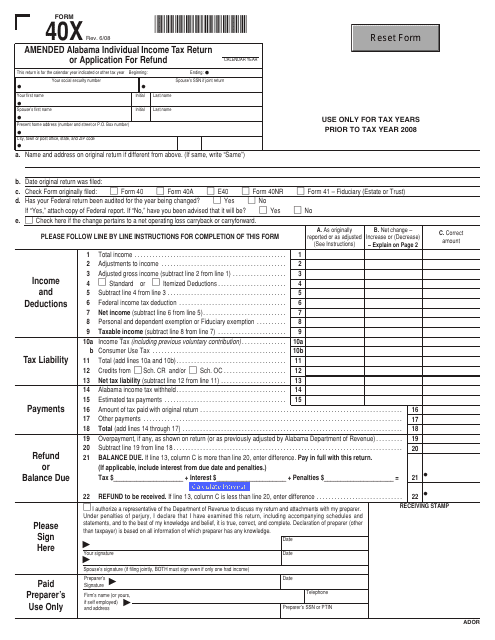

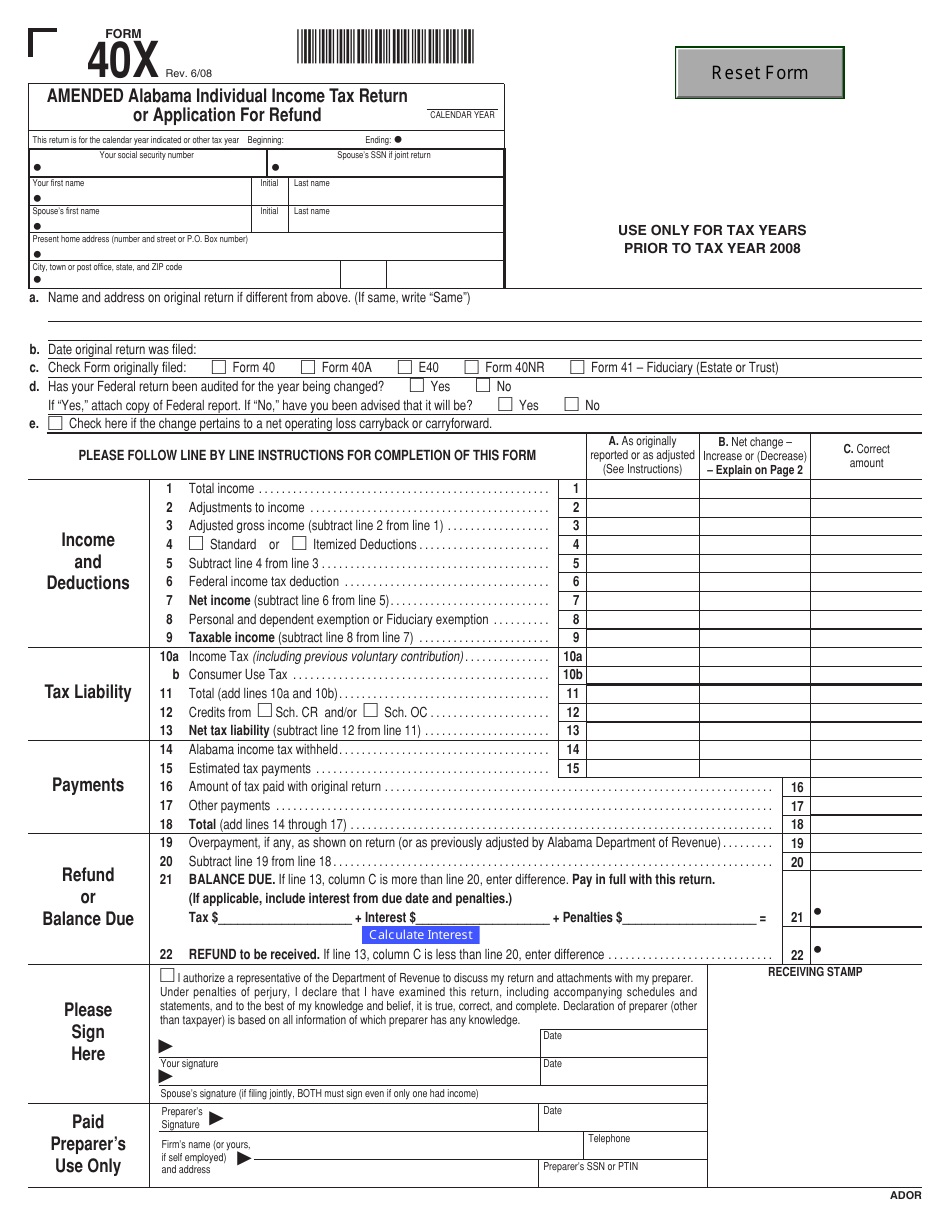

Form 40X Amended Alabama Individual Income Tax Return or Application for Refund - Alabama

What Is Form 40X?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40X?

A: Form 40X is the Amended Alabama Individual Income Tax Return or Application for Refund.

Q: When should I use Form 40X?

A: You should use Form 40X if you need to amend your Alabama Individual Income Tax Return or if you are applying for a refund.

Q: Can I e-file Form 40X?

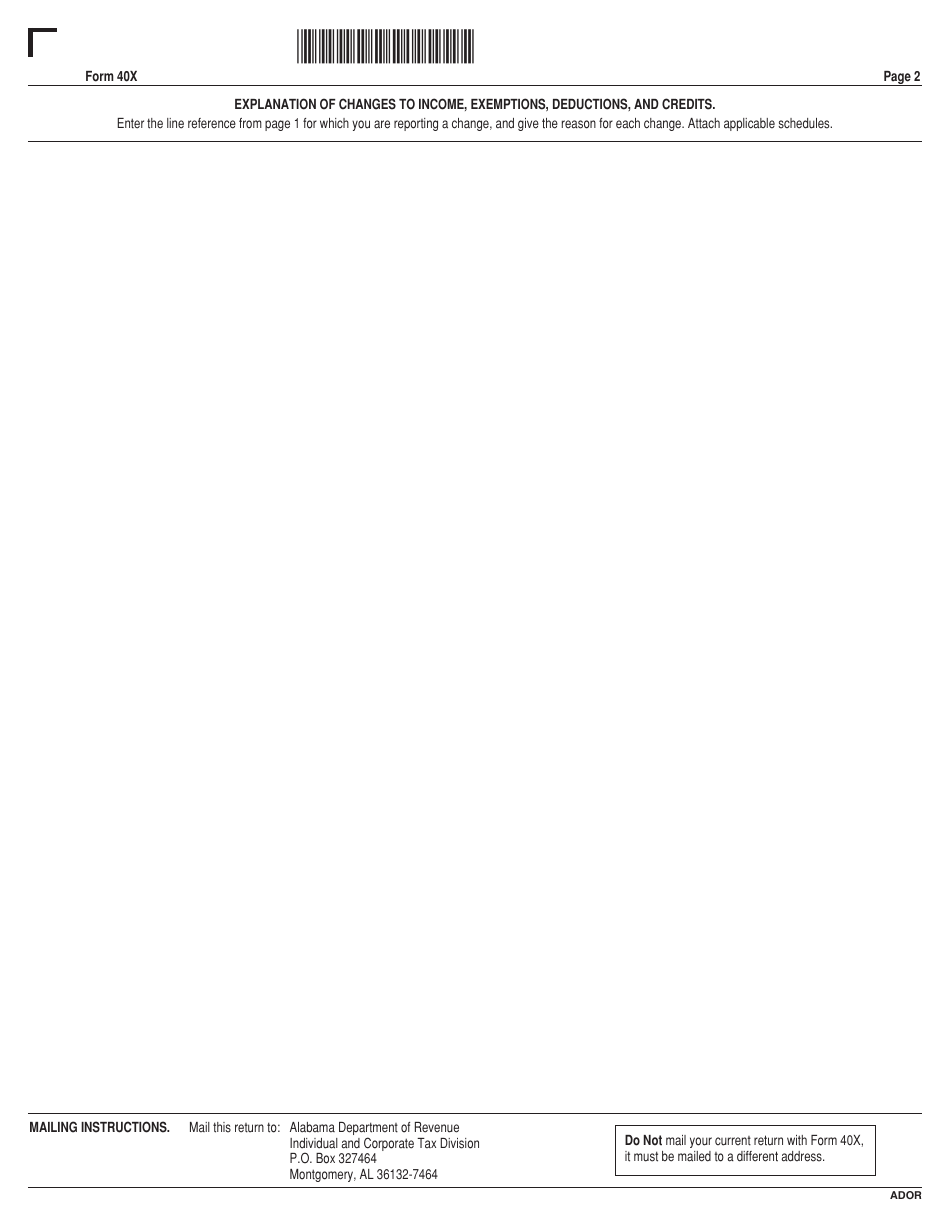

A: No, currently Alabama does not support e-filing for Form 40X. It must be filed by mail.

Q: What information do I need to include on Form 40X?

A: You need to provide your personal information, the tax year you are amending, and the changes you are making to your original return.

Q: How long does it take for the Alabama Department of Revenue to process Form 40X?

A: Processing times can vary, but it typically takes about 8 to 12 weeks for the department to process and issue a refund or adjust your tax liability.

Q: Is there a deadline for filing Form 40X?

A: Yes, you generally have three years from the original filing deadline to file Form 40X and claim a refund.

Q: Can I file an amended return if I owe additional taxes?

A: Yes, you can file an amended return to pay any additional taxes owed. Include payment with your Form 40X.

Q: Are there any penalties for filing an amended return?

A: If you are filing an amended return and owe additional taxes, you may be subject to penalties and interest for late payment.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40X by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.