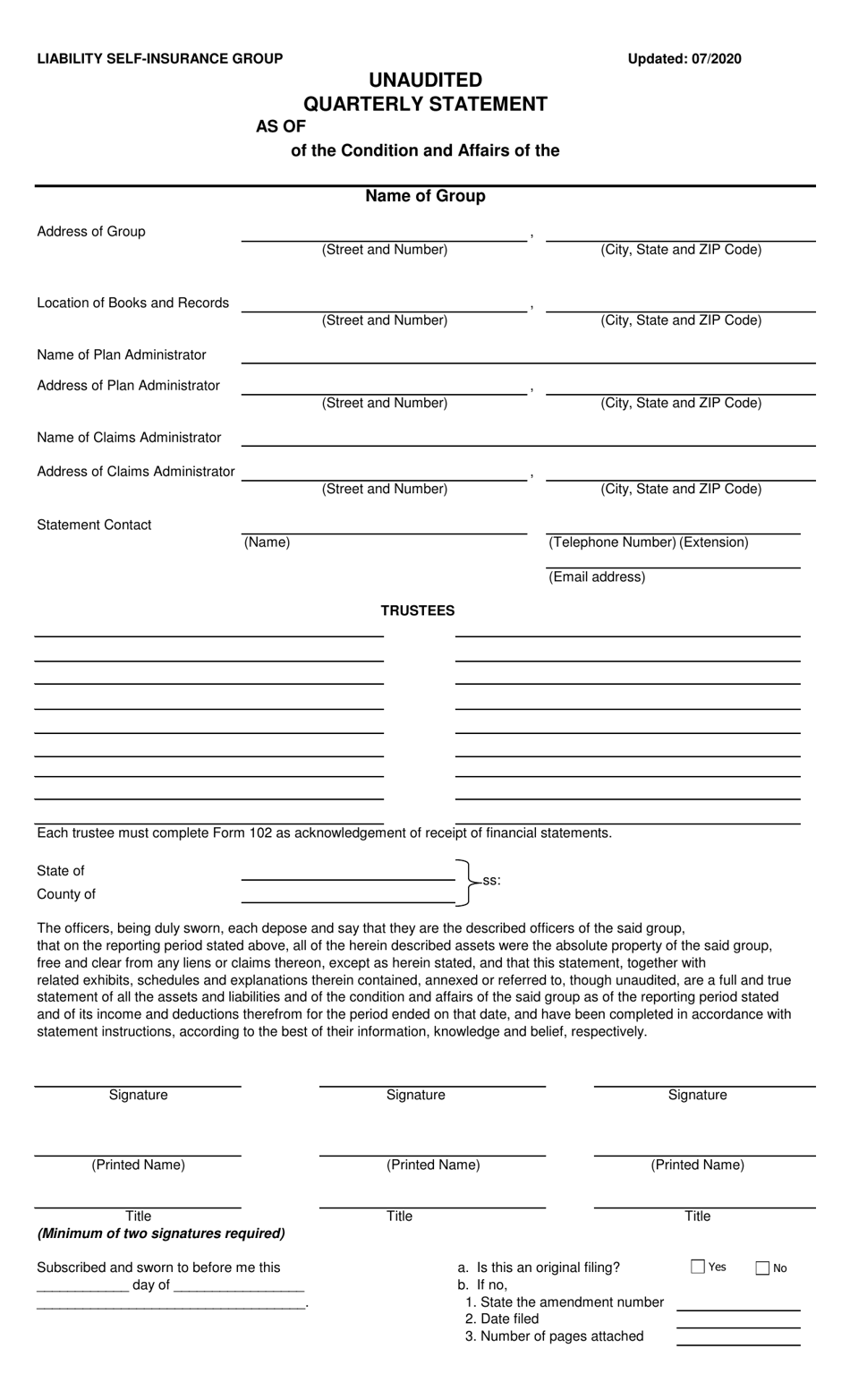

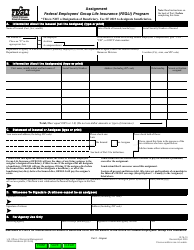

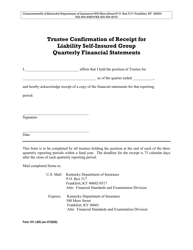

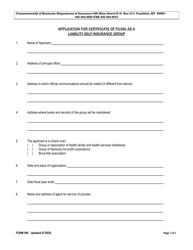

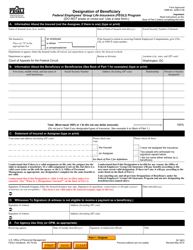

Liability Self-insurance Group Quarterly Statement - Kentucky

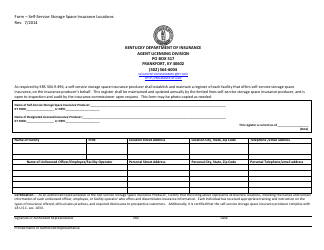

Liability Self-insurance Group Quarterly Statement is a legal document that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky.

FAQ

Q: What is a Liability Self-insurance Group?

A: A Liability Self-insurance Group is a group of employers who join together to self-insure their liabilities for workers' compensation or other types of insurance.

Q: What is a quarterly statement?

A: A quarterly statement is a report that provides an overview of financial activities and performance for a specific time period of three months.

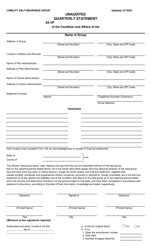

Q: Who prepares the quarterly statement for a Liability Self-insurance Group?

A: The quarterly statement for a Liability Self-insurance Group is typically prepared by the group's administrator or a designated financial professional.

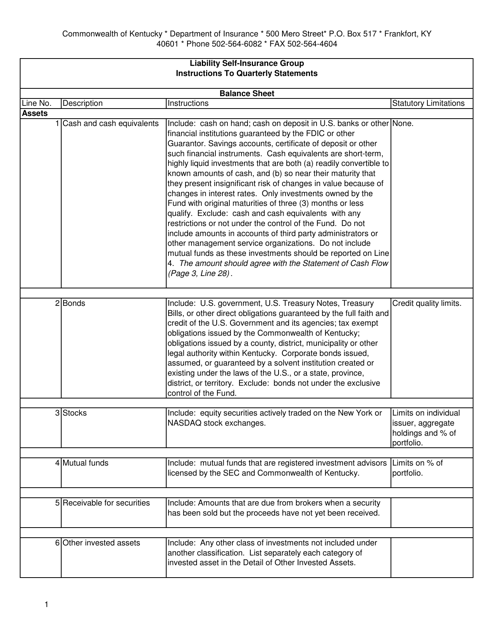

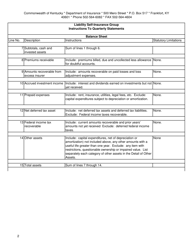

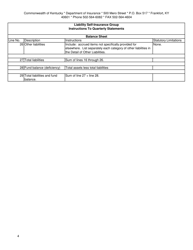

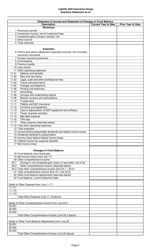

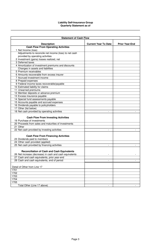

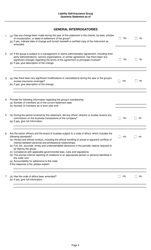

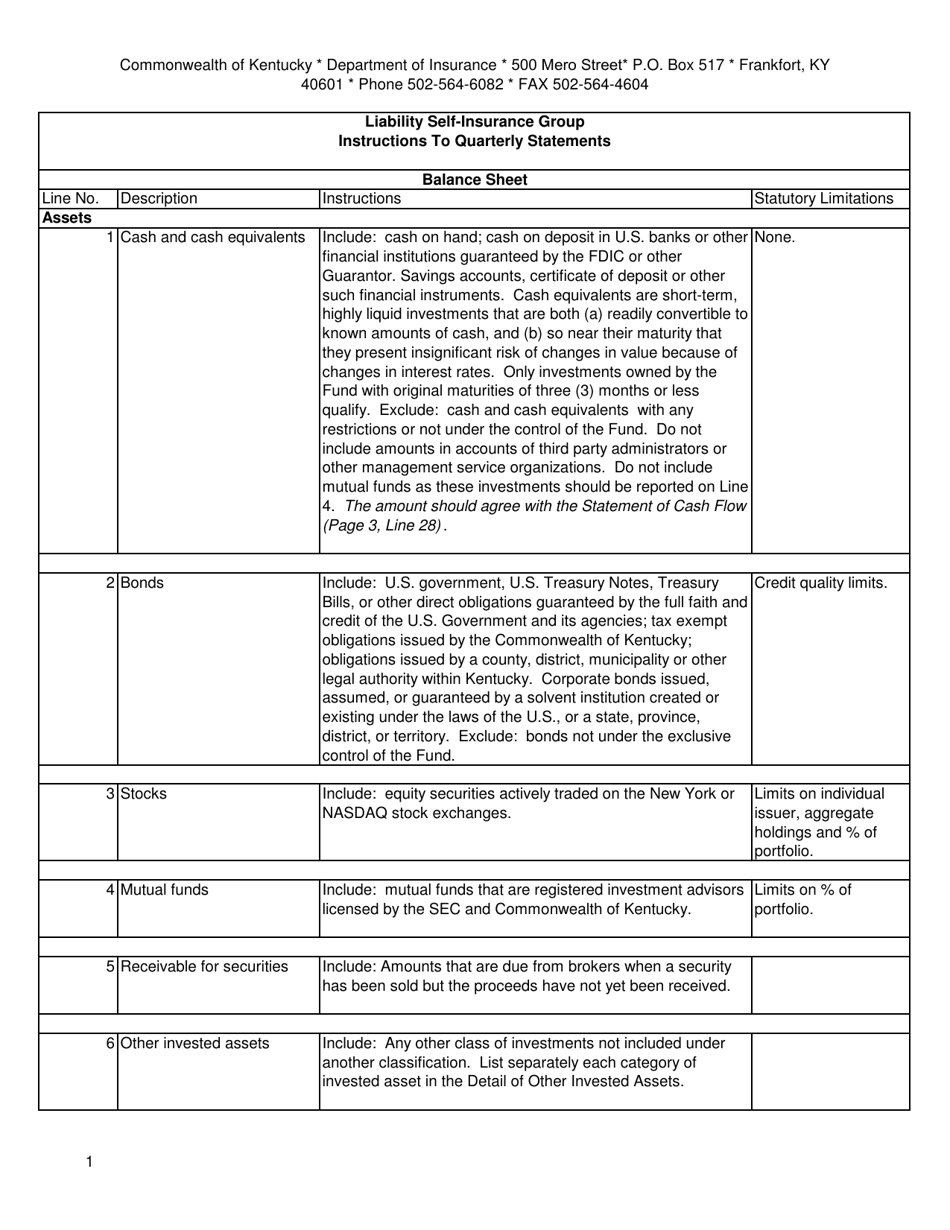

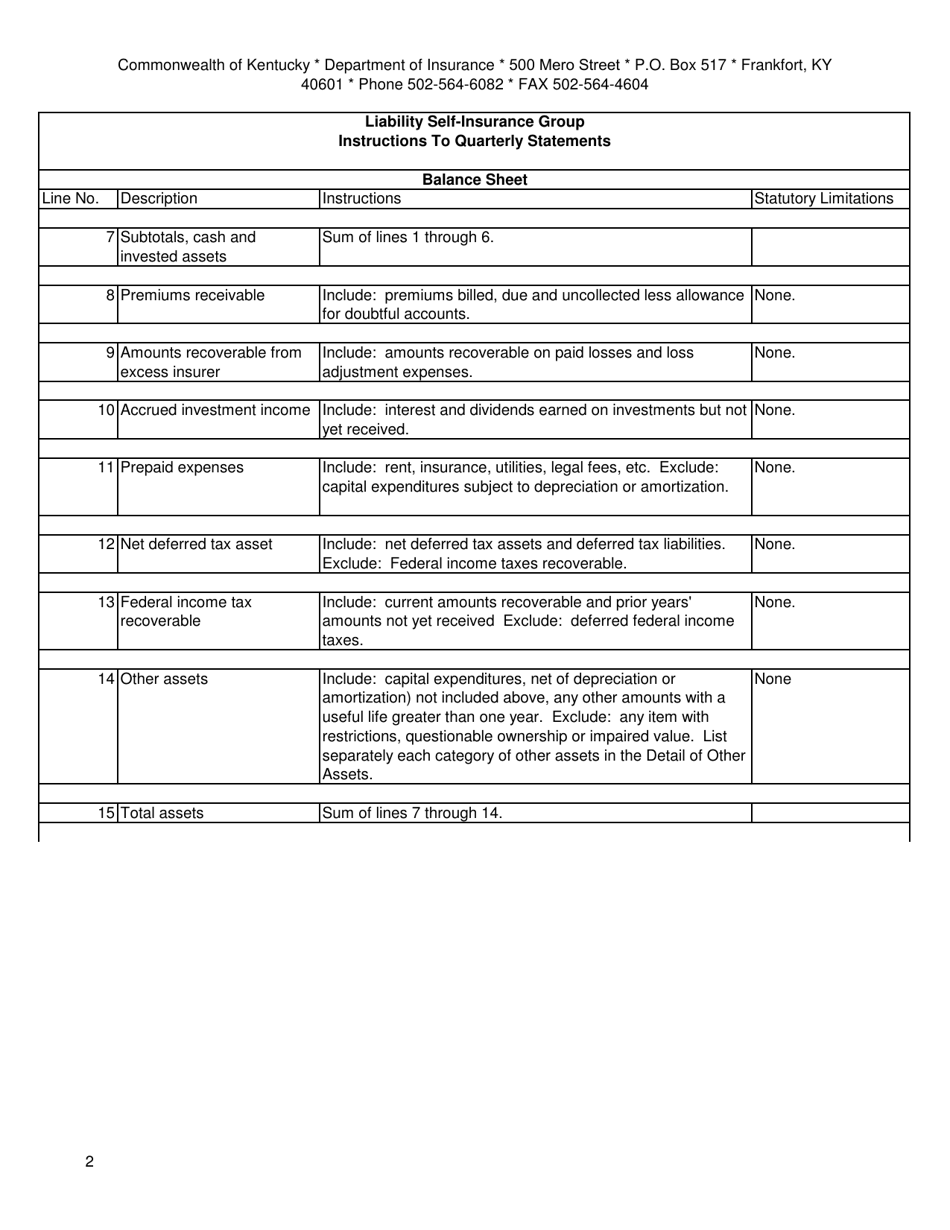

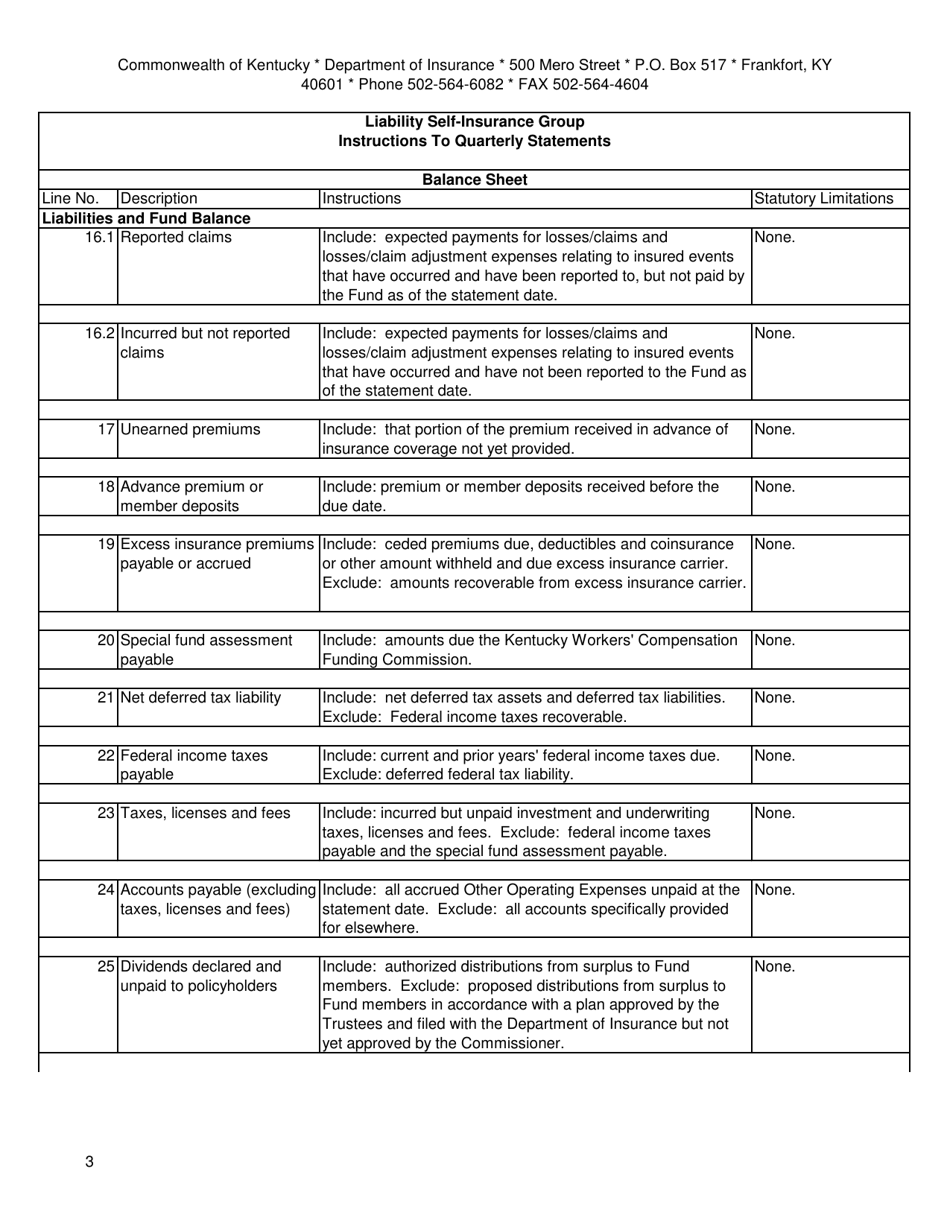

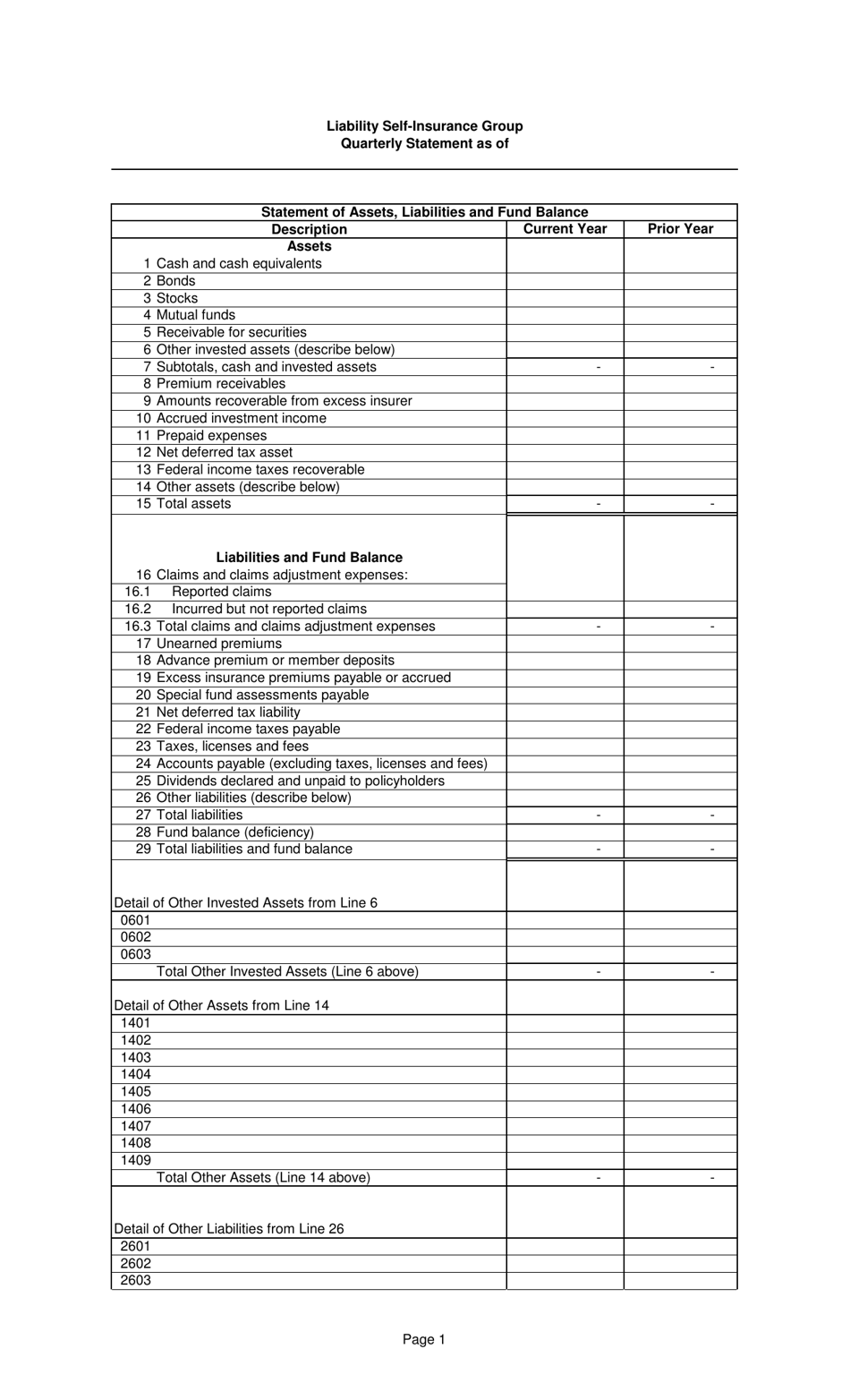

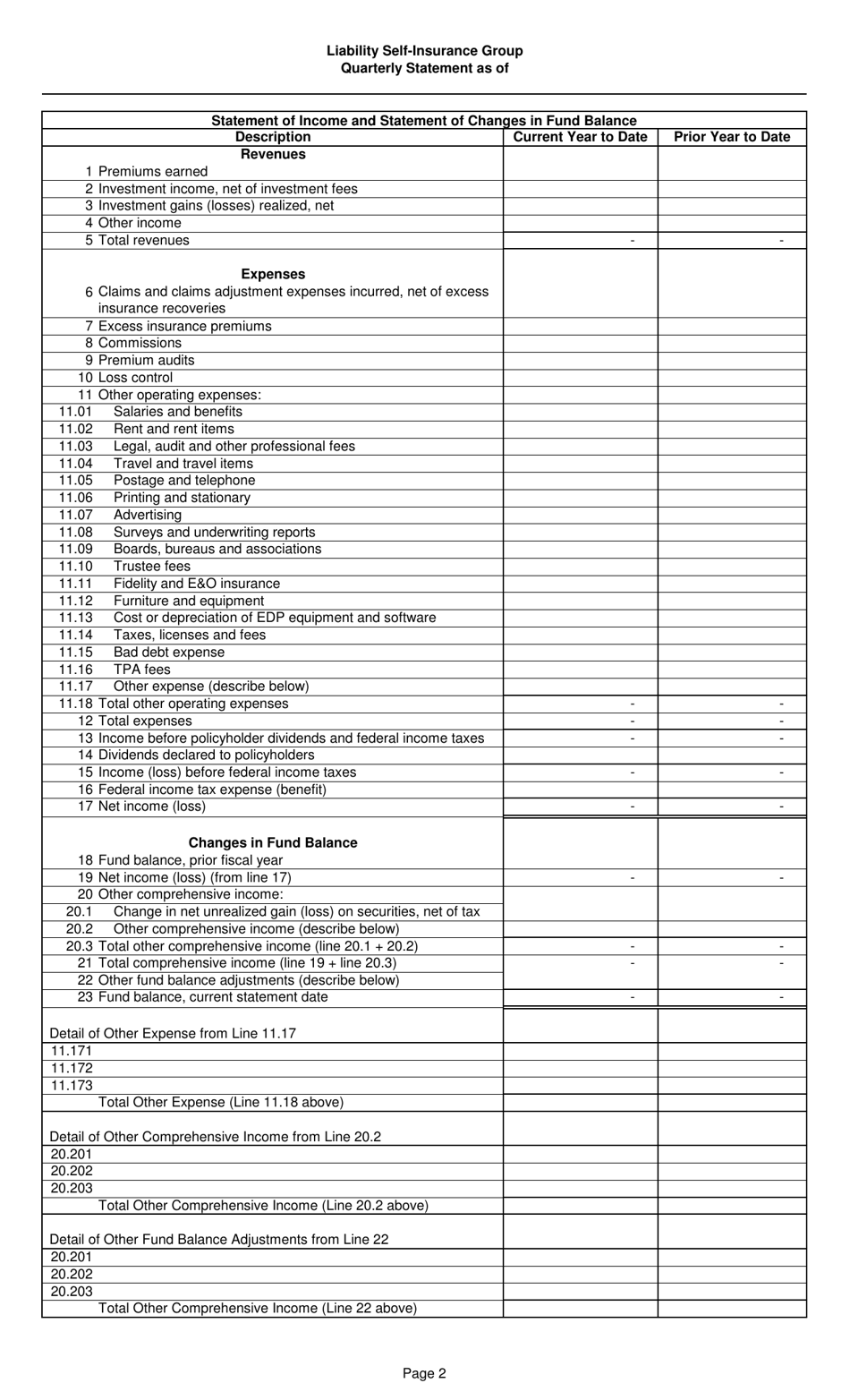

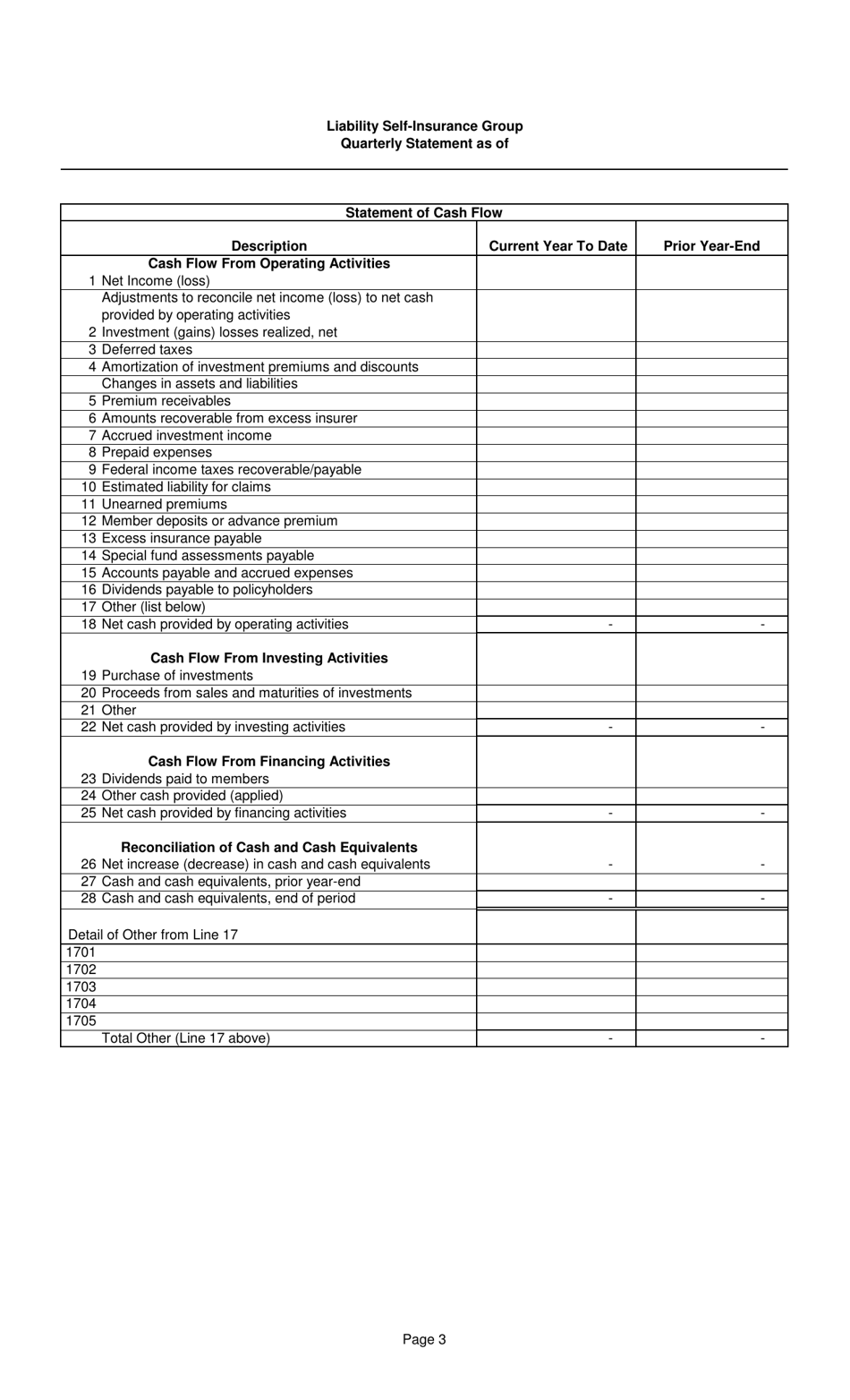

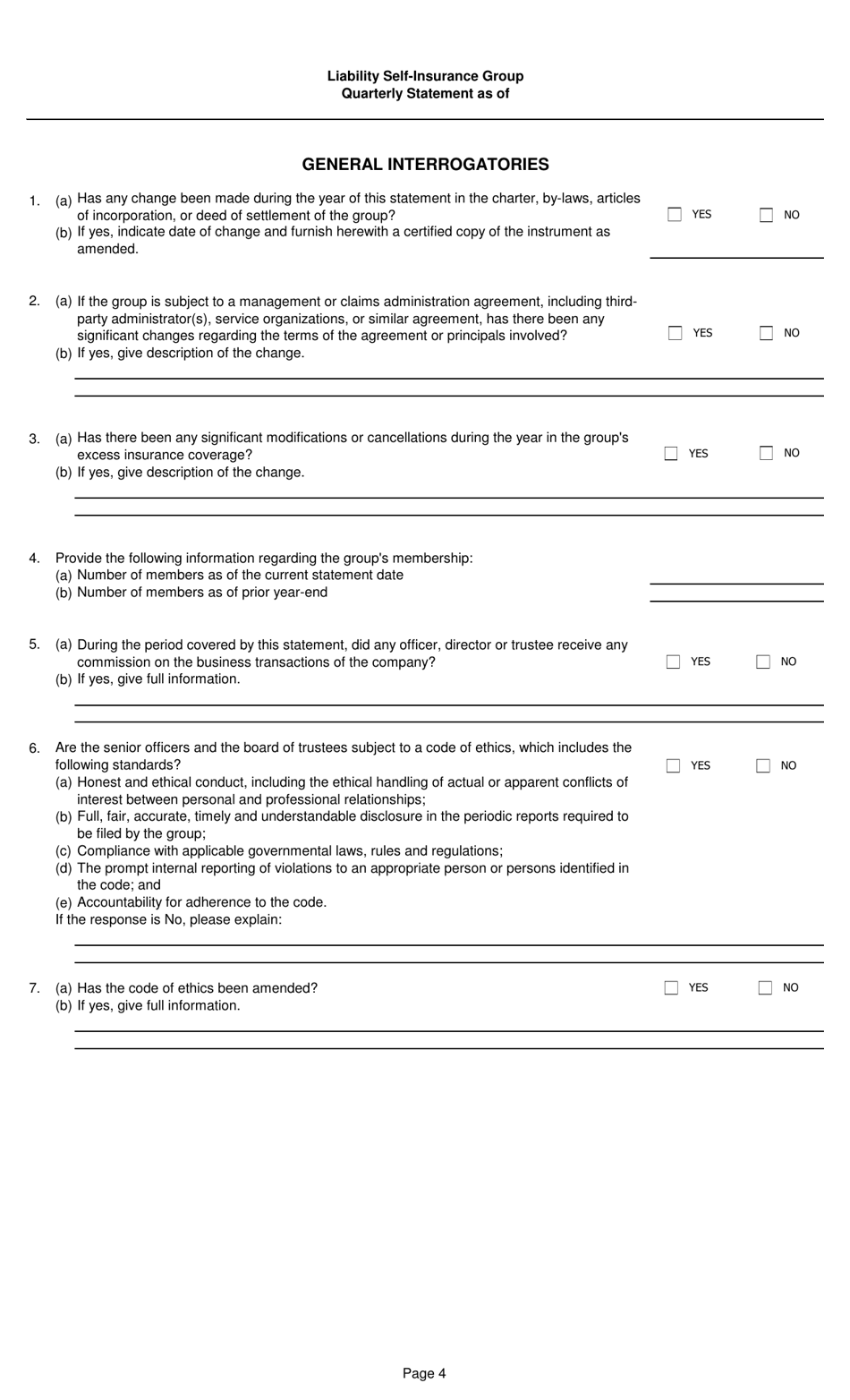

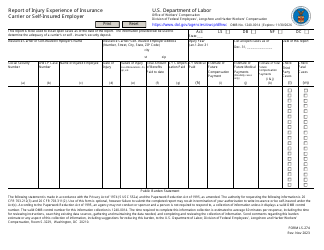

Q: What information is included in a quarterly statement?

A: A quarterly statement for a Liability Self-insurance Group usually includes financial data such as assets, liabilities, income, and expenses.

Q: Why is a quarterly statement important?

A: A quarterly statement is important because it allows members of the Liability Self-insurance Group to track and assess the financial performance and viability of the group.

Q: Who can access the quarterly statement of a Liability Self-insurance Group?

A: The members of the Liability Self-insurance Group and relevant regulatory authorities typically have access to the quarterly statement.

Q: How often is a quarterly statement issued?

A: As the name suggests, a quarterly statement is issued every quarter, which means it is prepared and provided every three months.

Q: What is the purpose of a quarterly statement for a Liability Self-insurance Group?

A: The purpose of a quarterly statement for a Liability Self-insurance Group is to provide transparency and accountability regarding the group's financial activities and performance.

Form Details:

- Released on July 1, 2020;

- The latest edition currently provided by the Kentucky Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.