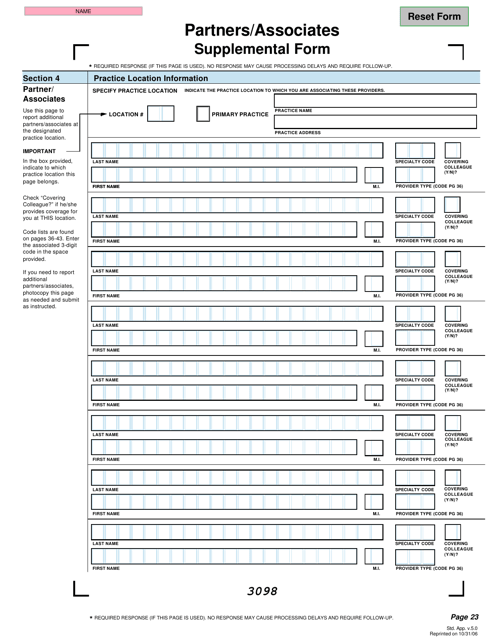

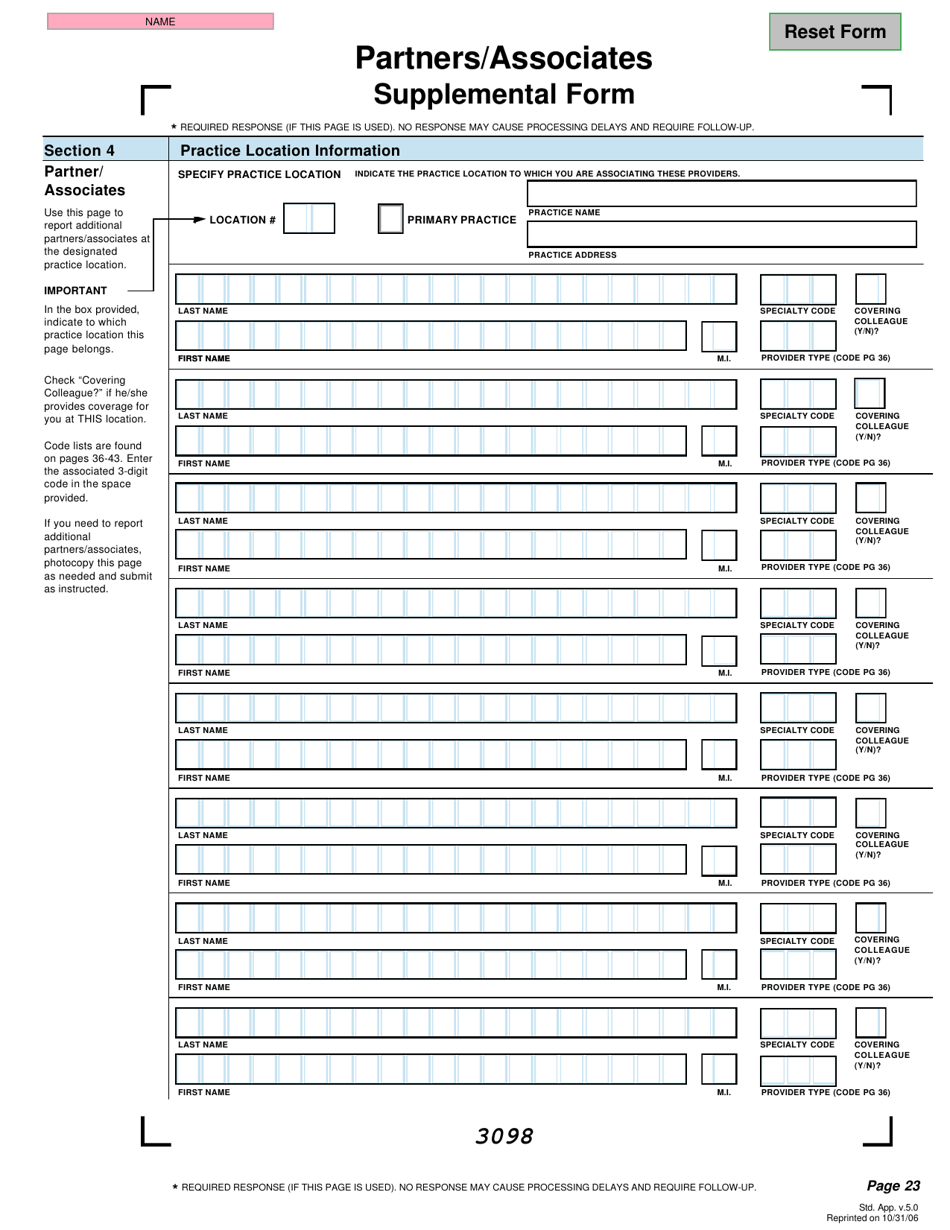

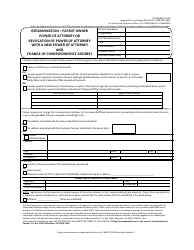

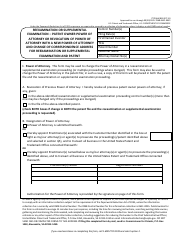

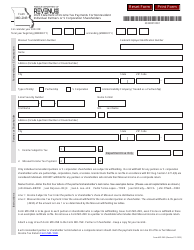

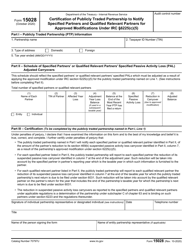

Partners / Associates Supplemental Form - Missouri

Partners/Associates Supplemental Form is a legal document that was released by the Missouri Department of Insurance - a government authority operating within Missouri.

FAQ

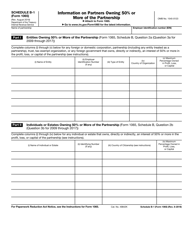

Q: What is the Partners/Associates Supplemental Form in Missouri?

A: The Partners/Associates Supplemental Form is a document that is required for certain types of businesses in Missouri when filing taxes.

Q: Who needs to fill out the Partners/Associates Supplemental Form in Missouri?

A: The Partners/Associates Supplemental Form needs to be filled out by businesses that have partnerships or associates.

Q: What information is required in the Partners/Associates Supplemental Form in Missouri?

A: The form typically requires information about the partners or associates, such as their names, social security numbers, and their share of the business's profits or losses.

Q: When is the deadline to file the Partners/Associates Supplemental Form in Missouri?

A: The deadline to file the form is usually the same as the deadline for filing the business's tax return in Missouri, which is generally April 15th.

Q: Is there a fee to file the Partners/Associates Supplemental Form in Missouri?

A: There is currently no fee to file the form in Missouri, but it is always best to check with the Missouri Department of Revenue for any updates or changes in the fee structure.

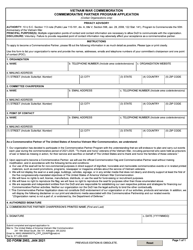

Form Details:

- Released on October 31, 2006;

- The latest edition currently provided by the Missouri Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Insurance.