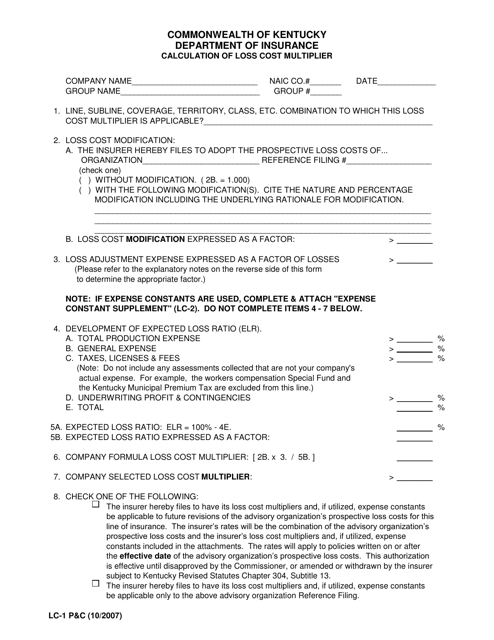

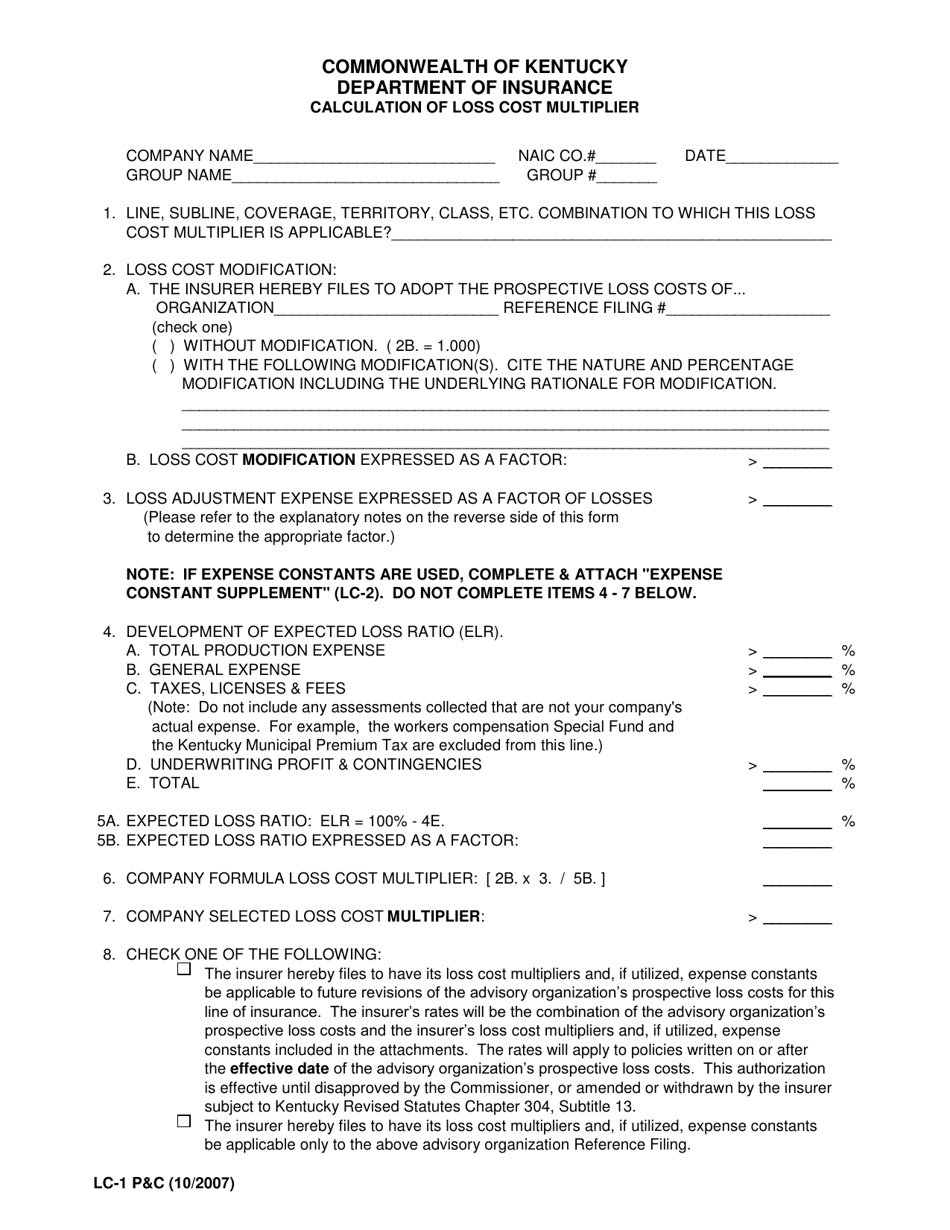

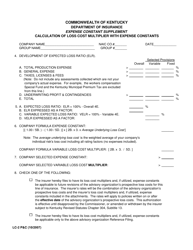

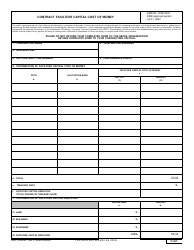

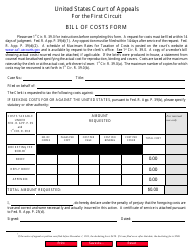

Form LC-1 P&C Calculation of Loss Cost Multiplier - Kentucky

What Is Form LC-1 P&C?

This is a legal form that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LC-1?

A: Form LC-1 is a document used for calculating the Loss Cost Multiplier (LCM) in Kentucky.

Q: What is Loss Cost Multiplier (LCM)?

A: The Loss Cost Multiplier (LCM) is a factor used to adjust the loss costs provided by the advisory organization to reflect the expenses and profit of individual insurance companies.

Q: Why is the LCM important?

A: The LCM is important because it determines the final insurance rates that companies charge to policyholders.

Q: Who uses Form LC-1?

A: Insurance companies in Kentucky use Form LC-1 to calculate the LCM for different coverages.

Q: What information is needed to complete Form LC-1?

A: Form LC-1 requires information such as the company's direct written premium, loss adjustment expenses, and profit and contingency provision.

Q: How is the LCM calculated?

A: The LCM is calculated by dividing the total losses and expenses by the total direct written premiums.

Q: What does the LCM represent?

A: The LCM represents the ratio of losses and expenses to premiums.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the Kentucky Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LC-1 P&C by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.