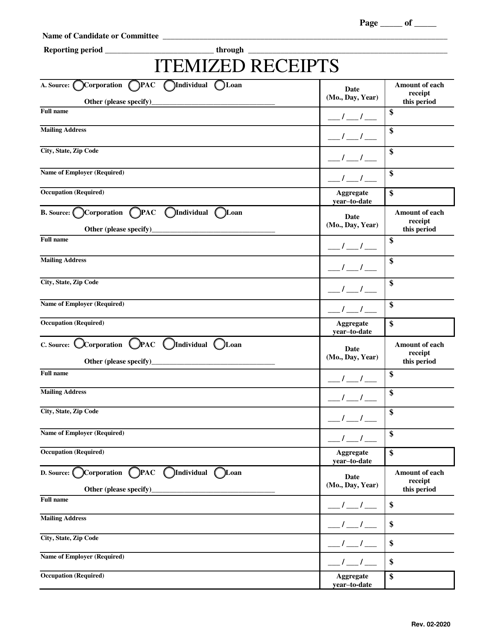

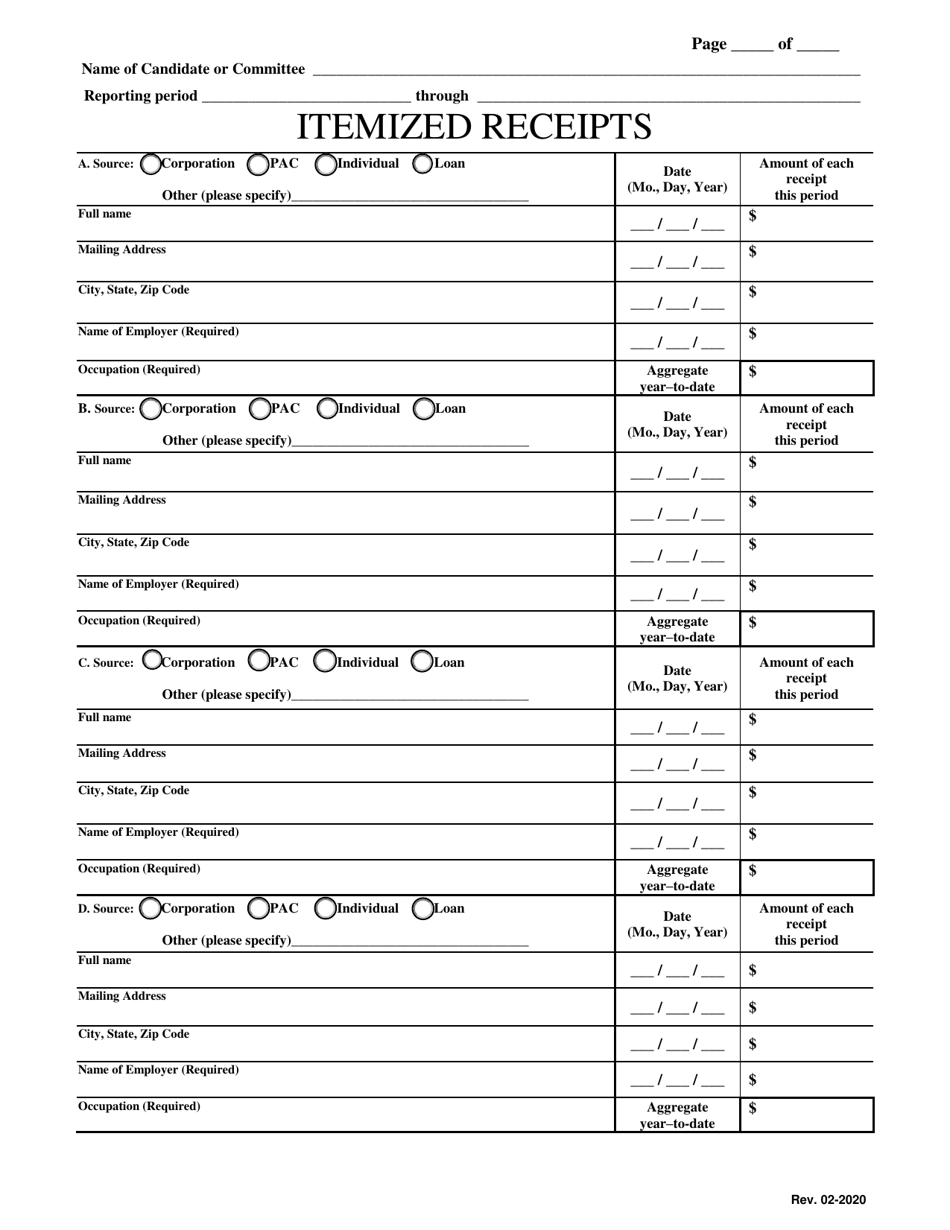

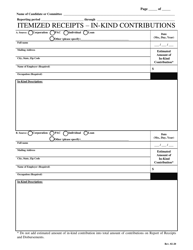

Itemized Receipts - Mississippi

Itemized Receipts is a legal document that was released by the Mississippi Secretary of State - a government authority operating within Mississippi.

FAQ

Q: What are itemized receipts?

A: Itemized receipts are detailed receipts that provide a breakdown of each item or service purchased, along with their individual costs.

Q: Why are itemized receipts important?

A: Itemized receipts are important for record-keeping and documentation purposes, as they provide proof of purchase and can be used for tax deductions or reimbursement purposes.

Q: What information is included in an itemized receipt?

A: An itemized receipt typically includes the date of purchase, a description of each item or service purchased, the quantity, the individual cost of each item, any applicable taxes or fees, and the total amount paid.

Q: Are itemized receipts required in Mississippi?

A: While itemized receipts are not explicitly required by law in Mississippi, they are generally recommended for business and personal financial transactions.

Q: Do I need an itemized receipt for tax purposes?

A: Having an itemized receipt can be helpful for tax purposes, as it allows you to accurately report your expenses and potentially claim deductions.

Q: Can I request an itemized receipt?

A: Yes, you can request an itemized receipt from a business or service provider if one is not initially provided. It is generally good practice to ask for an itemized receipt, especially for larger purchases or expenses.

Form Details:

- Released on February 1, 2020;

- The latest edition currently provided by the Mississippi Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Secretary of State.