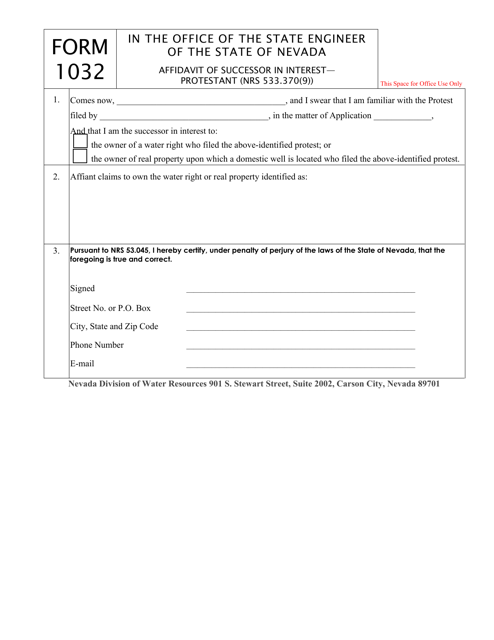

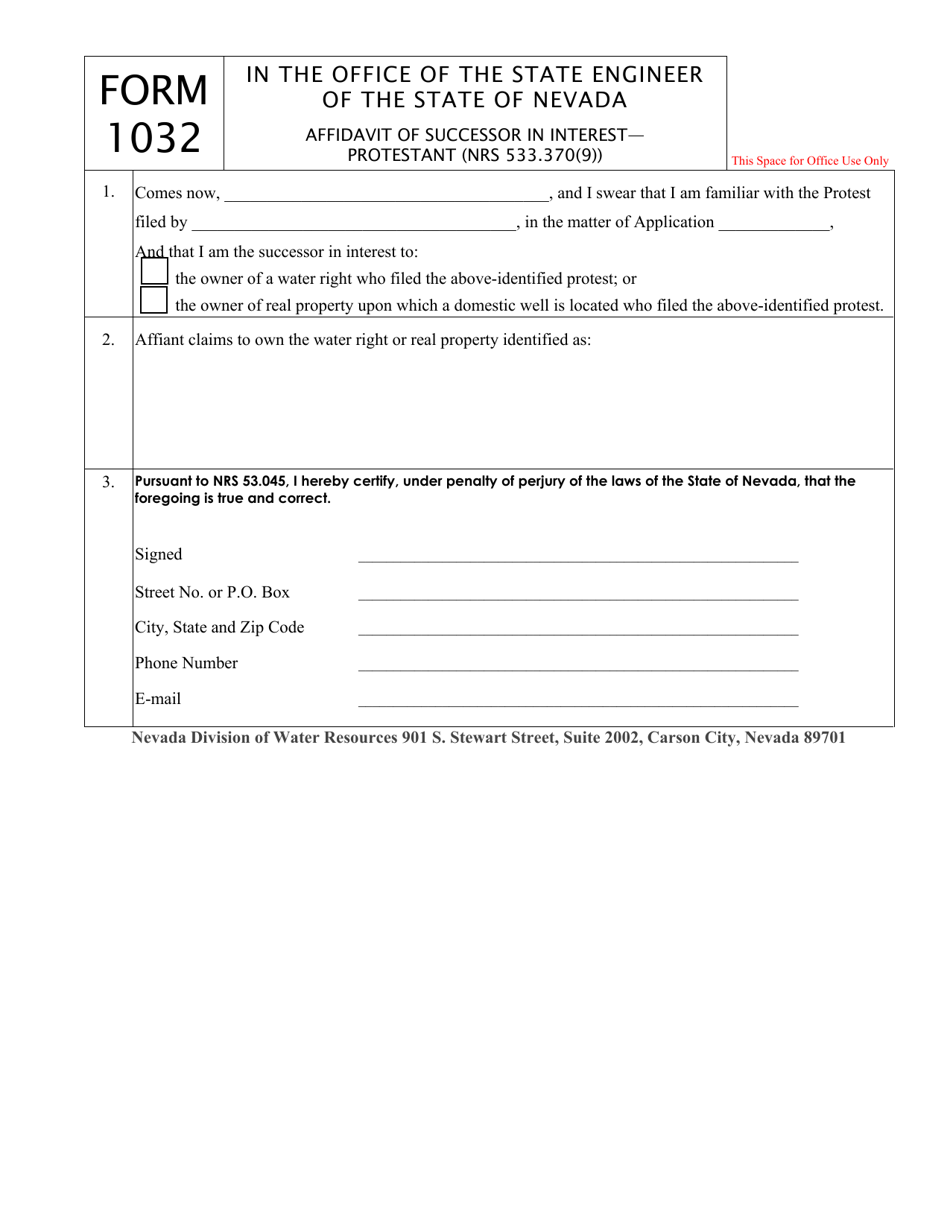

Form 1032 Affidavit of Successor in Interest - Protestant - Nevada

What Is Form 1032?

This is a legal form that was released by the Nevada Department of Conservation and Natural Resources - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1032?

A: Form 1032 is an Affidavit of Successor in Interest - Protestant specifically used in the state of Nevada.

Q: Who uses Form 1032?

A: Form 1032 is used by the successor in interest who wants to protest a property assessment in the state of Nevada.

Q: What is an Affidavit of Successor in Interest?

A: An Affidavit of Successor in Interest is a legal document used to establish the transfer of ownership or interest in a property.

Q: How is Form 1032 filled out?

A: Form 1032 requires the successor in interest to provide their personal information, details about the property, and the reason for the protest.

Q: What is the purpose of filing Form 1032?

A: The purpose of filing Form 1032 is to officially notify the taxation authorities of Nevada about a change in ownership or interest and to protest the property assessment.

Q: Is there a deadline for filing Form 1032?

A: Yes, Form 1032 must be filed within 60 days from the date of the notice of assessment.

Q: Are there any fees associated with filing Form 1032?

A: No, there are no fees required for filing Form 1032 in Nevada.

Q: What happens after filing Form 1032?

A: After filing Form 1032, the taxation authorities will review the protest and may conduct an assessment hearing to resolve any disputes.

Q: Can I appeal the decision made by the taxation authorities?

A: Yes, if you disagree with the decision made by the taxation authorities, you may appeal it through the appropriate channels.

Form Details:

- The latest edition provided by the Nevada Department of Conservation and Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1032 by clicking the link below or browse more documents and templates provided by the Nevada Department of Conservation and Natural Resources.