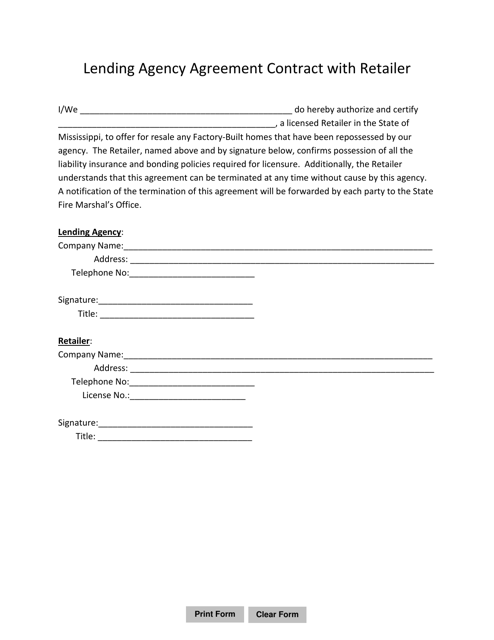

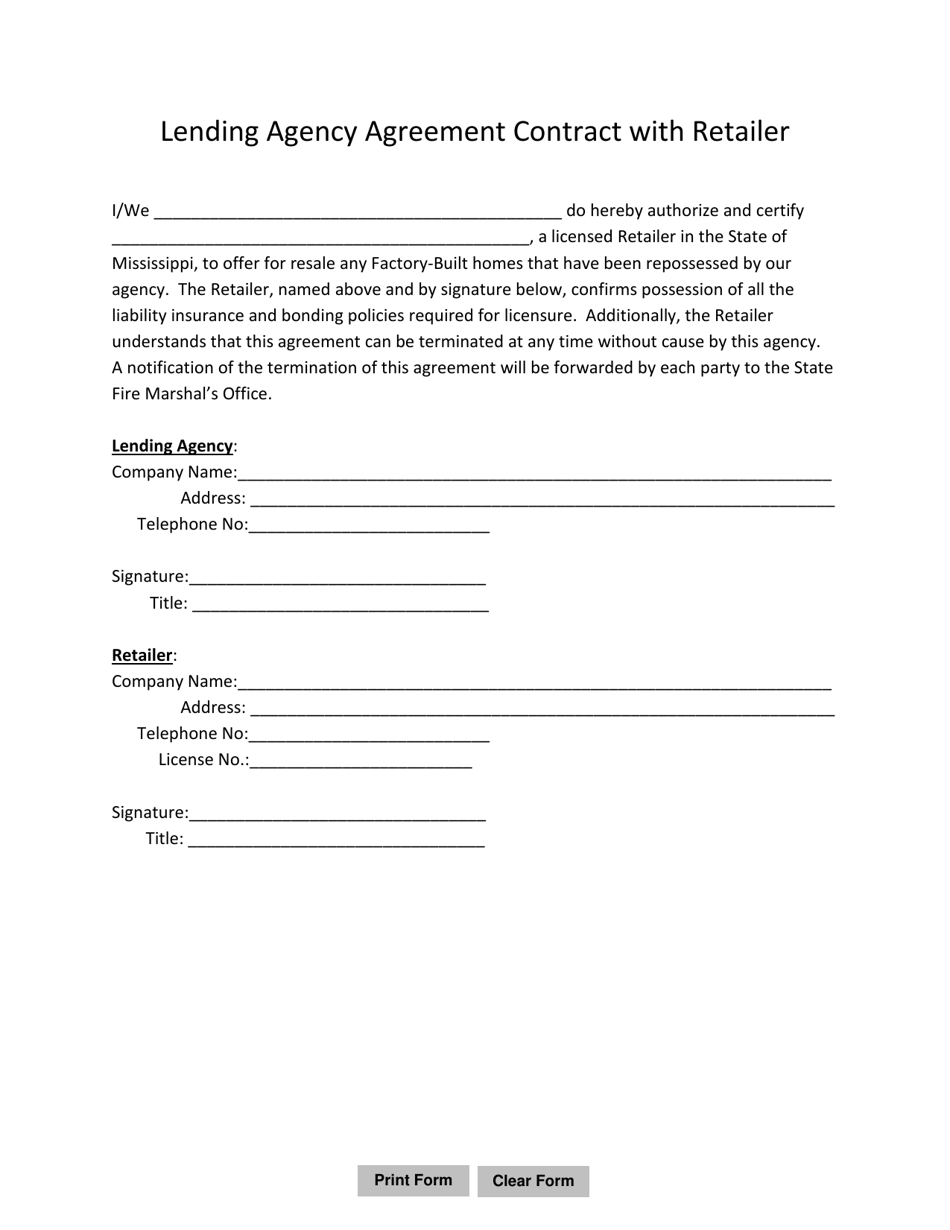

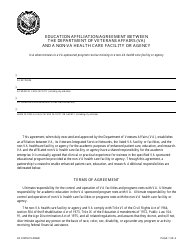

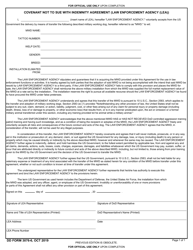

Lending Agency Agreement Contract With Retailer - Mississippi

Lending Agency Agreement Contract With Retailer is a legal document that was released by the Mississippi Department of Insurance - a government authority operating within Mississippi.

FAQ

Q: What is a lending agency agreement contract?

A: A lending agency agreement contract is a legal agreement between a lender and a borrower that outlines the terms and conditions of a loan.

Q: What is the role of the retailer in a lending agency agreement contract?

A: The retailer is the borrower in a lending agency agreement contract. They are the ones receiving the loan from the lender.

Q: What is the purpose of a lending agency agreement contract?

A: The purpose of a lending agency agreement contract is to establish a formal agreement between the lender and the retailer regarding the terms of the loan.

Q: What are some common terms included in a lending agency agreement contract?

A: Common terms in a lending agency agreement contract may include the loan amount, interest rate, repayment schedule, terms for default or late payment, and any collateral or security requirements.

Q: Is a lending agency agreement contract legally binding?

A: Yes, a lending agency agreement contract is legally binding once both parties have agreed to its terms and signed the contract.

Q: What happens if there is a breach of the lending agency agreement contract?

A: If there is a breach of the lending agency agreement contract, the party who has been harmed may seek legal remedies, such as filing a lawsuit for damages.

Q: Does a lending agency agreement contract have to be in writing?

A: It is highly recommended to have a lending agency agreement contract in writing to ensure clarity and enforceability. However, oral agreements may also be binding in certain circumstances.

Q: Can a lending agency agreement contract be modified or terminated?

A: A lending agency agreement contract can be modified or terminated if both parties agree to the changes and document them in writing.

Q: What laws govern lending agency agreement contracts in Mississippi?

A: Lending agency agreement contracts in Mississippi are subject to the general contract laws of the state as well as any specific regulations or statutes that may apply to lending.

Q: Should I consult with a lawyer when drafting or signing a lending agency agreement contract?

A: It is always a good idea to consult with a lawyer when dealing with legal contracts, especially if you are unfamiliar with the terms or want to ensure your rights are protected.

Form Details:

- The latest edition currently provided by the Mississippi Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Insurance.