This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

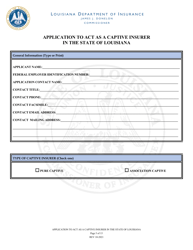

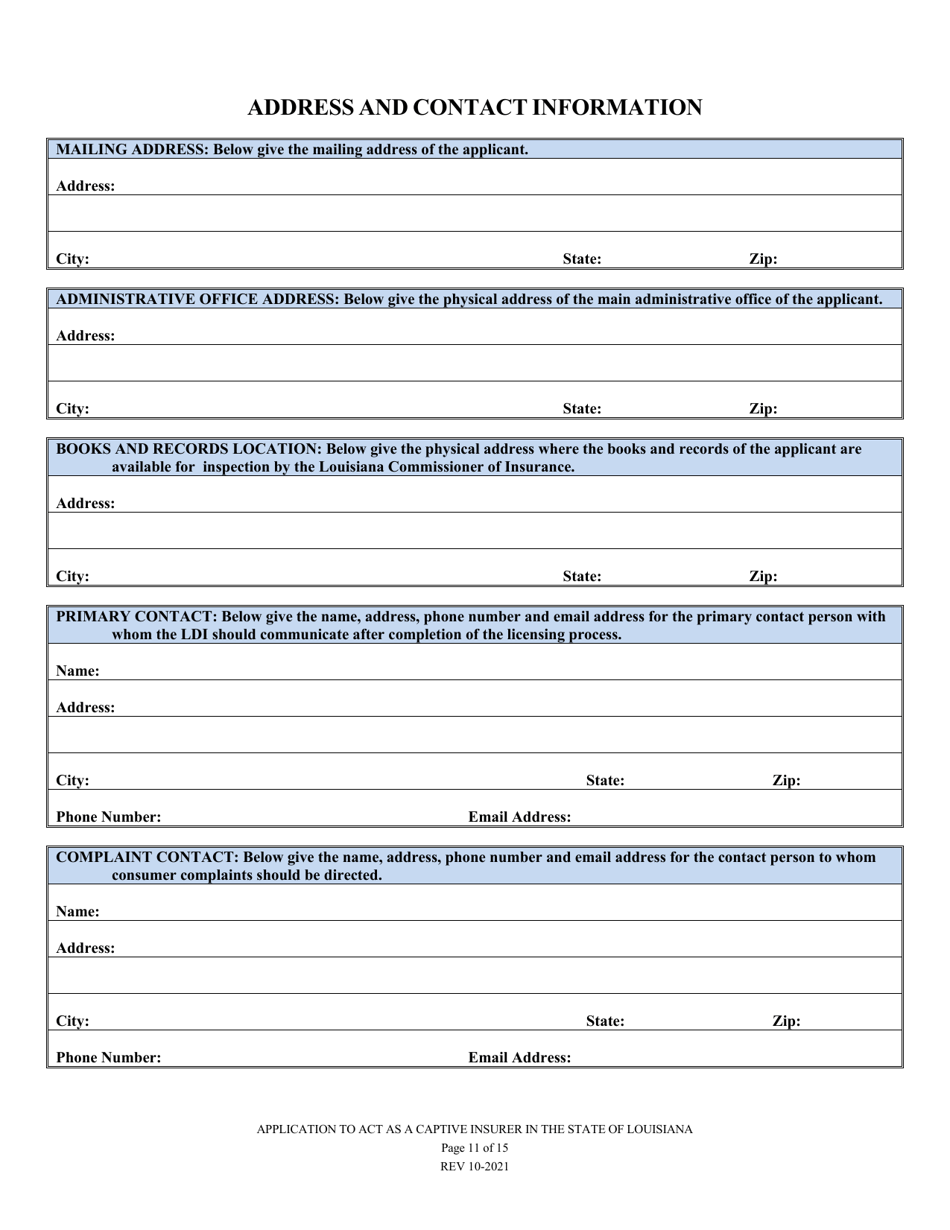

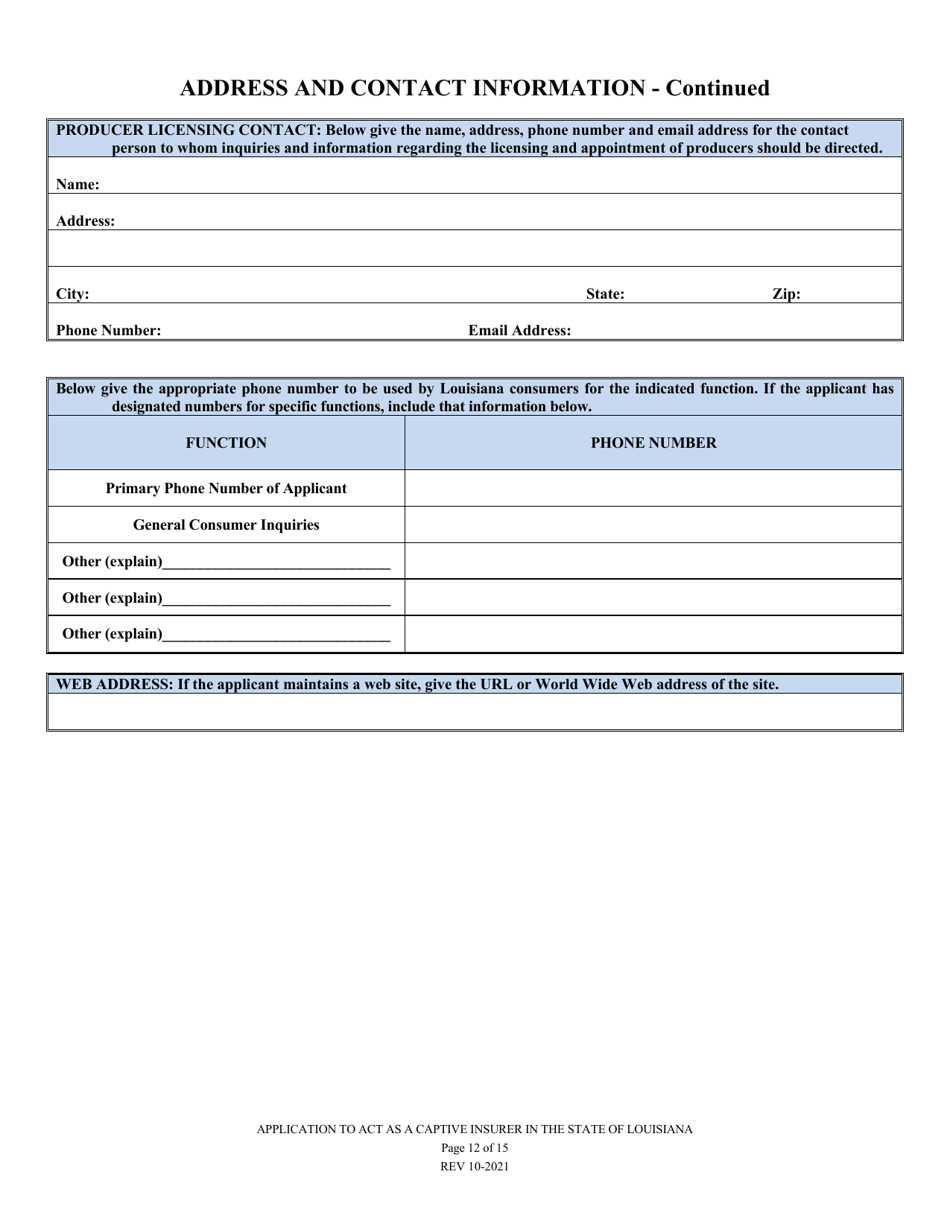

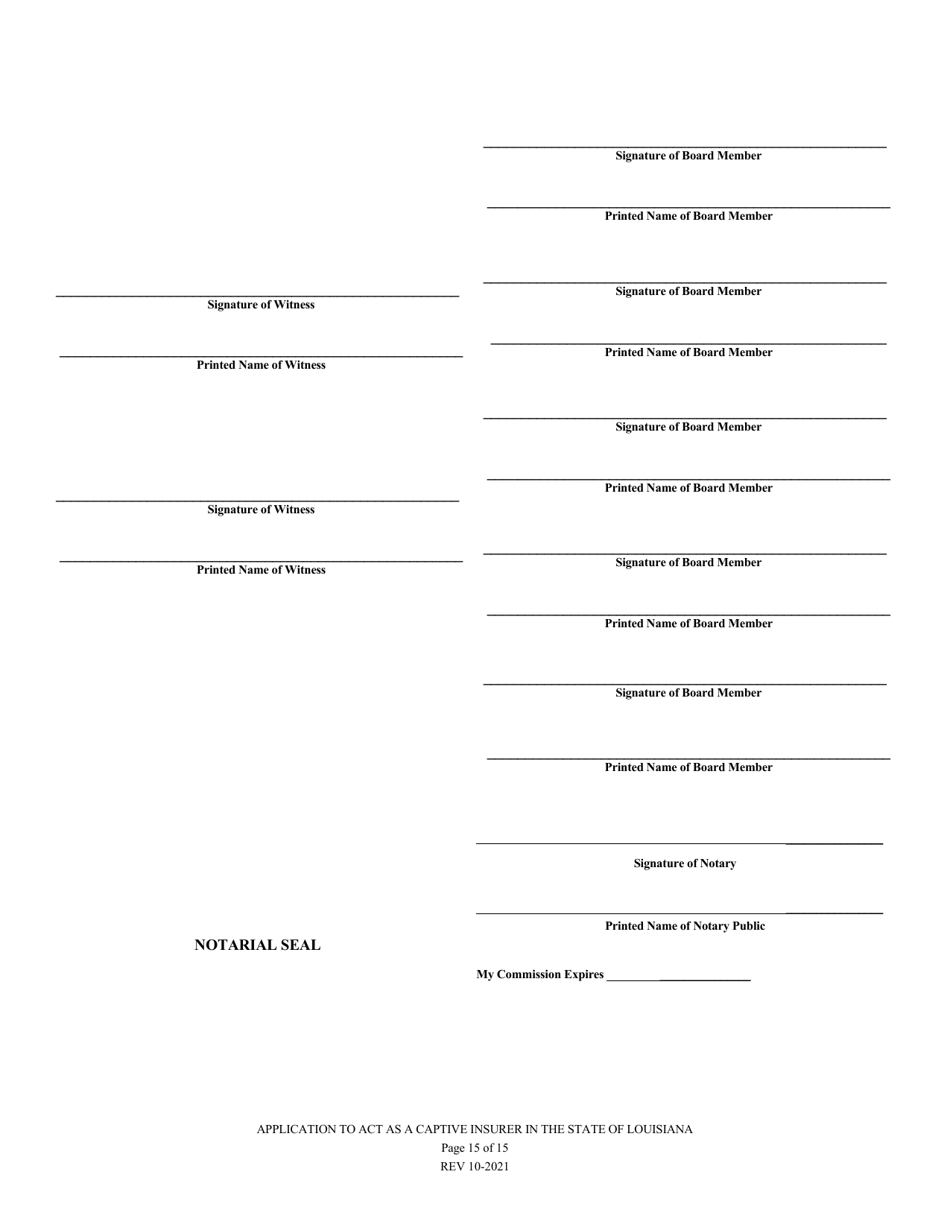

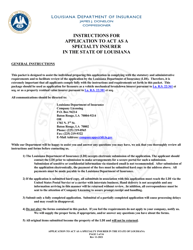

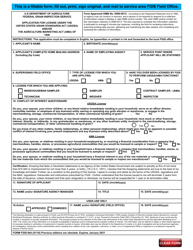

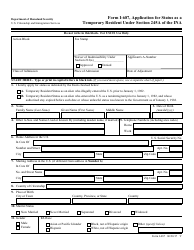

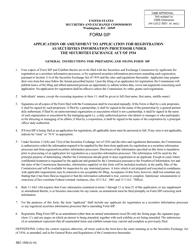

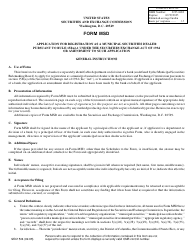

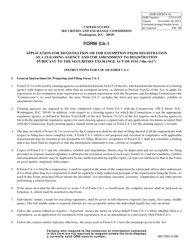

Application to Act as a Captive Insurer in the State of Louisiana - Louisiana

Application to Act as a Captive Insurer in the State of Louisiana is a legal document that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana.

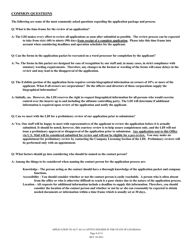

FAQ

Q: What is a captive insurer?

A: A captive insurer is an insurance company that is formed and owned by the entity it insures.

Q: Why would an entity want to form a captive insurer?

A: Forming a captive insurer allows an entity to have more control over its insurance coverage and potentially save on premiums.

Q: What is the process for applying to act as a captive insurer in Louisiana?

A: The specific process may vary, but generally it involves submitting an application, providing required documentation, and meeting certain financial and regulatory requirements.

Q: What are the requirements for financial strength to act as a captive insurer in Louisiana?

A: The specific financial strength requirements can vary depending on the type of captive insurer, but generally, there are minimum capital and surplus requirements.

Q: Are there any ongoing regulatory requirements for captive insurers in Louisiana?

A: Yes, captive insurers in Louisiana are subject to ongoing regulatory supervision and must comply with reporting and other requirements.

Q: Can a captive insurer provide coverage to entities outside of Louisiana?

A: Yes, a captive insurer in Louisiana can provide insurance coverage to entities outside of the state.

Q: Are there any advantages to forming a captive insurer in Louisiana?

A: Some potential advantages include tax advantages, increased control over insurance coverage, and potential cost savings on premiums.

Q: Are there any disadvantages to forming a captive insurer in Louisiana?

A: Disadvantages can include higher upfront costs, ongoing regulatory requirements, and the need to have the expertise to manage and operate an insurance company.

Q: Can a captive insurer write any type of insurance coverage?

A: The specific types of insurance coverage that a captive insurer can write may be limited by its license and regulatory requirements.

Q: Is it necessary to have a physical location in Louisiana to form a captive insurer?

A: No, it is not necessary to have a physical location in Louisiana to form a captive insurer, but there may be certain requirements related to having a registered agent in the state.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Louisiana Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.