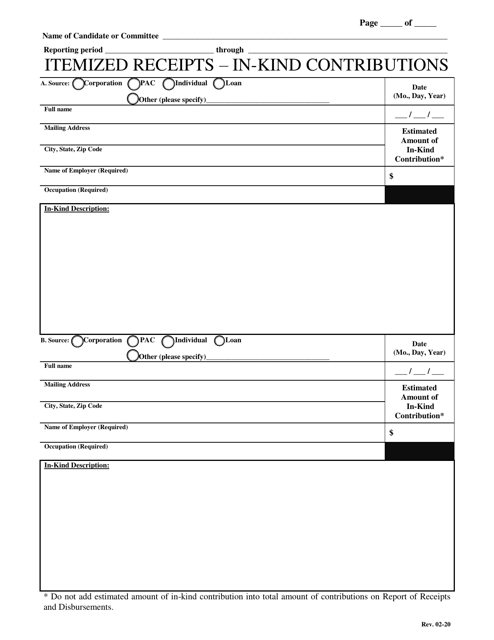

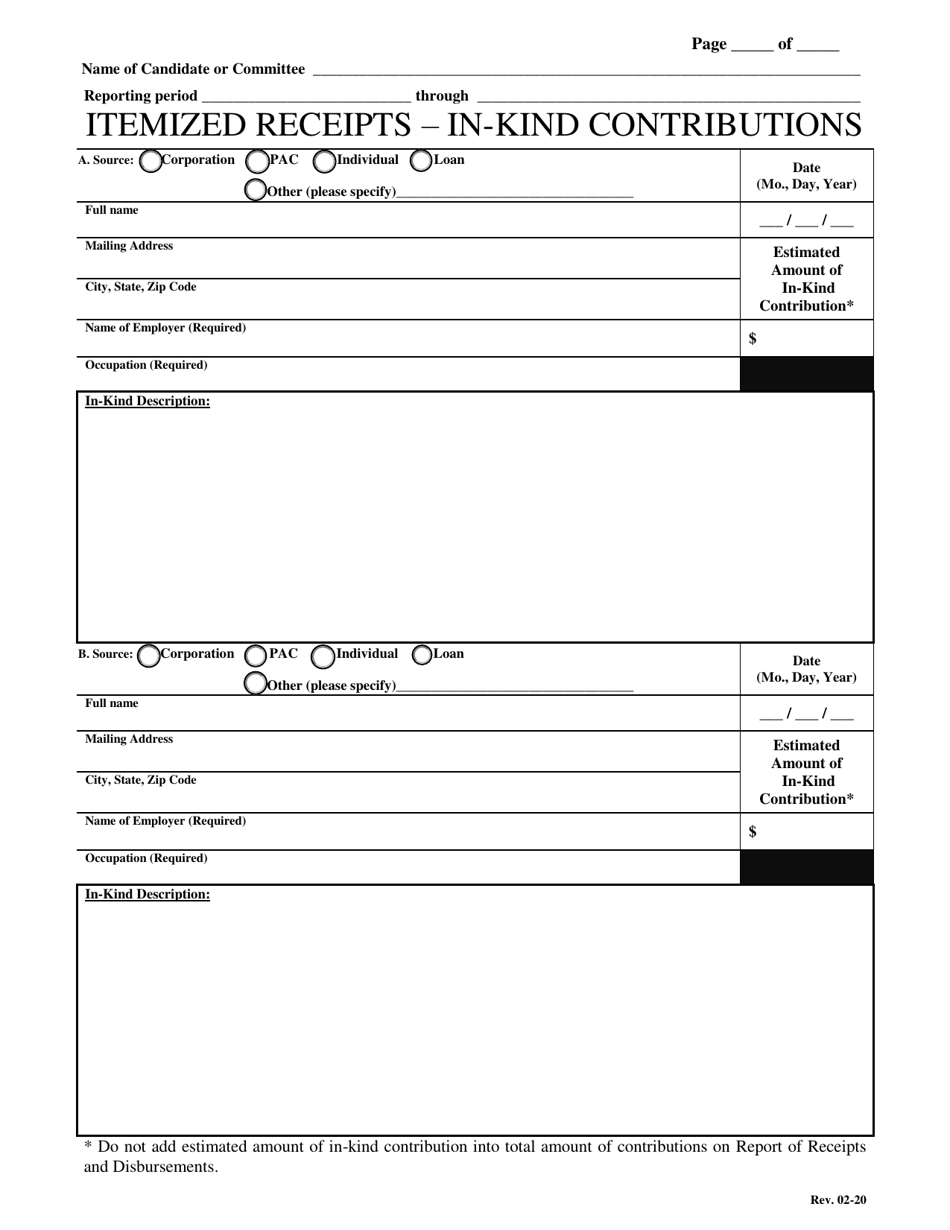

Itemized Receipts - in-Kind Contributions - Mississippi

Itemized Receipts - in-Kind Contributions is a legal document that was released by the Mississippi Secretary of State - a government authority operating within Mississippi.

FAQ

Q: What are itemized receipts?

A: Itemized receipts are detailed records that document the specific items or services received in a donation or contribution.

Q: Why are itemized receipts important for in-kind contributions?

A: Itemized receipts are important for in-kind contributions because they provide accurate records of the items or services donated, which can be used for tax purposes.

Q: What is an in-kind contribution?

A: An in-kind contribution refers to the donation of goods, services, or property instead of cash.

Q: What should be included in an itemized receipt for an in-kind contribution?

A: An itemized receipt for an in-kind contribution should include the date of the donation, a description of the donated items or services, their estimated value, and the name and address of the organization receiving the donation.

Q: Do in-kind contributions qualify for tax deductions?

A: Yes, in-kind contributions can qualify for tax deductions, but it is important to consult with a tax professional or the IRS for specific guidelines and requirements.

Form Details:

- Released on February 1, 2020;

- The latest edition currently provided by the Mississippi Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Secretary of State.