This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

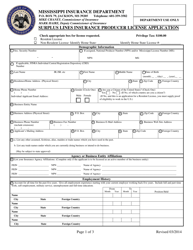

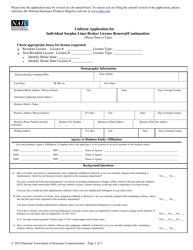

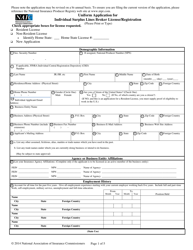

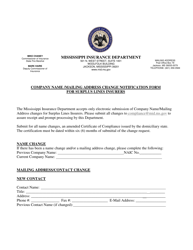

Application Verifying Eligibility as Surplus Lines Insurer in the State of Mississippi - Mississippi

Application Verifying Eligibility as Surplus Lines Insurer in the State of Mississippi is a legal document that was released by the Mississippi Department of Insurance - a government authority operating within Mississippi.

FAQ

Q: What is a surplus lines insurer?

A: A surplus lines insurer is an insurance company that provides coverage for risks that are not available through traditional insurance companies.

Q: Why do insurance companies need to be verified as surplus lines insurers in Mississippi?

A: Insurance companies need to be verified as surplus lines insurers in Mississippi to ensure that they meet the requirements and regulations set by the state for providing coverage for risks that cannot be insured by traditional insurance companies.

Q: How can an insurance company apply to be verified as a surplus lines insurer in Mississippi?

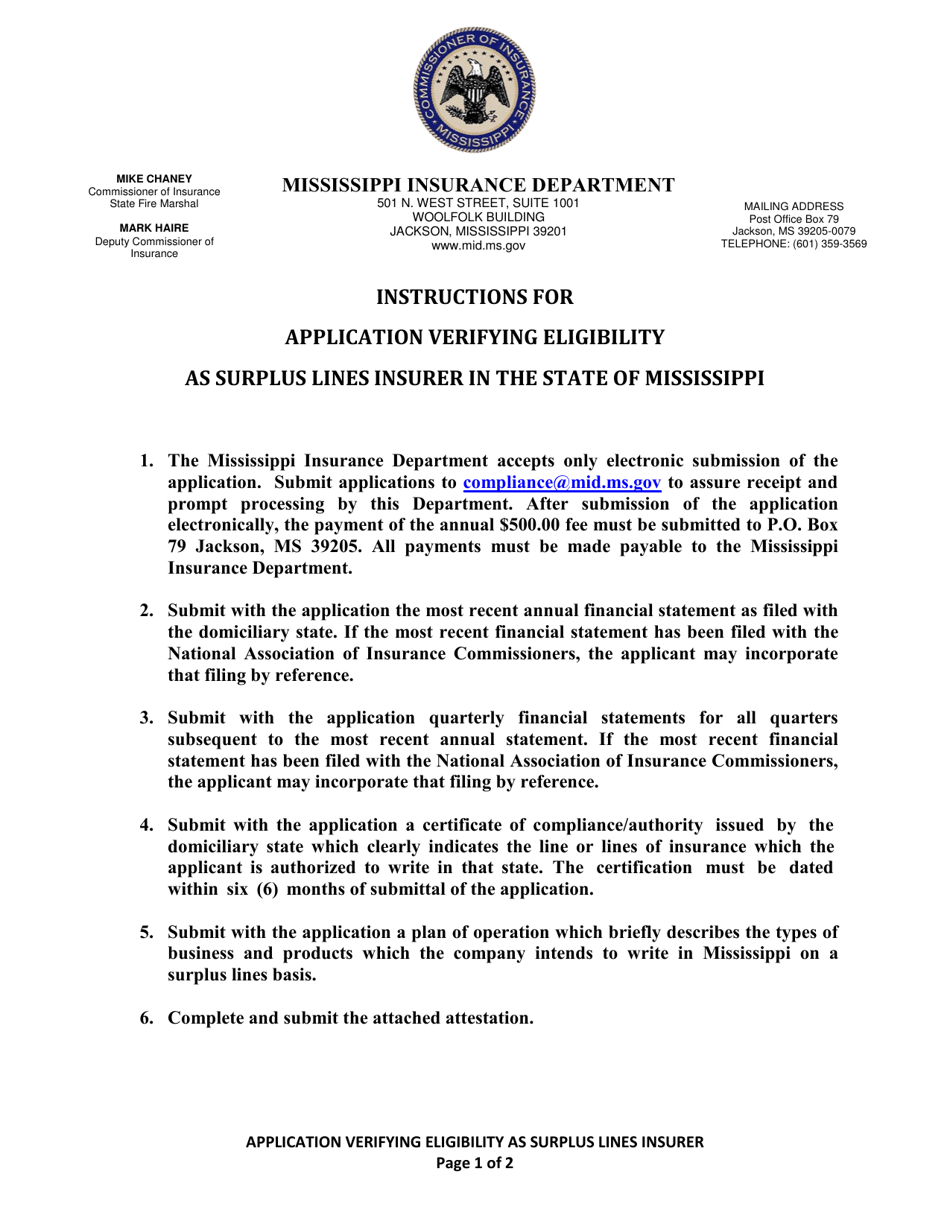

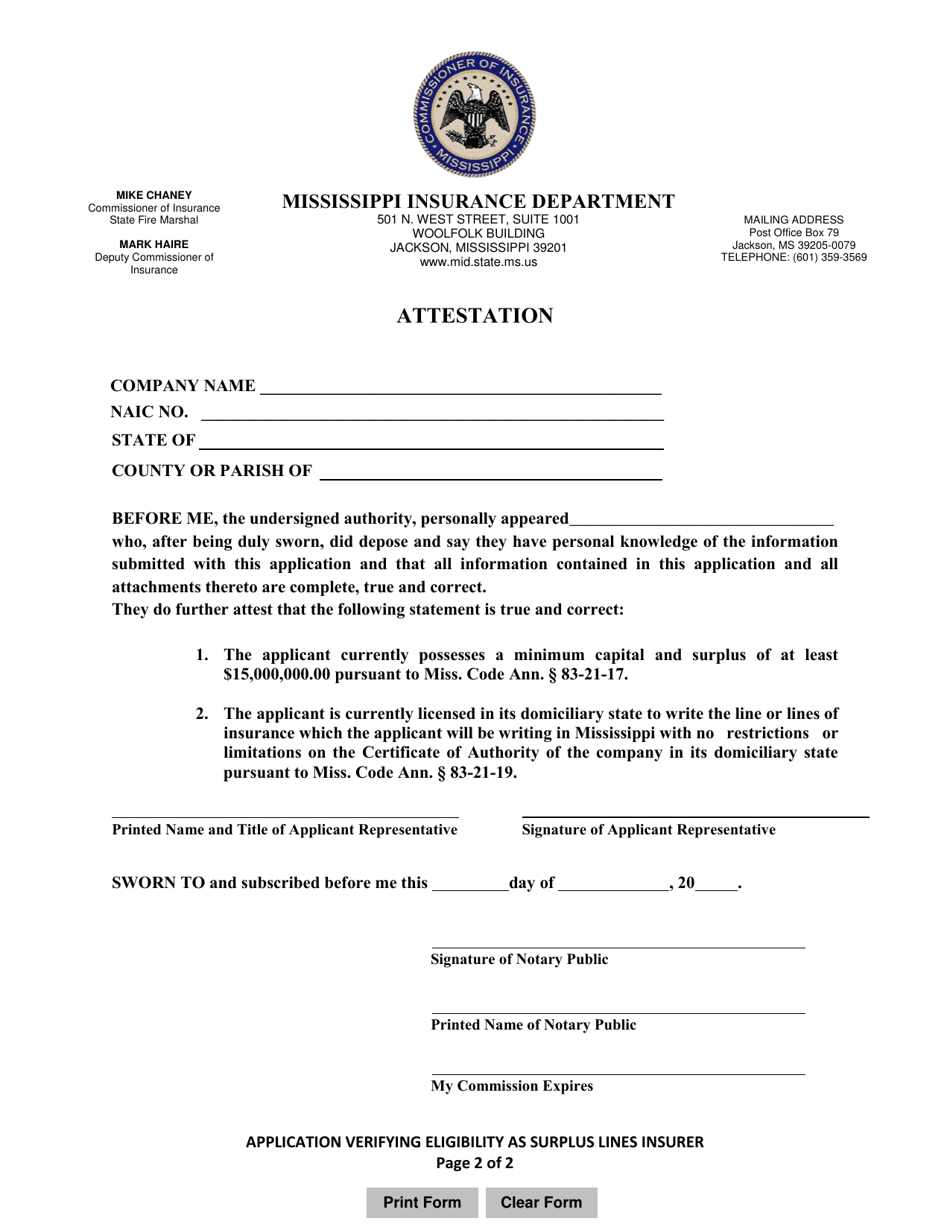

A: To apply to be verified as a surplus lines insurer in Mississippi, an insurance company must submit an application to the Mississippi Insurance Department and provide all the necessary documentation and fees.

Q: What documentation is required to apply as a surplus lines insurer in Mississippi?

A: Documentation required to apply as a surplus lines insurer in Mississippi may include a completed application form, financial statements, proof of licensure, and other relevant documents as requested by the Mississippi Insurance Department.

Q: How long does it take to get verified as a surplus lines insurer in Mississippi?

A: The time taken to get verified as a surplus lines insurer in Mississippi can vary depending on the completeness of the application and the workload of the Mississippi Insurance Department, but it generally takes a few weeks to several months.

Q: Is there a fee for applying to be a surplus lines insurer in Mississippi?

A: Yes, there is usually a fee associated with applying to be a surplus lines insurer in Mississippi. The specific fee amount can be obtained from the Mississippi Insurance Department.

Q: What happens after an insurance company is verified as a surplus lines insurer in Mississippi?

A: Once an insurance company is verified as a surplus lines insurer in Mississippi, they are eligible to provide coverage for risks that cannot be insured by traditional insurance companies in the state.

Q: Are there any ongoing requirements for surplus lines insurers in Mississippi?

A: Yes, surplus lines insurers in Mississippi are subject to ongoing requirements such as filing of reports, maintaining proper financial security, and complying with all relevant laws and regulations.

Q: Can insurance agents sell policies from surplus lines insurers in Mississippi?

A: Yes, insurance agents in Mississippi can sell policies from surplus lines insurers as long as the surplus lines insurers are verified by the Mississippi Insurance Department to provide coverage in the state.

Q: What types of risks are typically covered by surplus lines insurers?

A: Surplus lines insurers typically provide coverage for risks that are considered too high or specialized to be insured by traditional insurance companies, such as unique or hard-to-place risks.

Form Details:

- The latest edition currently provided by the Mississippi Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Insurance.