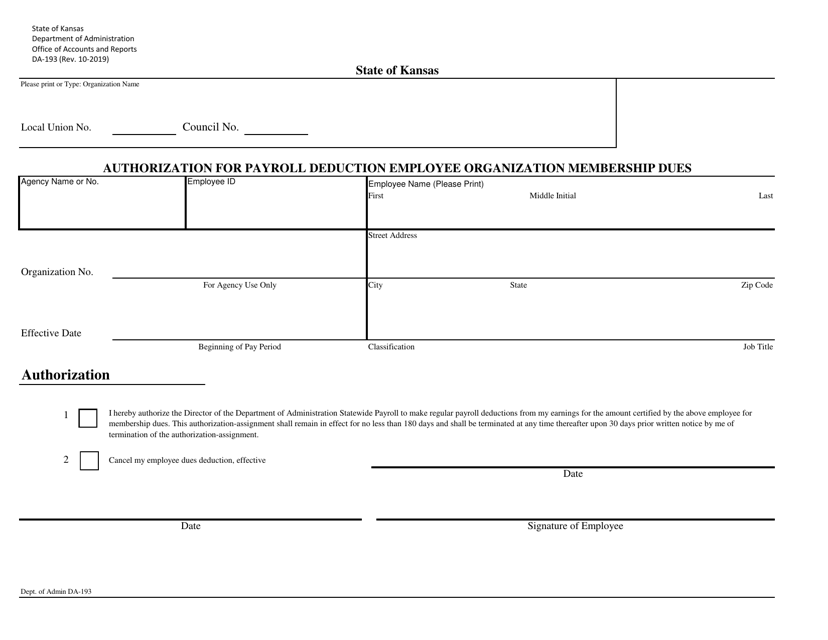

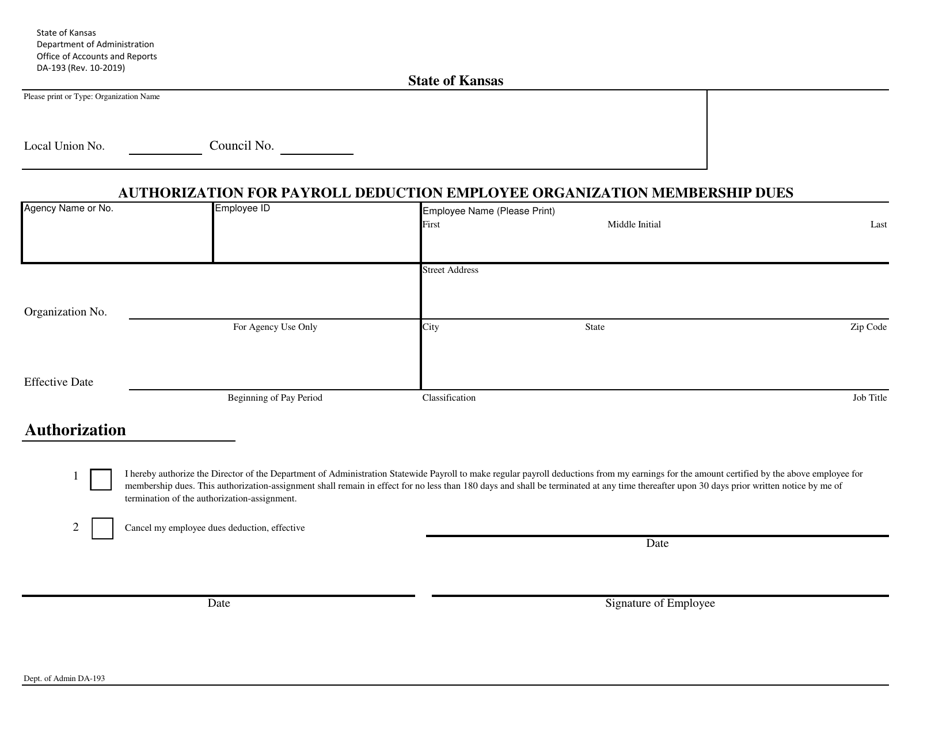

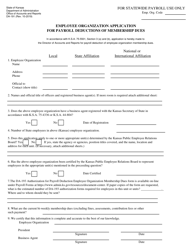

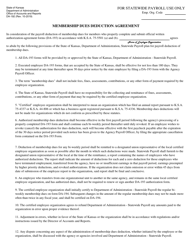

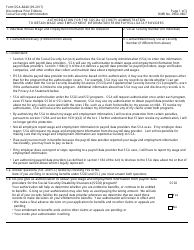

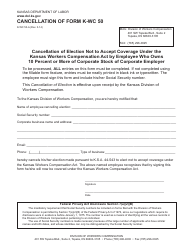

Form DA-193 Authorization for Payroll Deduction Employee Organization Membership Dues - Kansas

What Is Form DA-193?

This is a legal form that was released by the Kansas Department of Administration - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DA-193?

A: Form DA-193 is the Authorization for Payroll Deduction Employee Organization Membership Dues form in Kansas.

Q: What is the purpose of Form DA-193?

A: The purpose of Form DA-193 is to authorize the payroll deduction of employee organization membership dues.

Q: Who needs to fill out Form DA-193?

A: Employees who want to authorize payroll deduction for their employee organization membership dues need to fill out Form DA-193.

Q: Are there any fees associated with Form DA-193?

A: No, there are no fees associated with Form DA-193.

Q: What information is required on Form DA-193?

A: Form DA-193 requires information such as the employee's name, address, social security number, employer information, employee organization information, and the amount of dues to be deducted.

Q: Can I revoke the authorization on Form DA-193?

A: Yes, you can revoke the authorization on Form DA-193 at any time by submitting a written notice to your employer and the employee organization.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kansas Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DA-193 by clicking the link below or browse more documents and templates provided by the Kansas Department of Administration.