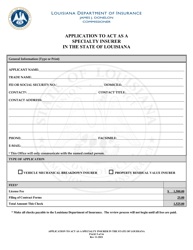

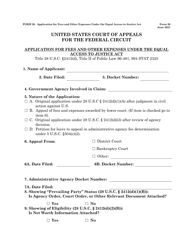

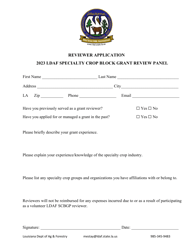

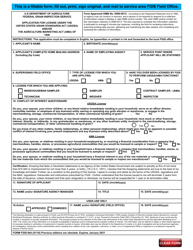

Application to Act as a Specialty Insurer in the State of Louisiana - Louisiana

Application to Act as a Specialty Insurer in the State of Louisiana is a legal document that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana.

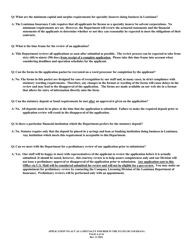

FAQ

Q: What is an application to act as a specialty insurer?

A: An application to act as a specialty insurer is a formal request to the state of Louisiana to be authorized to operate as a specialty insurer in the state.

Q: What does it mean to be a specialty insurer?

A: Being a specialty insurer means that the insurance company is focused on providing coverage for unique or specialized risks that may not be covered by traditional insurance companies.

Q: Why would a company want to become a specialty insurer?

A: A company may want to become a specialty insurer to fill a market need for specific types of insurance coverage that are not readily available from other insurers.

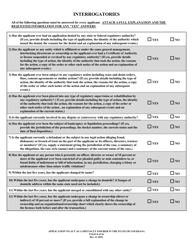

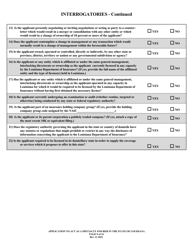

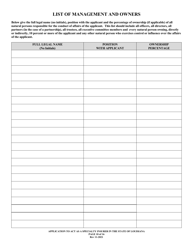

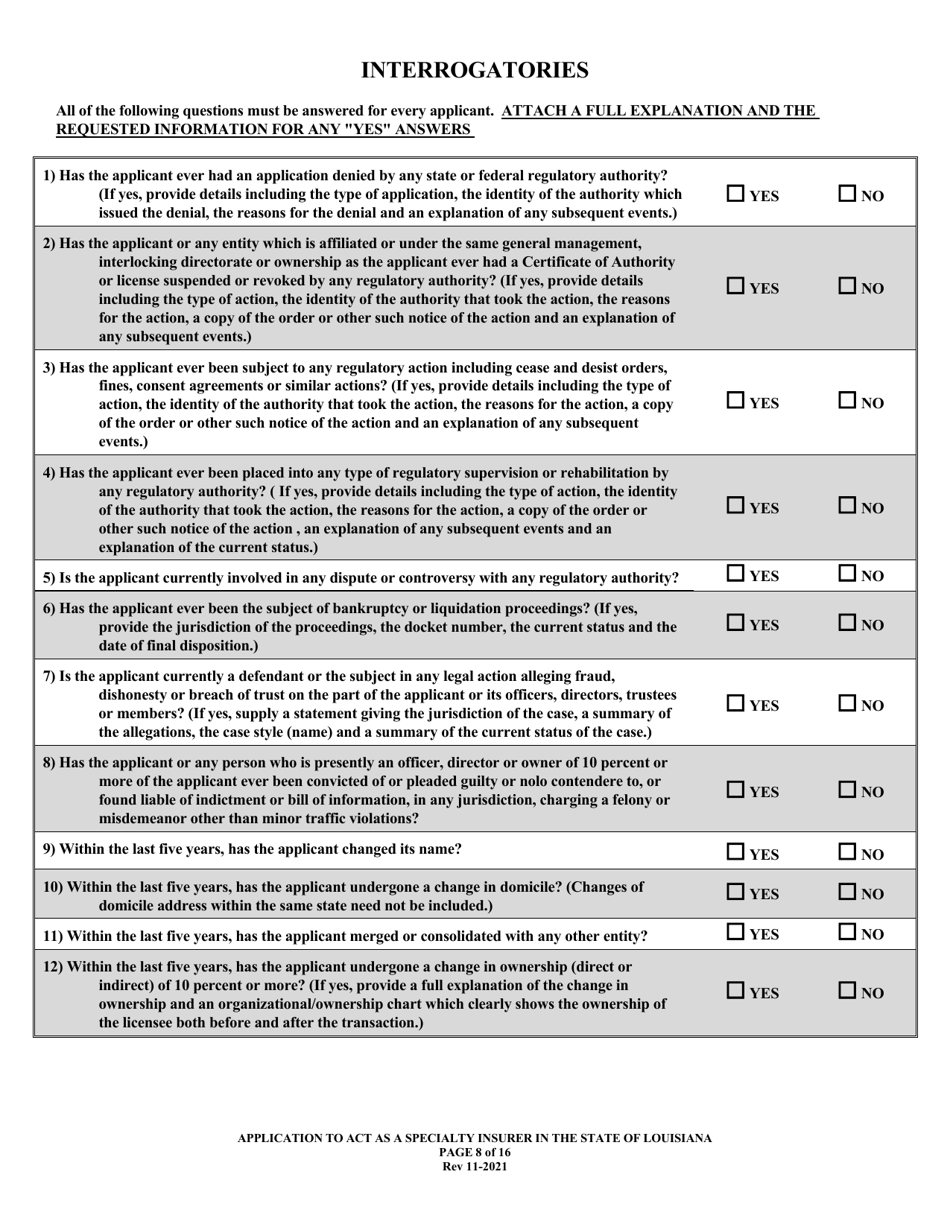

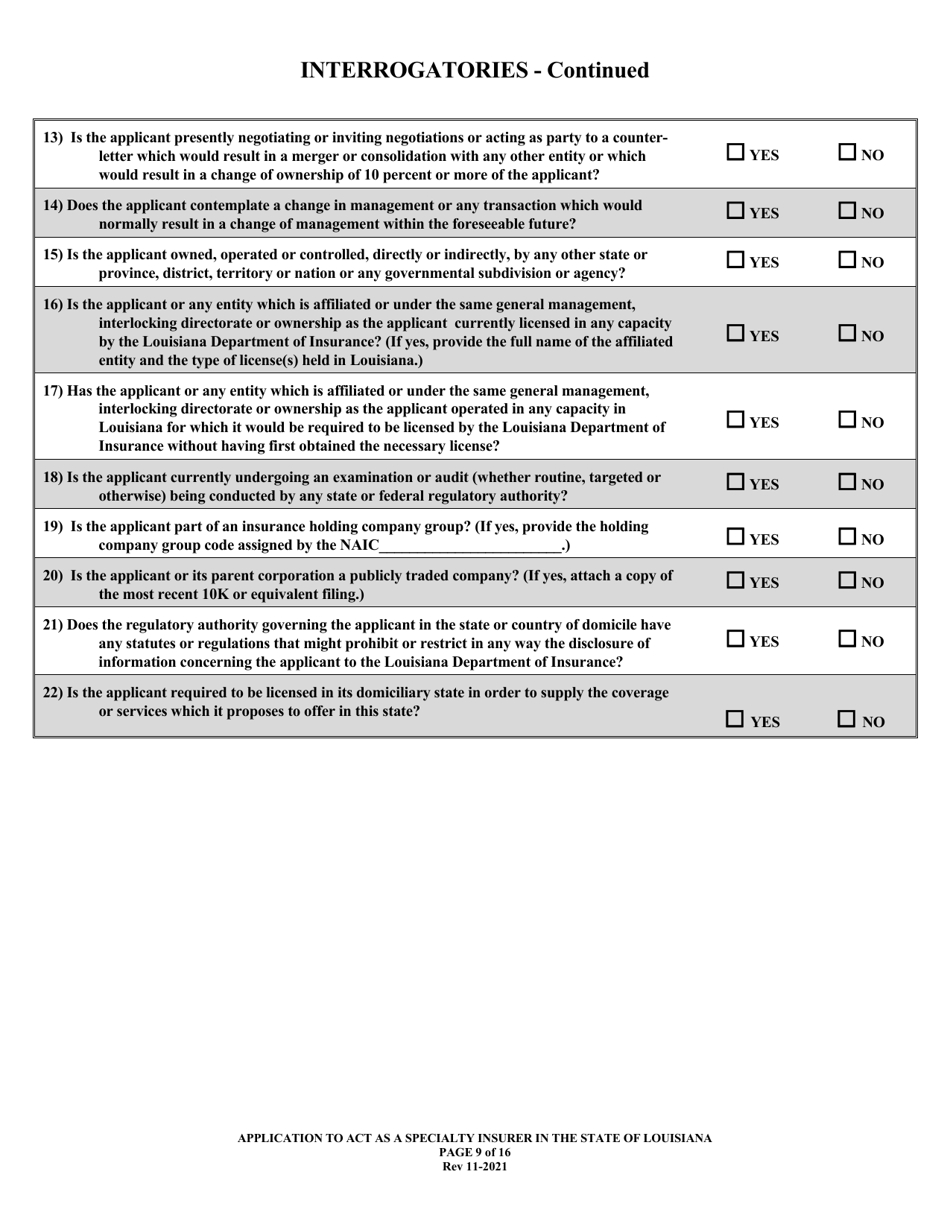

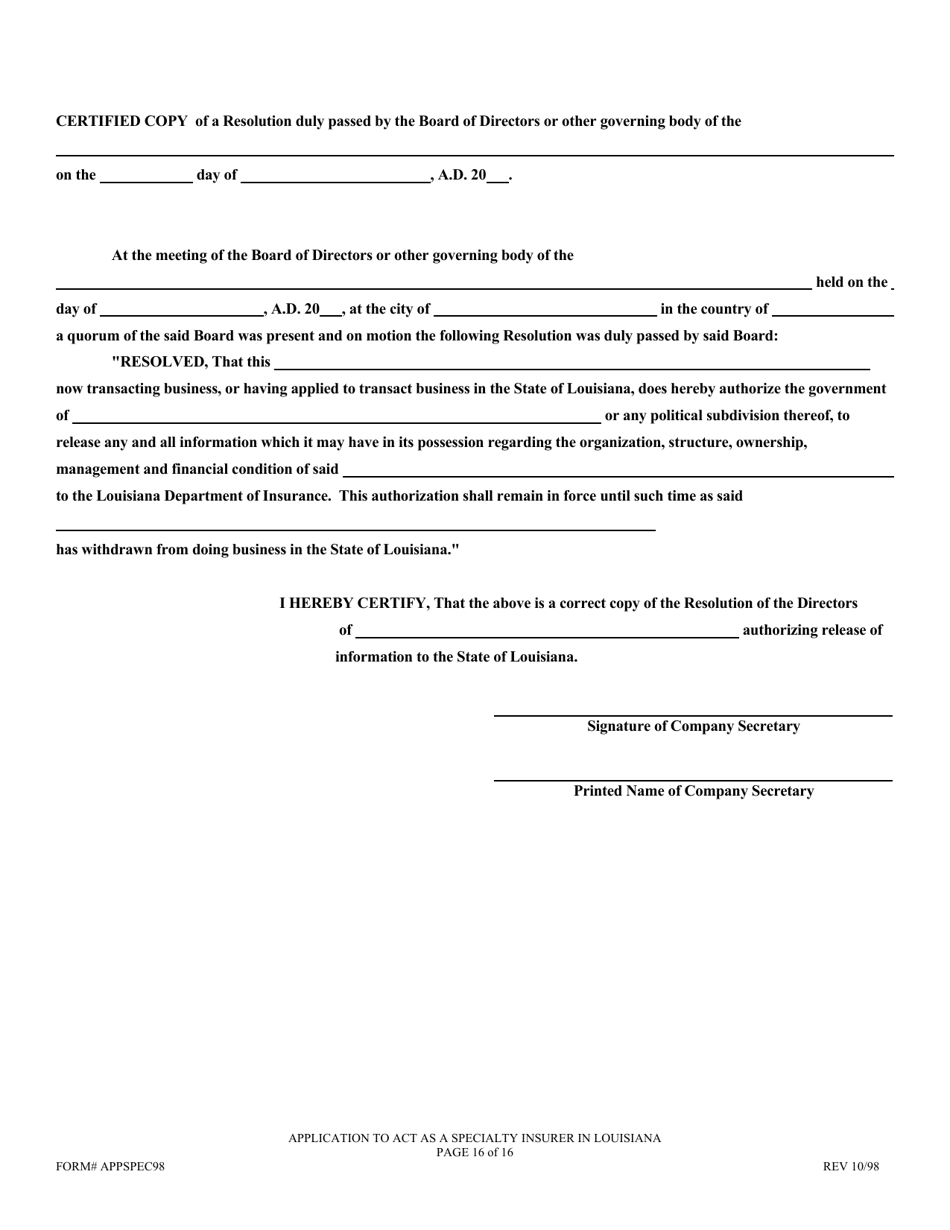

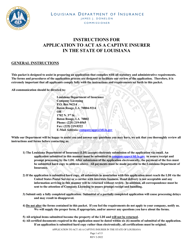

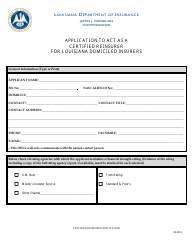

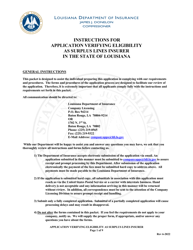

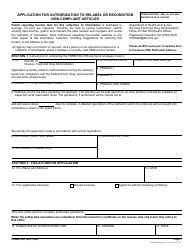

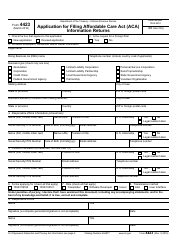

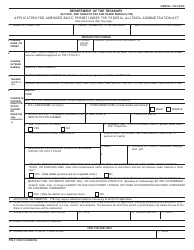

Q: What is the process to apply for a specialty insurer license in Louisiana?

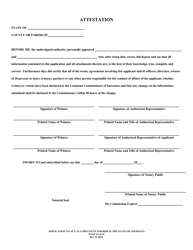

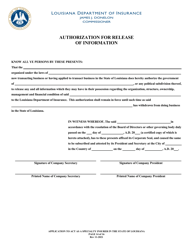

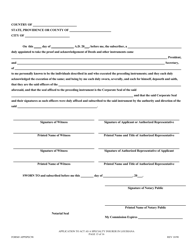

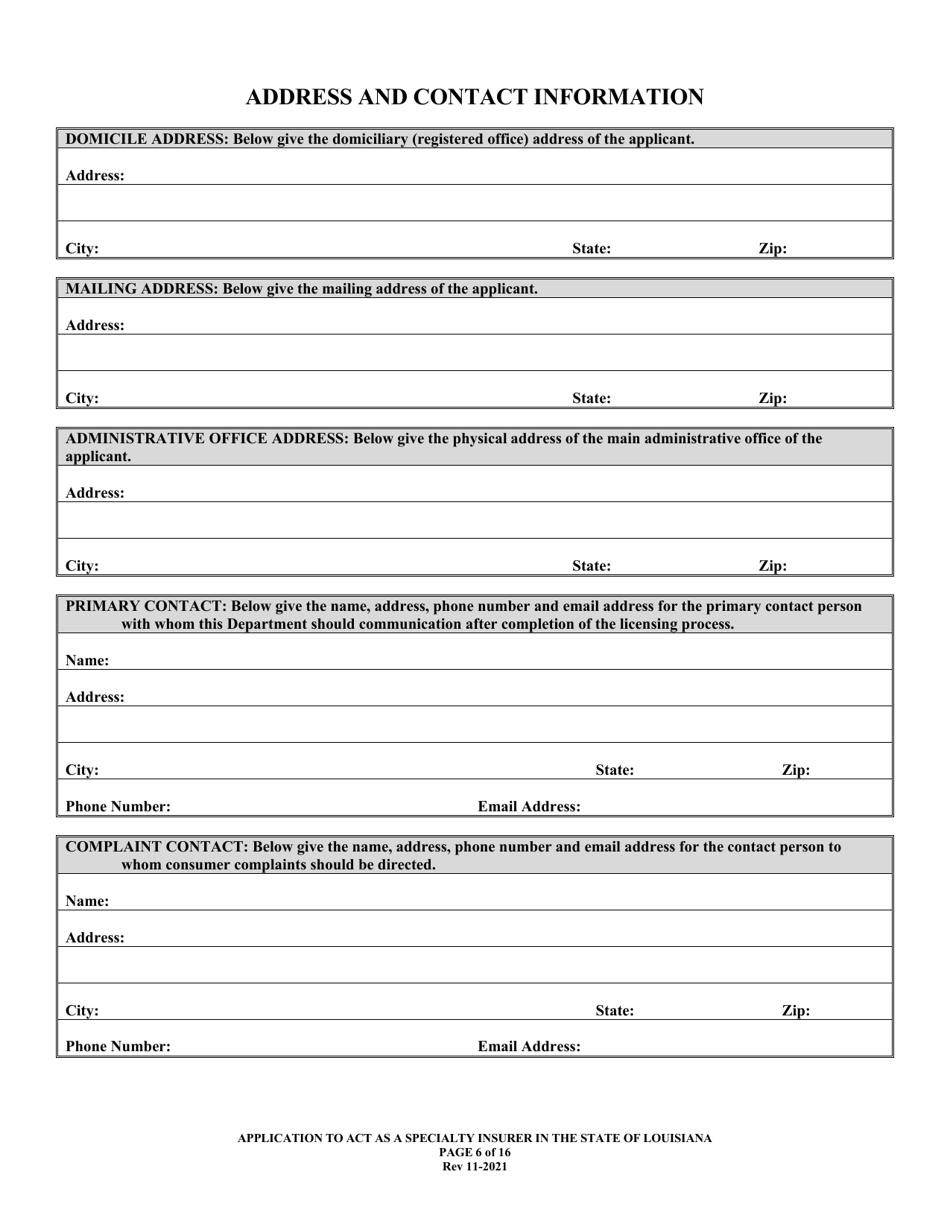

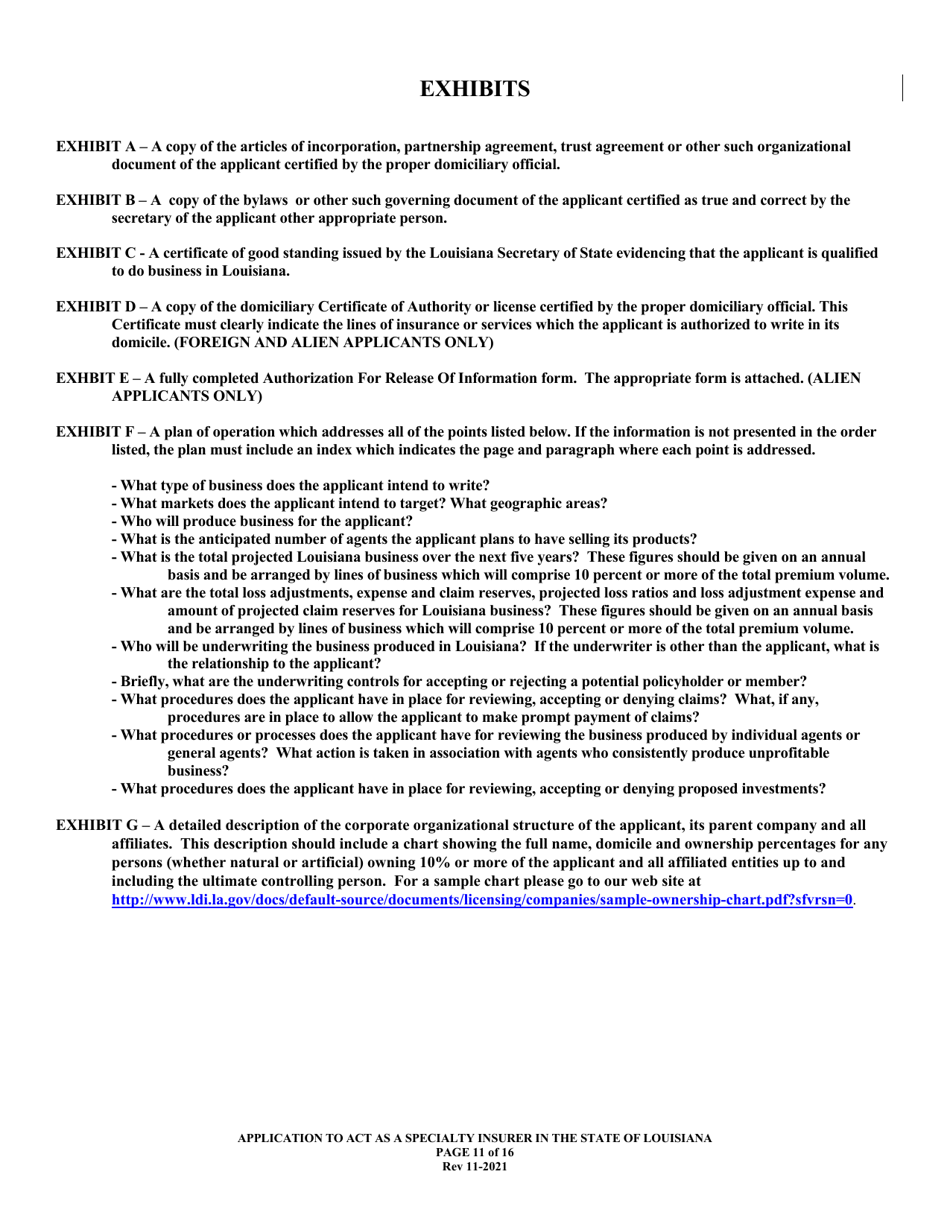

A: The process to apply for a specialty insurer license in Louisiana involves submitting a completed application form, paying the required fees, and providing all necessary supporting documents.

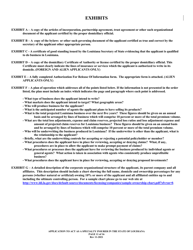

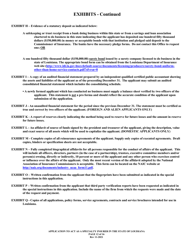

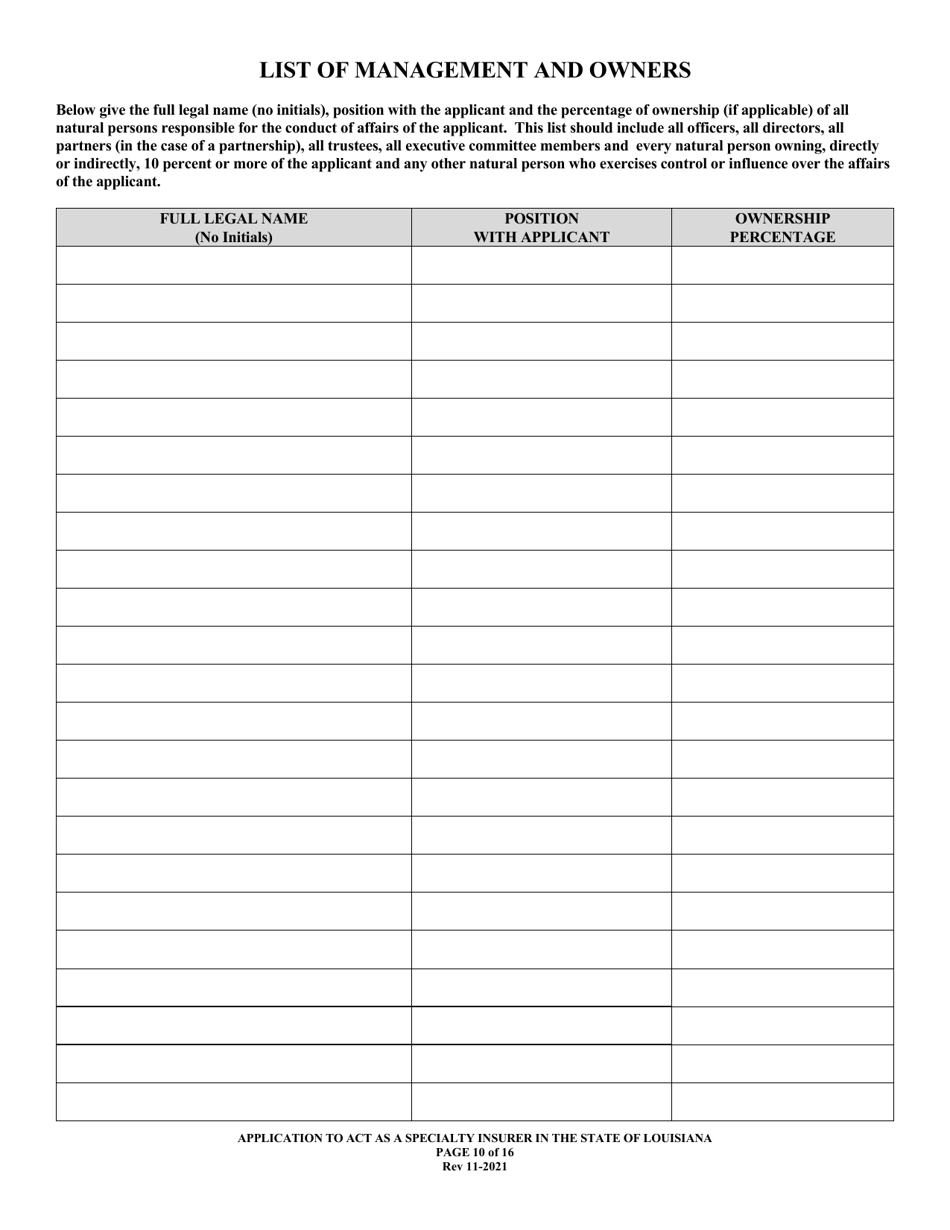

Q: What documents are required to apply for a specialty insurer license in Louisiana?

A: The specific documents required may vary, but generally, applicants should expect to provide financial statements, business plans, proof of licensure, and other relevant information.

Q: How long does it take to get a specialty insurer license in Louisiana?

A: The time it takes to get a specialty insurer license in Louisiana can vary, but it typically takes several months for the application to be reviewed and processed.

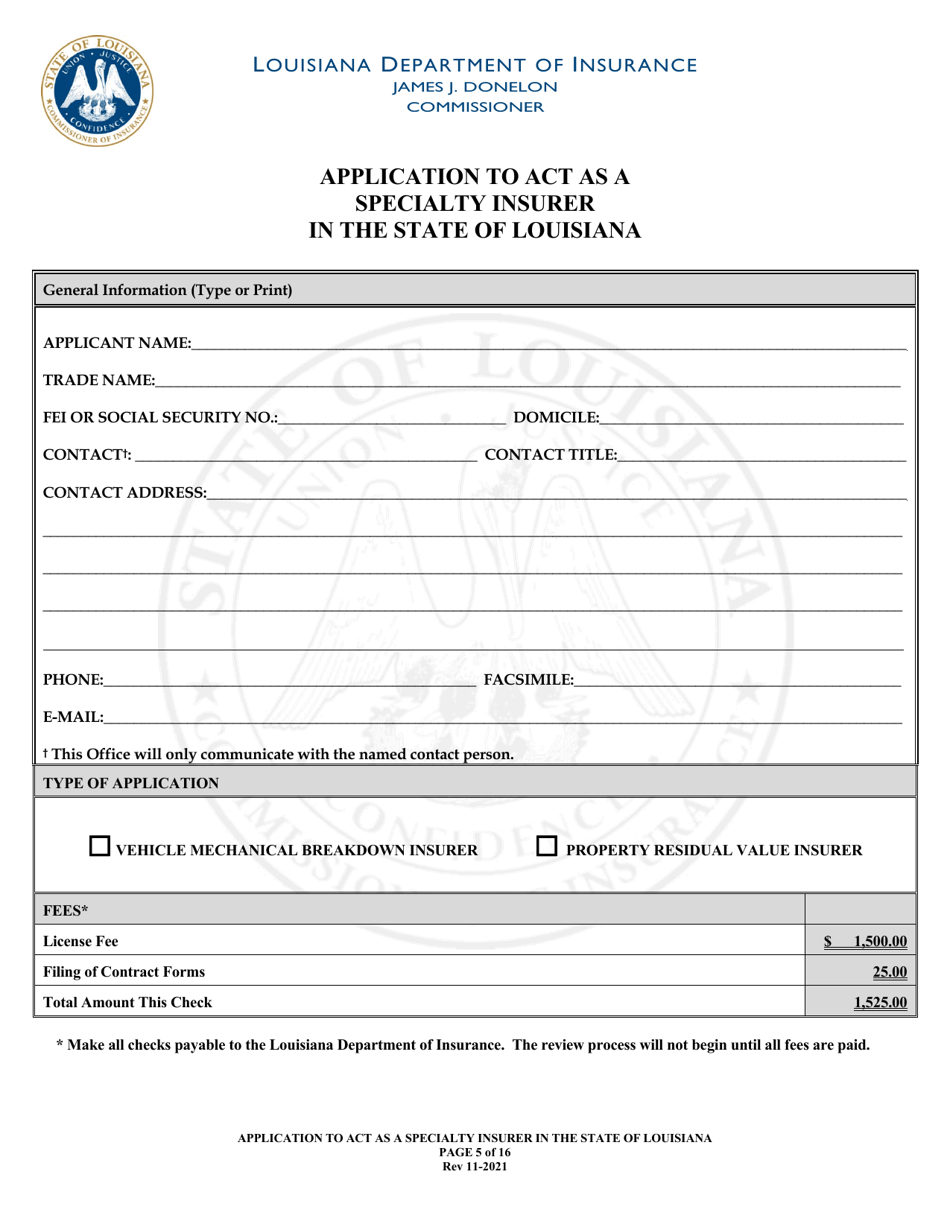

Q: What are the fees associated with applying for a specialty insurer license in Louisiana?

A: The fees associated with applying for a specialty insurer license in Louisiana may include an application fee, an examination fee, and an annual renewal fee.

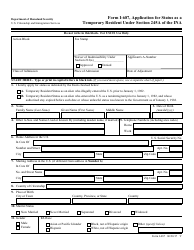

Q: Are there any specific requirements for a company to qualify as a specialty insurer in Louisiana?

A: Yes, there are specific requirements, such as meeting minimum capital and surplus requirements, having a designated specialist, and demonstrating expertise in the specialty insurance market.

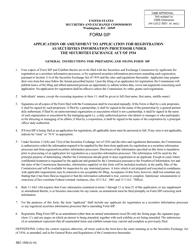

Q: What types of insurance coverage can specialty insurers provide?

A: Specialty insurers can provide a wide range of coverage, including but not limited to, medical malpractice insurance, professional liability insurance, cyber insurance, and product liability insurance.

Q: Can specialty insurers operate in multiple states?

A: Yes, specialty insurers can operate in multiple states, but they need to be licensed in each state they wish to operate in.

Q: Are specialty insurers subject to regulation and oversight in Louisiana?

A: Yes, specialty insurers are subject to regulation and oversight by the Louisiana Department of Insurance to ensure compliance with state laws and to protect the interests of policyholders.

Form Details:

- Released on November 1, 2021;

- The latest edition currently provided by the Louisiana Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.