This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

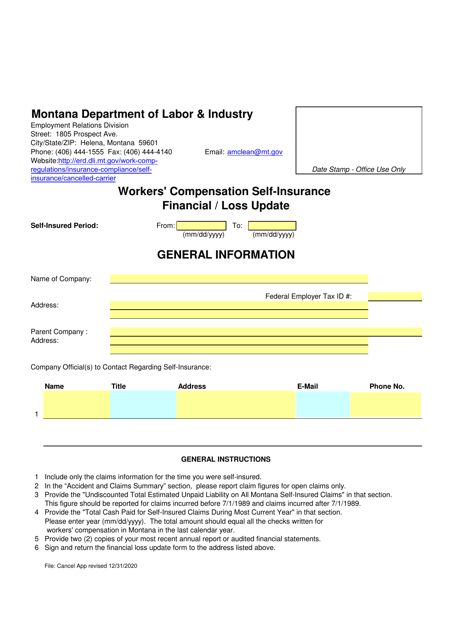

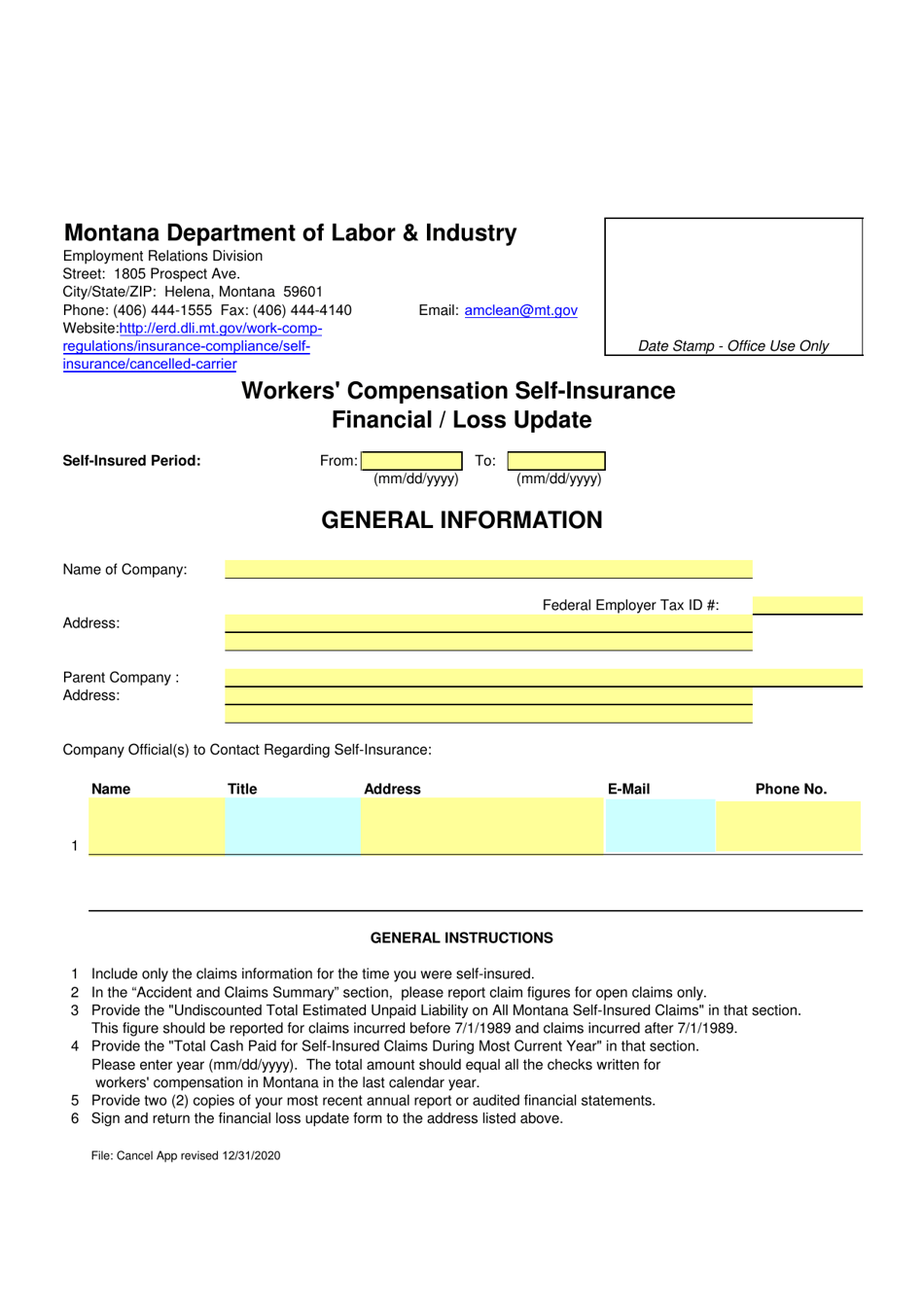

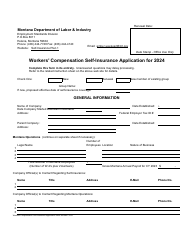

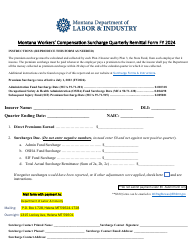

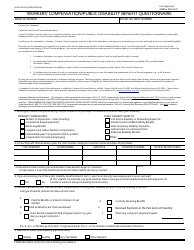

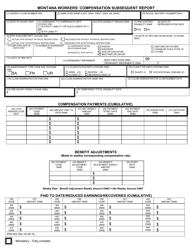

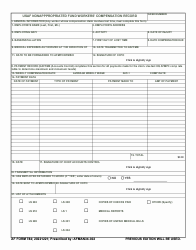

Workers' Compensation Self-insurance Financial / Loss Update - Montana

Workers' Compensation Self-insurance Financial/Loss Update is a legal document that was released by the Montana Department of Labor and Industry - a government authority operating within Montana.

FAQ

Q: What is workers' compensation self-insurance?

A: Workers' compensation self-insurance is a program in which employers cover the cost of their employees' work-related injuries or illnesses.

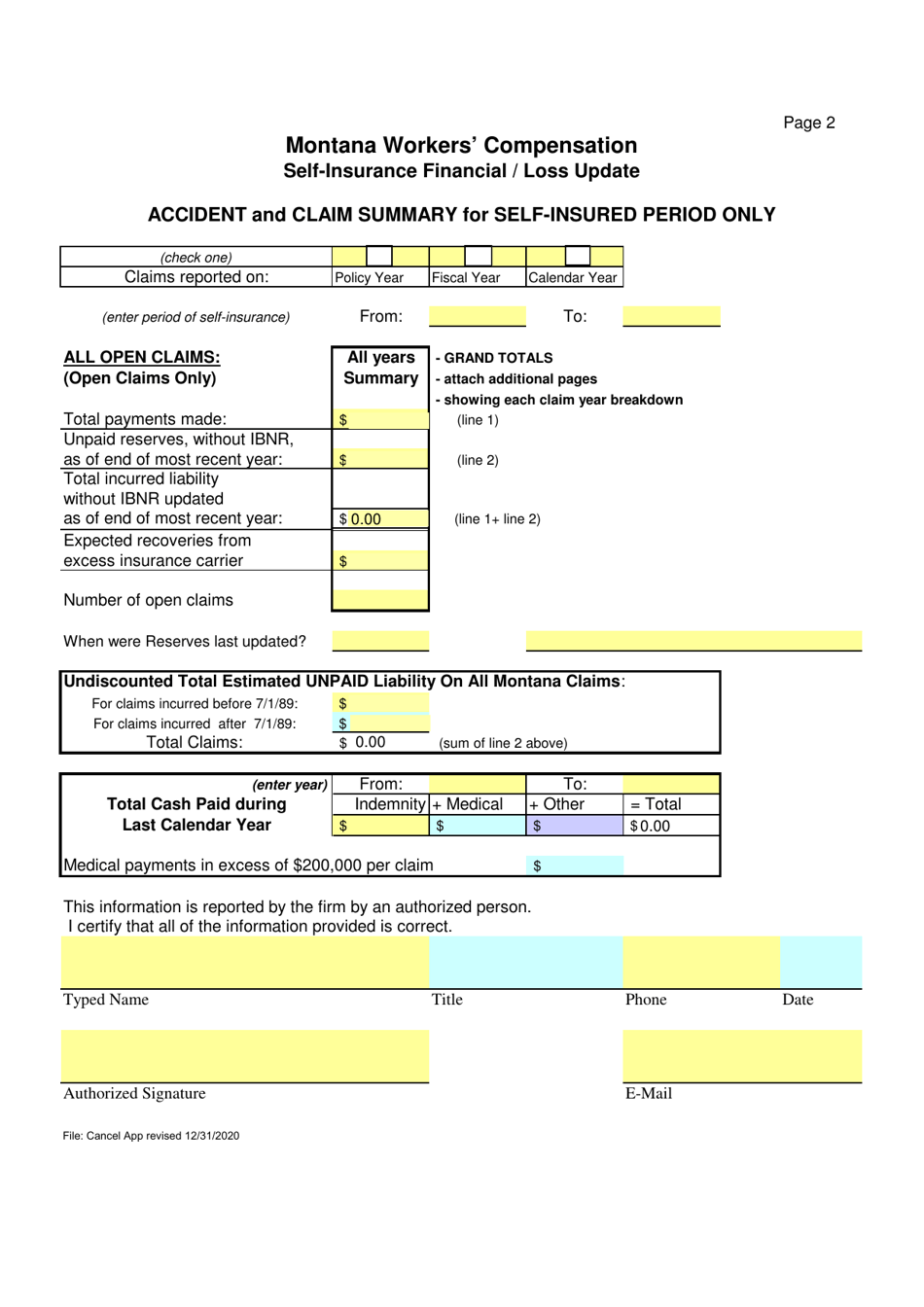

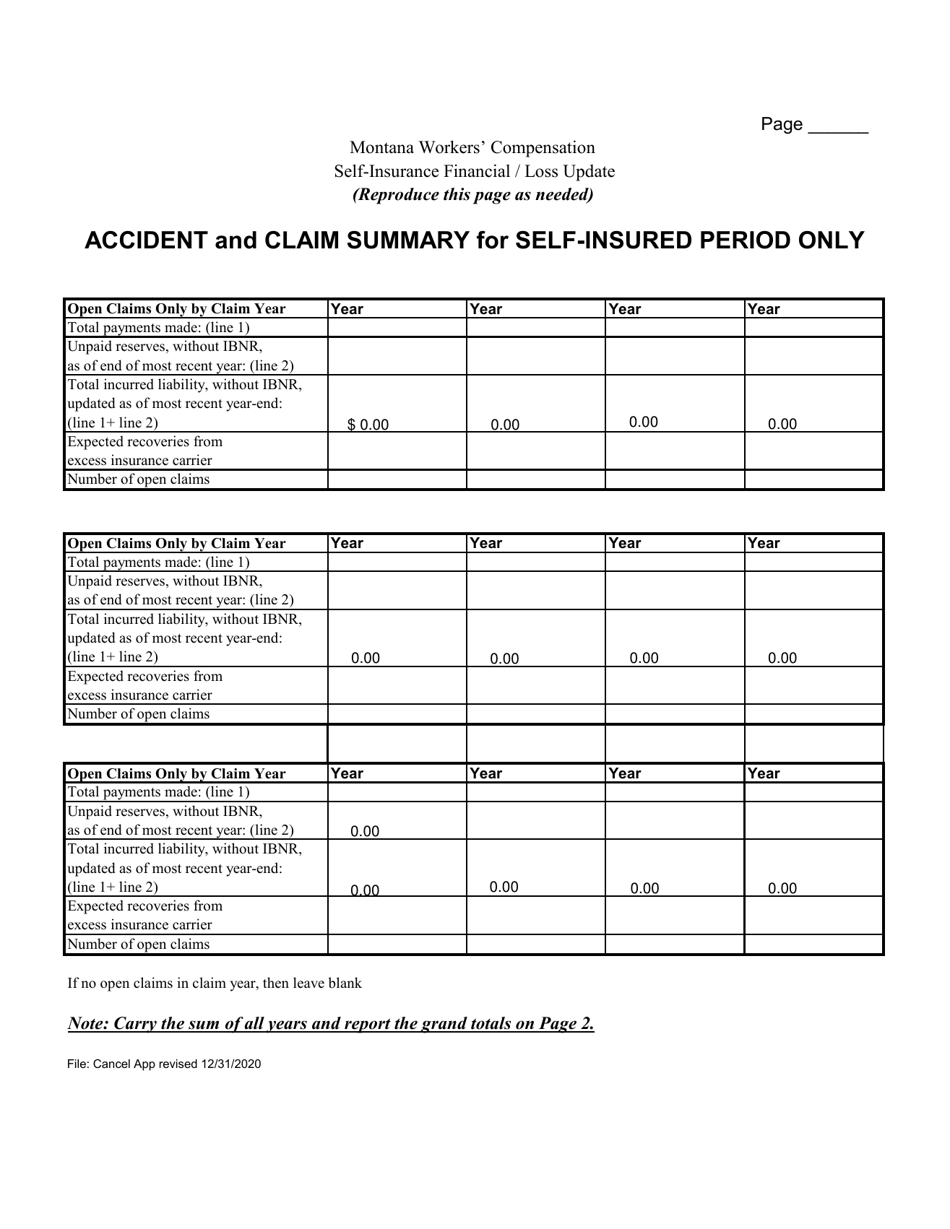

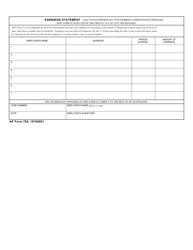

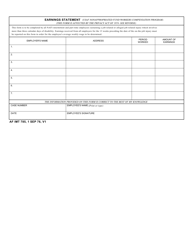

Q: What is a financial/loss update in workers' compensation self-insurance?

A: A financial/loss update is an assessment or report that provides information on the financial status and loss experience of a workers' compensation self-insurance program.

Q: Why is a financial/loss update important?

A: A financial/loss update is important because it helps employers evaluate the financial health of their workers' compensation self-insurance program and make informed decisions.

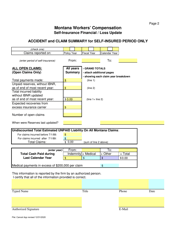

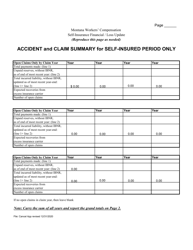

Q: What does a financial/loss update typically include?

A: A financial/loss update typically includes information on claims and expenses, reserves, premiums, losses, and other financial indicators.

Q: Who provides workers' compensation self-insurance in Montana?

A: Workers' compensation self-insurance is provided by employers who choose to self-insure rather than purchasing insurance coverage from a commercial provider.

Q: Are all employers eligible for workers' compensation self-insurance?

A: Not all employers are eligible for workers' compensation self-insurance. Eligibility requirements vary by state and usually include financial stability and meeting specific criteria.

Q: What are the benefits of workers' compensation self-insurance?

A: The benefits of workers' compensation self-insurance include more control over claims handling, potential cost savings, and the ability to customize coverage to meet specific needs.

Q: Are there any challenges or risks associated with workers' compensation self-insurance?

A: Yes, there are challenges and risks associated with workers' compensation self-insurance, such as higher financial responsibility, potential for higher costs in case of large claims, and the need for expertise in claims management.

Q: Do employers need approval to self-insure for workers' compensation in Montana?

A: Yes, employers in Montana need approval from the state's Department of Labor and Industry to self-insure for workers' compensation.

Form Details:

- Released on December 31, 2020;

- The latest edition currently provided by the Montana Department of Labor and Industry;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Labor and Industry.