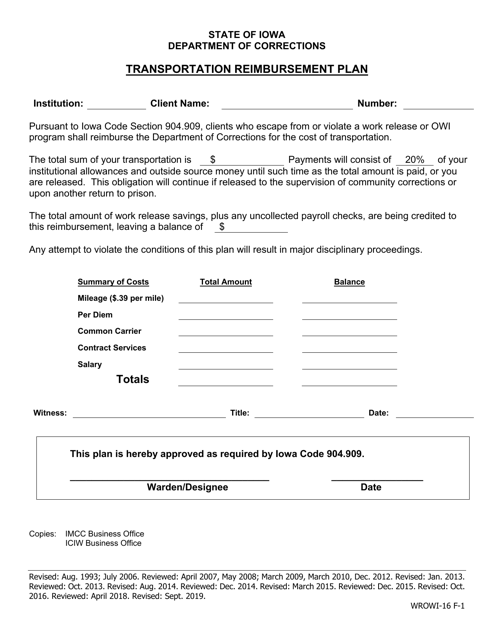

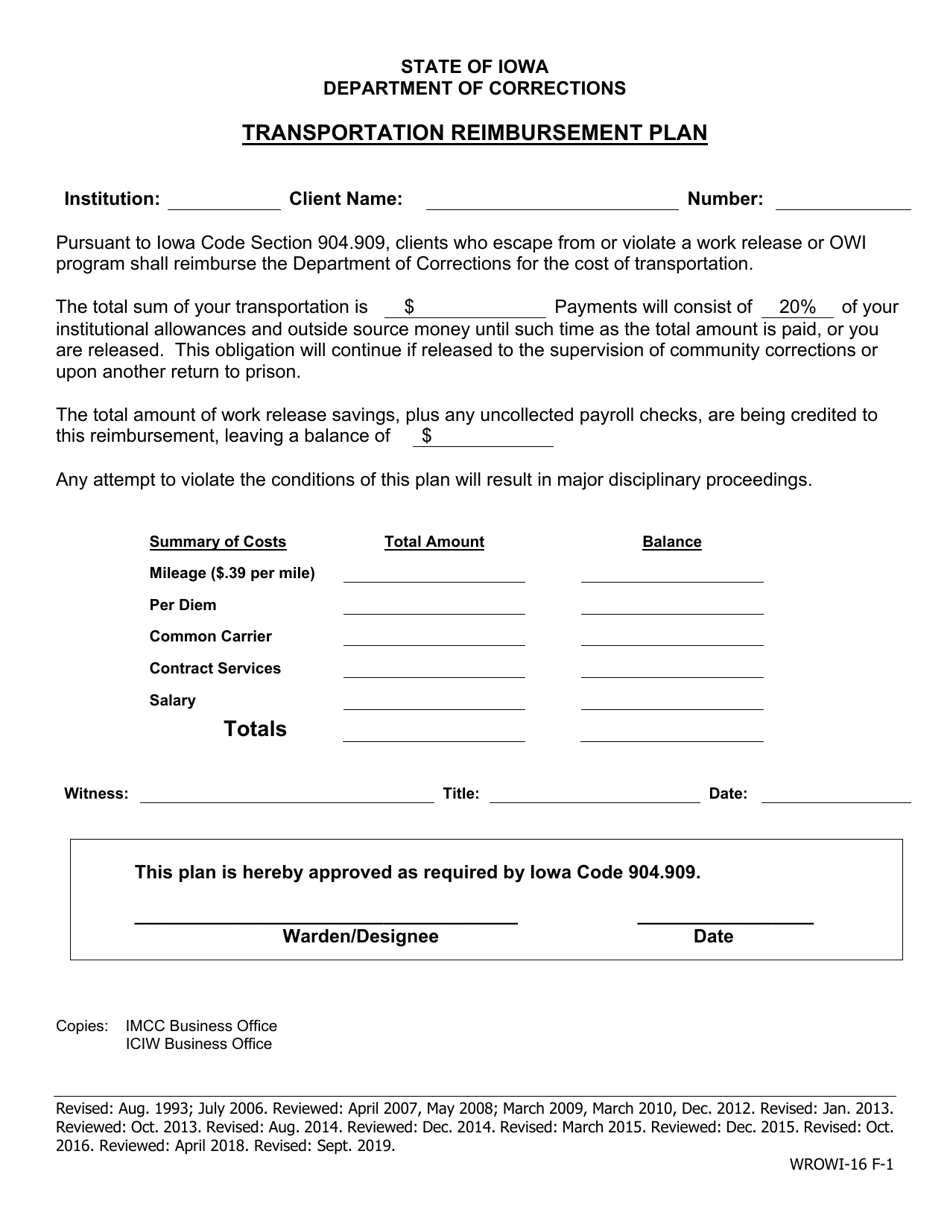

Transportation Reimbursement Plan - Iowa

Transportation Reimbursement Plan is a legal document that was released by the Iowa Department of Corrections - a government authority operating within Iowa.

FAQ

Q: What is a transportation reimbursement plan?

A: A transportation reimbursement plan is a benefit provided by employers to help employees cover the costs of transportation for work-related purposes.

Q: How does a transportation reimbursement plan work?

A: Employees can submit expenses related to transportation, such as commuting costs or business travel expenses, and they will be reimbursed by their employer.

Q: Does every employer offer a transportation reimbursement plan?

A: Not every employer offers a transportation reimbursement plan. It is up to individual employers to decide if they want to provide this benefit to their employees.

Q: Are transportation reimbursement payments taxable?

A: Transportation reimbursement payments can be taxable or non-taxable, depending on the specific rules and regulations set by the Internal Revenue Service (IRS). It is recommended to consult with a tax professional for specific information.

Q: Are there any limitations or restrictions on a transportation reimbursement plan?

A: Yes, there may be limitations or restrictions on a transportation reimbursement plan, such as limits on the amount that can be reimbursed or specific eligibility criteria set by the employer.

Q: How do I know if my employer offers a transportation reimbursement plan?

A: You can check with your HR department or employee benefits representative to see if your employer offers a transportation reimbursement plan.

Q: What expenses can be reimbursed under a transportation reimbursement plan?

A: Typically, expenses related to commuting to and from work, business travel, or other work-related transportation costs can be considered for reimbursement under a transportation reimbursement plan.

Q: Can I submit expenses for public transportation under a transportation reimbursement plan?

A: Yes, expenses for public transportation, such as bus or train fares, can usually be submitted for reimbursement under a transportation reimbursement plan.

Q: Are there any deadlines for submitting reimbursement requests?

A: Deadlines for submitting reimbursement requests may vary depending on the specific policies of your employer. It is best to find out about any deadlines or timeframes from your HR department.

Q: Can I be reimbursed for mileage if I use my own car for work purposes?

A: In many cases, employees can be reimbursed for mileage if they use their own car for work purposes. The reimbursement rate is usually based on the IRS standard mileage rate for the given tax year.

Form Details:

- Released on September 1, 2019;

- The latest edition currently provided by the Iowa Department of Corrections;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Corrections.