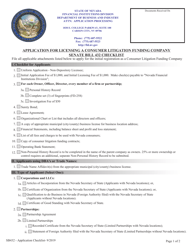

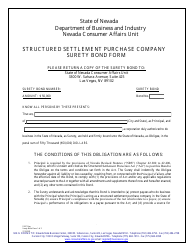

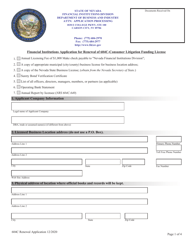

Surety Bond - Consumer Litigation Funding Company - Nevada

Surety Bond - Consumer Litigation Funding Company is a legal document that was released by the Nevada Department of Business and Industry - a government authority operating within Nevada.

FAQ

Q: What is a surety bond?

A: A surety bond is a financial guarantee provided by a bonding company to ensure that a business or individual will fulfill their obligations.

Q: What is a consumer litigation funding company?

A: A consumer litigation funding company is a company that provides funding to individuals involved in lawsuits, often in exchange for a portion of the settlement or judgment.

Q: Why would a consumer litigation funding company need a surety bond?

A: A consumer litigation funding company may need a surety bond to comply with state regulations and provide financial protection to the consumers they work with.

Q: Why is a surety bond important for consumers?

A: A surety bond is important for consumers as it provides them with a level of financial protection in case the consumer litigation funding company fails to fulfill their obligations or engages in unlawful practices.

Q: What is the role of the bonding company in a surety bond?

A: The bonding company acts as a guarantor and provides a financial guarantee that the consumer litigation funding company will meet its obligations.

Q: Is a surety bond the same as insurance?

A: No, a surety bond is not the same as insurance. While both involve financial protection, a surety bond is a guarantee of performance or payment, while insurance covers risks and potential losses.

Q: How can consumers verify if a consumer litigation funding company has a surety bond?

A: Consumers can verify if a consumer litigation funding company has a surety bond by checking with the appropriate state regulatory agency or requesting proof of the bond from the company itself.

Q: What happens if a consumer litigation funding company fails to fulfill its obligations?

A: If a consumer litigation funding company fails to fulfill its obligations, consumers may have recourse through legal actions or by filing claims against the surety bond.

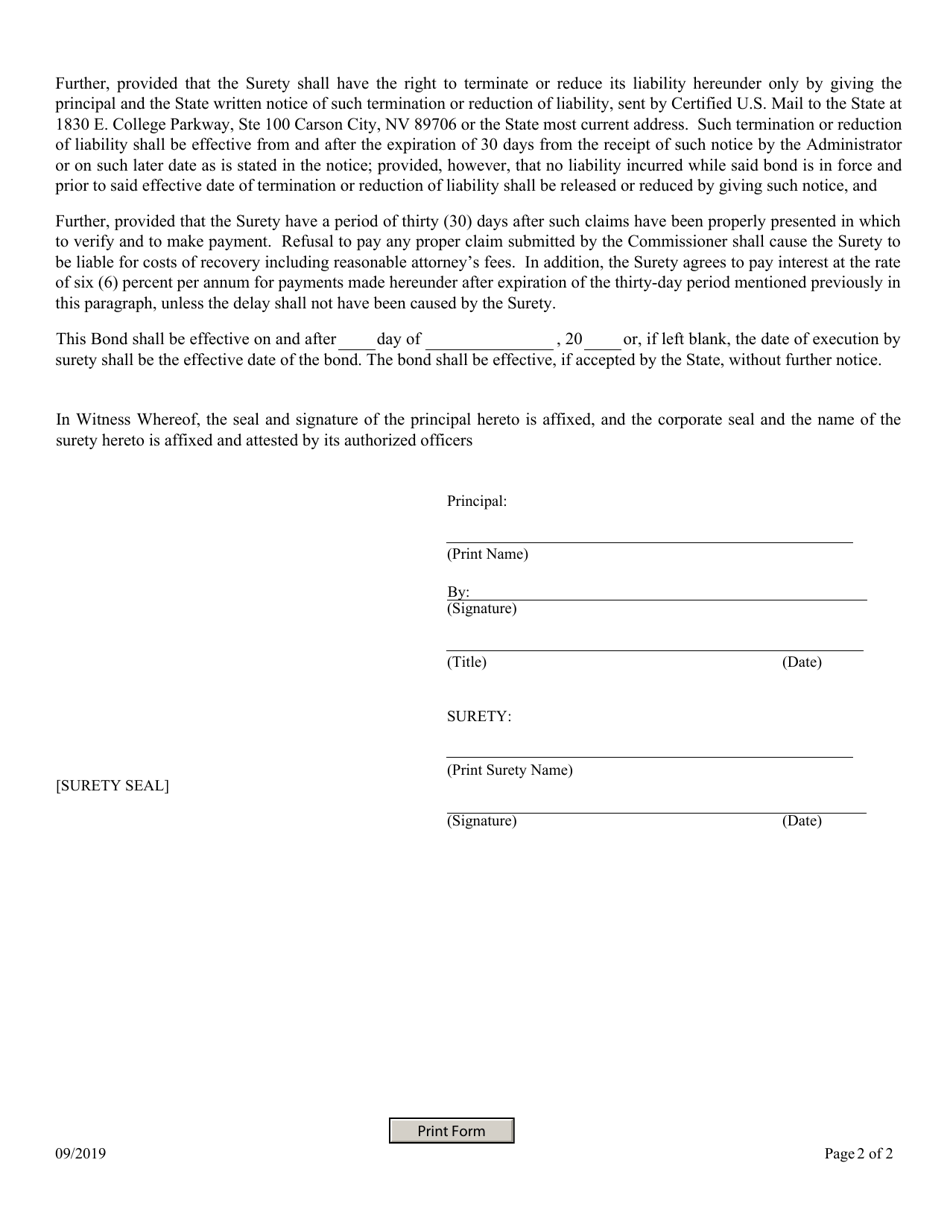

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Nevada Department of Business and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Business and Industry.