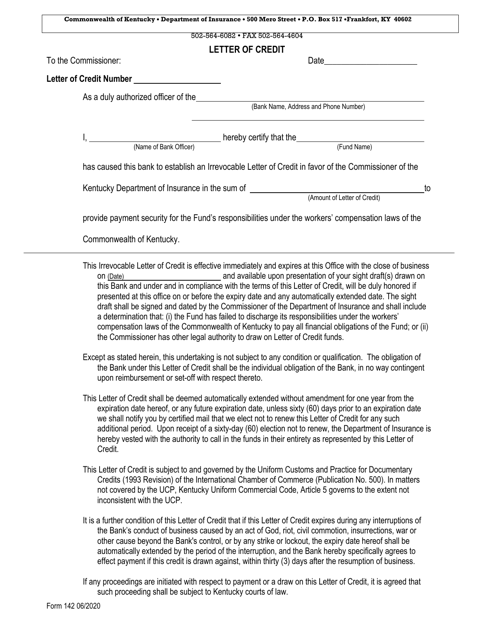

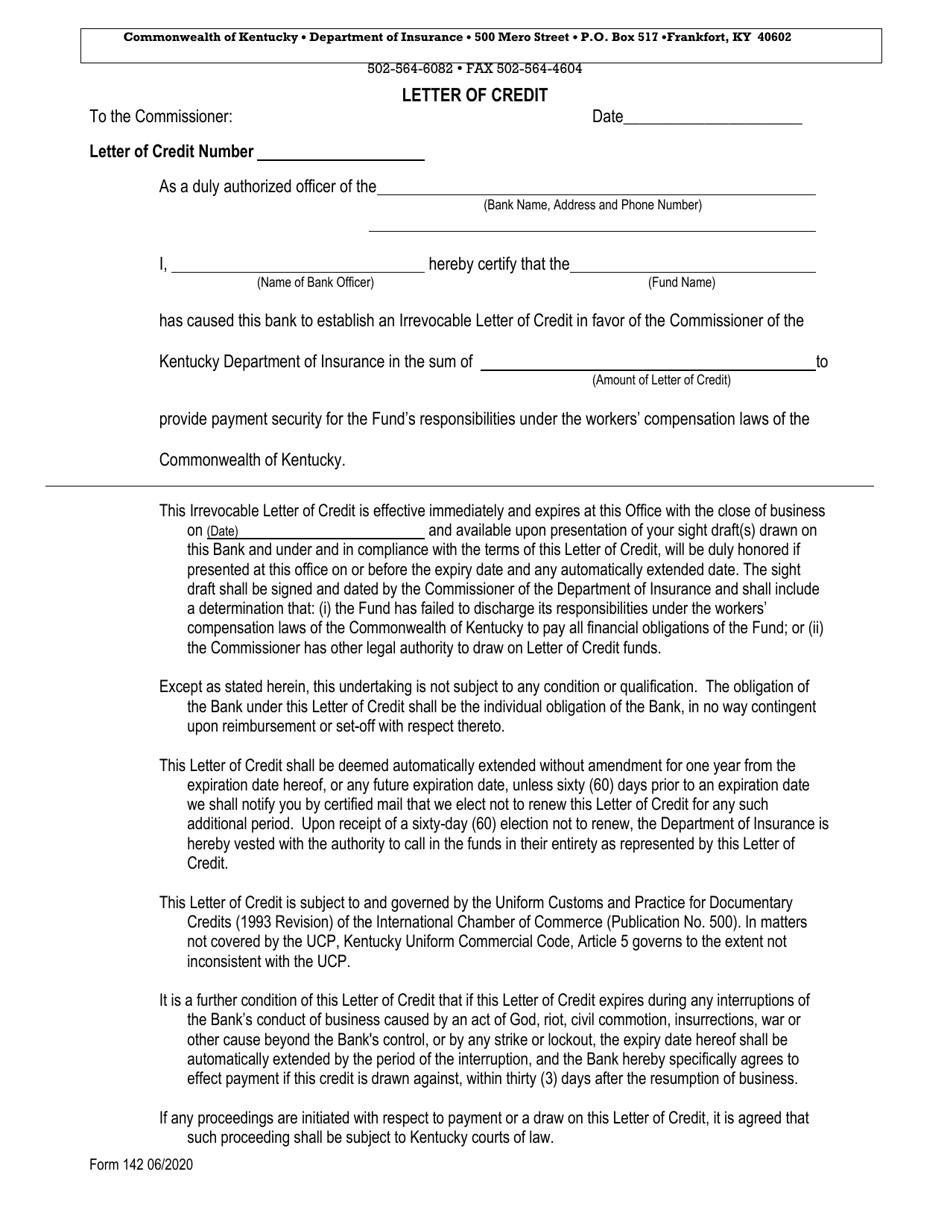

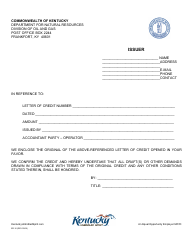

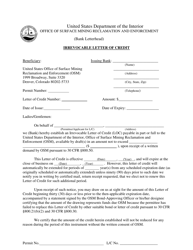

Form 142 Letter of Credit - Kentucky

What Is Form 142?

This is a legal form that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 142 Letter of Credit?

A: Form 142 Letter of Credit is a document used in Kentucky.

Q: What is the purpose of Form 142 Letter of Credit?

A: The purpose of Form 142 Letter of Credit is to specify the terms and conditions of a letter of credit transaction.

Q: Who uses Form 142 Letter of Credit?

A: Form 142 Letter of Credit is used by banks, financial institutions, and businesses involved in international trade.

Q: What information is included in Form 142 Letter of Credit?

A: Form 142 Letter of Credit includes details such as the beneficiary name, amount of credit, expiry date, and documents required for payment.

Q: Why is Form 142 Letter of Credit important?

A: Form 142 Letter of Credit is important as it provides a secure method of payment and reduces the risks associated with international transactions.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Kentucky Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 142 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.