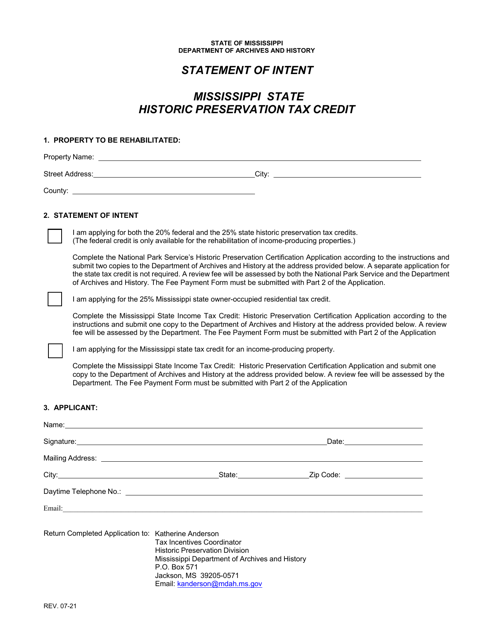

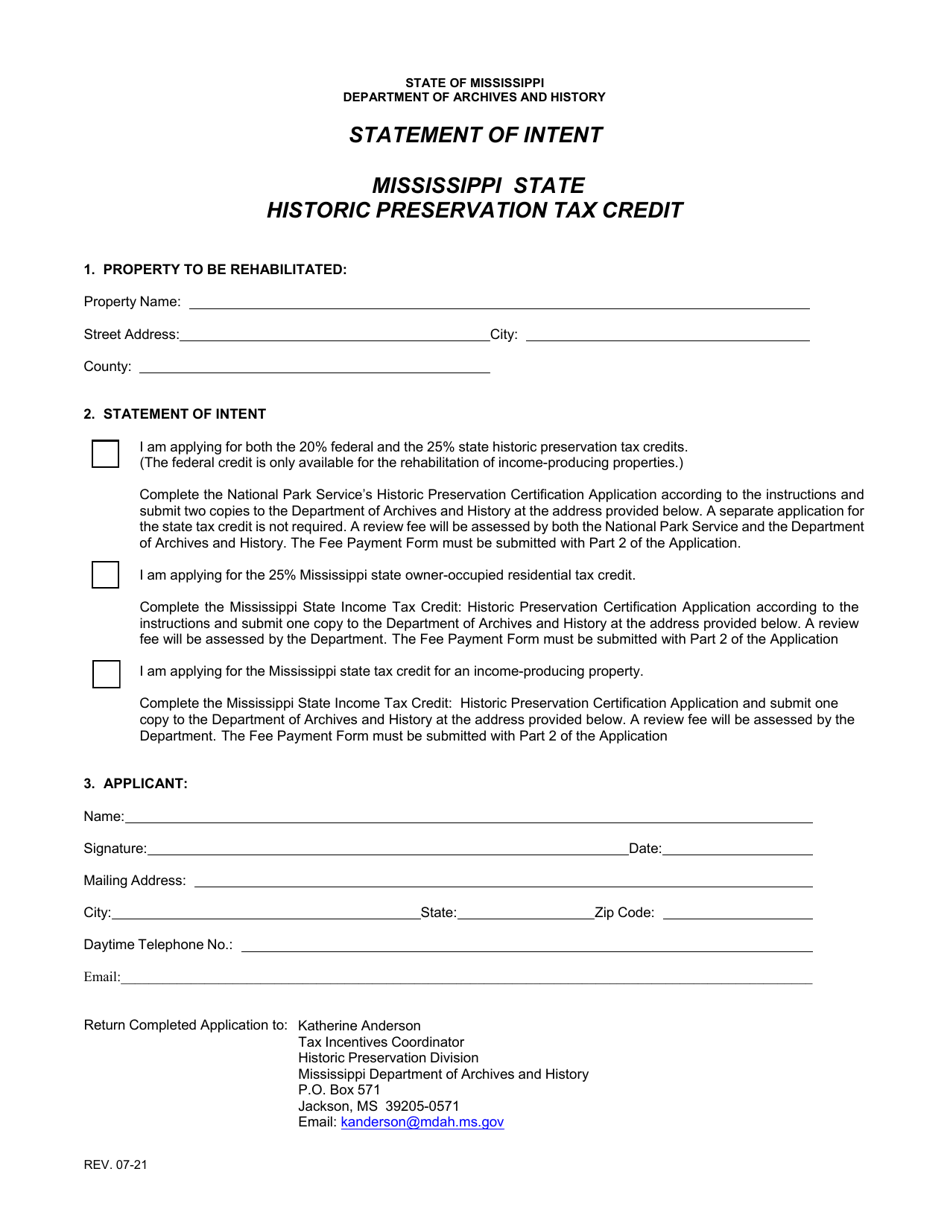

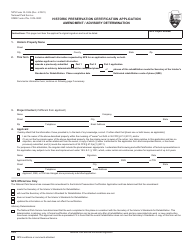

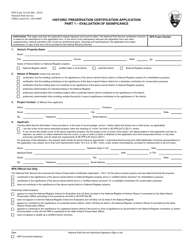

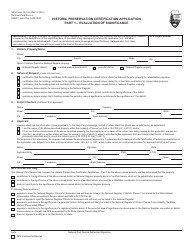

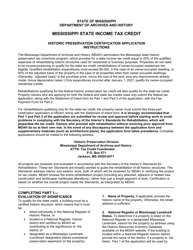

Mississippi State Historic Preservation Tax Credit Statement of Intent - Mississippi

Mississippi State Tax Credit Statement of Intent is a legal document that was released by the Mississippi Department of Archives and History - a government authority operating within Mississippi.

FAQ

Q: What is the Mississippi State Historic Preservation Tax Credit?

A: The Mississippi State Historic Preservation Tax Credit is a program that provides tax incentives for the rehabilitation of historic buildings in Mississippi.

Q: Who is eligible for the Mississippi State Historic Preservation Tax Credit?

A: Property owners and developers who are rehabilitating historic buildings in Mississippi are eligible for the tax credit.

Q: What types of buildings are eligible for the tax credit?

A: Historic buildings that are listed on the National Register of Historic Places or located in a Certified Local Government are eligible for the tax credit.

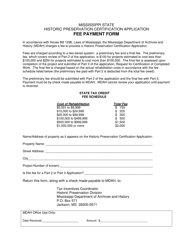

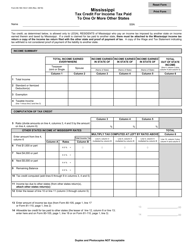

Q: How much is the tax credit?

A: The tax credit is equal to 25% of the qualified rehabilitation expenses, up to a maximum credit of $60,000 per project.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses include costs directly related to the rehabilitation of the historic building, such as construction, architectural fees, and engineering fees.

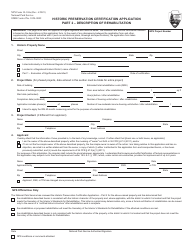

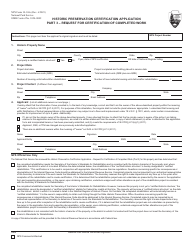

Q: How can I apply for the Mississippi State Historic Preservation Tax Credit?

A: To apply for the tax credit, you must submit a Statement of Intent to the Mississippi Department of Archives and History before beginning the rehabilitation project.

Q: Is there a deadline for applying for the tax credit?

A: There is no specific deadline for applying, but it is recommended to submit the Statement of Intent as early as possible to ensure eligibility.

Q: What happens after the Statement of Intent is approved?

A: Once the Statement of Intent is approved, you can proceed with the rehabilitation project. After the project is completed, you will need to submit a Final Certification of Completed Work to receive the tax credit.

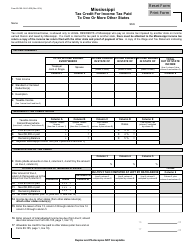

Q: Can the tax credit be transferred or sold?

A: Yes, the tax credit can be transferred or sold to another taxpayer.

Q: Are there any restrictions on the use of the tax credit?

A: The tax credit can only be used to offset Mississippi state income tax liability, and any unused credit can be carried forward for up to five years.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Mississippi Department of Archives and History;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Mississippi Department of Archives and History.