This version of the form is not currently in use and is provided for reference only. Download this version of

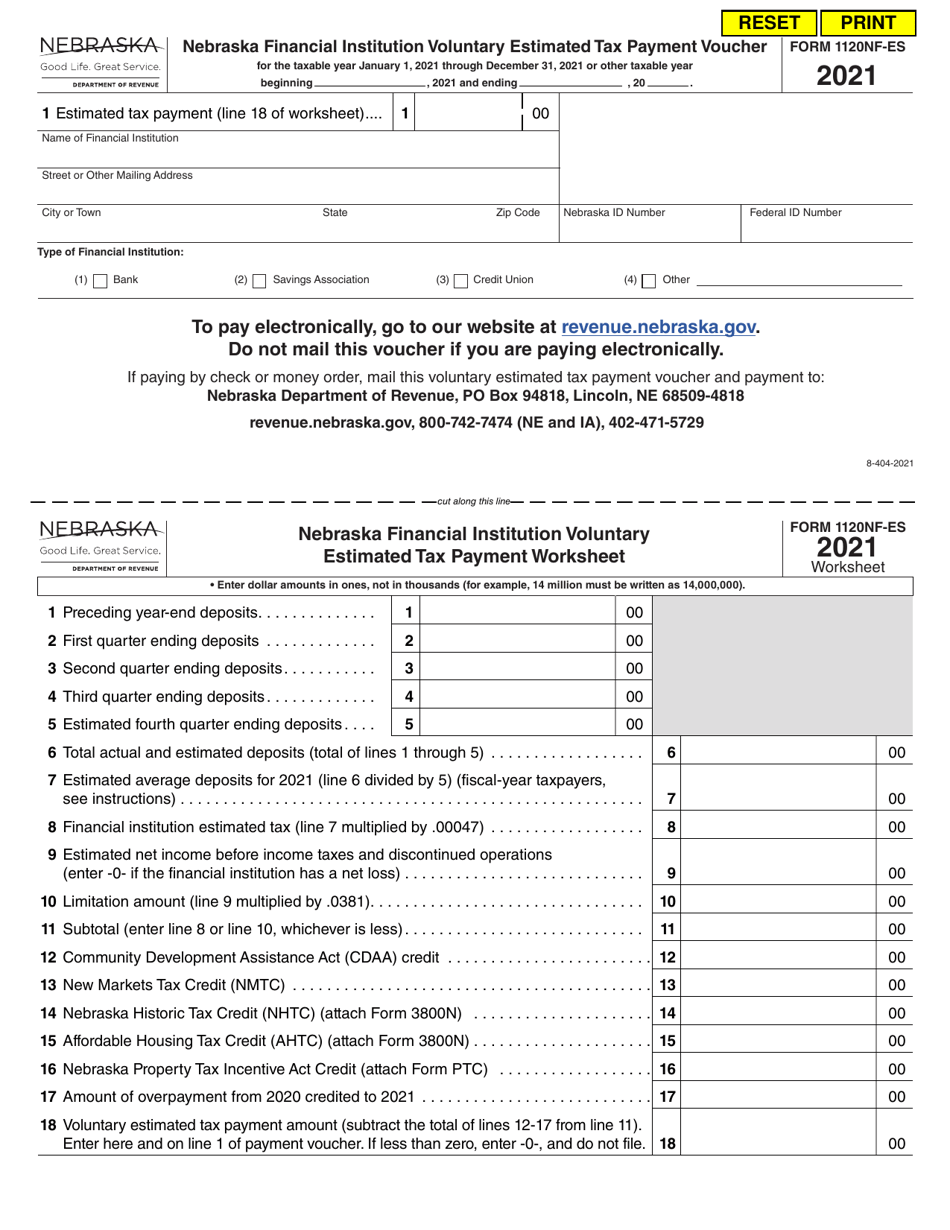

Form 1120NF-ES

for the current year.

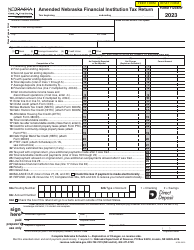

Form 1120NF-ES Nebraska Financial Institution Voluntary Estimated Tax Payment Voucher and Worksheet - Nebraska

What Is Form 1120NF-ES?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 1120NF-ES?

A: Form 1120NF-ES is the Nebraska Financial Institution Voluntary Estimated Tax Payment Voucher and Worksheet.

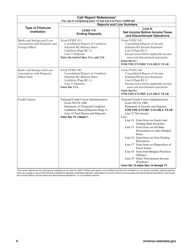

Q: Who needs to use form 1120NF-ES?

A: Financial institutions in Nebraska who want to make voluntary estimated tax payments.

Q: What is the purpose of form 1120NF-ES?

A: The form is used to make estimated tax payments for financial institutions in Nebraska.

Q: When should form 1120NF-ES be used?

A: Form 1120NF-ES should be used when a financial institution wants to make voluntary estimated tax payments.

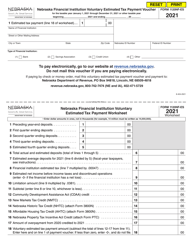

Q: How do I fill out form 1120NF-ES?

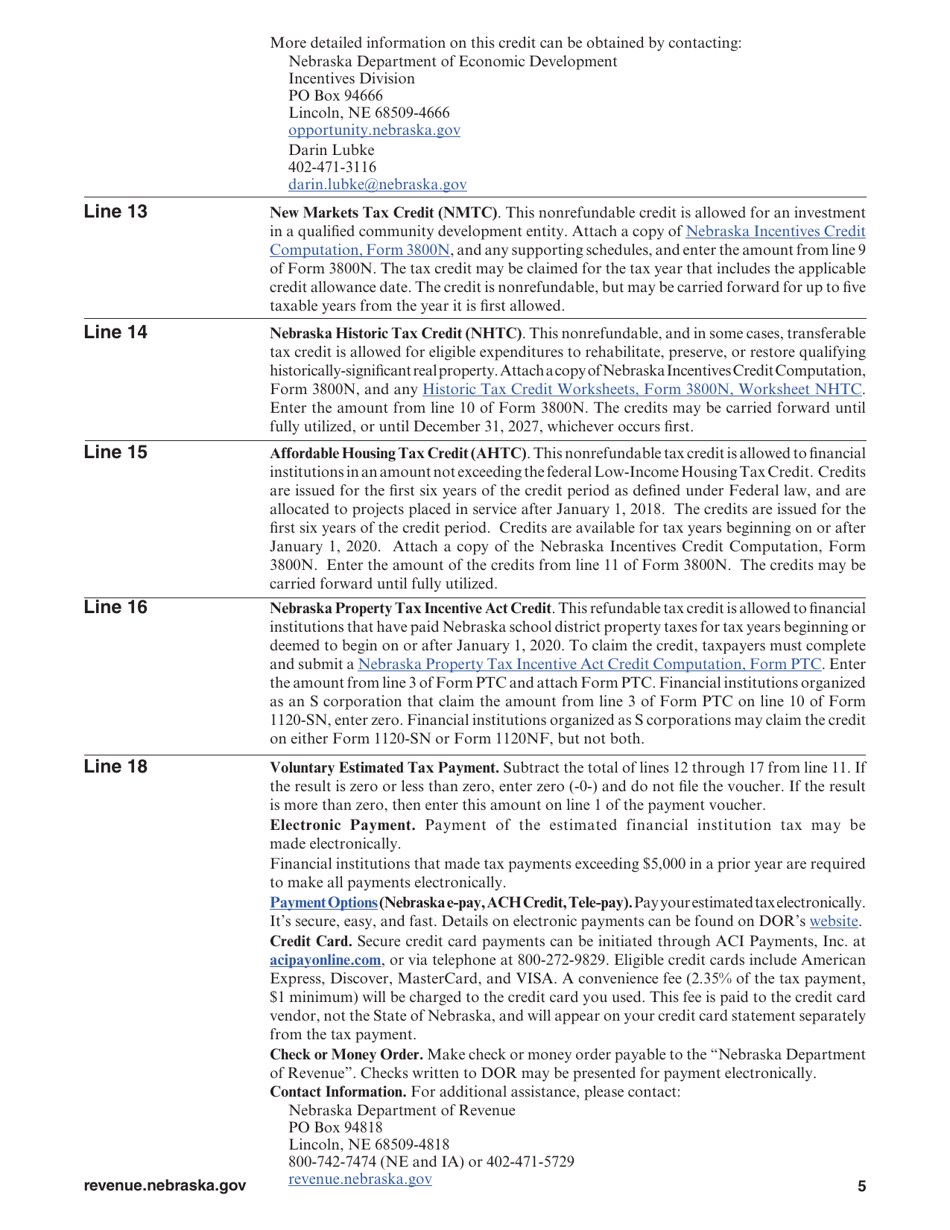

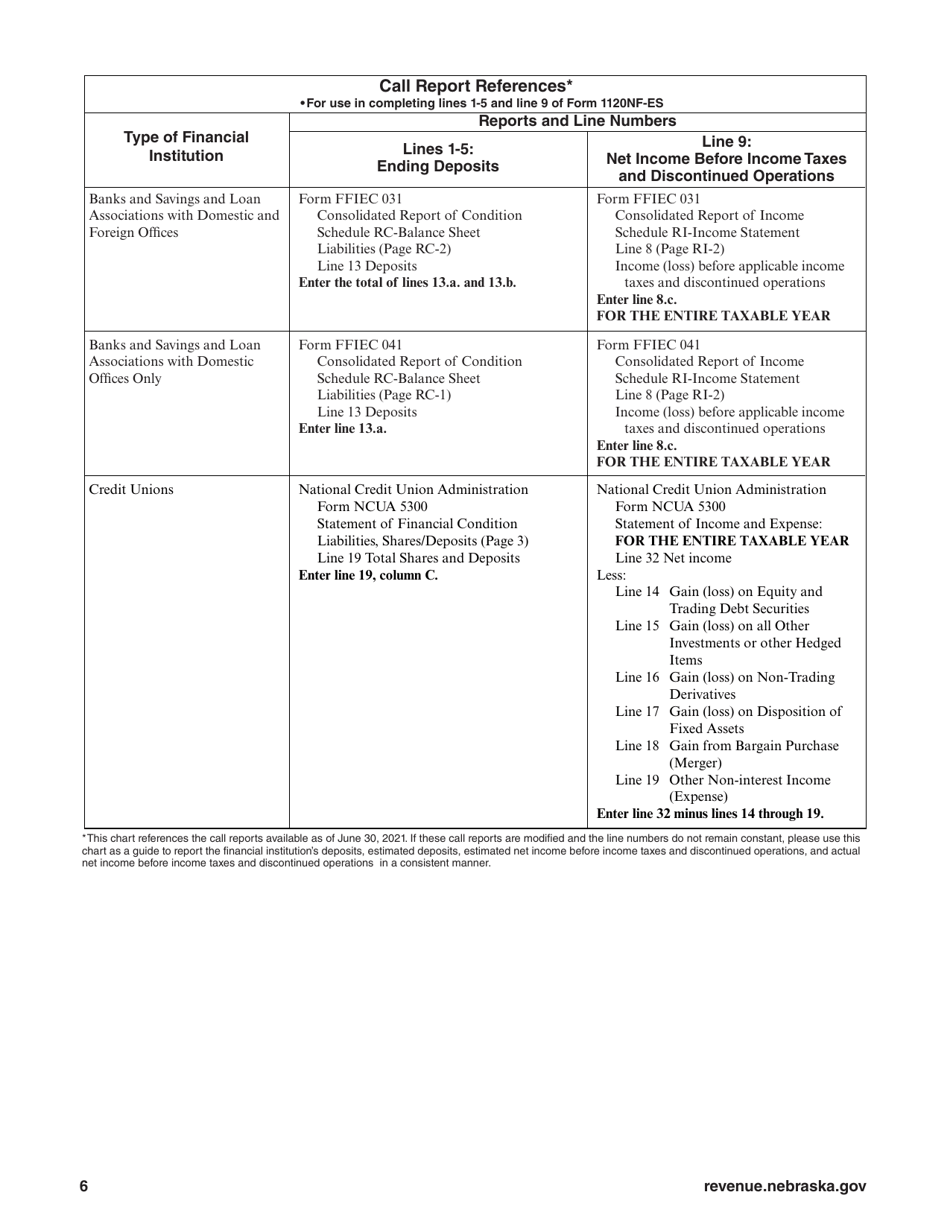

A: The form includes sections for the financial institution's information, estimated tax amounts, and payment details. Consult the instructions provided with the form for specific guidance.

Q: Why would a financial institution make voluntary estimated tax payments?

A: Financial institutions may choose to make voluntary estimated tax payments to avoid penalties or interest on underpayment of taxes.

Q: Are voluntary estimated tax payments required for financial institutions in Nebraska?

A: No, voluntary estimated tax payments are not required. They are optional for financial institutions that choose to make them.

Q: What happens if a financial institution underpays its taxes?

A: If a financial institution underpays its taxes, it may be subject to penalties and interest.

Q: Can I pay my estimated taxes electronically?

A: Yes, electronic payment options are available for submitting estimated tax payments for form 1120NF-ES. Consult the form instructions for more information.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120NF-ES by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.