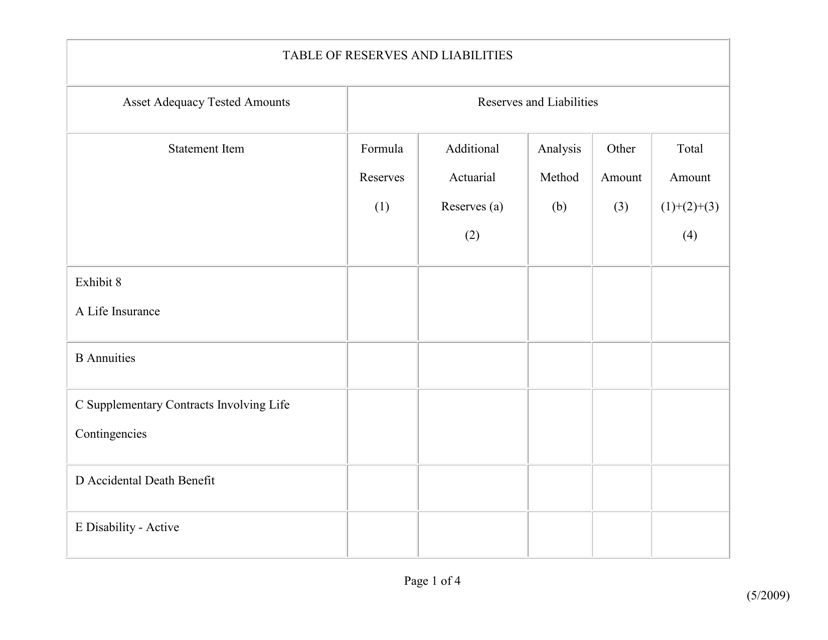

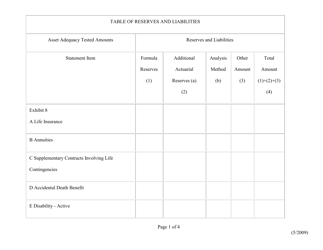

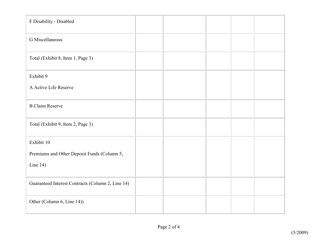

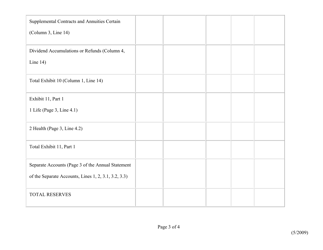

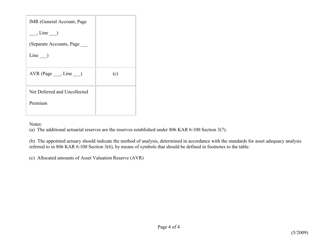

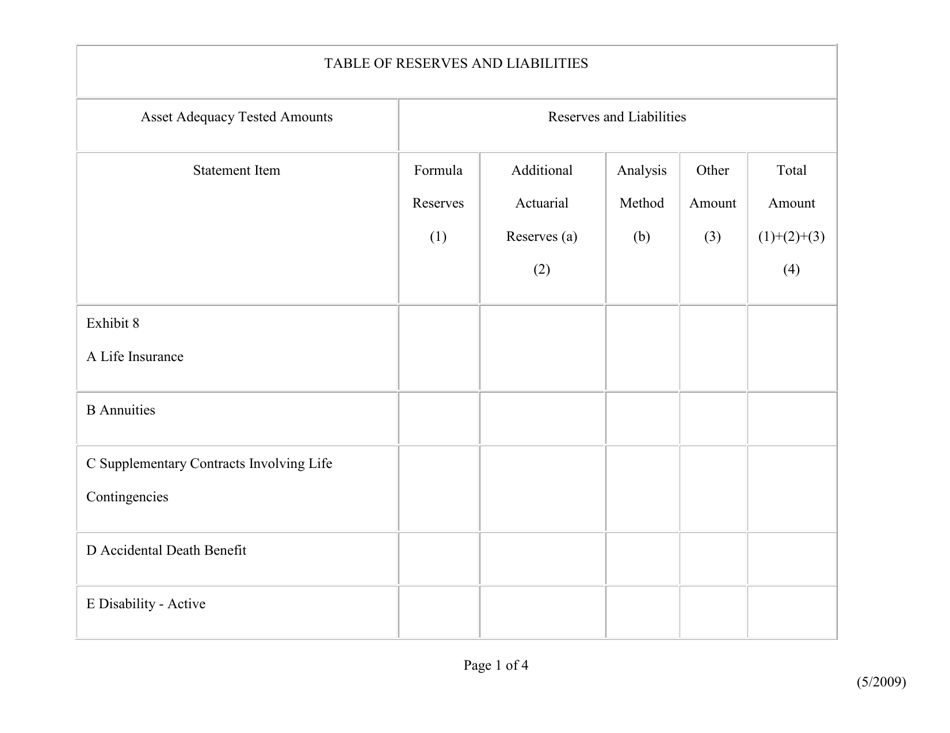

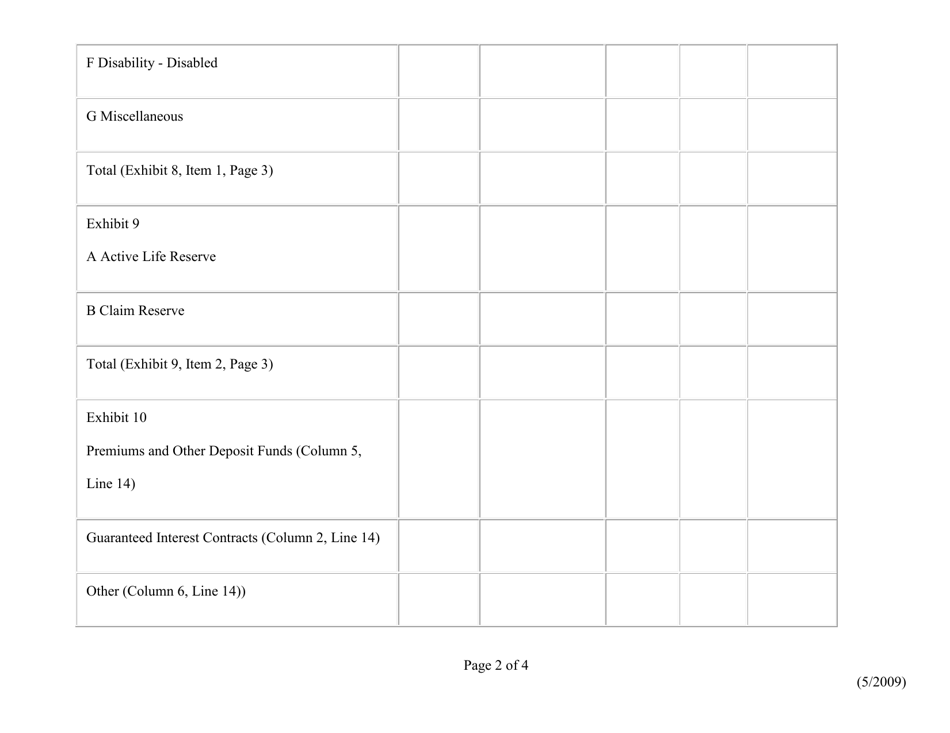

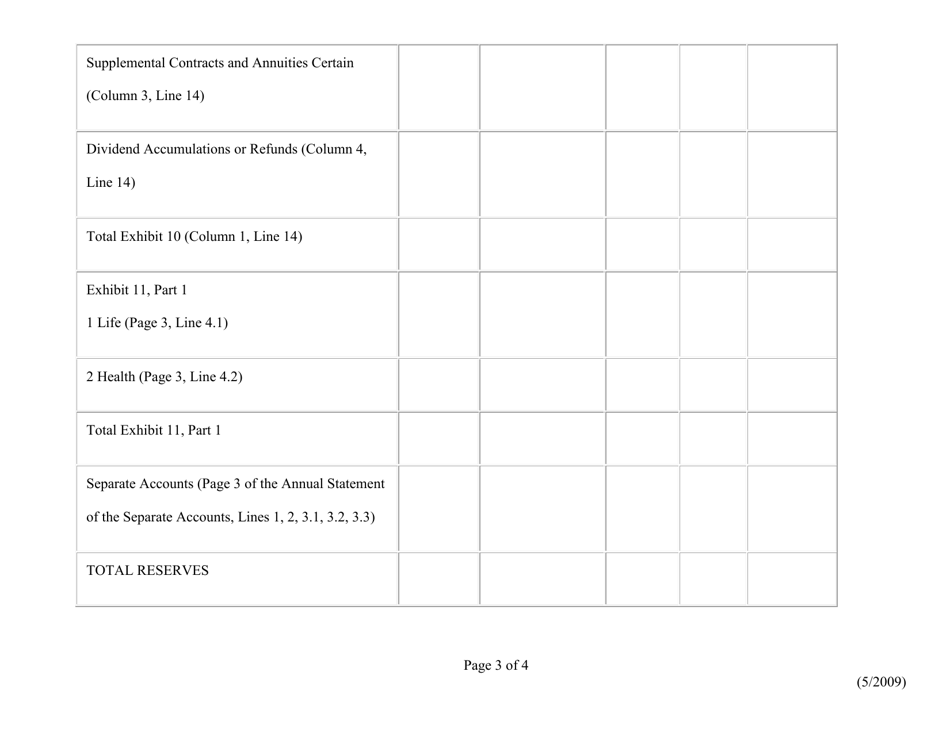

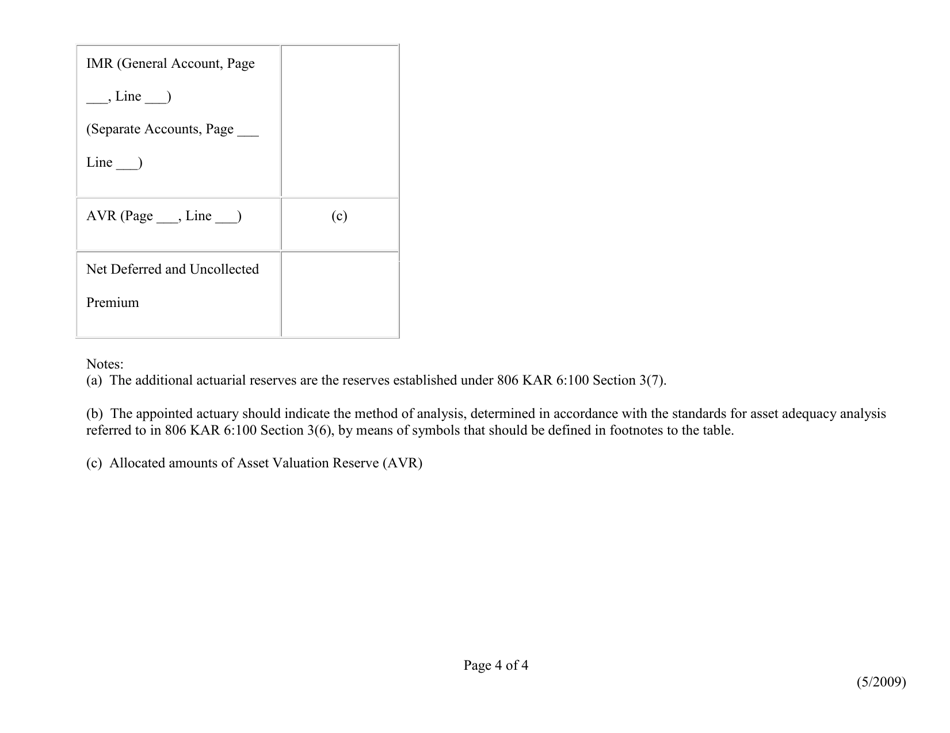

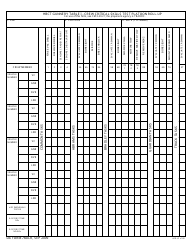

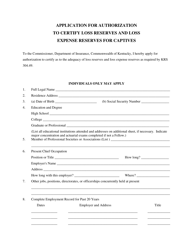

Table of Reserves and Liabilities - Kentucky

Table of Reserves and Liabilities is a legal document that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky.

FAQ

Q: What is a reserves and liabilities?

A: Reserves and liabilities are financial obligations or commitments that an entity, such as a government or organization, is responsible for.

Q: Why is it important to have reserves?

A: Reserves are important because they serve as a financial cushion or backup for unexpected expenses or emergencies.

Q: What are examples of reserves?

A: Examples of reserves include funds set aside for future capital projects, contingency funds for emergencies, and pension funds for retired employees.

Q: What are examples of liabilities?

A: Examples of liabilities include debts, loans, unpaid expenses, and obligations towards employees or vendors.

Q: What is the purpose of reporting reserves and liabilities?

A: Reporting reserves and liabilities provides transparency and accountability in financial statements, allowing stakeholders to understand an entity's financial health and obligations.

Form Details:

- Released on May 1, 2009;

- The latest edition currently provided by the Kentucky Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.