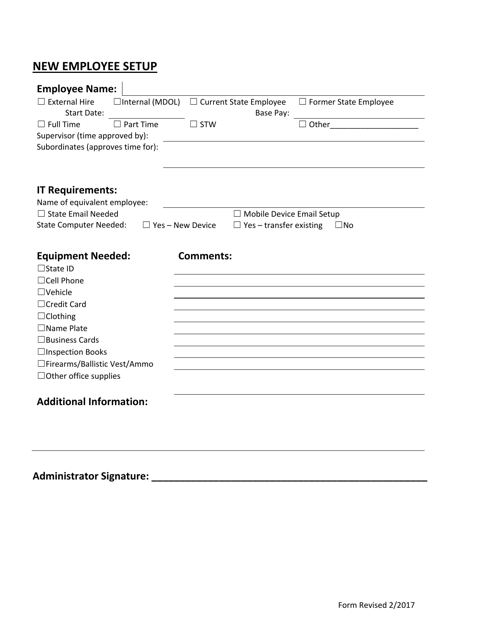

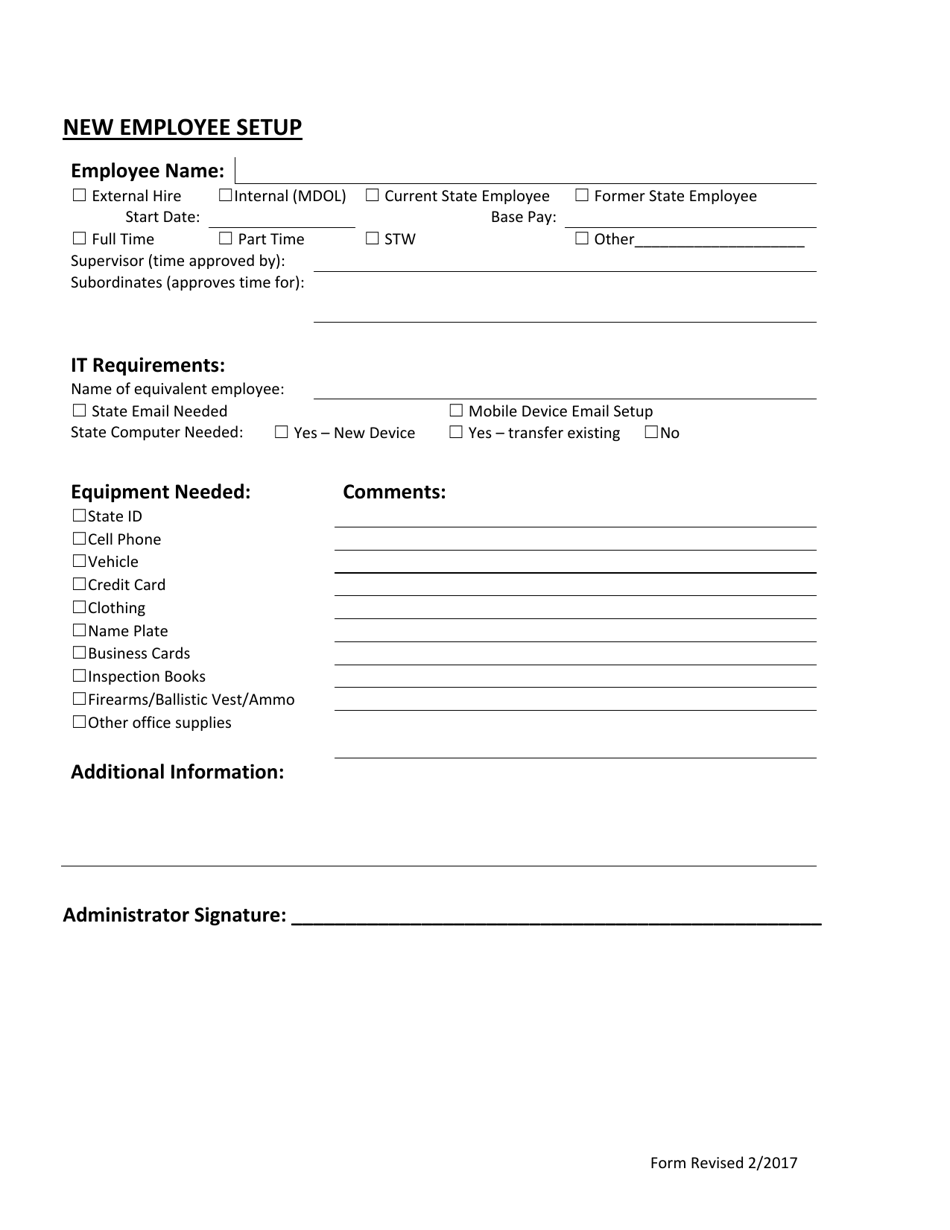

New Employee Setup - Montana

New Employee Setup is a legal document that was released by the Montana Department of Livestock - a government authority operating within Montana.

FAQ

Q: What documents do I need to bring for new employee setup in Montana?

A: You will need to bring a valid photo ID and your social security card.

Q: What is the minimum wage in Montana?

A: The minimum wage in Montana is $8.65 per hour.

Q: How often do I need to pay my employees in Montana?

A: You must pay your employees at least semi-monthly (twice a month) in Montana.

Q: Are there any additional labor laws I need to be aware of in Montana?

A: Yes, Montana has specific laws regarding overtime pay, breaks, and child labor that you should familiarize yourself with.

Q: Do I need to provide workers' compensation insurance for my employees in Montana?

A: Yes, employers in Montana are required to provide workers' compensation insurance coverage.

Q: How do I register as an employer in Montana?

A: You can register as an employer with the Montana Department of Revenue.

Q: What taxes do I need to withhold from my employees' wages in Montana?

A: You will need to withhold federal income tax, social security tax, Medicare tax, and Montana state income tax from your employees' wages.

Form Details:

- Released on February 1, 2017;

- The latest edition currently provided by the Montana Department of Livestock;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Livestock.