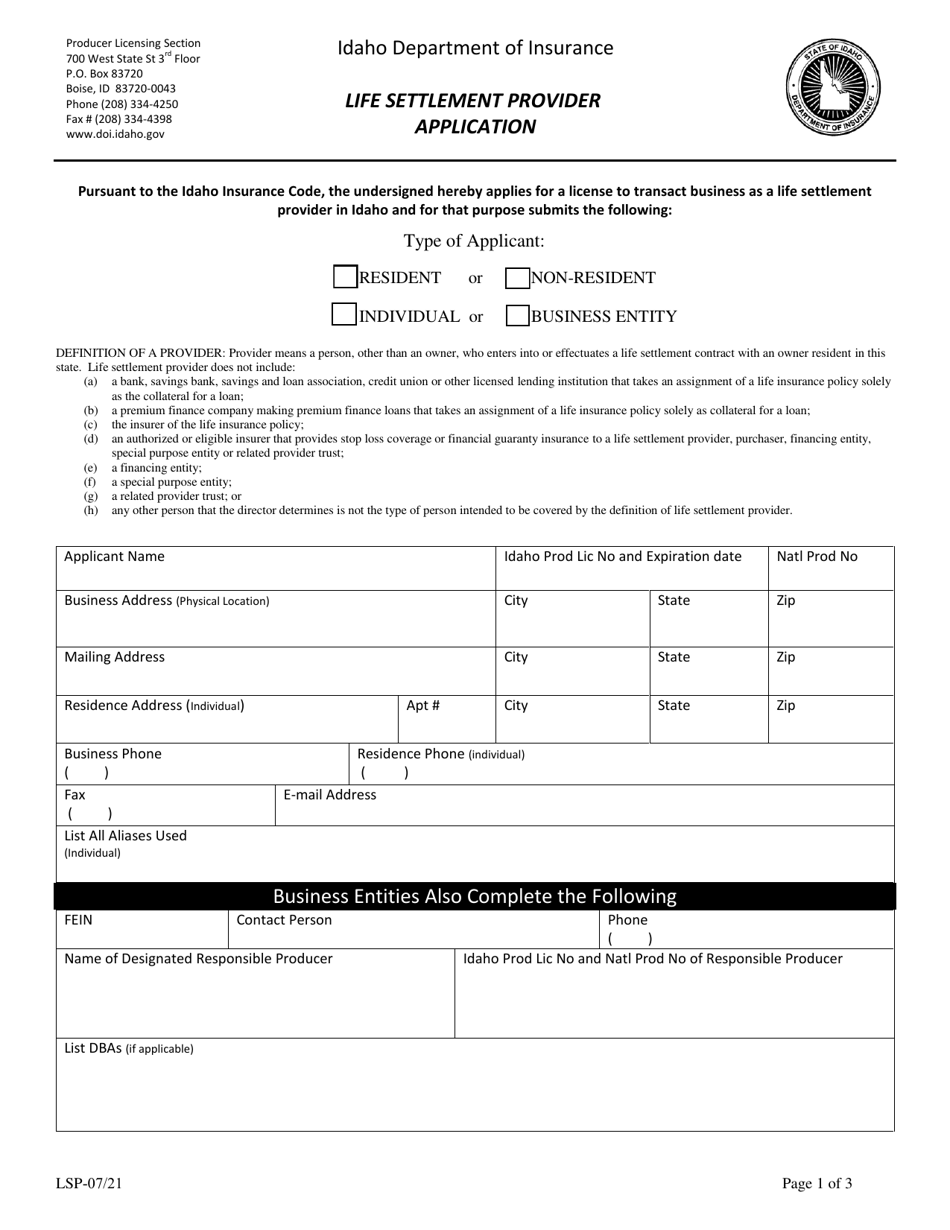

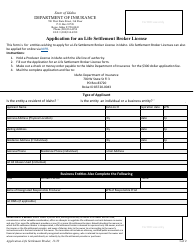

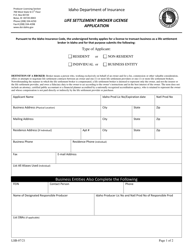

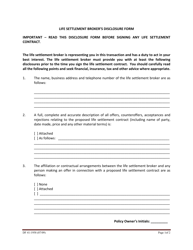

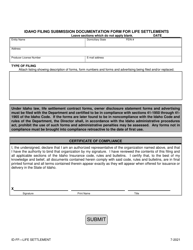

Life Settlement Provider Application - Idaho

Life Settlement Provider Application is a legal document that was released by the Idaho Department of Insurance - a government authority operating within Idaho.

FAQ

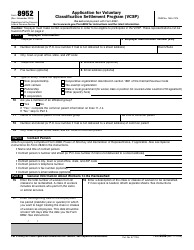

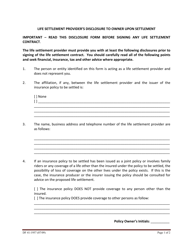

Q: What is a life settlement provider?

A: A life settlement provider is a company that purchases life insurance policies from policyholders.

Q: Why would someone sell their life insurance policy?

A: People may choose to sell their life insurance policy for a variety of reasons, such as needing cash for medical expenses or retirement funds.

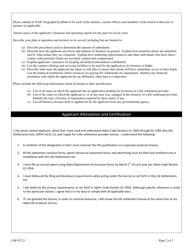

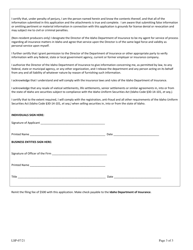

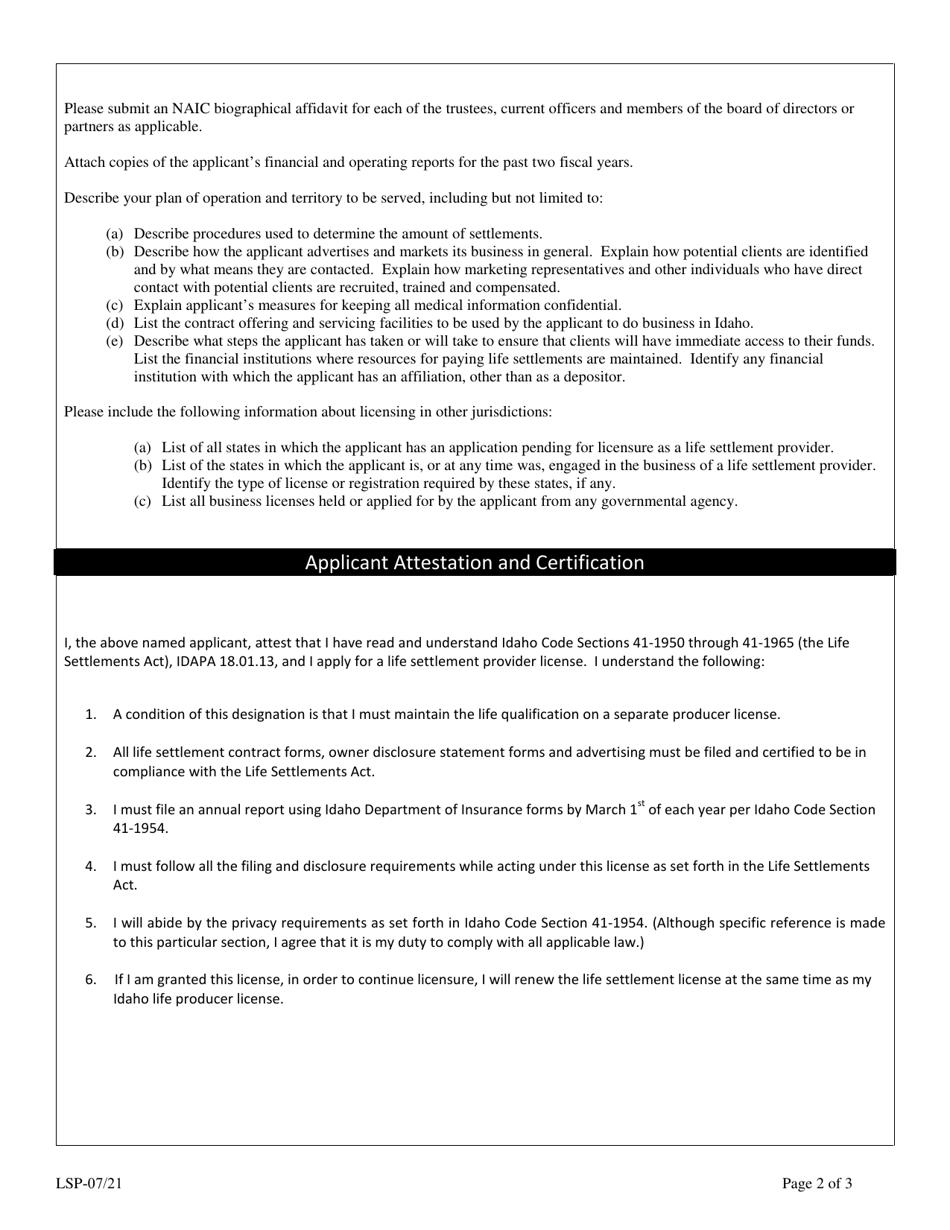

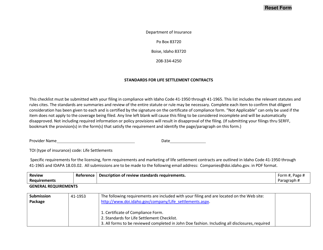

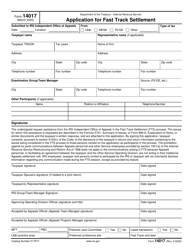

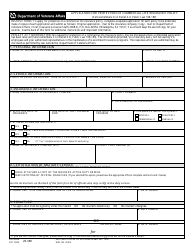

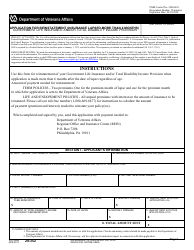

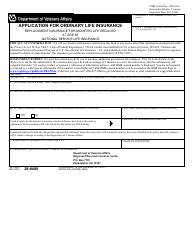

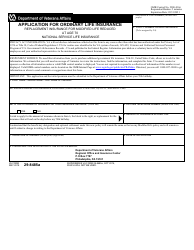

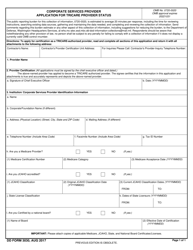

Q: How does the life settlement provider application process work?

A: The application process typically involves providing information about the policyholder, the policy itself, and any existing health conditions.

Q: Is there a minimum or maximum age requirement for selling a life insurance policy?

A: There is usually a minimum age requirement of 65, but there is no maximum age limit for selling a life insurance policy.

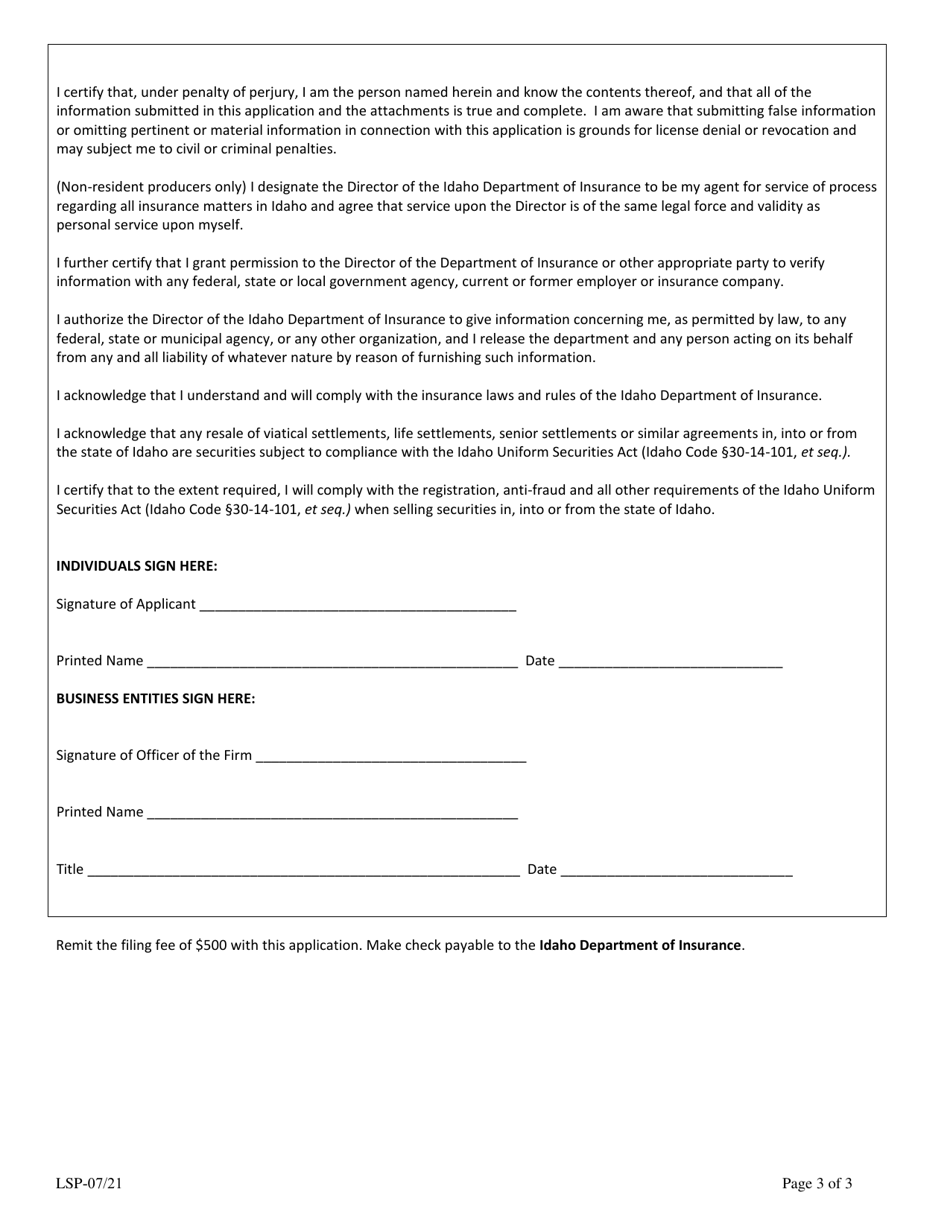

Q: Are there any fees associated with selling a life insurance policy?

A: There may be fees associated with the application process and the sale of the policy, so it is important to review the terms and conditions carefully.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Idaho Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Insurance.