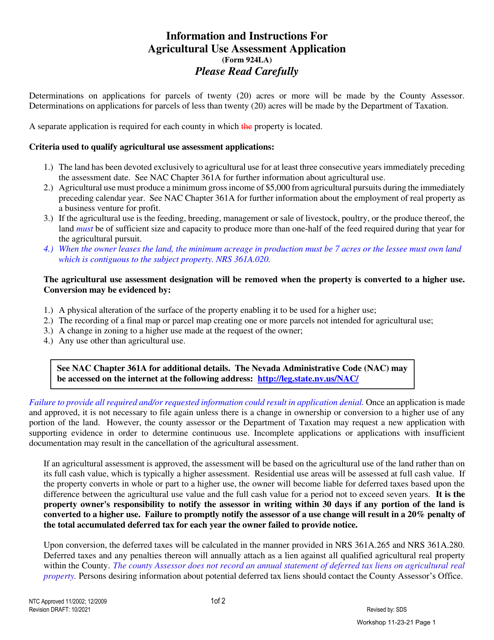

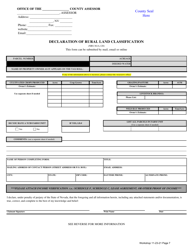

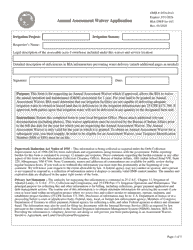

Form 924LA Agricultural Use Assessment Application - Nevada

What Is Form 924LA?

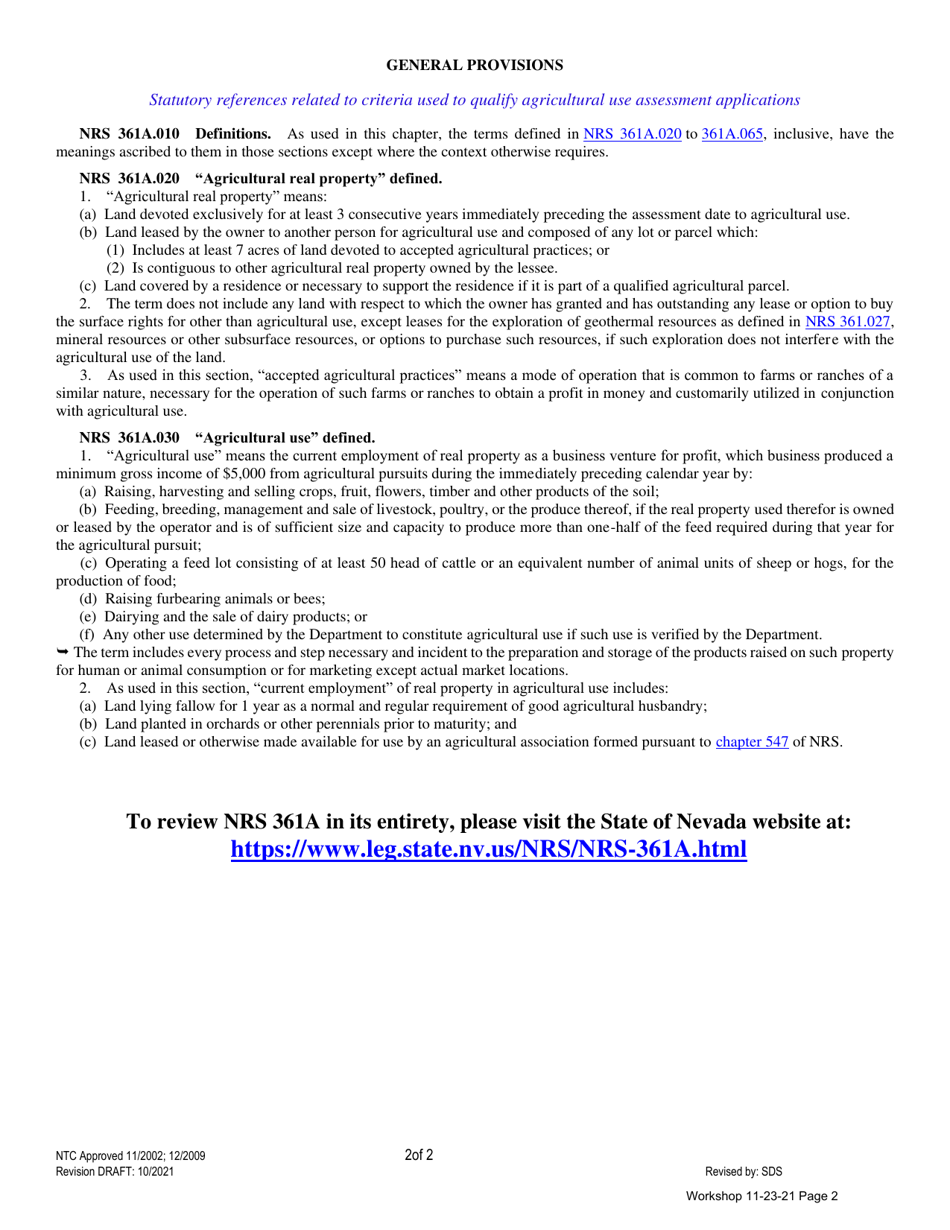

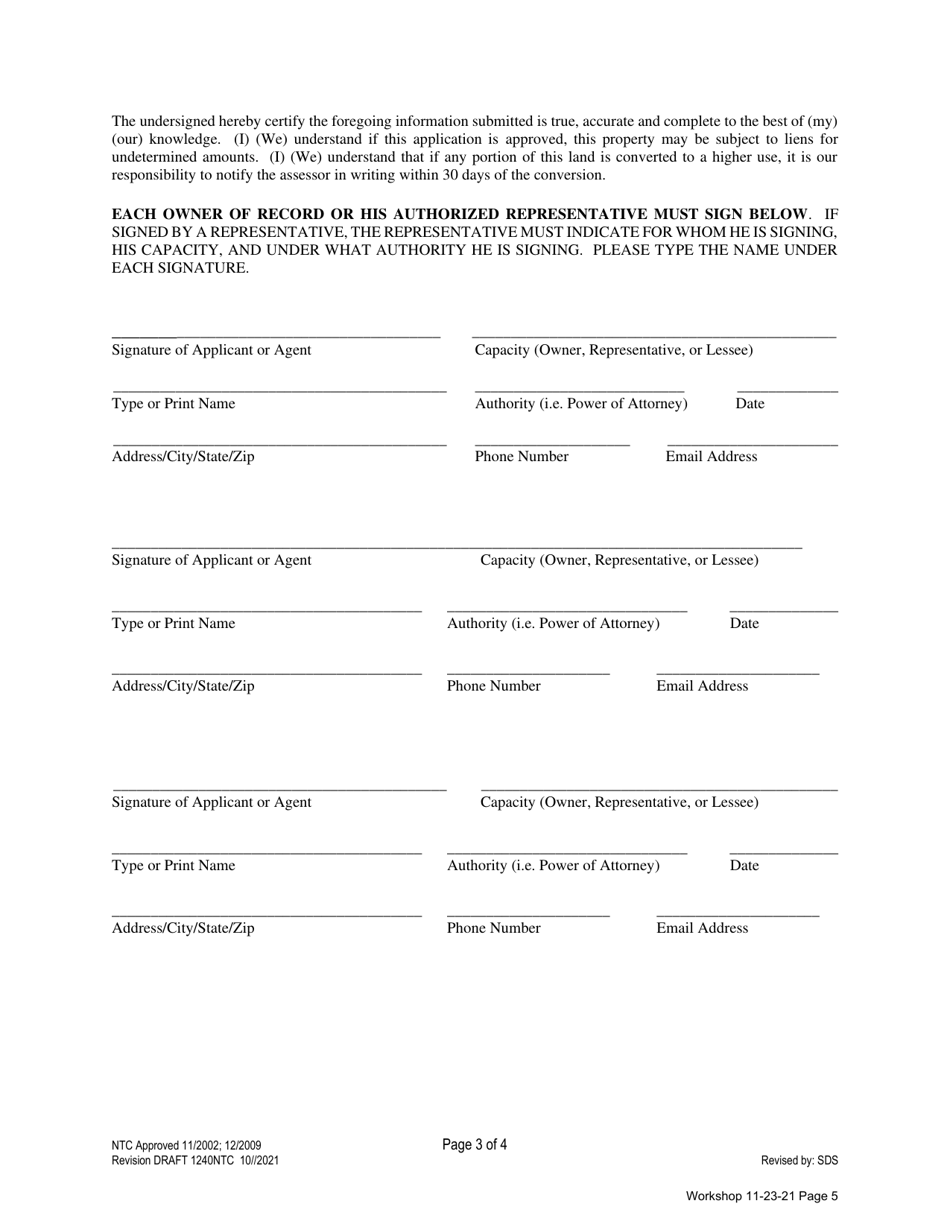

This is a legal form that was released by the Nevada Department of Taxation - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

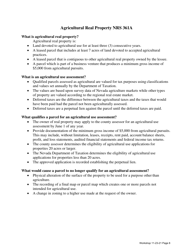

Q: What is Form 924LA?

A: Form 924LA is the Agricultural Use Assessment Application in Nevada.

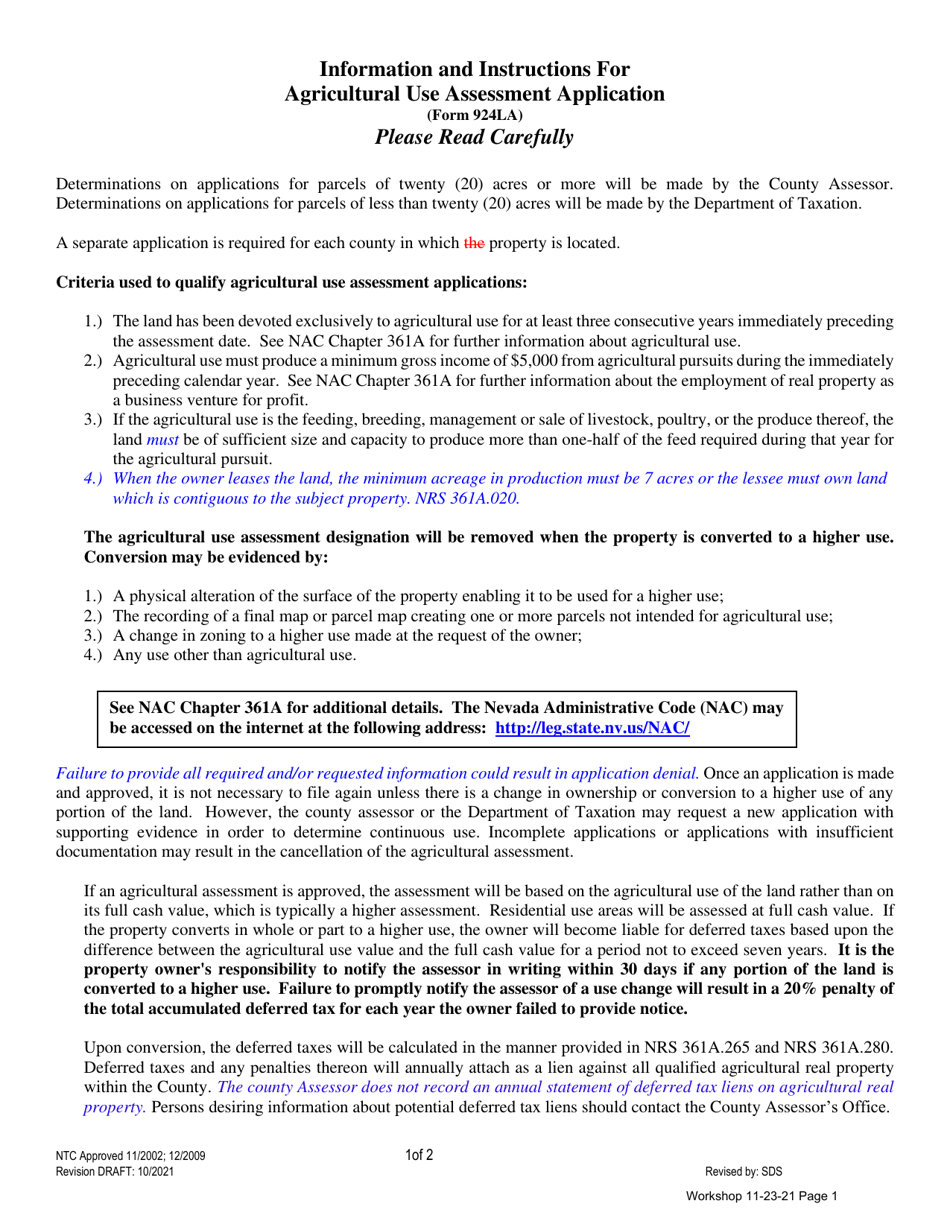

Q: What is the purpose of Form 924LA?

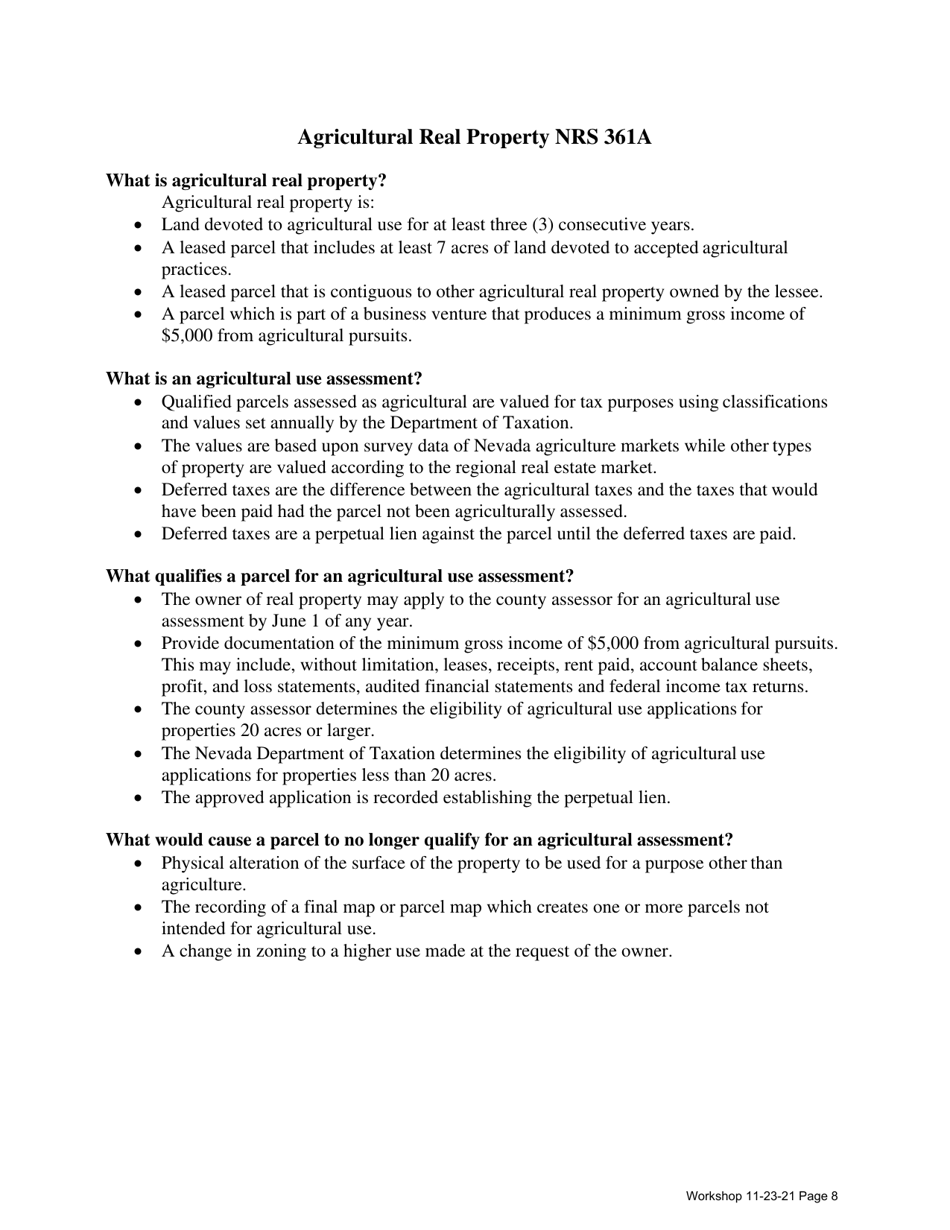

A: The purpose of Form 924LA is to apply for agricultural use assessment of property in Nevada.

Q: Who is eligible to use Form 924LA?

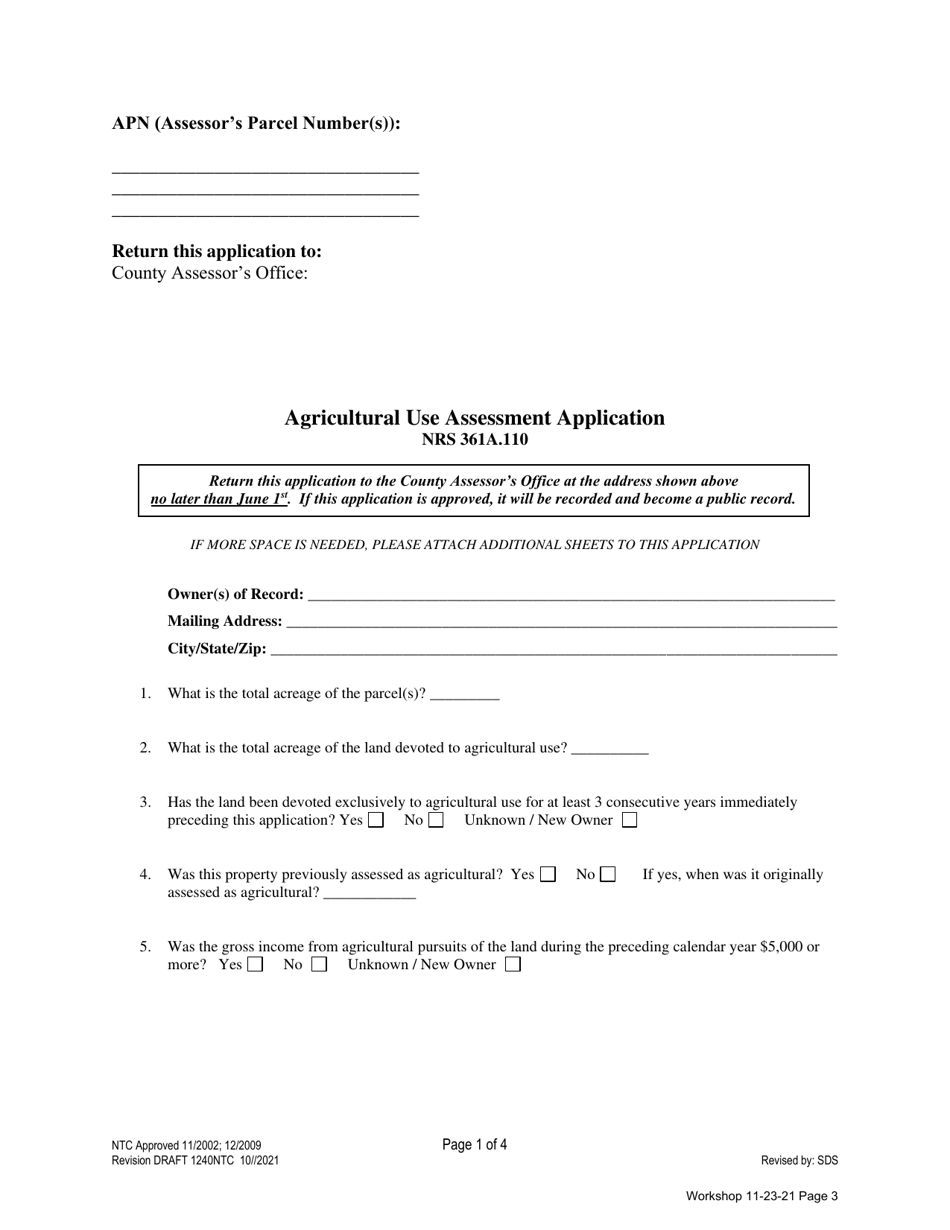

A: Property owners in Nevada who use their land for agricultural purposes are eligible to use Form 924LA.

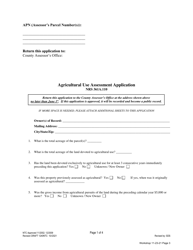

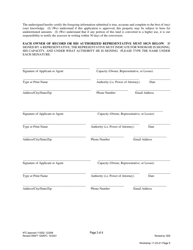

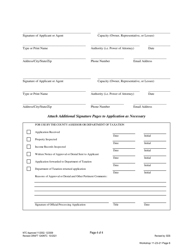

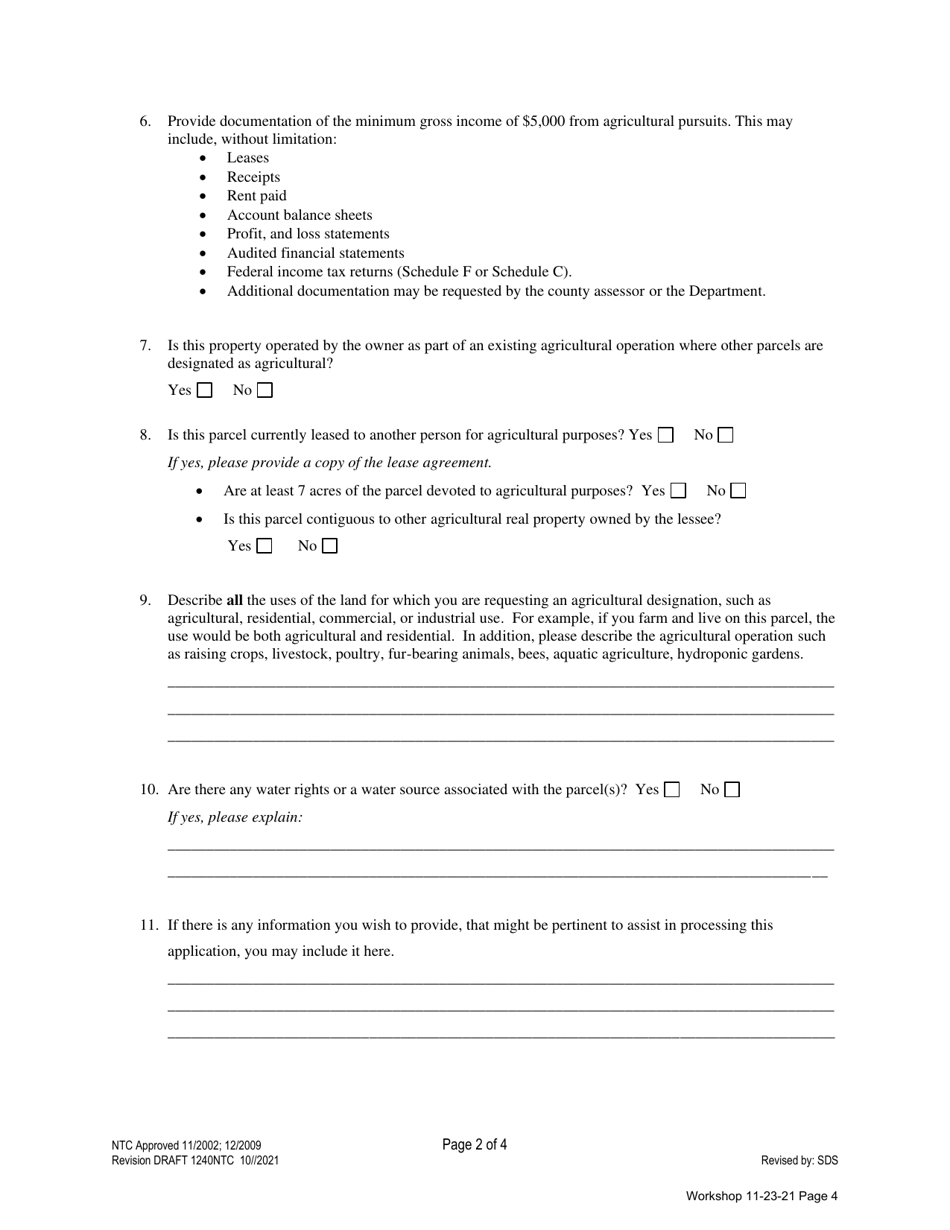

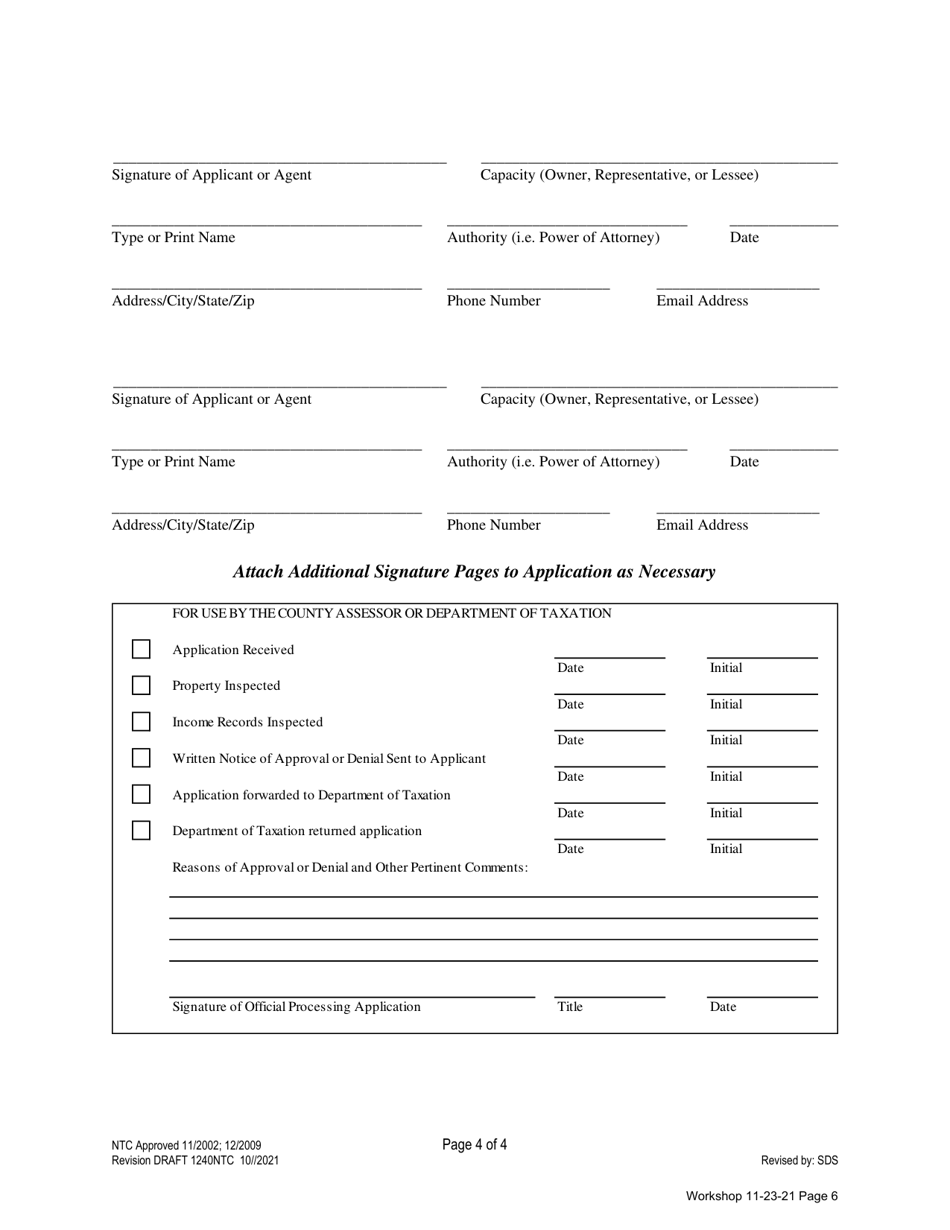

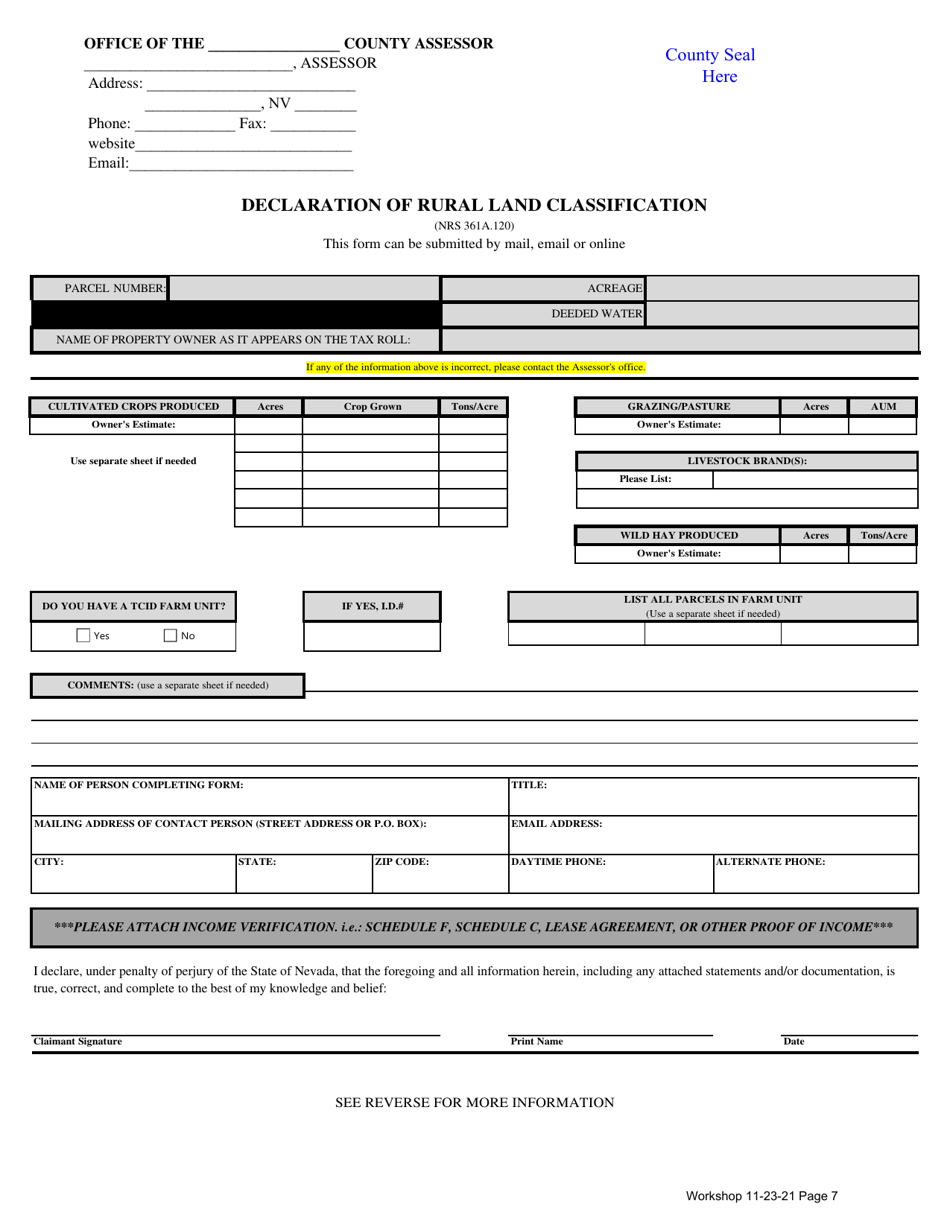

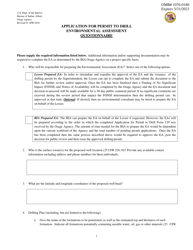

Q: What information do I need to provide on Form 924LA?

A: You will need to provide information about the property, its agricultural use, and your contact details on Form 924LA.

Q: When is Form 924LA due?

A: Form 924LA is due annually on the last day of February.

Q: What happens after I submit Form 924LA?

A: After you submit Form 924LA, the Nevada Department of Taxation will review your application and determine if your property qualifies for agricultural use assessment.

Q: What are the benefits of agricultural use assessment in Nevada?

A: The main benefit of agricultural use assessment is a lower property tax assessment, which can result in significant tax savings for property owners.

Q: Can I appeal a denial of agricultural use assessment?

A: Yes, if your application for agricultural use assessment is denied, you have the right to appeal the decision.

Form Details:

- Released on November 23, 2021;

- The latest edition provided by the Nevada Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 924LA by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.