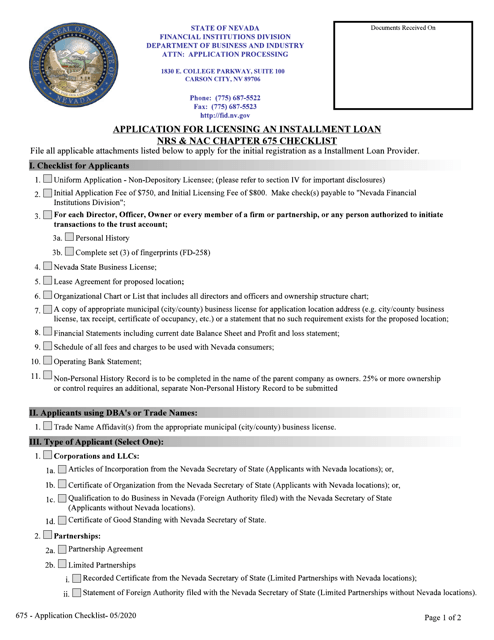

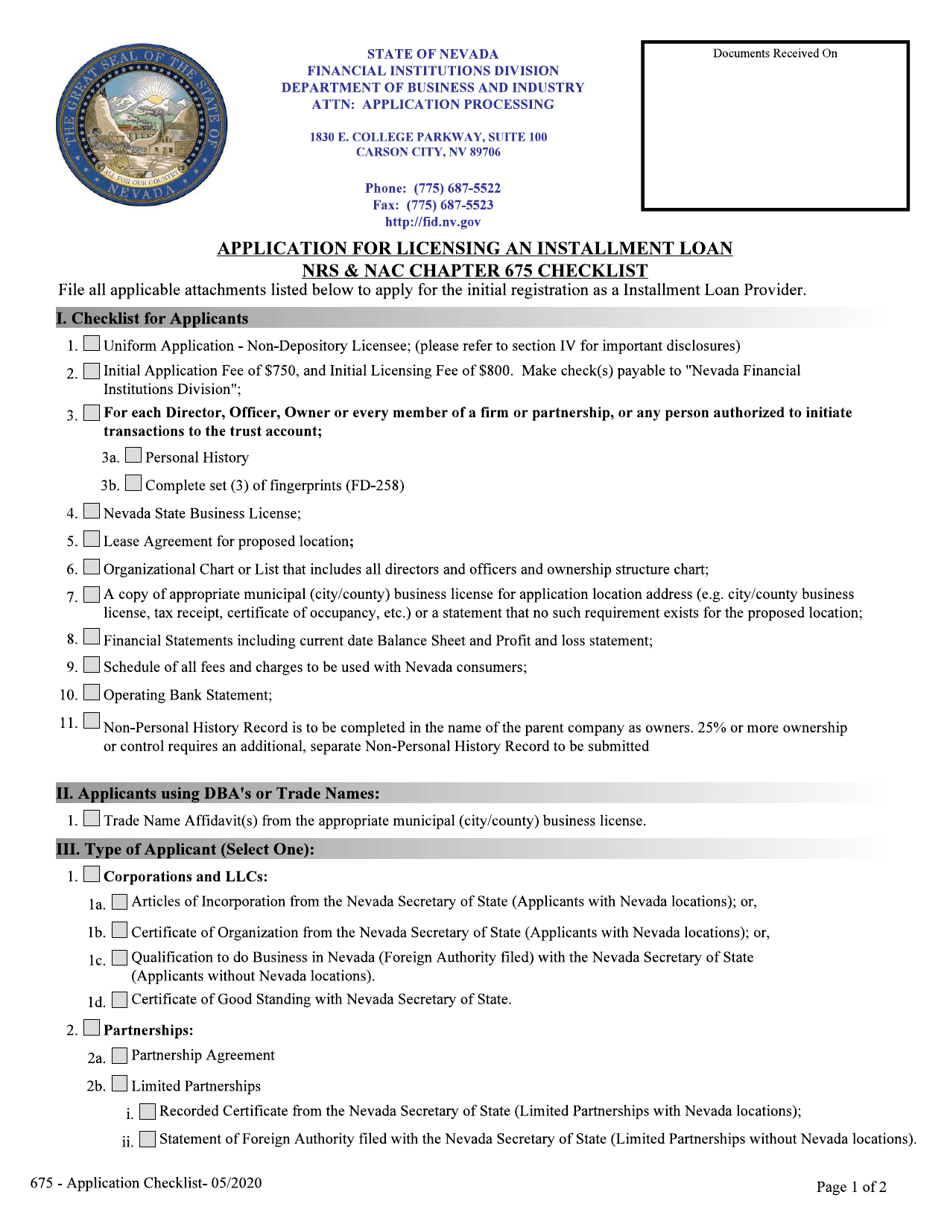

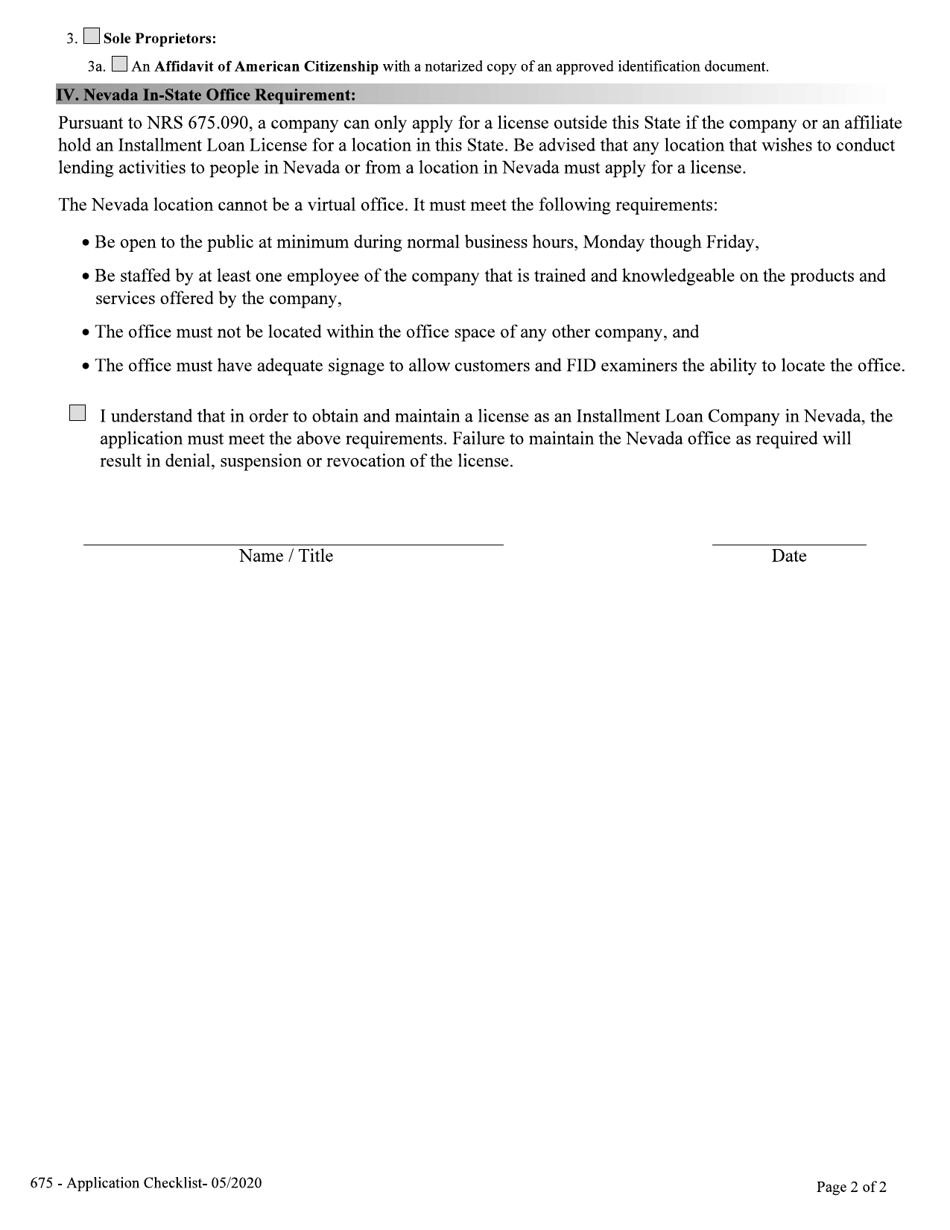

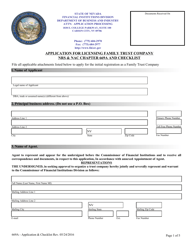

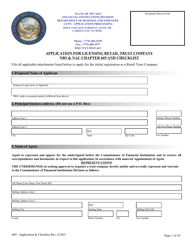

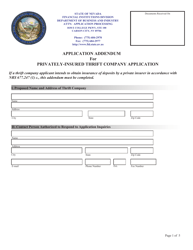

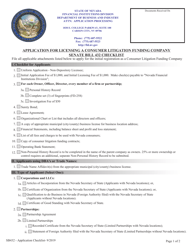

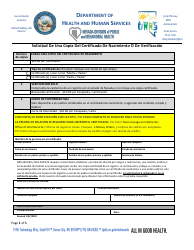

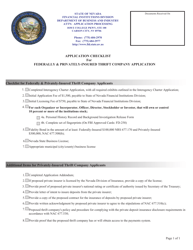

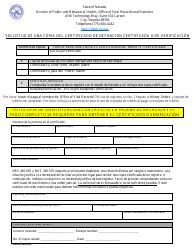

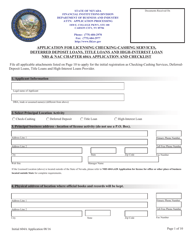

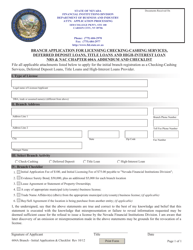

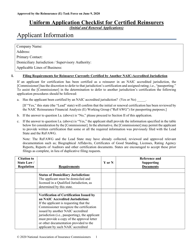

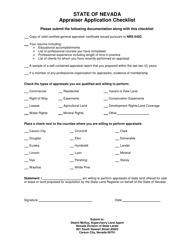

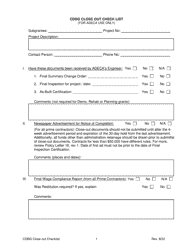

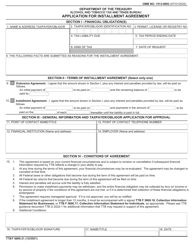

Installment Loan Company Application Checklist - Nevada

Installment Loan Company Application Checklist is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

FAQ

Q: What is an installment loan company?

A: An installment loan company is a lender that provides loans to borrowers, which are repaid in fixed monthly installments over a set period of time.

Q: What do I need to provide when applying for an installment loan in Nevada?

A: When applying for an installment loan in Nevada, you will typically need to provide proof of identity, proof of income, proof of residency, and your banking information.

Q: What is proof of identity?

A: Proof of identity can include a valid driver's license, passport, or other government-issued identification.

Q: What is proof of income?

A: Proof of income can include pay stubs, bank statements, or tax returns that show your current and ongoing source of income.

Q: What is proof of residency?

A: Proof of residency can include a utility bill, lease agreement, or other official documents that show your current address.

Q: Why do I need to provide my banking information?

A: Lenders may require your banking information to deposit the loan funds directly into your account and to set up automatic loan payments.

Q: Can I apply for an installment loan with bad credit?

A: Yes, some installment loan companies may work with borrowers who have bad credit, but the terms and interest rates may be less favorable.

Q: What is the maximum loan amount I can get from an installment loan company in Nevada?

A: The maximum loan amount can vary depending on the lender and your individual circumstances, but it is typically capped at a certain percentage of your income.

Q: How long do I have to repay the loan?

A: The repayment period for an installment loan can vary, but it is usually between 6 months to a few years.

Q: What happens if I miss a payment?

A: If you miss a payment, you may incur late fees and it could negatively impact your credit score. It is important to communicate with your lender if you are facing financial difficulties to explore possible solutions.

Form Details:

- Released on May 1, 2020;

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.