This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

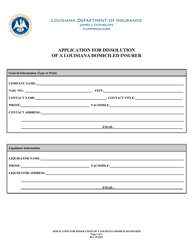

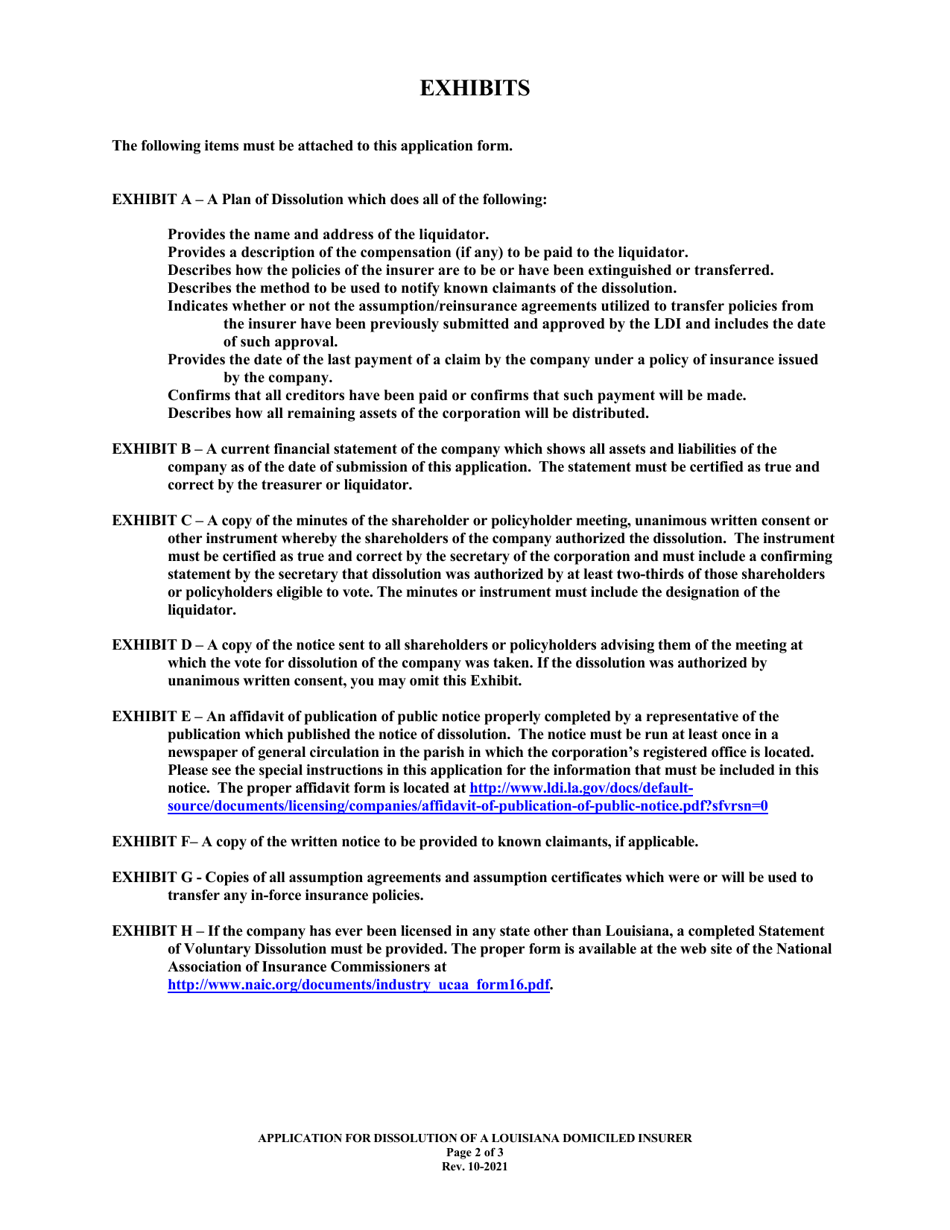

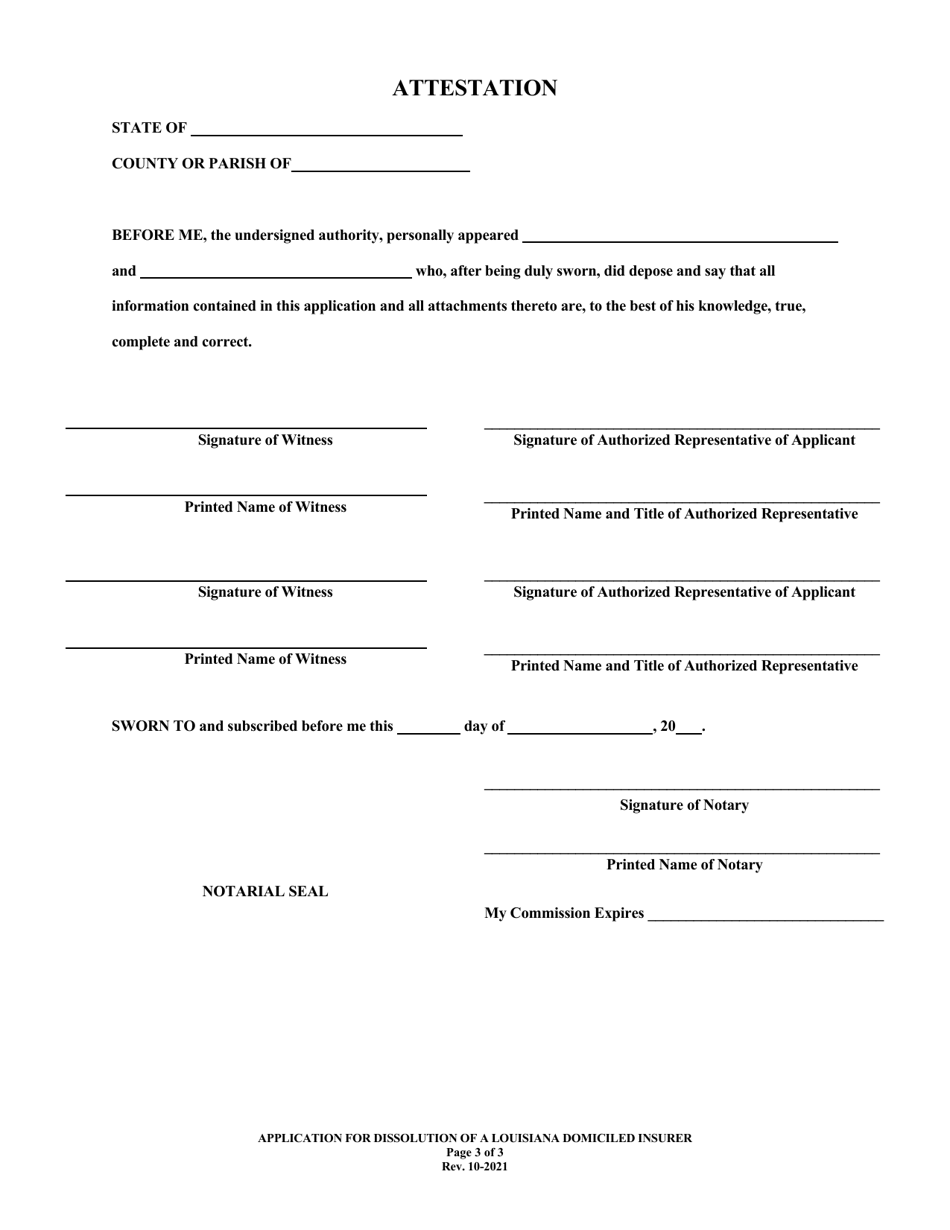

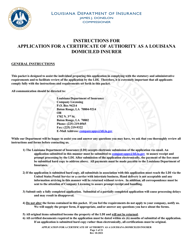

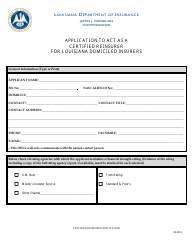

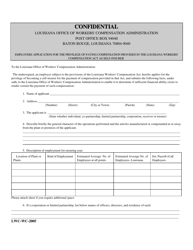

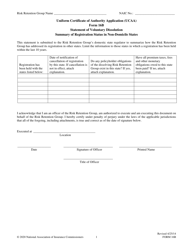

Application for Dissolution of a Louisiana Domiciled Insurer - Louisiana

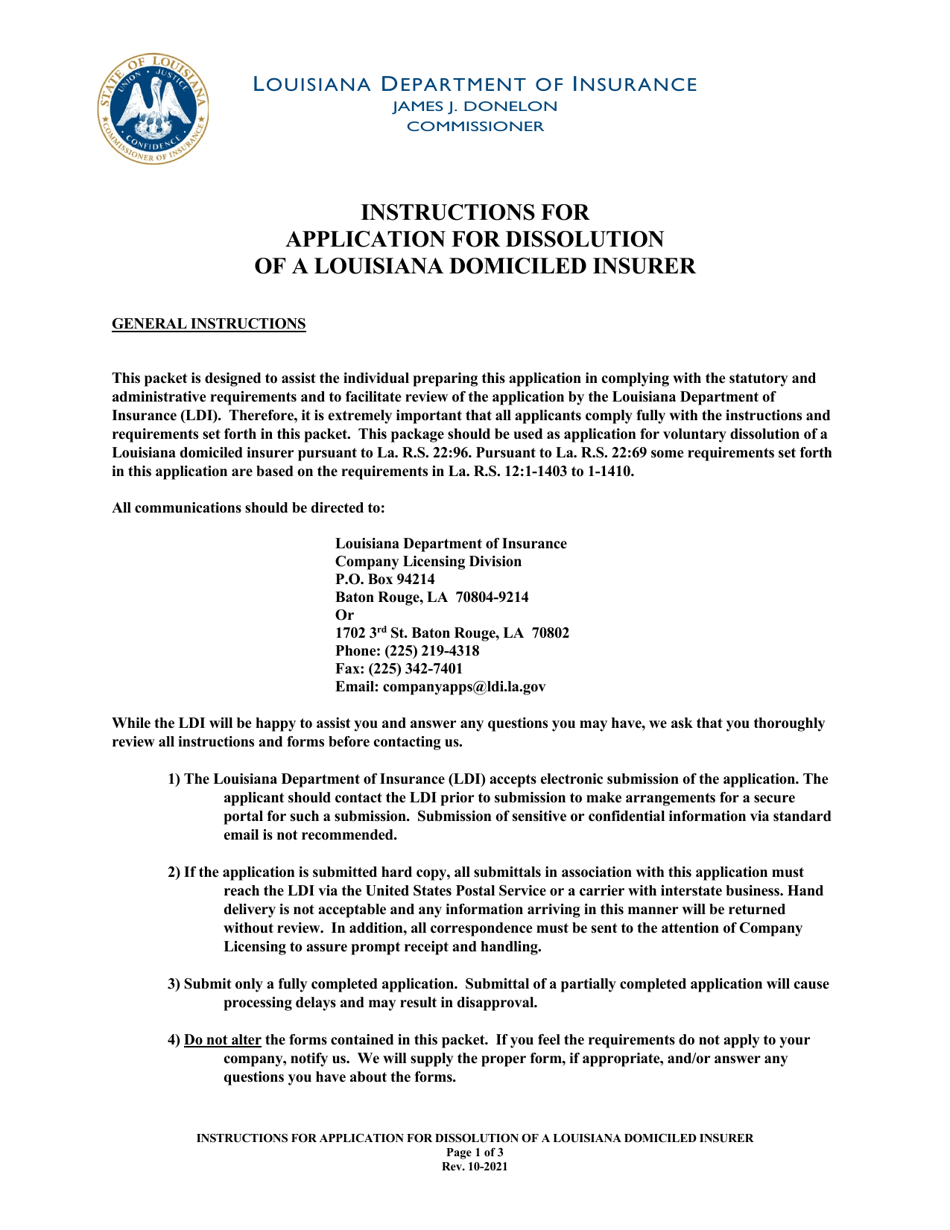

Application for Dissolution of a Louisiana Domiciled Insurer is a legal document that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana.

FAQ

Q: What is an application for dissolution?

A: An application for dissolution is a legal process of permanently closing down a business or organization.

Q: What is a Louisiana domiciled insurer?

A: A Louisiana domiciled insurer is an insurance company that is based in and regulated by the state of Louisiana.

Q: What does it mean to dissolve an insurer?

A: To dissolve an insurer means to terminate its existence as a legal entity, usually due to financial or operational reasons.

Q: How can an insurer apply for dissolution?

A: An insurer can apply for dissolution by submitting an application to the appropriate regulatory or governing body, following the required procedures and meeting any applicable criteria.

Q: What happens after an insurer's application for dissolution is approved?

A: After an insurer's application for dissolution is approved, it will undergo a process to wind down its operations, settle any outstanding obligations, and distribute assets to stakeholders as required by law.

Q: Is there a specific form or document required for the application for dissolution of a Louisiana domiciled insurer?

A: Yes, there is likely a specific form or document required for the application for dissolution of a Louisiana domiciled insurer. It is best to consult with the relevant regulatory or governing body to obtain the necessary form or document.

Q: What are the reasons for an insurer to apply for dissolution?

A: An insurer may apply for dissolution due to financial difficulties, strategic decisions, mergers or acquisitions, or other circumstances that make it no longer viable to continue operating.

Q: Is the dissolution of an insurer a common occurrence?

A: The dissolution of an insurer can occur, but it is not a common or routine event. It typically happens in specific situations where the insurer faces significant challenges or is unable to meet its obligations.

Q: What are the consequences of an insurer's dissolution?

A: The consequences of an insurer's dissolution can vary depending on the circumstances. It may result in the transfer of policies to another insurer, potential loss of coverage for policyholders, and the closure of the insurer's business operations.

Q: Are policyholders protected if an insurer is dissolved?

A: Policyholders may be protected through various mechanisms such as state insurance guaranty associations, which provide coverage for claims against insolvent insurers. However, the specific protections and coverage may vary by state and policy type.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Louisiana Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.