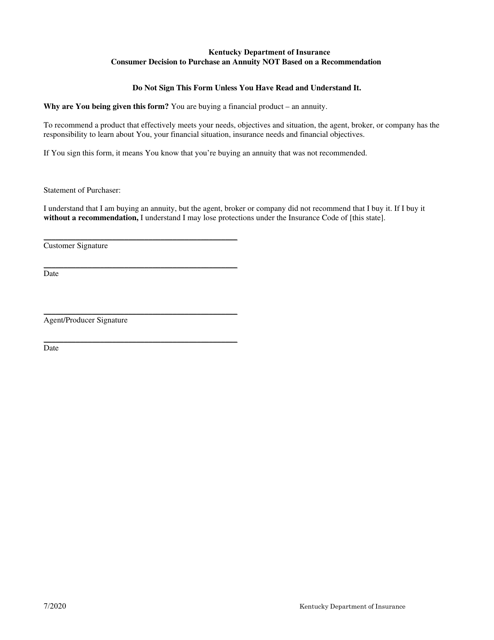

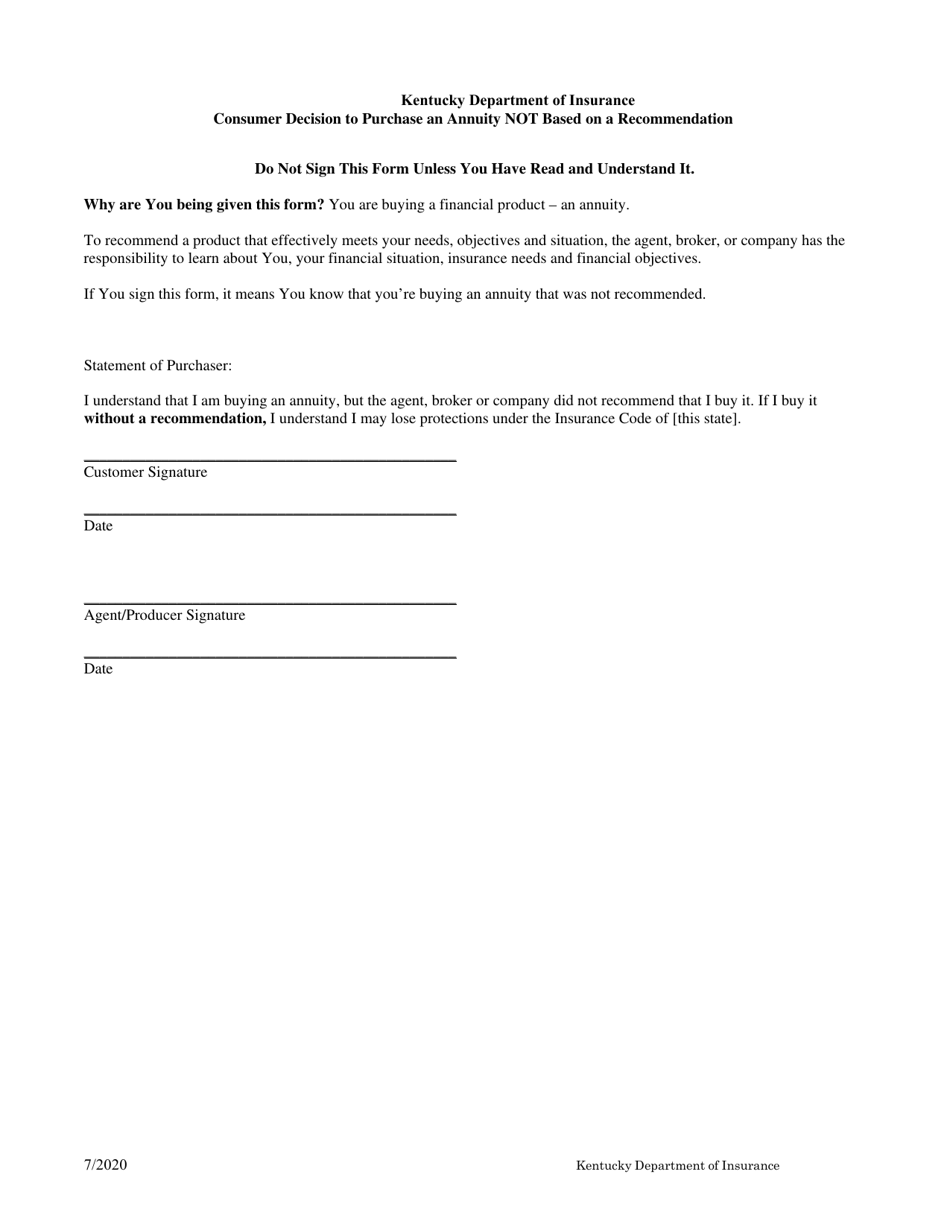

Consumer Decision to Purchase an Annuity Not Based on a Recommendation - Kentucky

Consumer Decision to Purchase an Annuity Not Based on a Recommendation is a legal document that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky.

FAQ

Q: What is an annuity?

A: An annuity is a financial product that provides regular income payments to an individual, typically in retirement.

Q: Why would someone purchase an annuity?

A: Someone might purchase an annuity to secure a steady income stream during retirement or to save and grow their money.

Q: Is purchasing an annuity based on a recommendation?

A: No, the decision to purchase an annuity can be based on personal choice and financial goals.

Q: What factors can influence the decision to purchase an annuity?

A: Factors such as age, retirement savings, desired income, and risk tolerance can influence the decision to purchase an annuity.

Q: Are there specific rules or regulations for purchasing annuities in Kentucky?

A: Yes, Kentucky may have specific rules or regulations regarding the sale and purchase of annuities. It is important to consult with a financial professional or the relevant authorities for accurate information.

Q: Can an annuity be a good investment?

A: An annuity can be a good investment for some individuals, depending on their financial goals and circumstances. It is important to carefully consider all factors before making a decision.

Q: What are the risks associated with purchasing an annuity?

A: Some risks associated with purchasing an annuity include potential loss of principal, limited access to funds, and inflation risk. It is important to understand these risks before purchasing an annuity.

Q: Can you cash out an annuity?

A: In many cases, annuities have surrender charges or penalties for early withdrawals. It is important to review the terms of the annuity contract to understand the options for cashing out.

Q: Should I consult with a financial professional before purchasing an annuity?

A: It is advisable to consult with a qualified financial professional before purchasing an annuity. They can help assess your financial situation and provide guidance on whether an annuity is right for you.

Q: Can annuities provide tax advantages?

A: Yes, certain types of annuities may provide tax advantages. It is important to consult with a tax professional for specific information on tax implications of annuities.

Form Details:

- Released on July 1, 2020;

- The latest edition currently provided by the Kentucky Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.