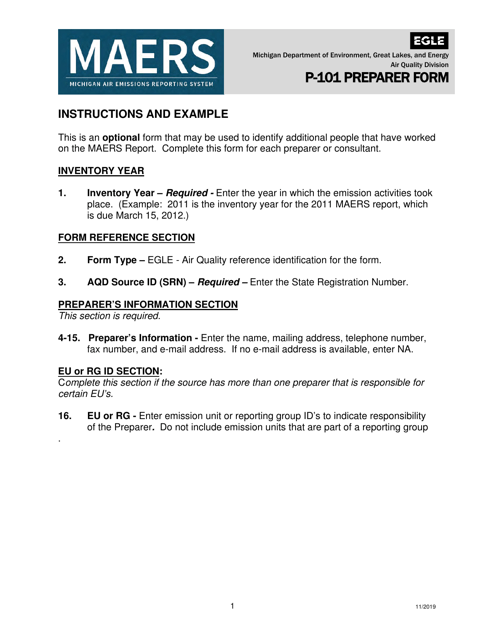

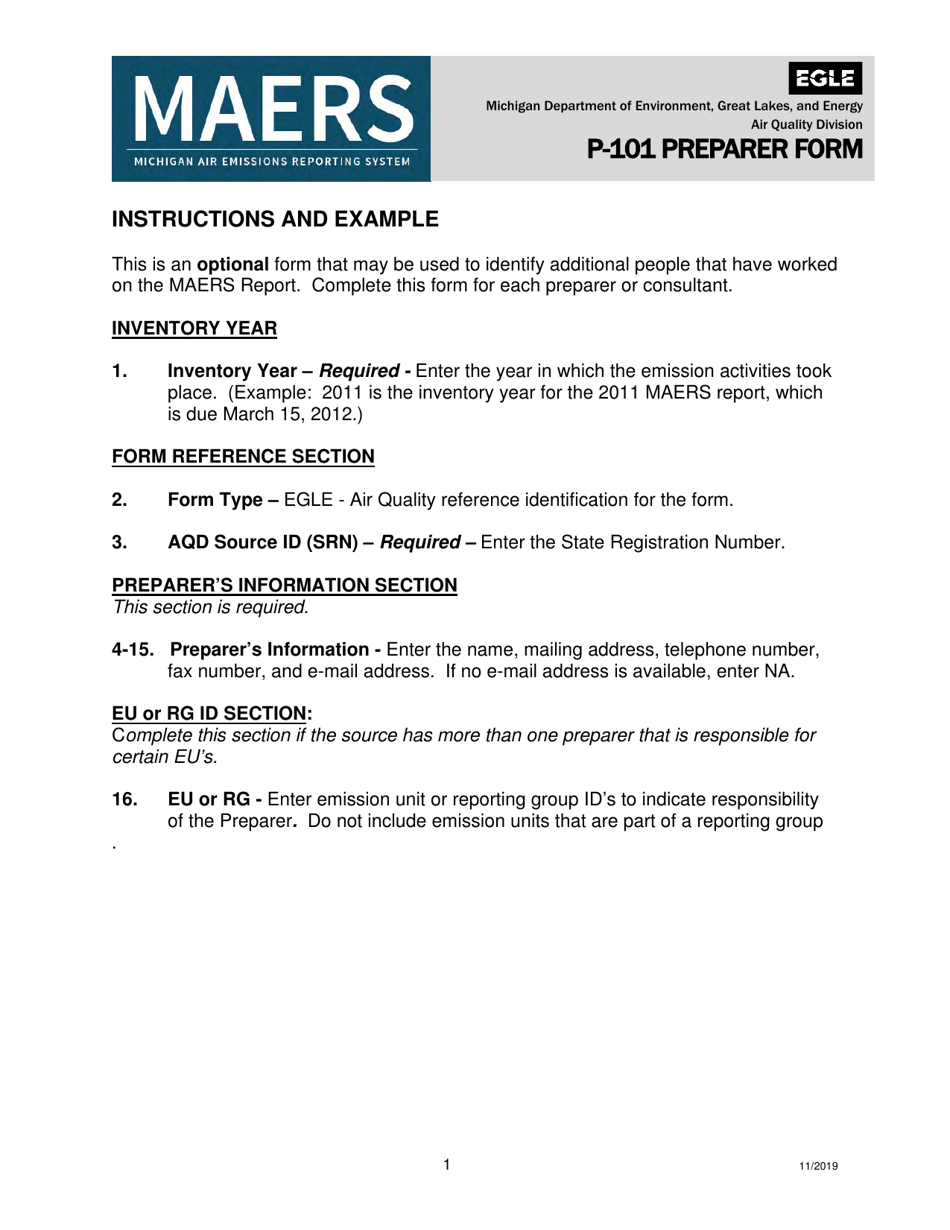

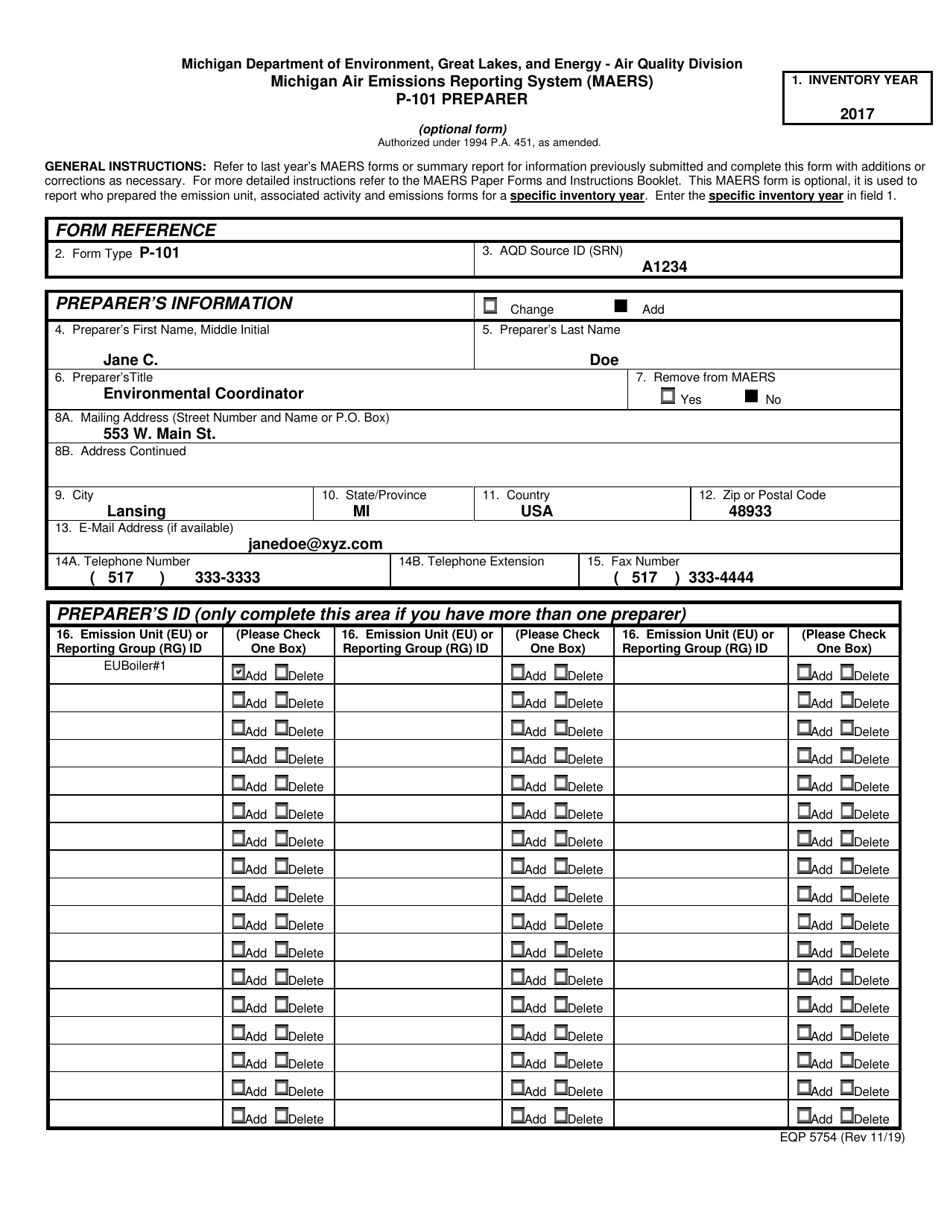

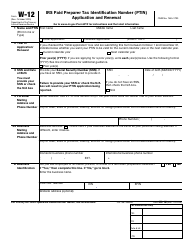

Instructions for Form P-101, EQP5754 Preparer - Michigan

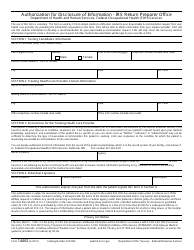

This document contains official instructions for Form P-101 , and Form EQP5754 . Both forms are released and collected by the Michigan Department of Environment, Great Lakes, and Energy. An up-to-date fillable Form P-101 (EQP5754) is available for download through this link.

FAQ

Q: What is Form P-101?

A: Form P-101 is a tax form used by preparers in Michigan.

Q: What is EQP5754?

A: EQP5754 is a specific version of Form P-101 for preparers.

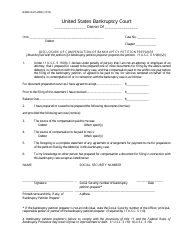

Q: Who uses Form P-101?

A: Preparers in Michigan use Form P-101.

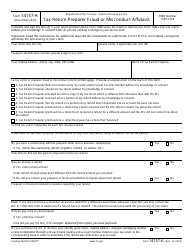

Q: What is the purpose of Form P-101?

A: Form P-101 is used to report tax information to the state of Michigan.

Q: Is Form P-101 applicable only to individuals or businesses as well?

A: Form P-101 can be used by both individuals and businesses in Michigan.

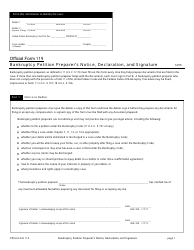

Q: What do I need to include with Form P-101?

A: You may need to include supporting documents such as W-2 forms and 1099 forms, depending on your specific tax situation.

Q: What if I need help with completing Form P-101?

A: If you need help with completing Form P-101, you can contact the Michigan Department of Treasury for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Michigan Department of Environment, Great Lakes, and Energy.