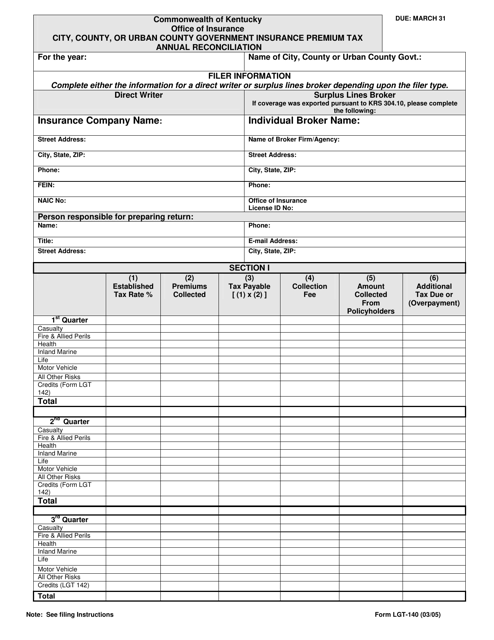

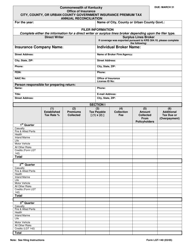

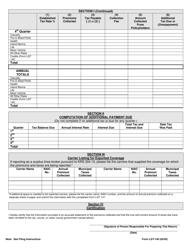

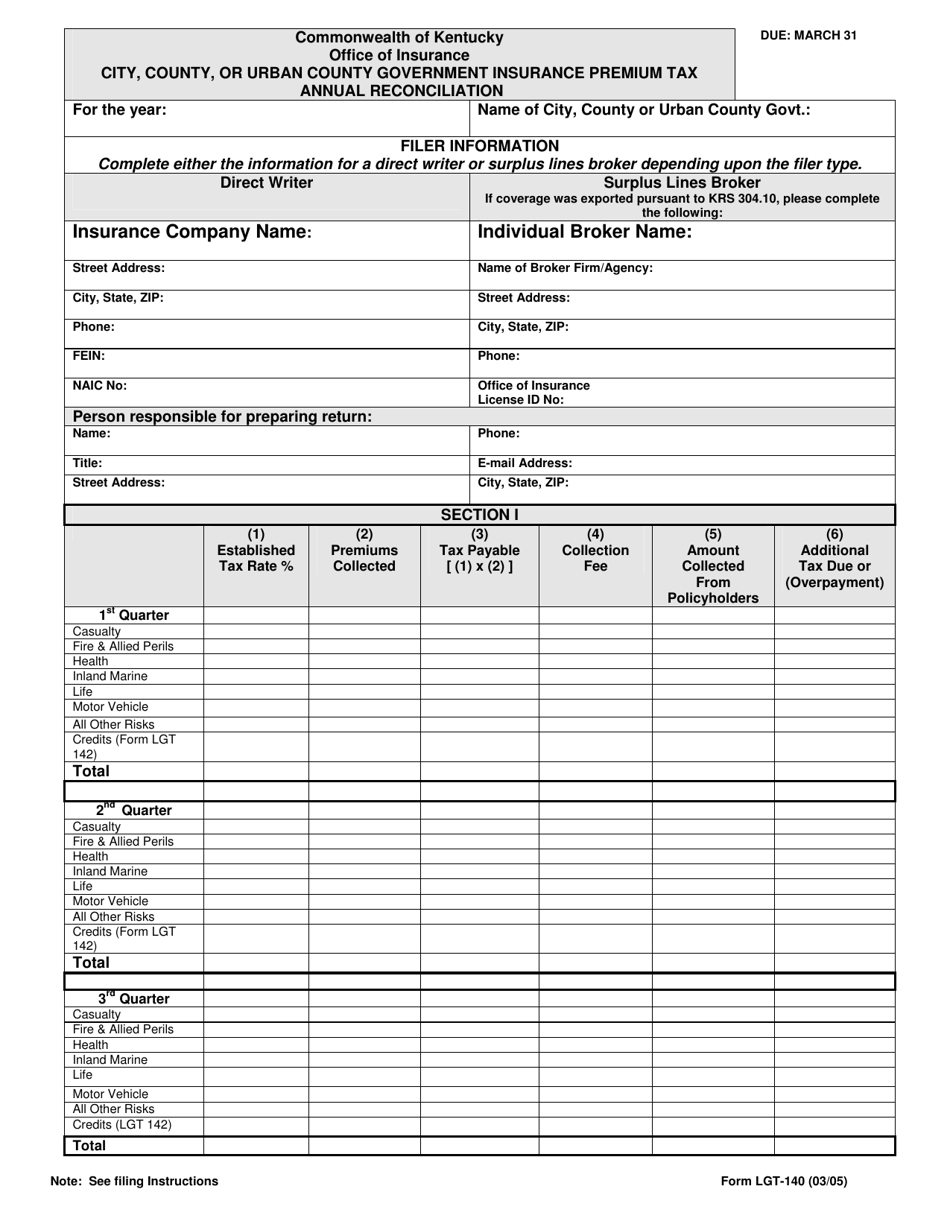

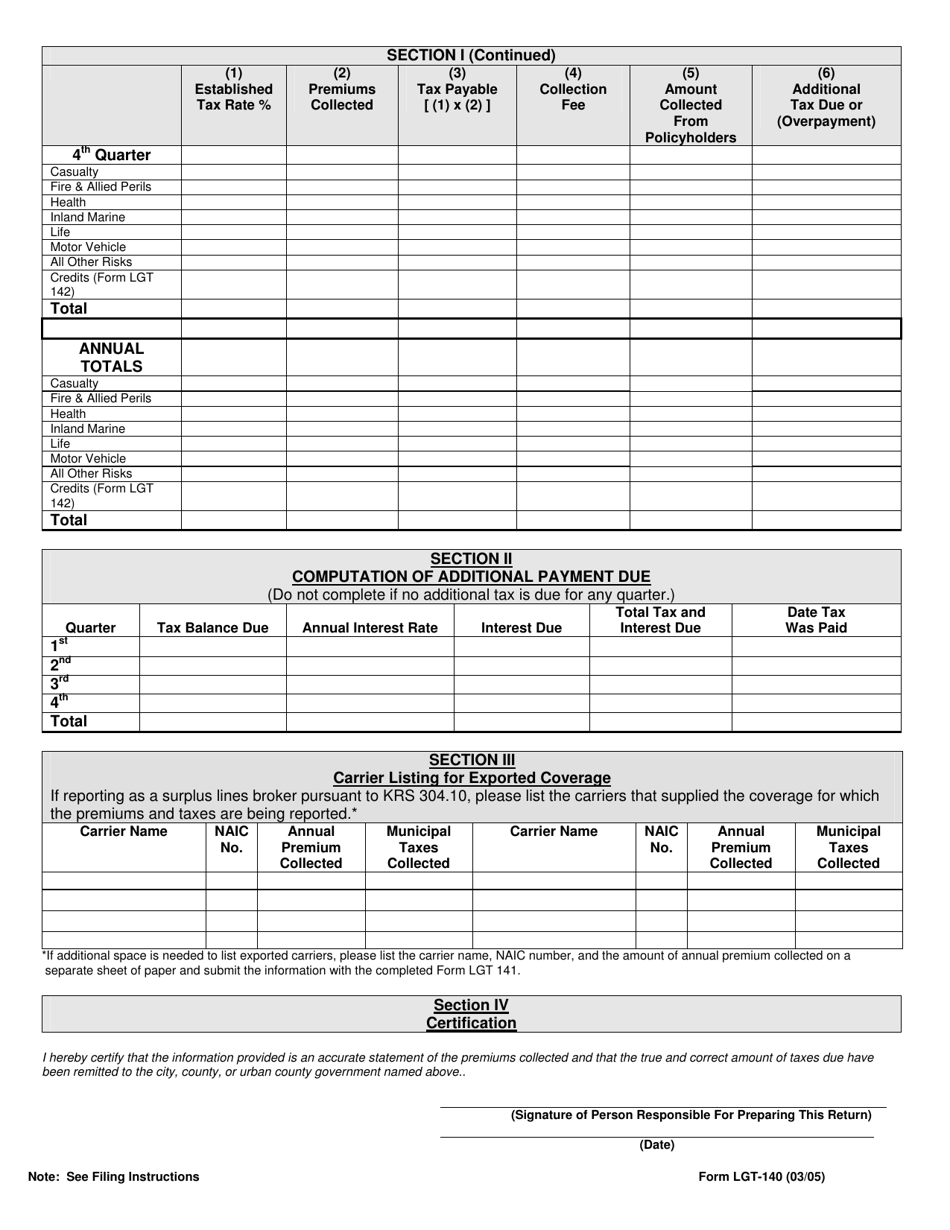

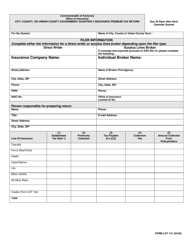

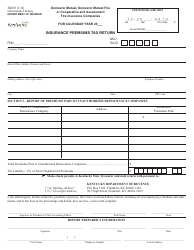

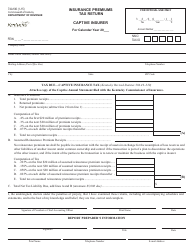

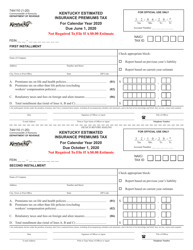

Form LGT-140 City, County, or Urban County Government Insurance Premium Tax Annual Reconciliation - Kentucky

What Is Form LGT-140?

This is a legal form that was released by the Kentucky Department of Insurance - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LGT-140?

A: Form LGT-140 is the City, County, or Urban County Government Insurance Premium Tax Annual Reconciliation form for Kentucky.

Q: Who needs to file Form LGT-140?

A: City, County, or Urban County governments in Kentucky that collect insurance premium taxes need to file Form LGT-140.

Q: What is the purpose of Form LGT-140?

A: Form LGT-140 is used to reconcile the insurance premium tax collected by City, County, or Urban County governments in Kentucky.

Q: When is the deadline to file Form LGT-140?

A: The deadline for filing Form LGT-140 is based on the City, County, or Urban County government's fiscal year end. It is generally due within 90 days after the fiscal year end.

Q: Are there any penalties for late filing of Form LGT-140?

A: Yes, there may be penalties for late filing of Form LGT-140. It is important to file the form by the deadline to avoid penalties.

Q: Is there any assistance available for completing Form LGT-140?

A: Yes, the Kentucky Department of Revenue provides assistance for completing Form LGT-140. You can contact them for any guidance or support needed.

Q: Are there any other supporting documents required to be submitted with Form LGT-140?

A: No, there are no specific supporting documents required to be submitted with Form LGT-140. However, it is recommended to keep all relevant records for reference and audit purposes.

Form Details:

- Released on March 1, 2005;

- The latest edition provided by the Kentucky Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LGT-140 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Insurance.