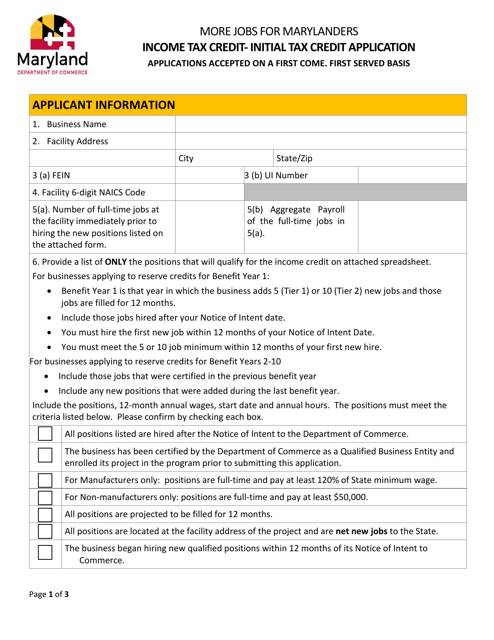

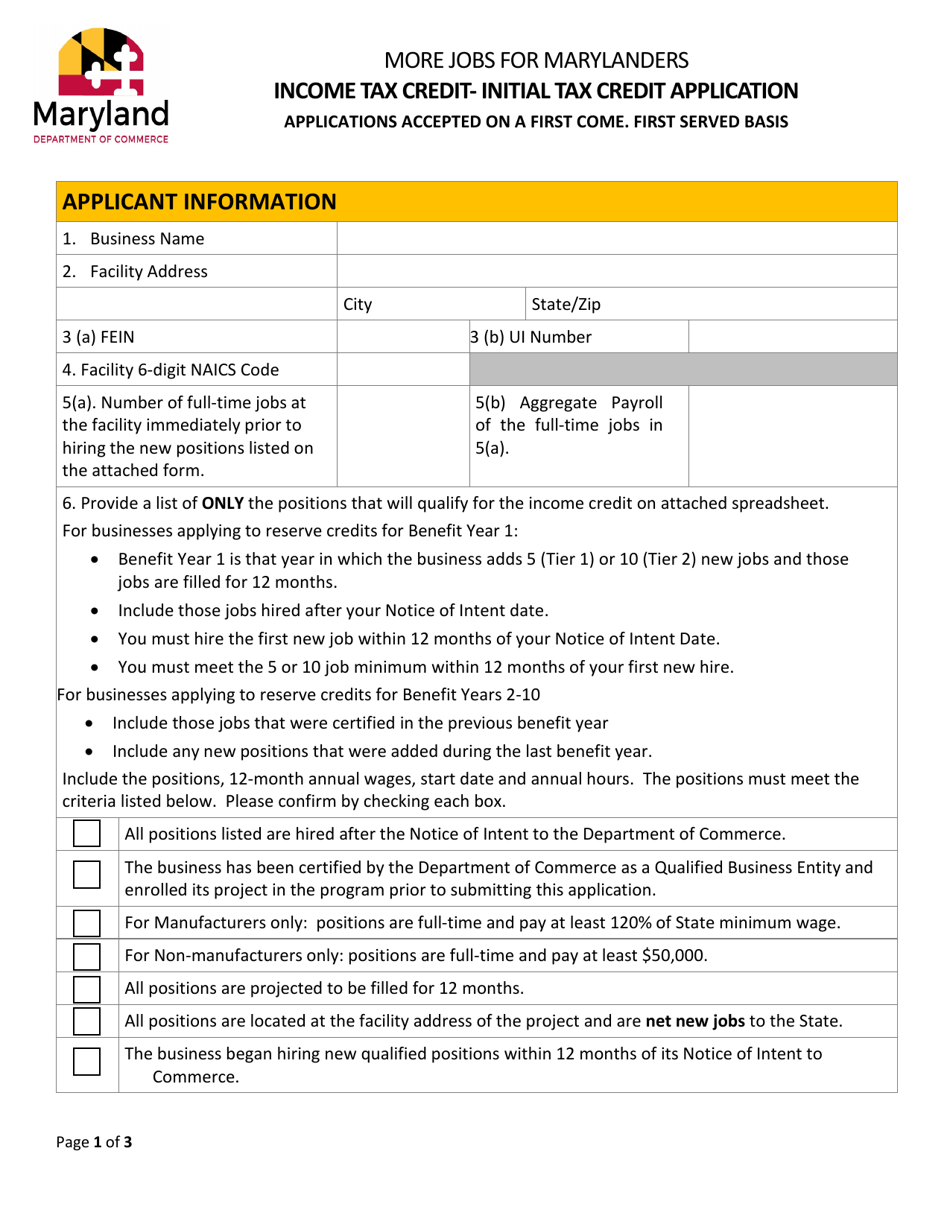

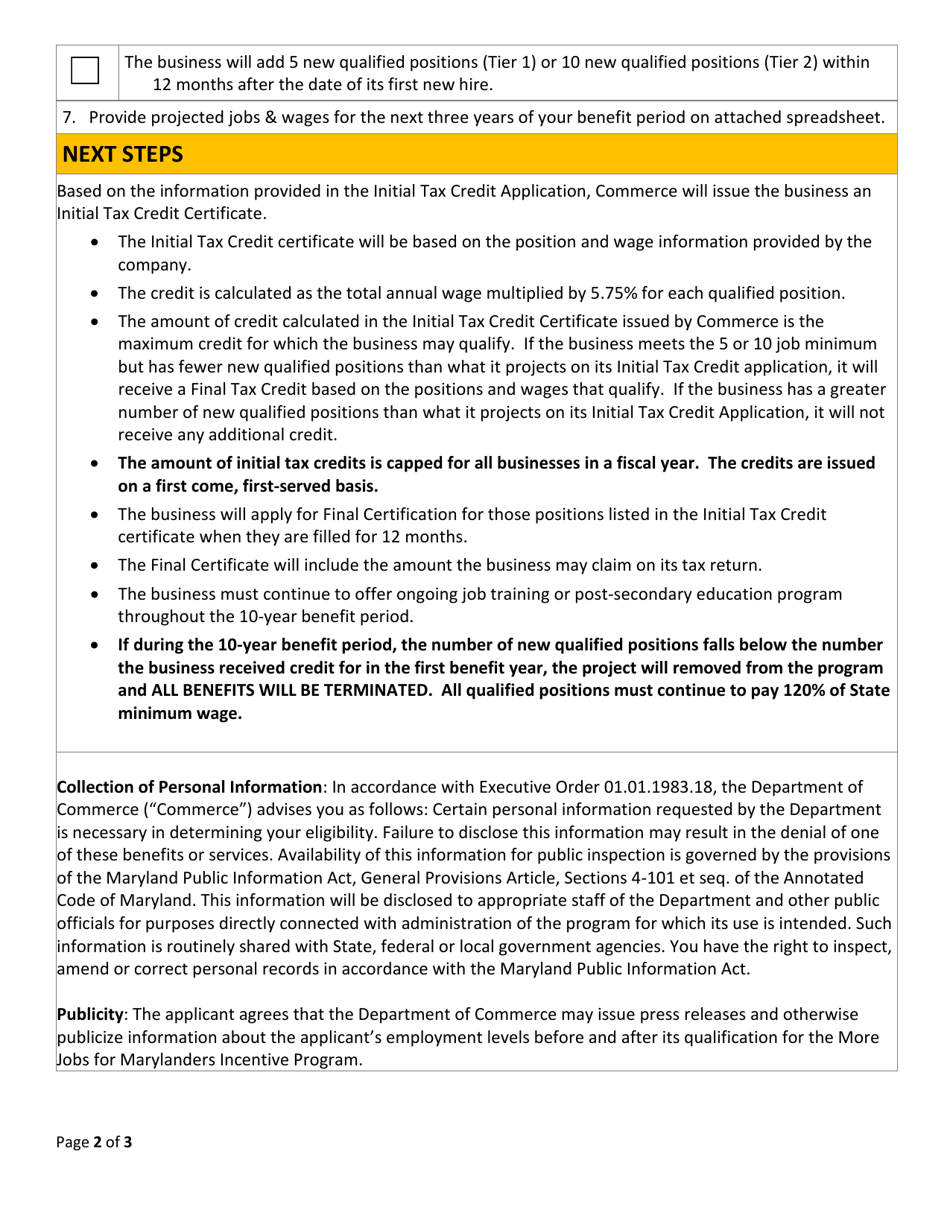

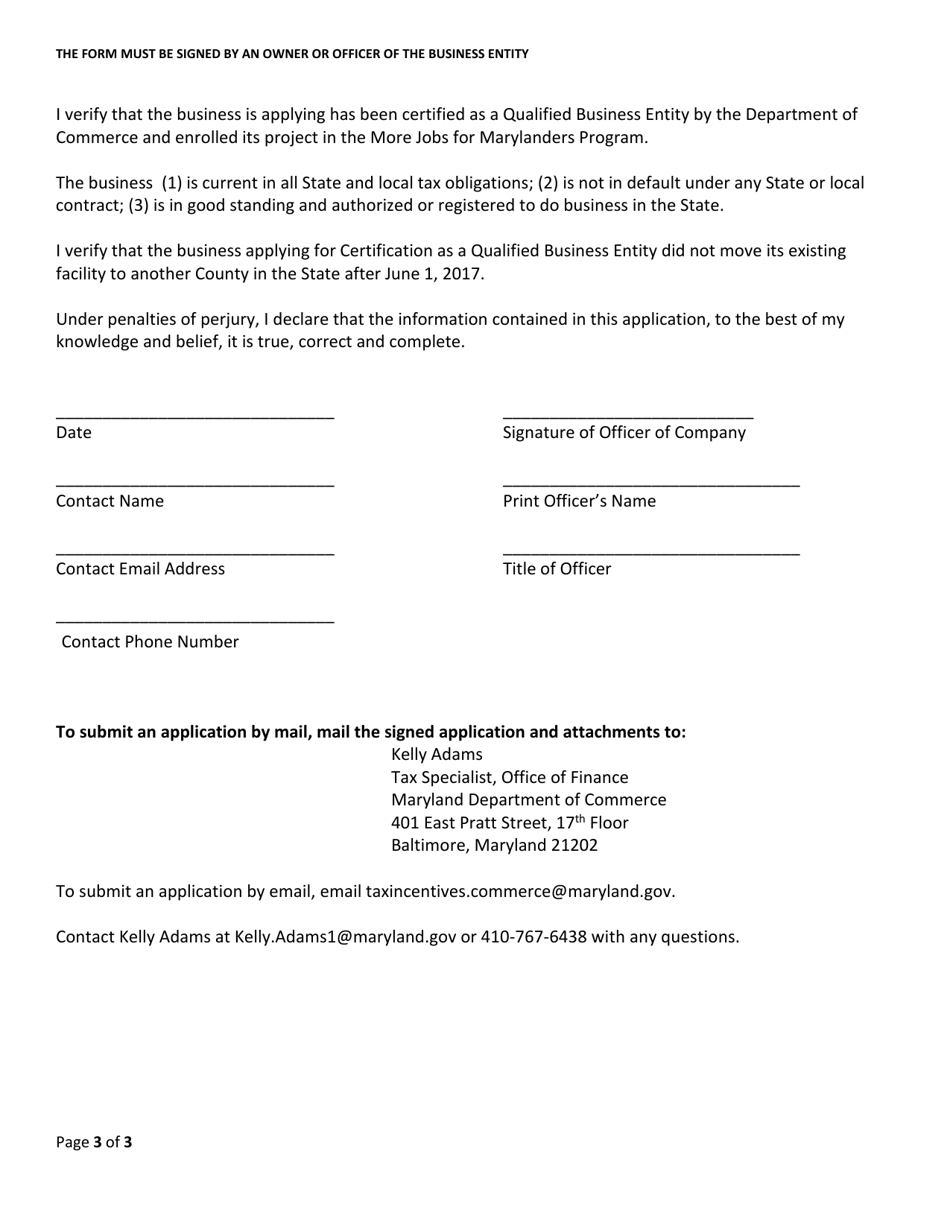

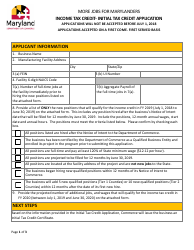

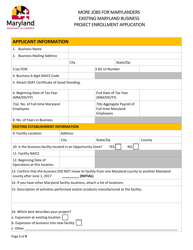

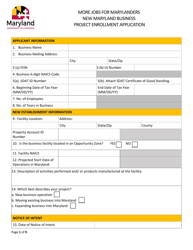

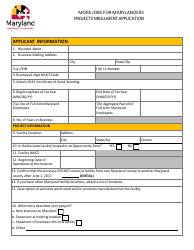

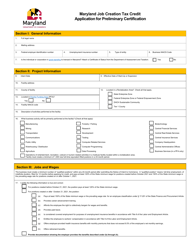

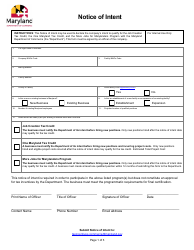

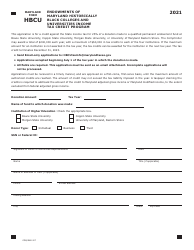

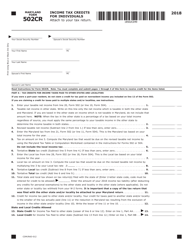

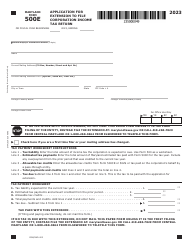

More Jobs for Marylanders Income Tax Credit - Initial Tax Credit Application - Maryland

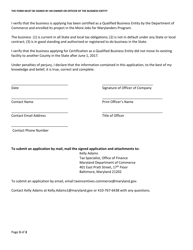

More Jobs for Marylanders Tax Credit Application is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

Q: What is the More Jobs for Marylanders Income Tax Credit?

A: The More Jobs for Marylanders Income Tax Credit is a tax credit program in Maryland.

Q: Who can apply for the Initial Tax Credit?

A: Employers can apply for the Initial Tax Credit under the More Jobs for Marylanders Income Tax Credit program.

Q: What is the purpose of the Initial Tax Credit Application?

A: The Initial Tax Credit Application is used to apply for the More Jobs for Marylanders Income Tax Credit.

Q: How can employers apply for the Initial Tax Credit?

A: Employers can apply for the Initial Tax Credit by filling out the application form provided by the Maryland Department of Commerce.

Q: What is the benefit of the More Jobs for Marylanders Income Tax Credit?

A: The tax credit provides incentives for employers to create new jobs in designated areas of Maryland.

Q: Are there any eligibility requirements for the tax credit?

A: Yes, employers must meet certain criteria to be eligible for the More Jobs for Marylanders Income Tax Credit.

Q: Is there a deadline for submitting the Initial Tax Credit Application?

A: Yes, the application must be submitted by the specified deadline, which is usually mentioned on the application form.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.