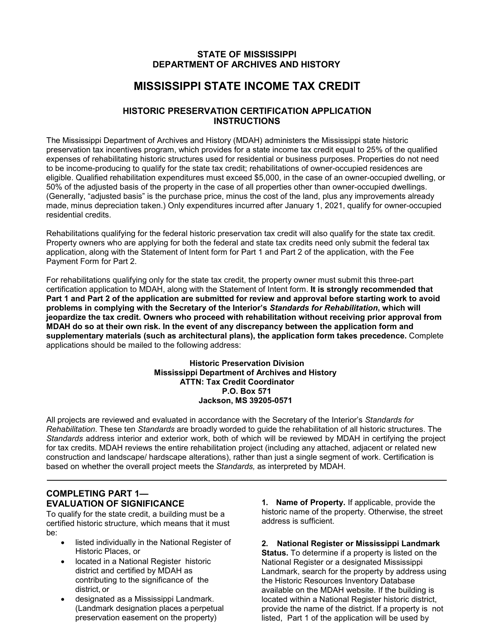

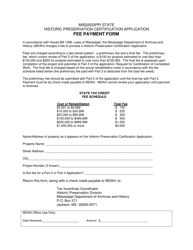

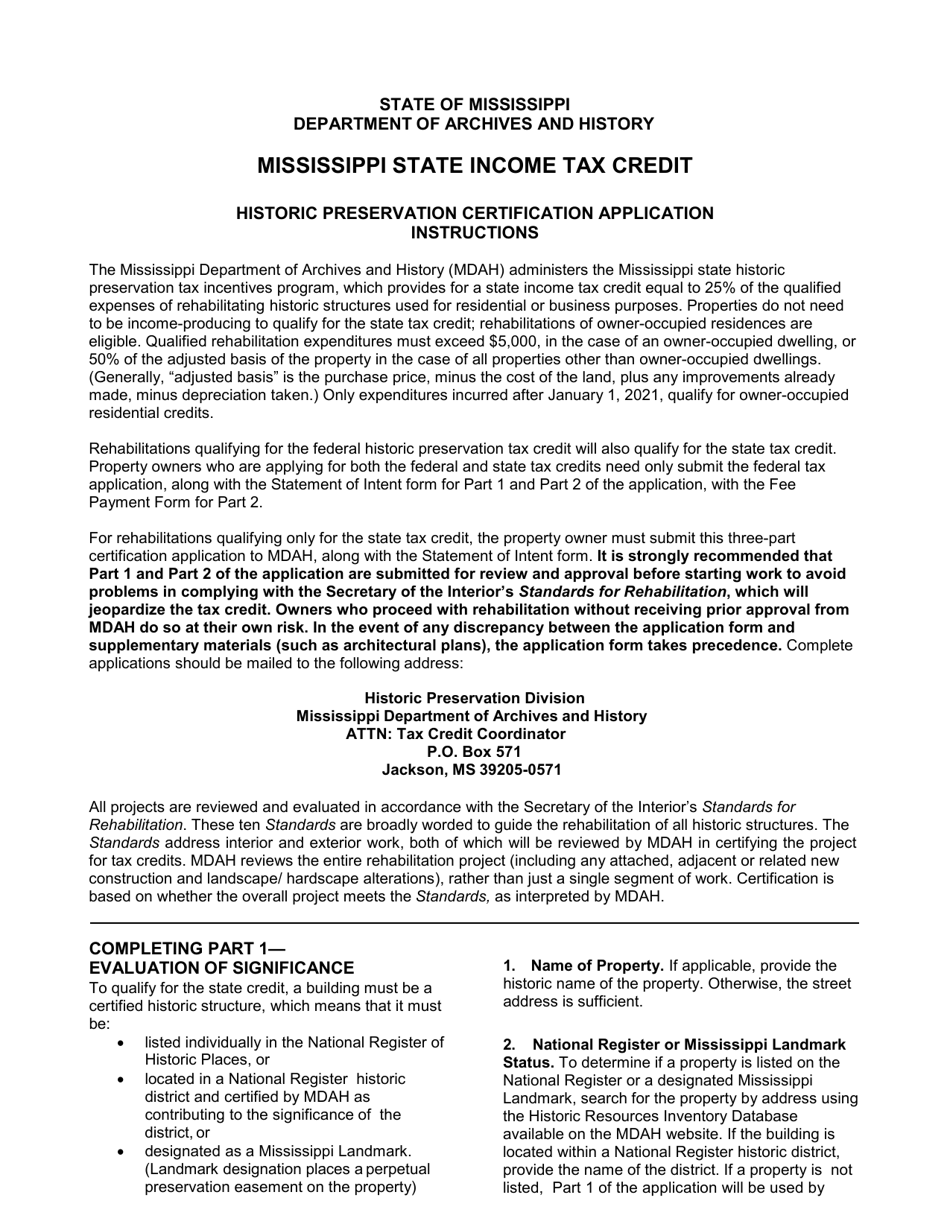

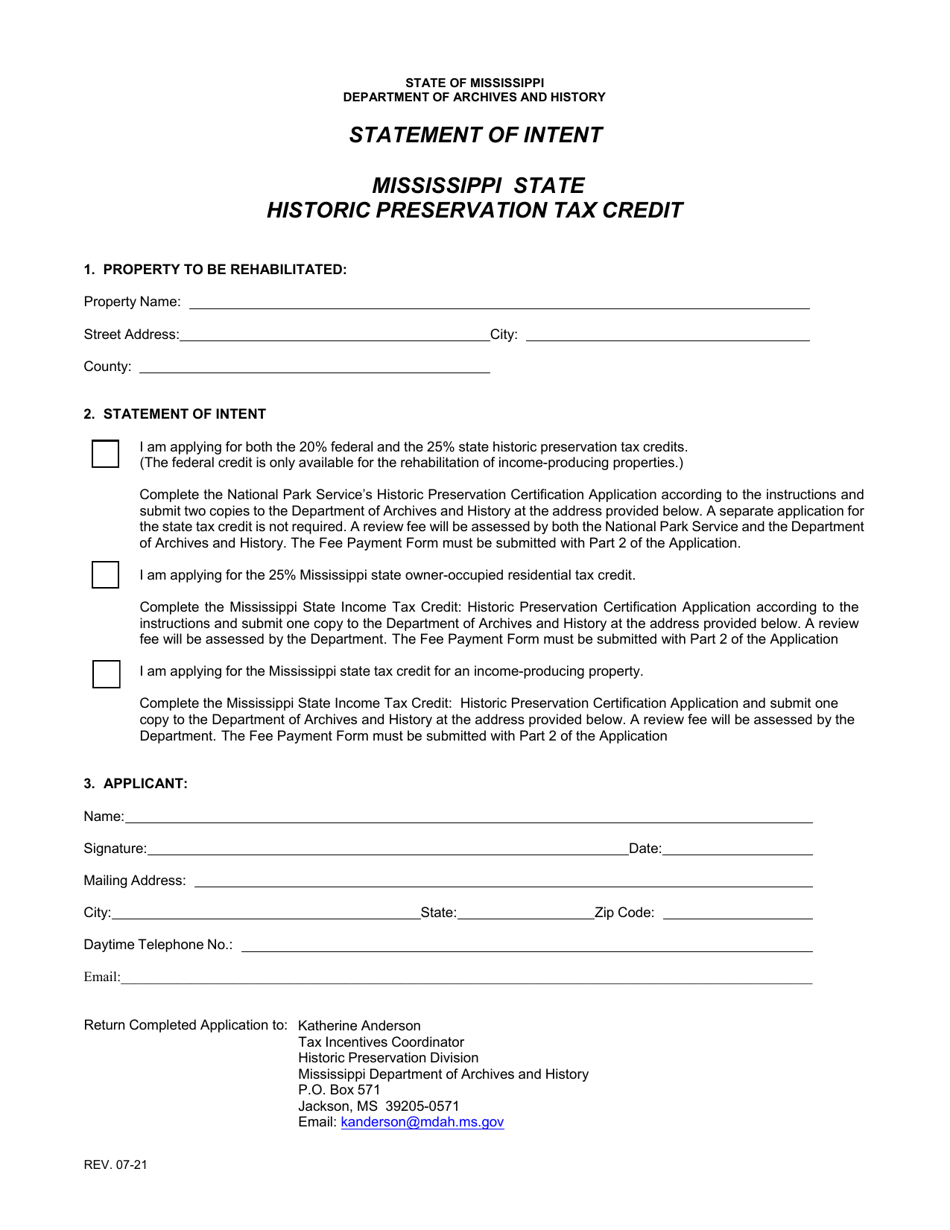

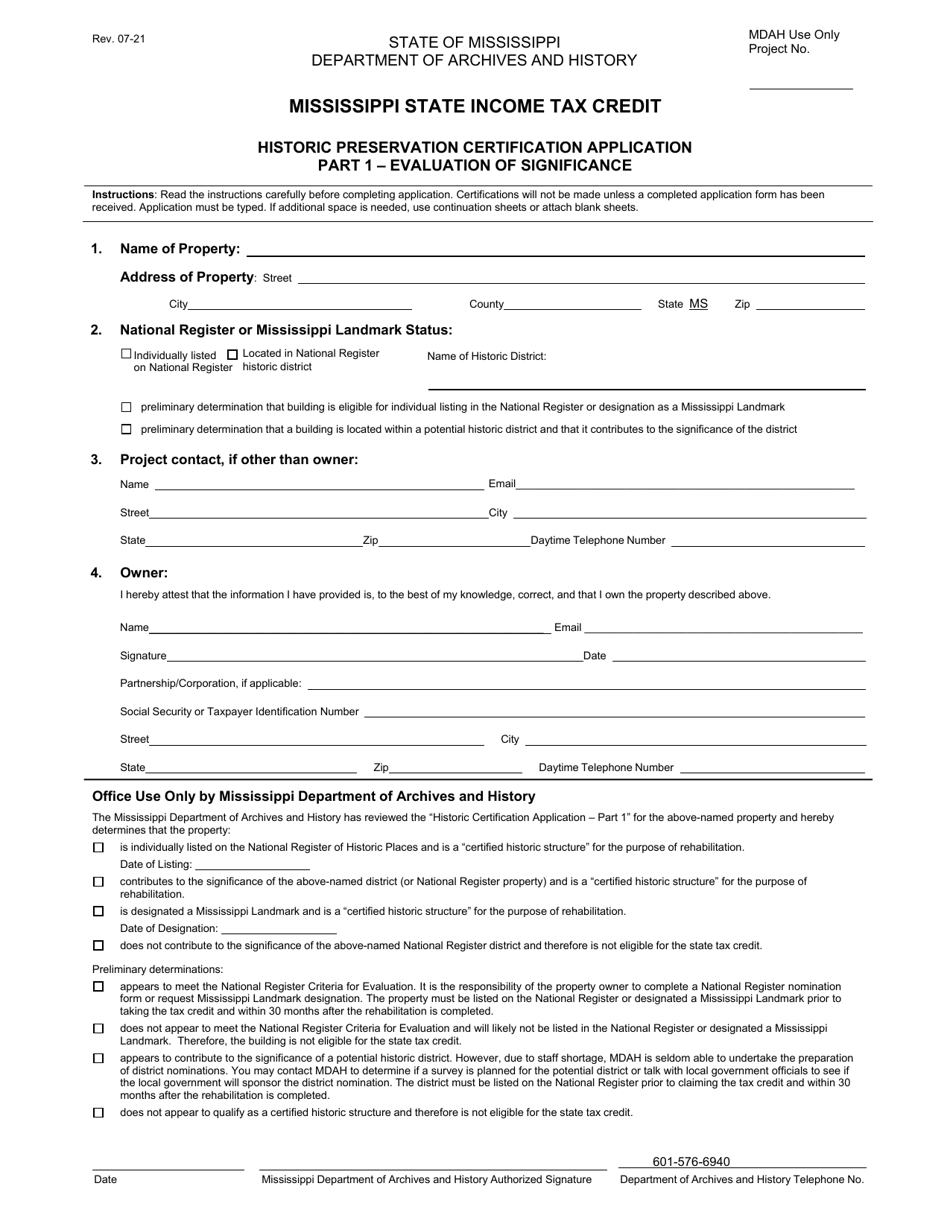

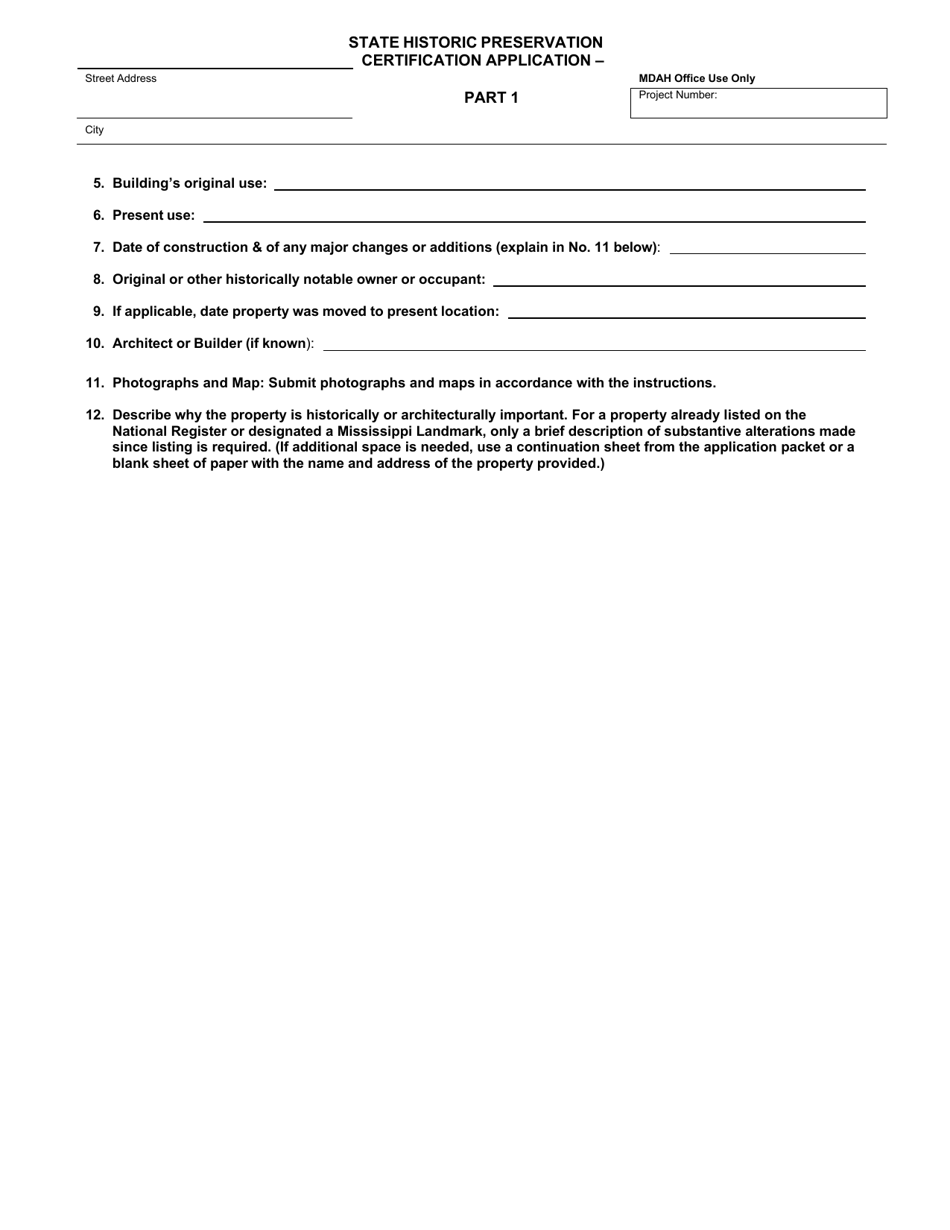

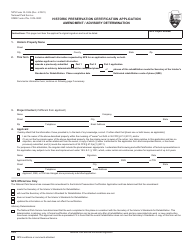

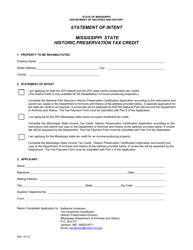

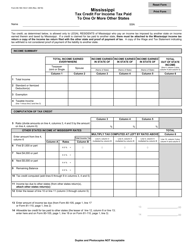

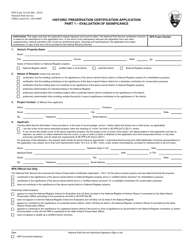

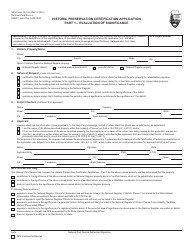

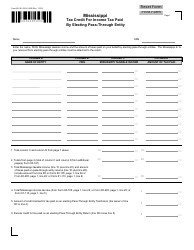

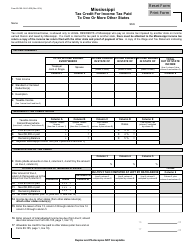

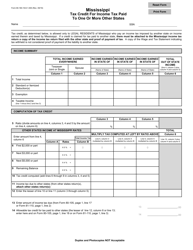

Mississippi State Income Tax Credit Historic Preservation Certification Application - Mississippi

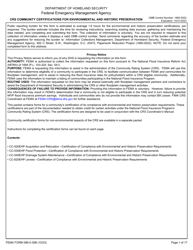

Mississippi State Historic Preservation Certification Application is a legal document that was released by the Mississippi Department of Archives and History - a government authority operating within Mississippi.

FAQ

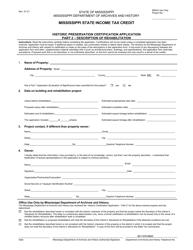

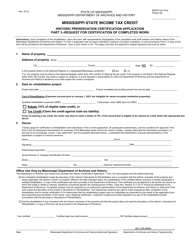

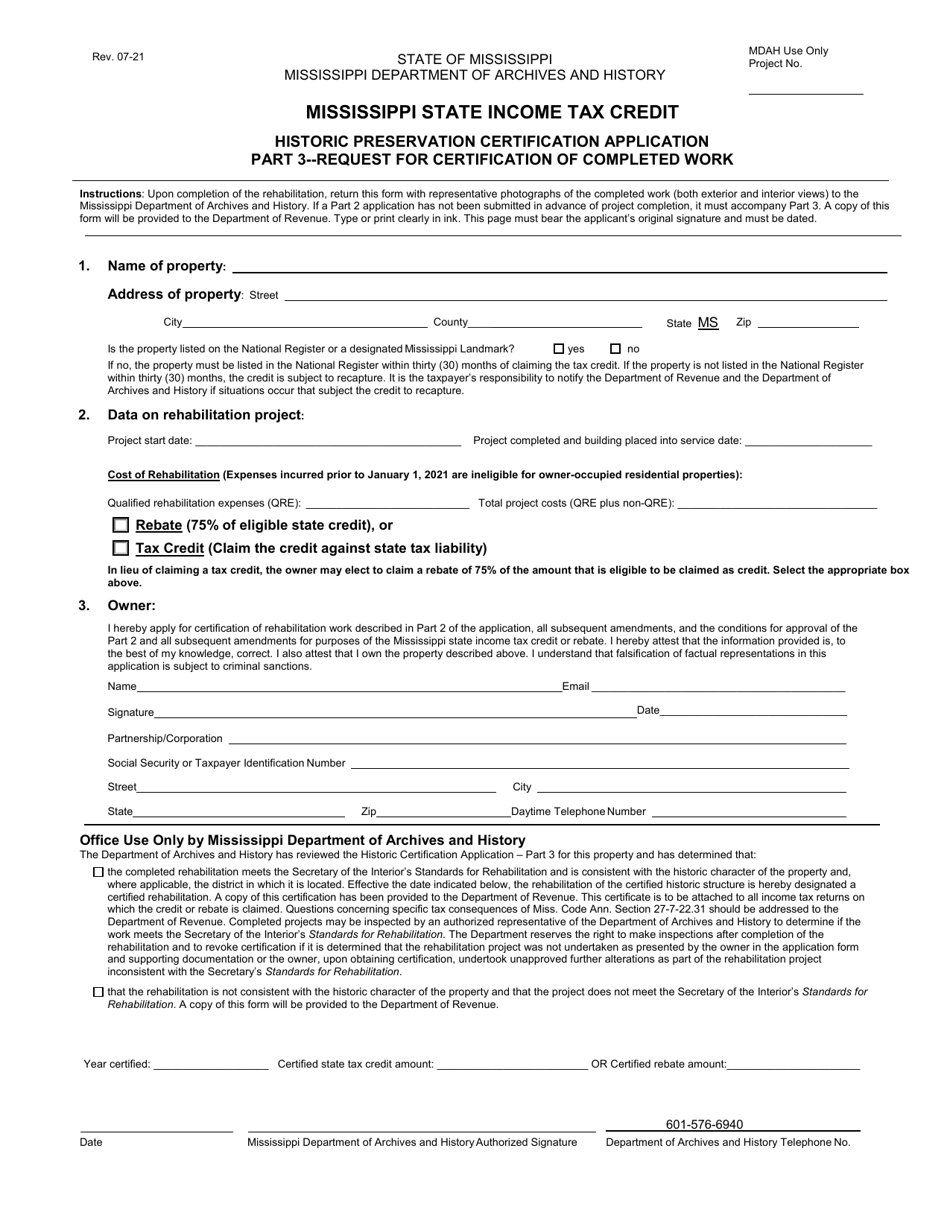

Q: What is the Mississippi State Income Tax Credit Historic Preservation Certification Application?

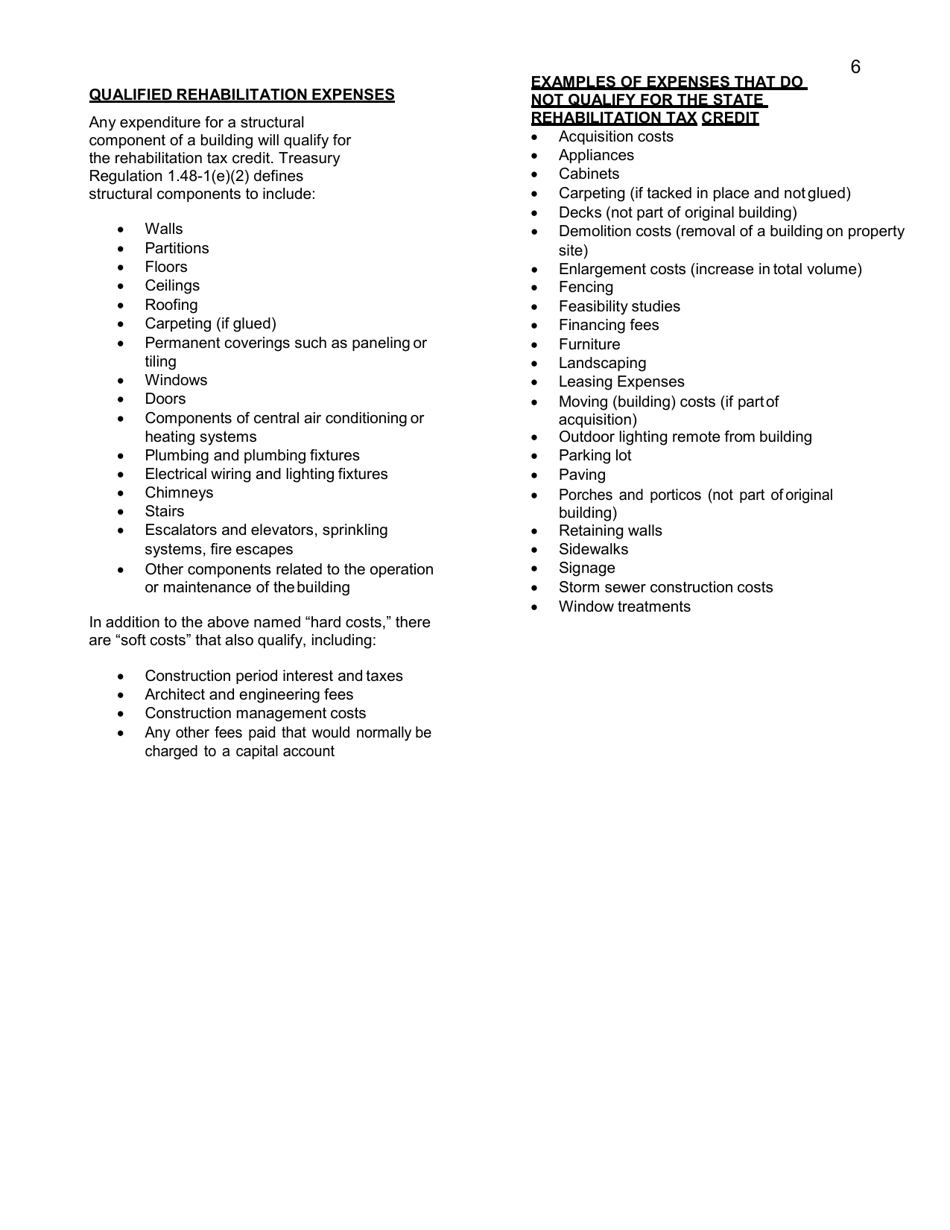

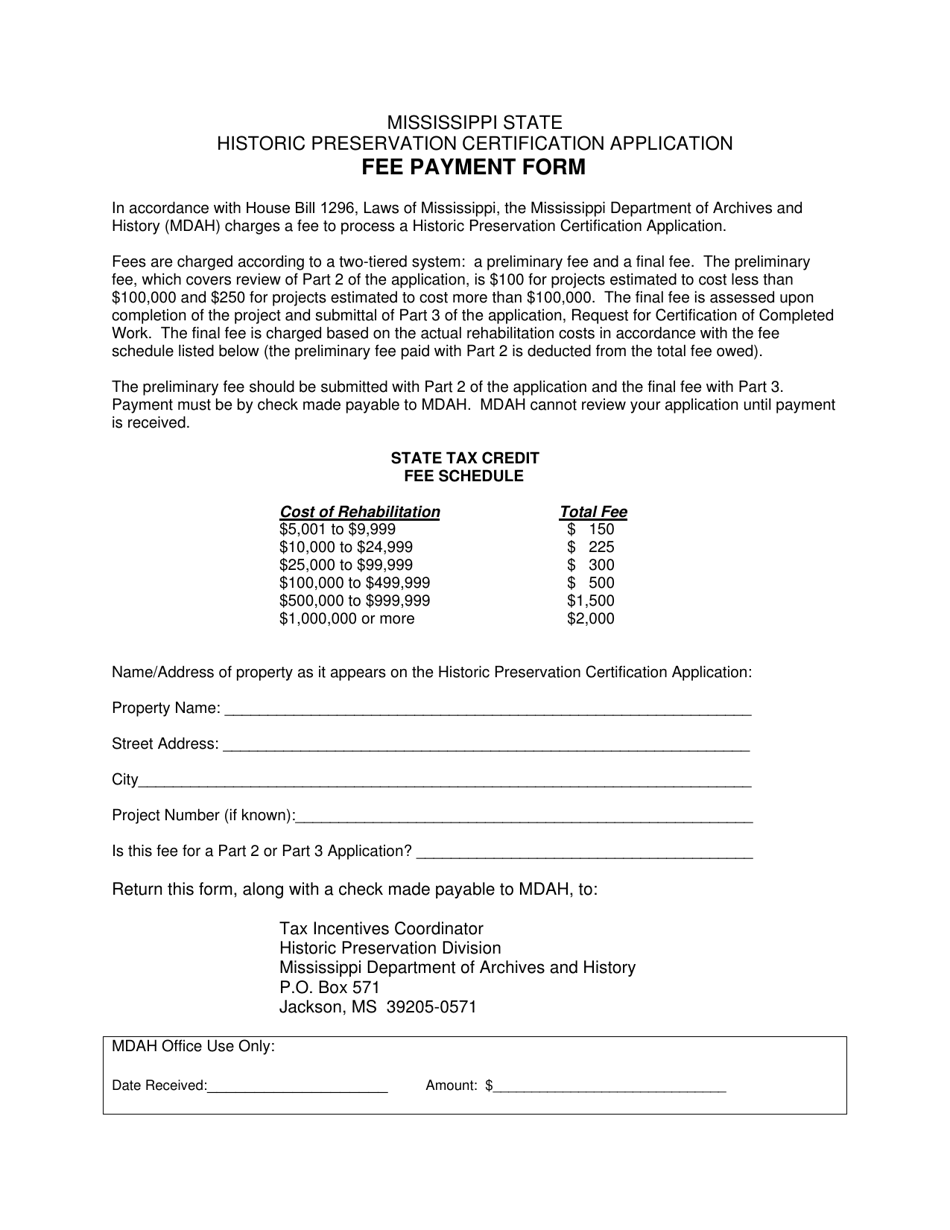

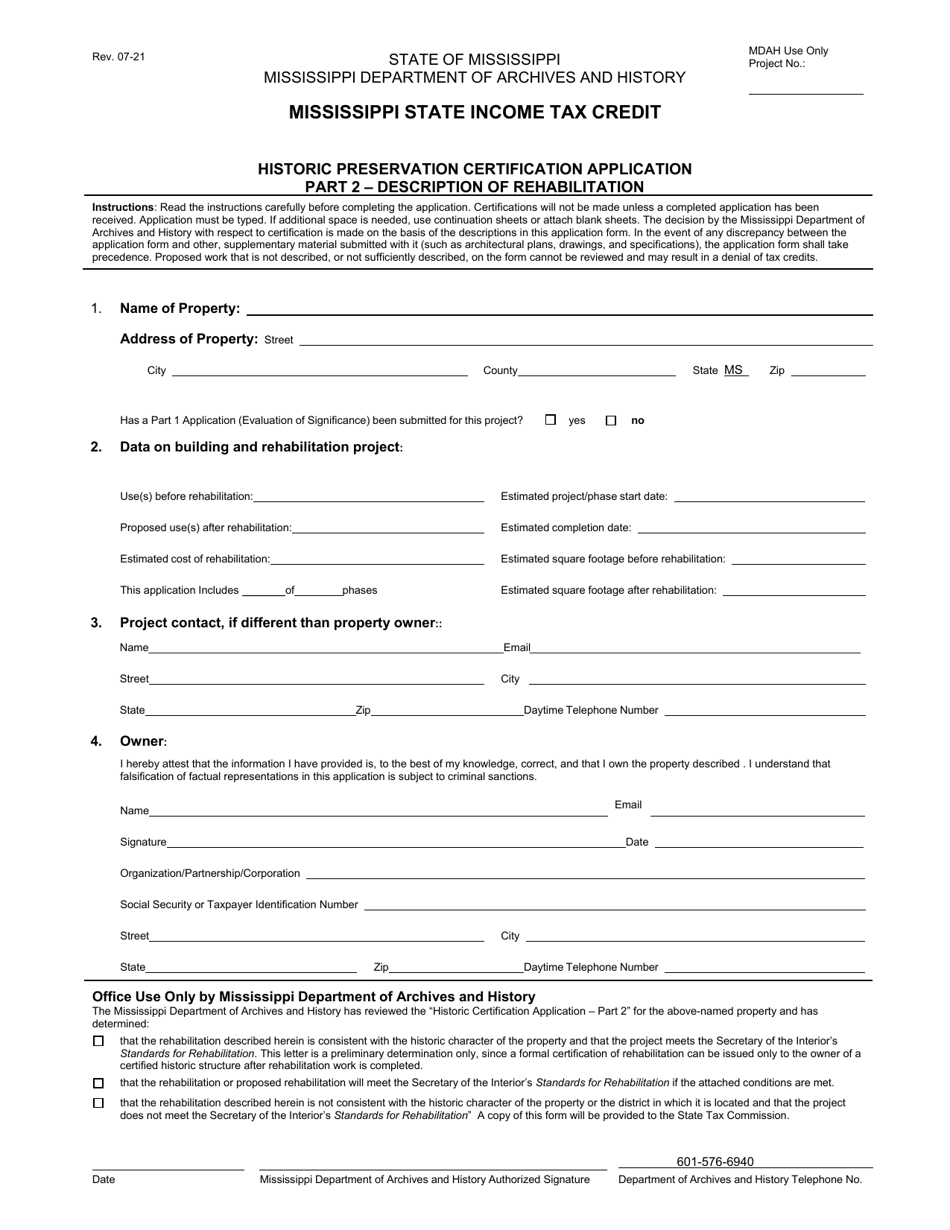

A: The Mississippi State Income Tax Credit Historic Preservation Certification Application is a form that allows individuals or businesses to receive tax credits for rehabilitating historic properties in Mississippi.

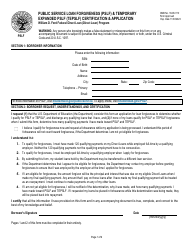

Q: Who is eligible to apply for the Mississippi State Income Tax Credit Historic Preservation Certification?

A: Individuals and businesses that are rehabilitating historic properties in Mississippi are eligible to apply for the tax credits.

Q: What is the purpose of the tax credits?

A: The purpose of the tax credits is to incentivize the preservation and rehabilitation of historic properties in Mississippi.

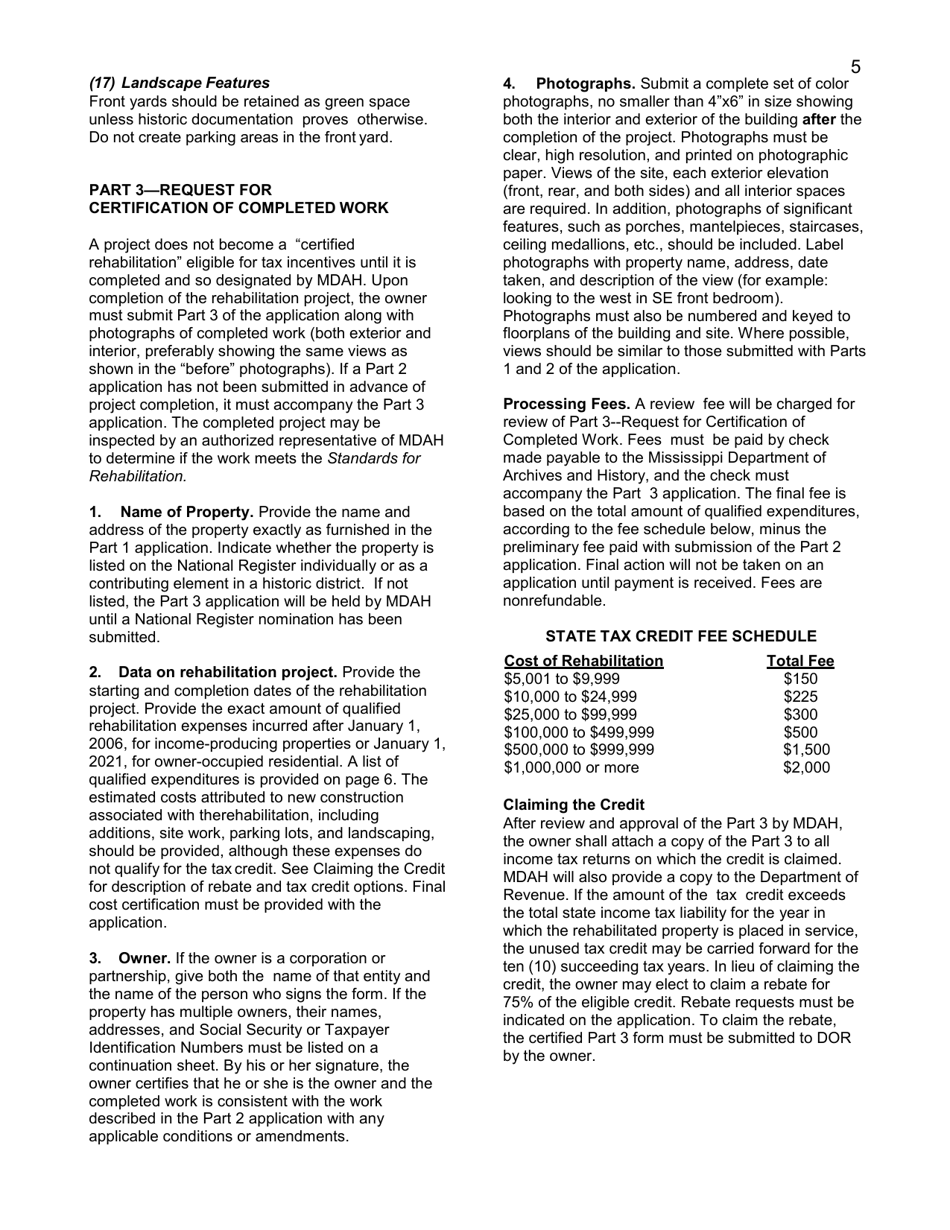

Q: How much tax credit can be received?

A: The tax credit amount is equal to 25% of the total expenditure on the rehabilitation of the historic property.

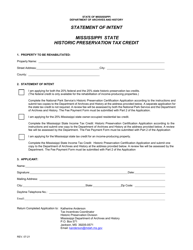

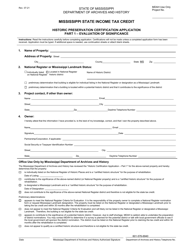

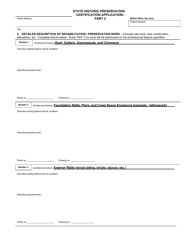

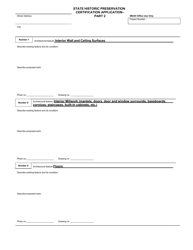

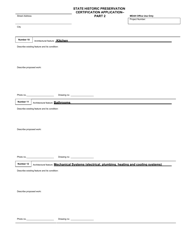

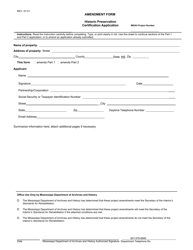

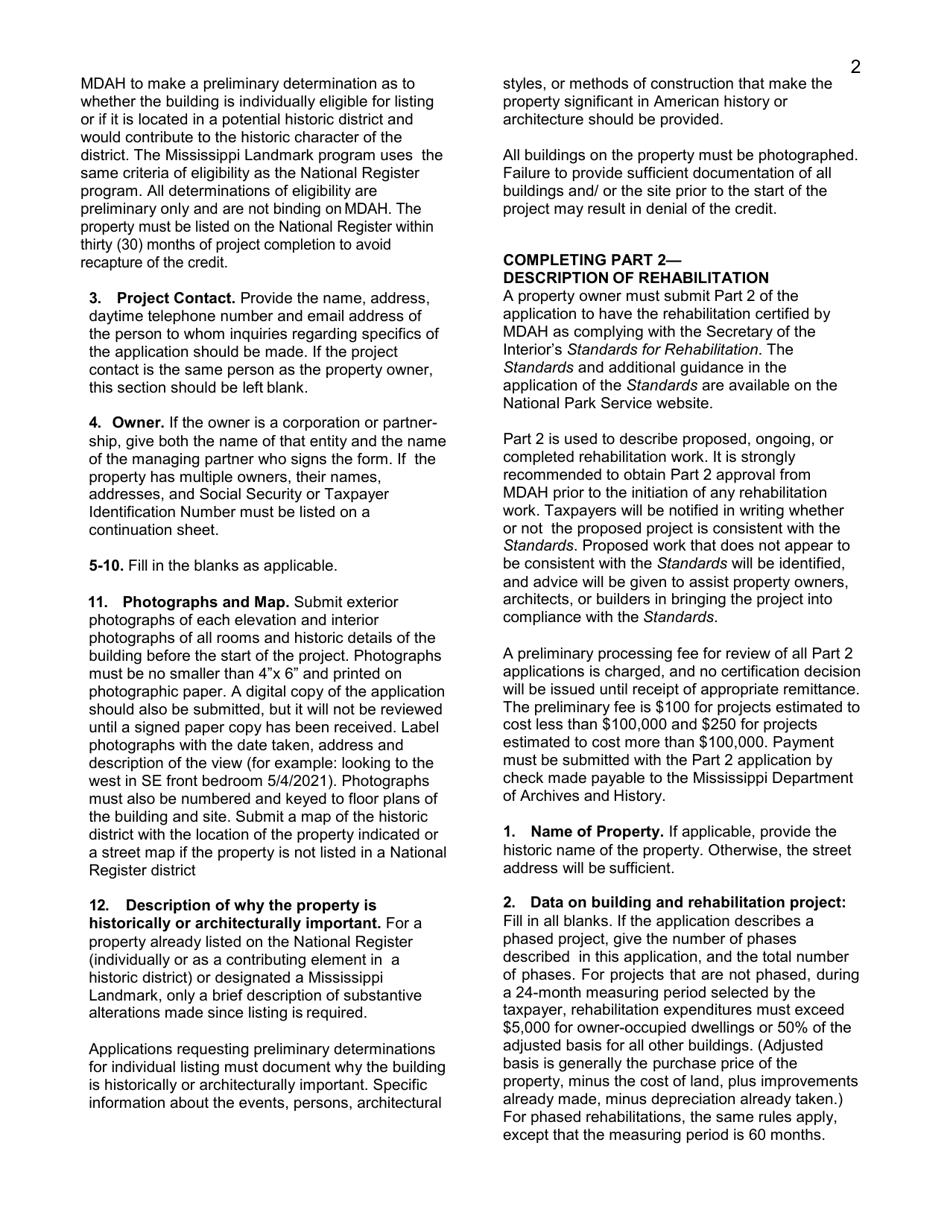

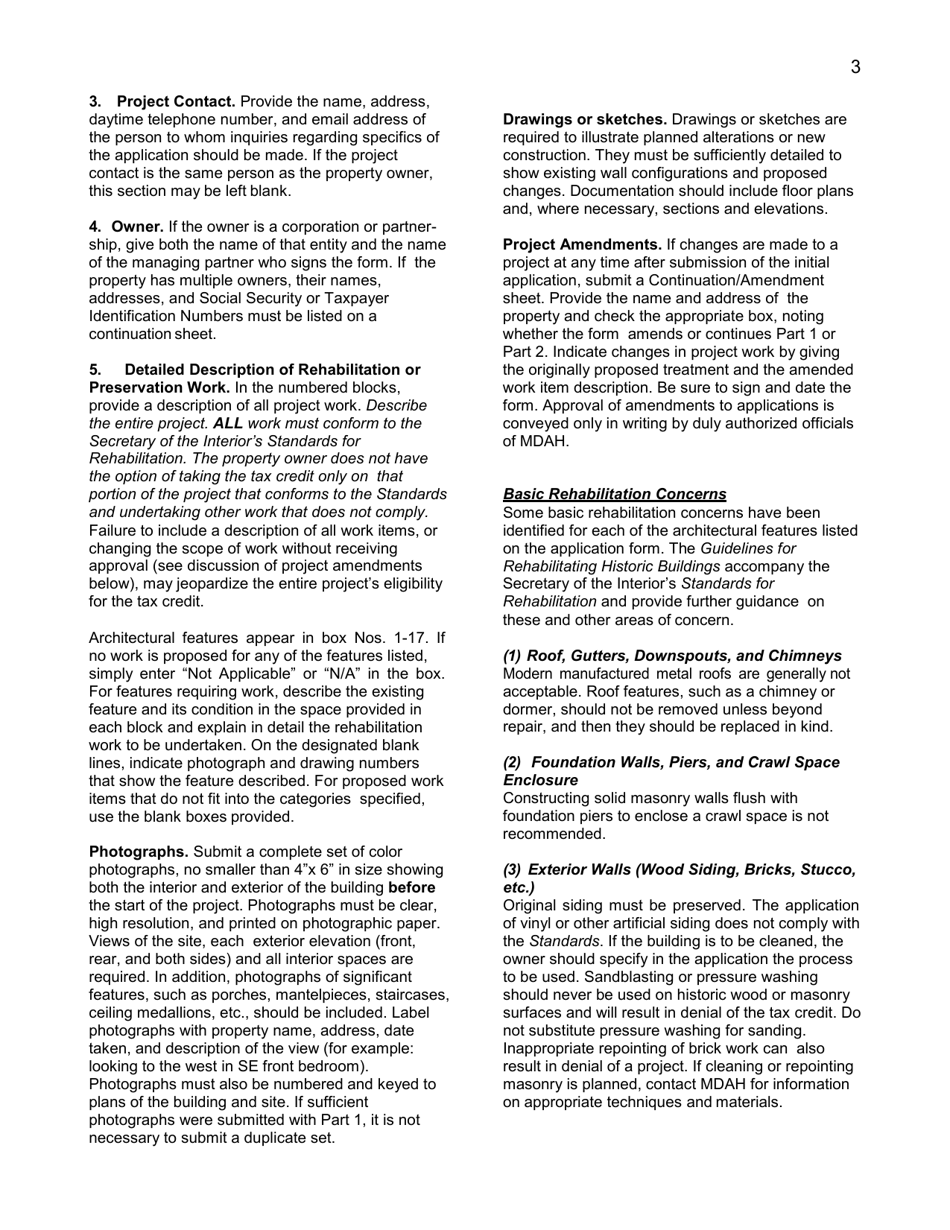

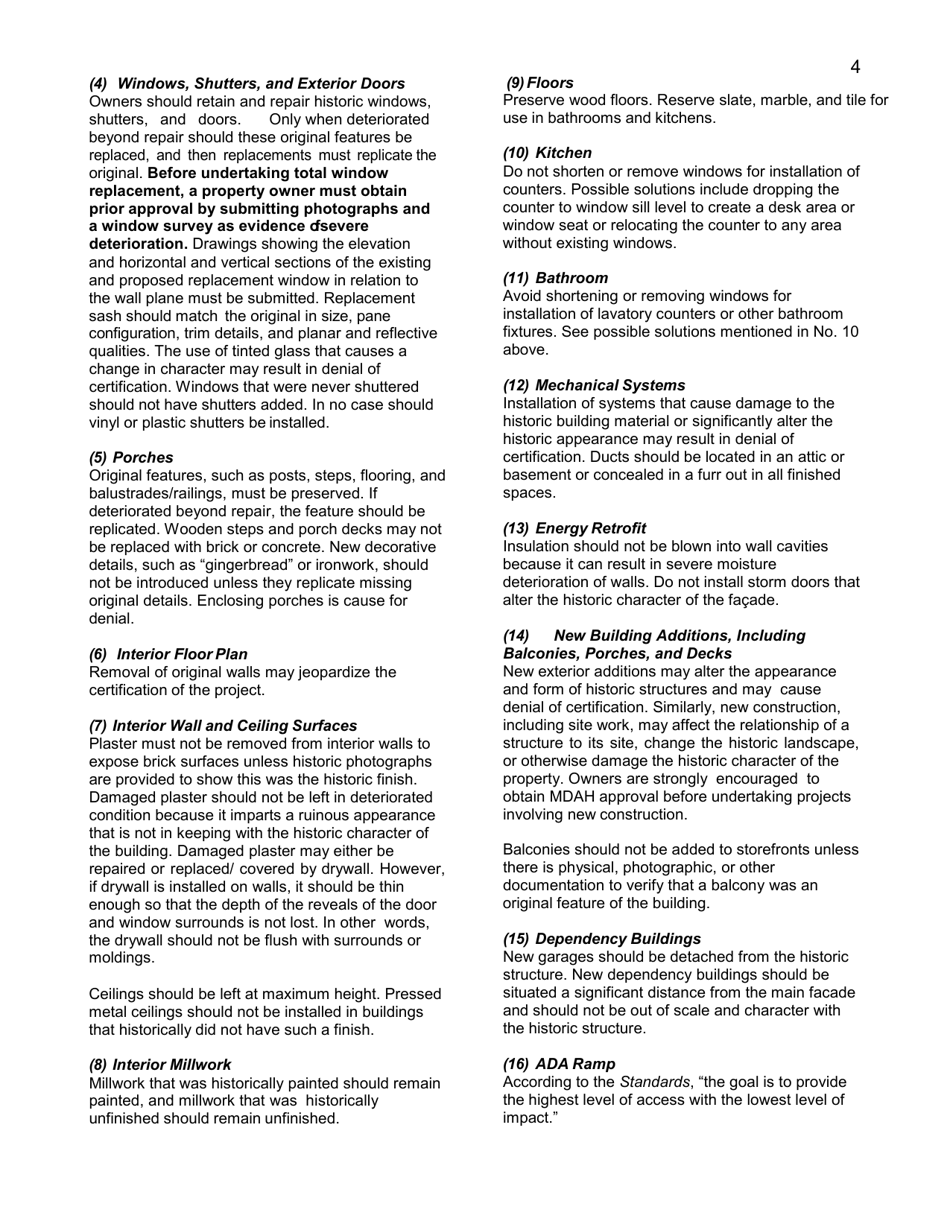

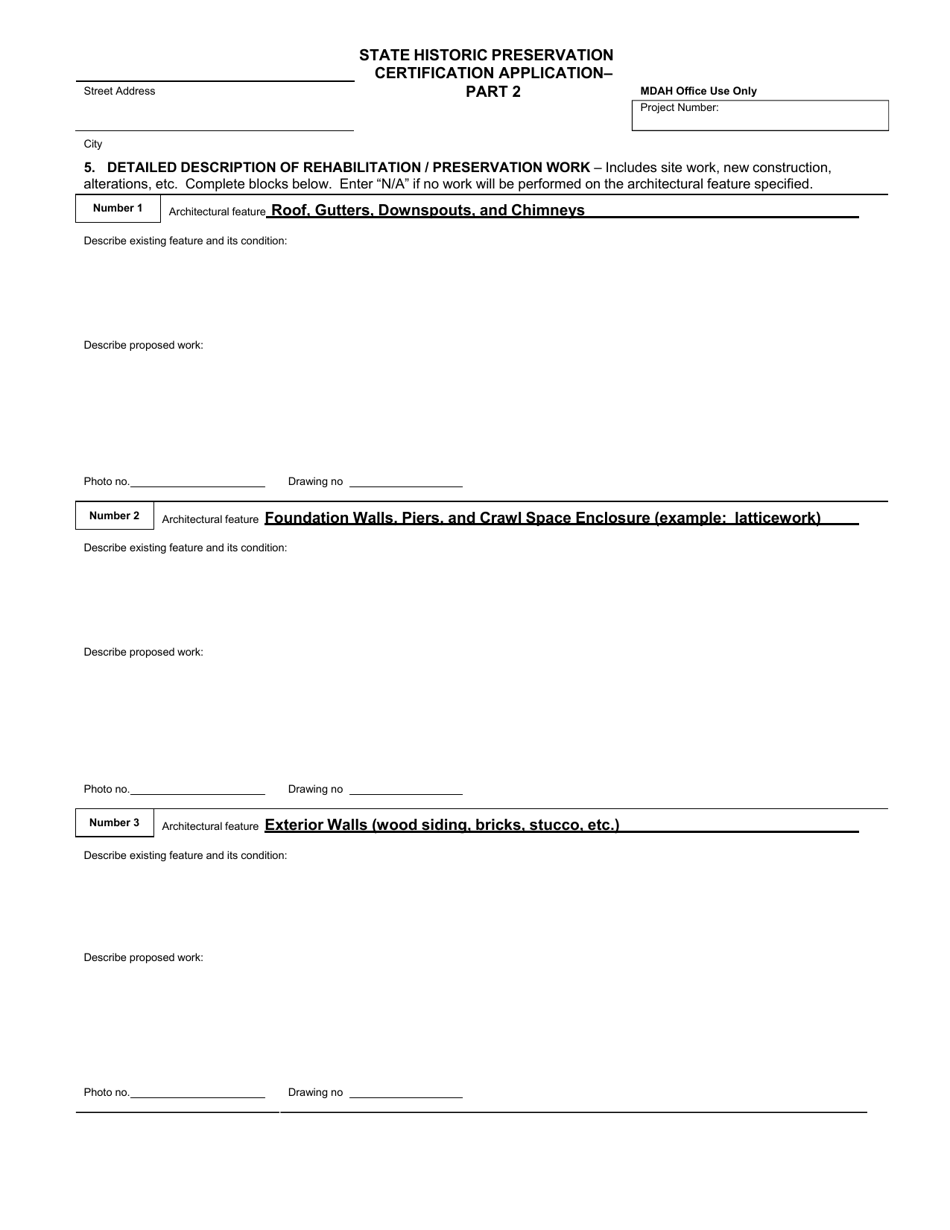

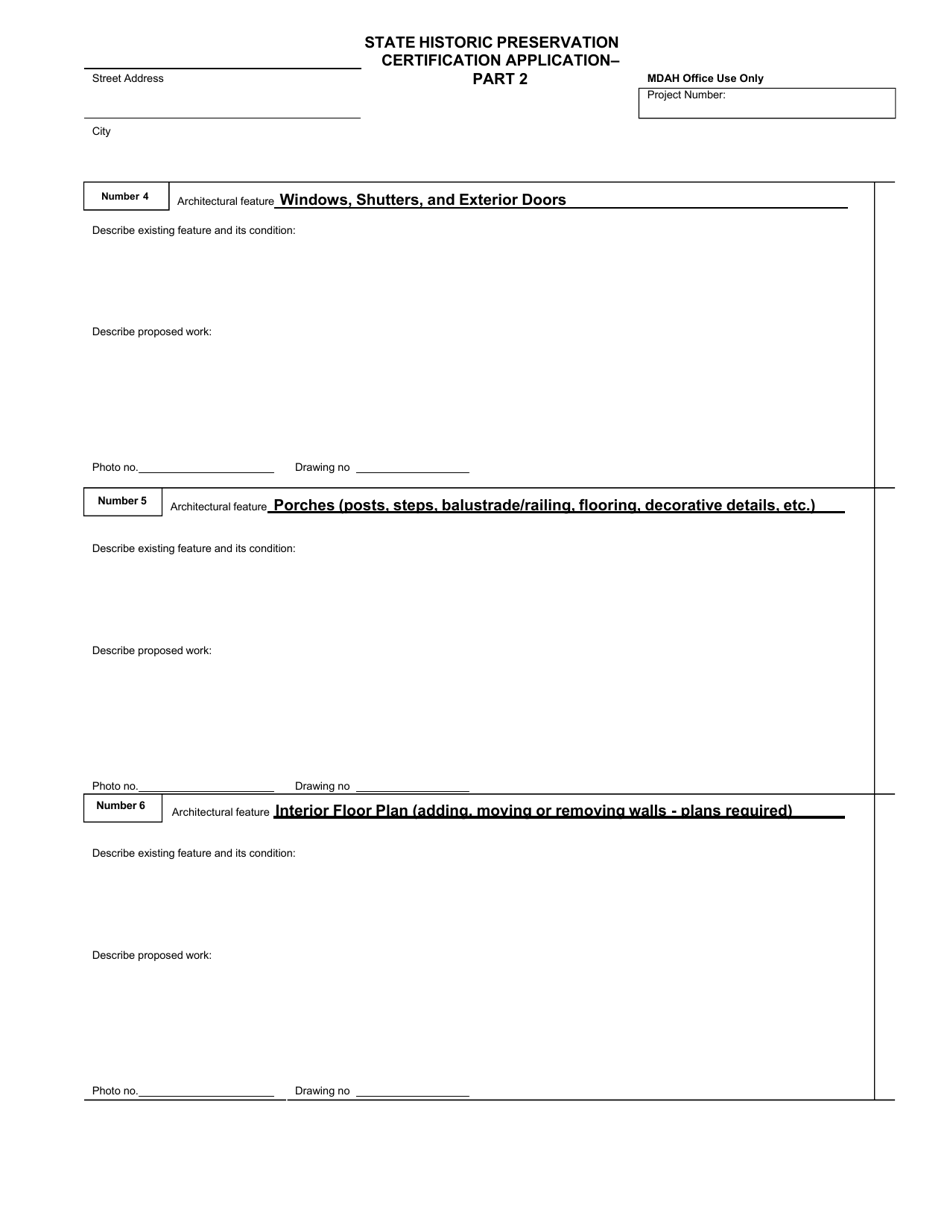

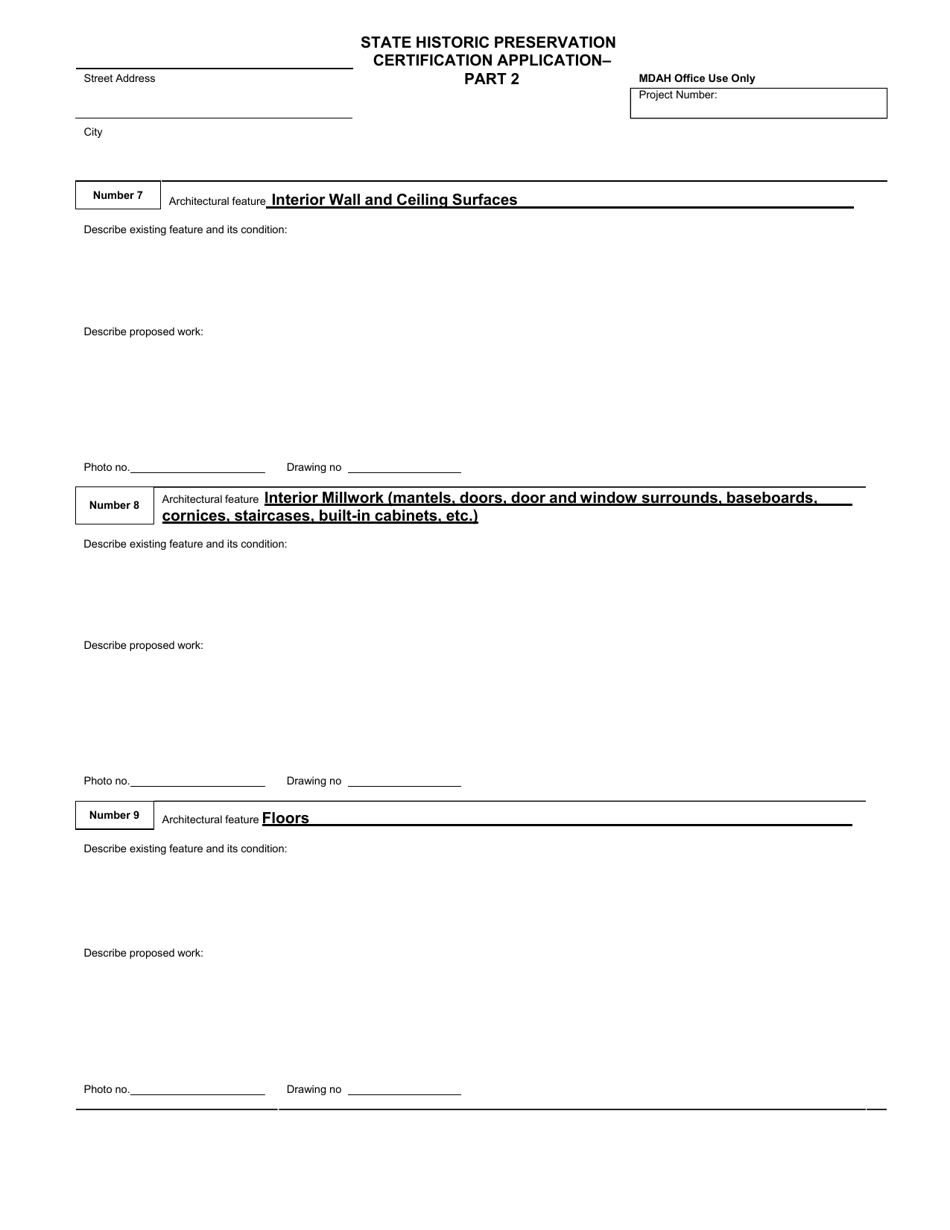

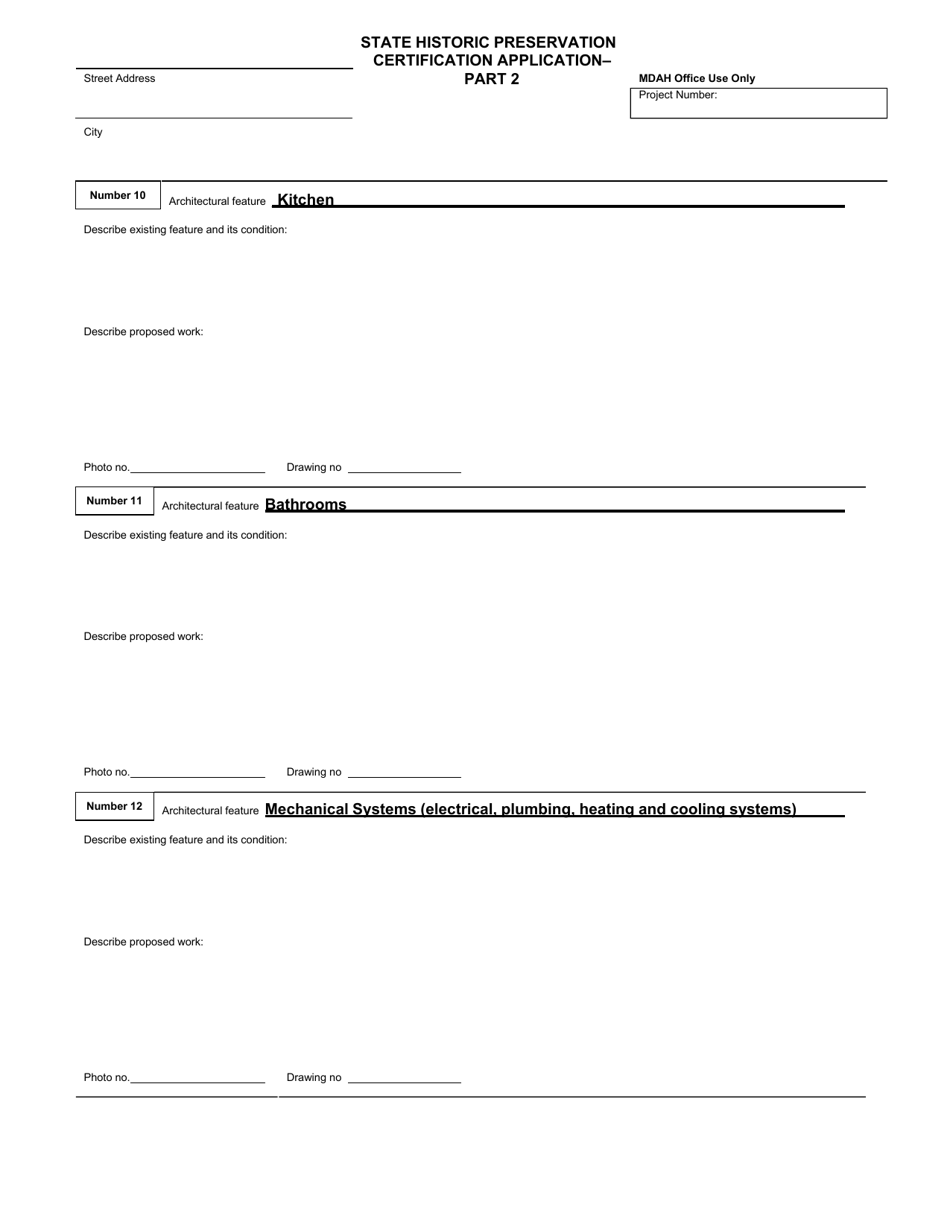

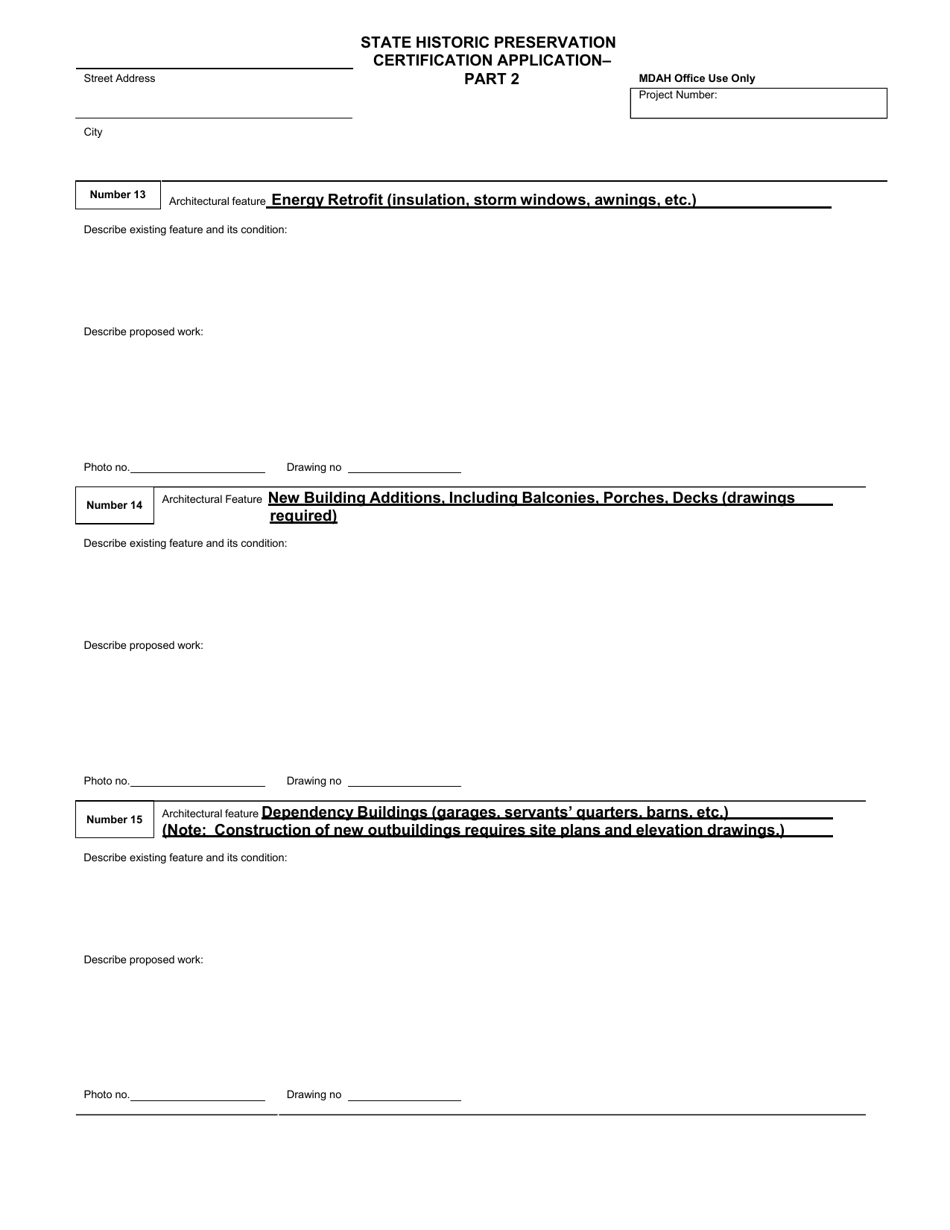

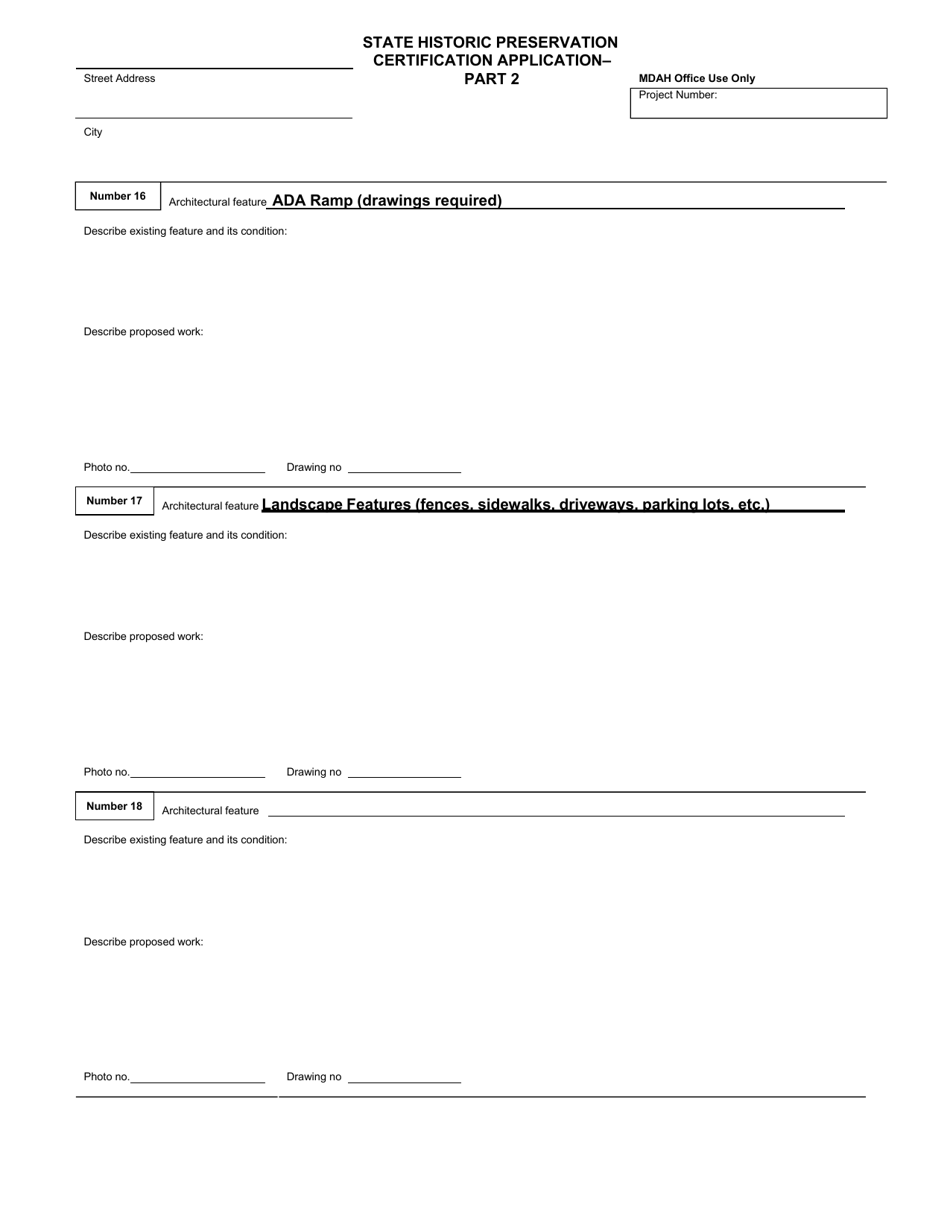

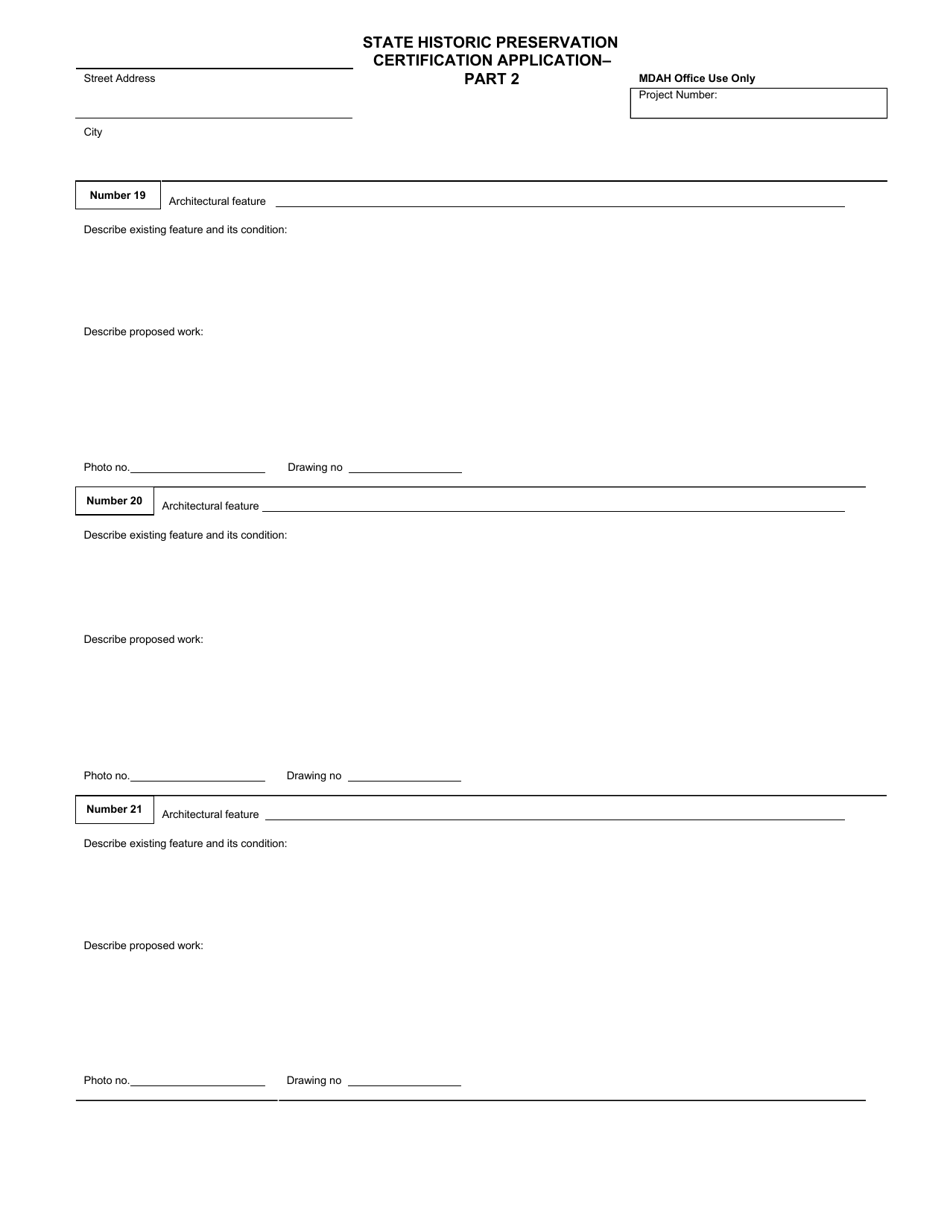

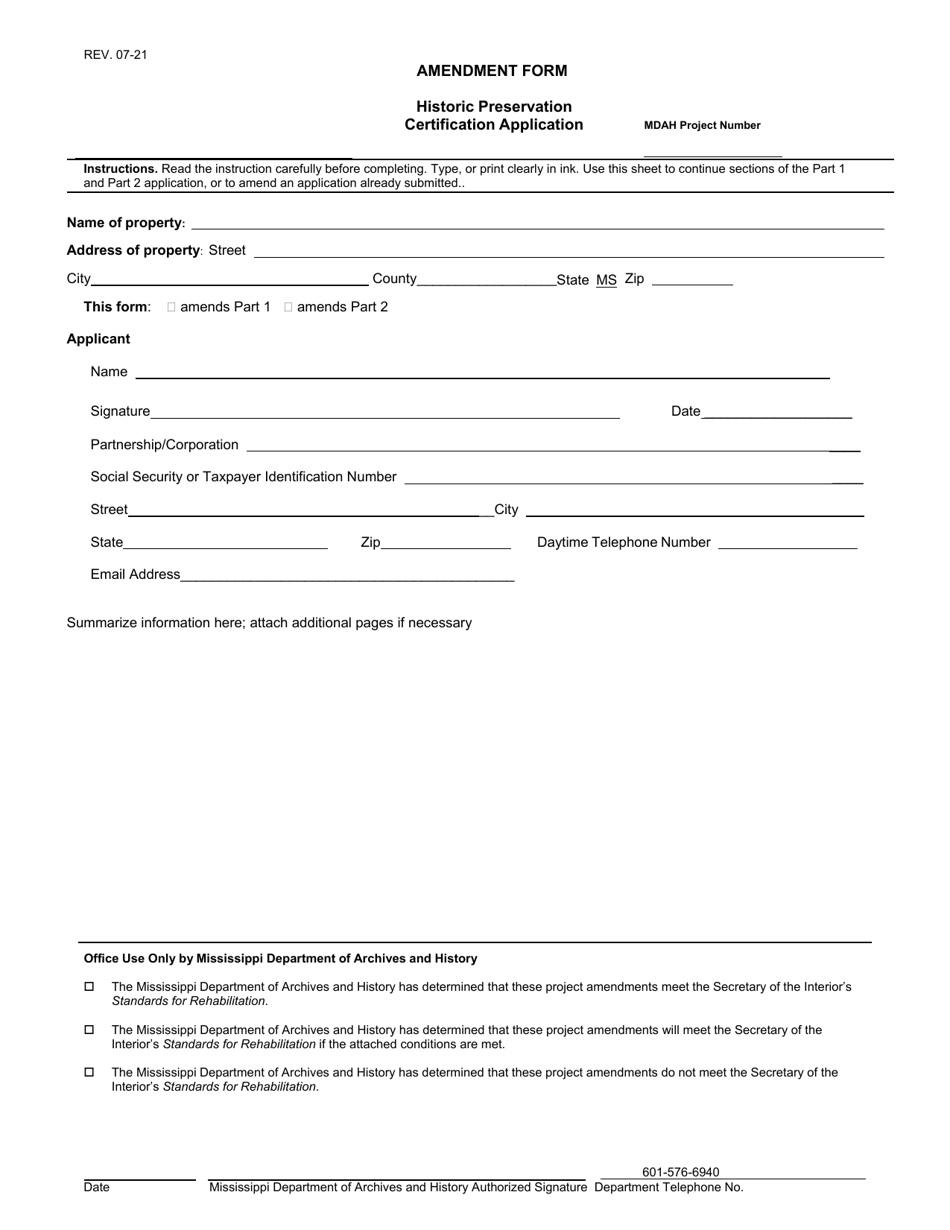

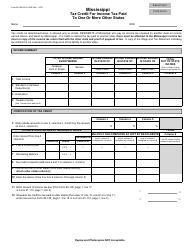

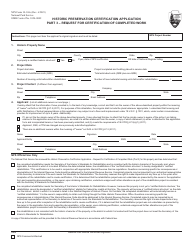

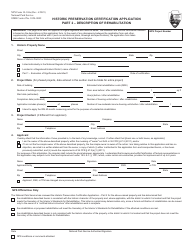

Q: What documentation is required for the application?

A: The application requires documentation such as photographs, architectural plans, and cost estimates for the rehabilitation project.

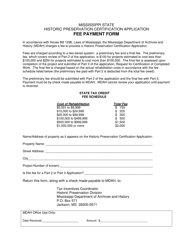

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Mississippi Department of Archives and History;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Archives and History.