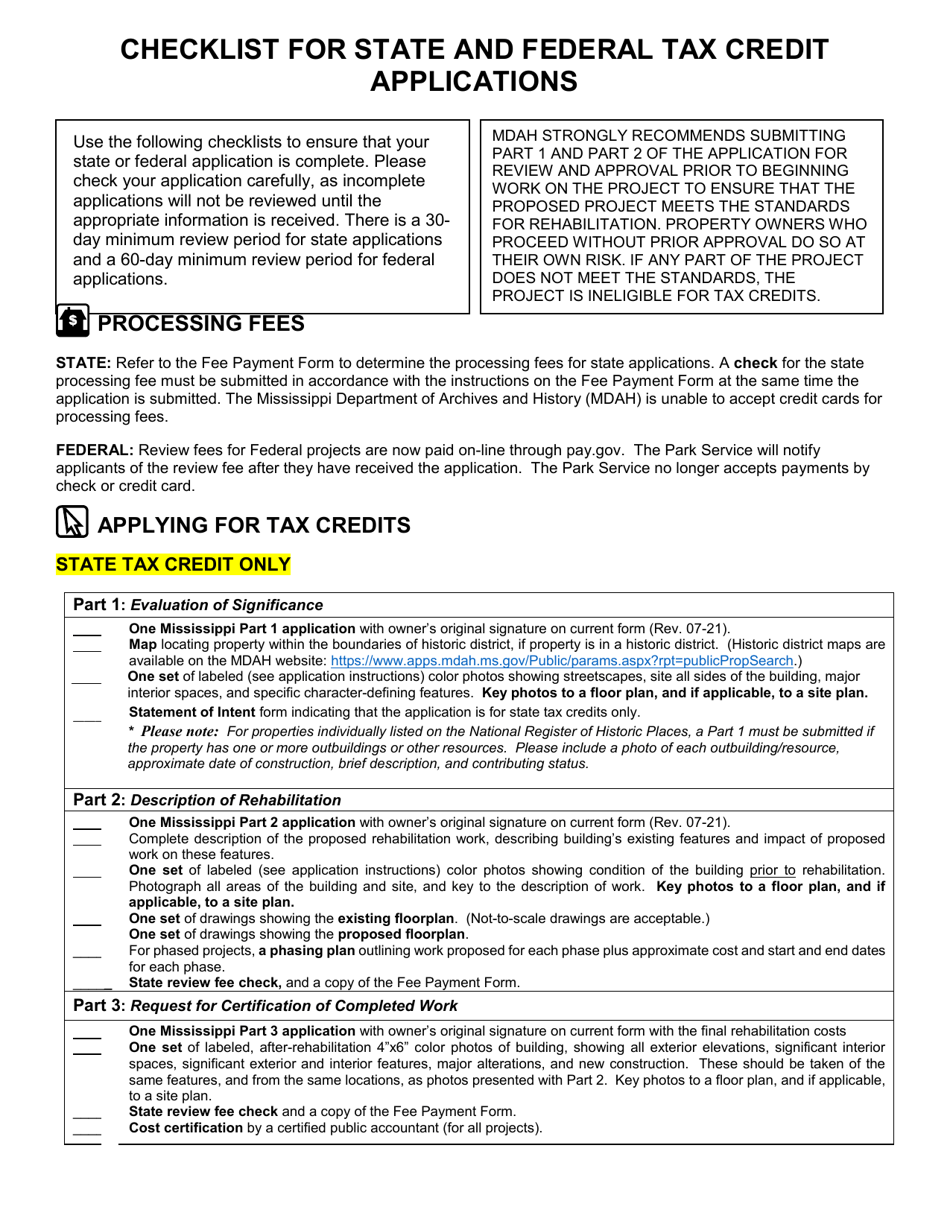

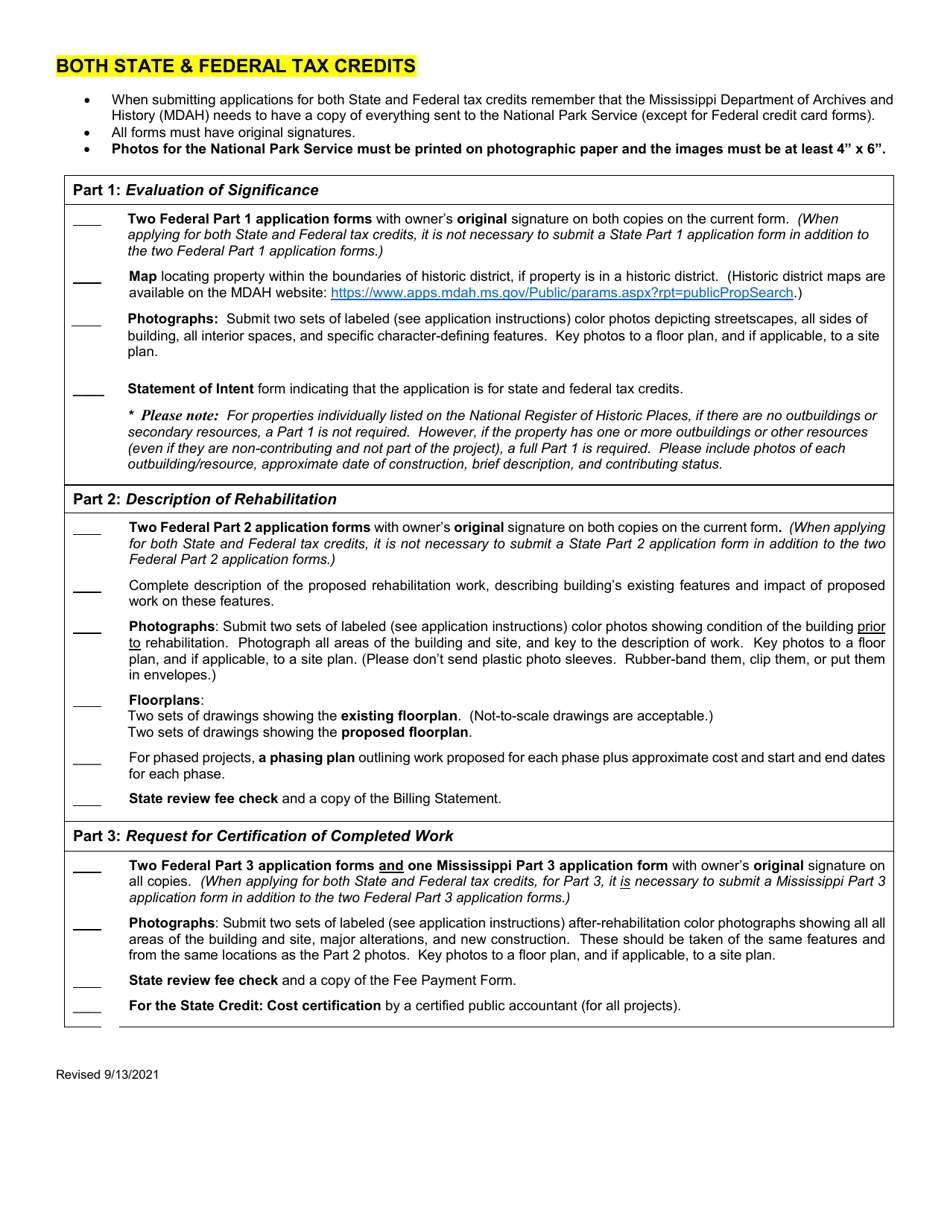

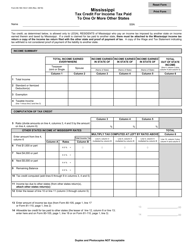

Checklist for State and Federal Tax Credit Applications - Mississippi

Checklist for State and Federal Tax Credit Applications is a legal document that was released by the Mississippi Department of Archives and History - a government authority operating within Mississippi.

FAQ

Q: What is the State Tax Credit Application?

A: The State Tax Credit Application is a form that allows Mississippi residents to apply for tax credits offered by the state government.

Q: What is the Federal Tax Credit Application?

A: The Federal Tax Credit Application is a form that allows Mississippi residents to apply for tax credits offered by the federal government.

Q: What are tax credits?

A: Tax credits are deductions from the total amount of taxes owed. They can help reduce your overall tax liability.

Q: Who is eligible to apply for tax credits in Mississippi?

A: Mississippi residents who meet certain criteria, determined by the state or federal government, may be eligible to apply for tax credits.

Q: What are some examples of tax credits in Mississippi?

A: Some examples of tax credits in Mississippi include the Earned Income Tax Credit, the Child and Dependent Care Credit, and the Residential Energy Efficiency Credit.

Q: How do I fill out the State Tax Credit Application?

A: To fill out the State Tax Credit Application, you will need to provide information about your income, expenses, and any qualifying circumstances.

Q: How do I fill out the Federal Tax Credit Application?

A: To fill out the Federal Tax Credit Application, you will need to provide information about your income, expenses, and any qualifying circumstances.

Q: What documents do I need to include with my tax credit application?

A: The required documents may vary depending on the specific tax credit you are applying for. Generally, you will need to include proof of your income, expenses, and any qualifying circumstances.

Q: When is the deadline to submit the tax credit application?

A: The deadline to submit a tax credit application may vary depending on the specific credit. It is important to check the specific deadlines for each credit you are applying for.

Q: Can I apply for multiple tax credits at the same time?

A: Yes, you can apply for multiple tax credits at the same time, as long as you meet the eligibility requirements for each credit.

Q: What happens after I submit my tax credit application?

A: After you submit your tax credit application, it will be reviewed by the appropriate government agency. If approved, you may receive a tax credit on your next tax return.

Q: What should I do if my tax credit application is denied?

A: If your tax credit application is denied, you may have the option to appeal the decision or seek assistance from a tax professional to understand why it was denied and explore any possible alternatives.

Q: Are tax credits the same as tax deductions?

A: No, tax credits are different from tax deductions. Tax credits directly reduce the amount of taxes you owe, while tax deductions reduce your taxable income.

Form Details:

- Released on September 13, 2021;

- The latest edition currently provided by the Mississippi Department of Archives and History;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Archives and History.