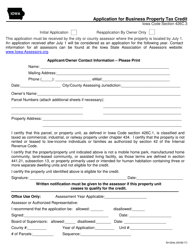

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 32-041

for the current year.

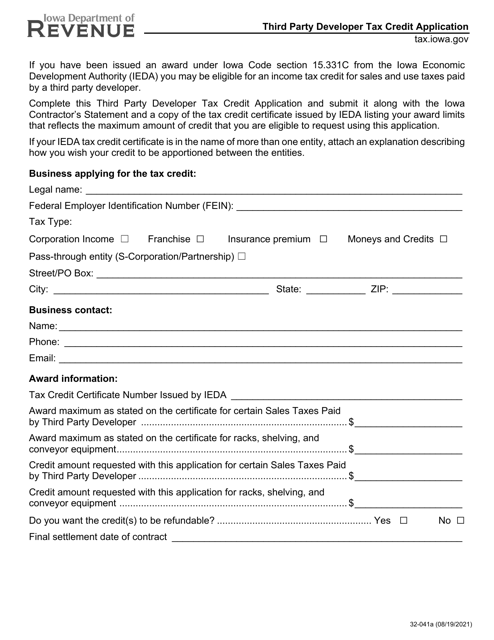

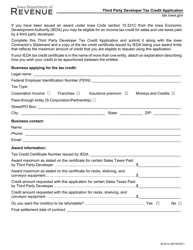

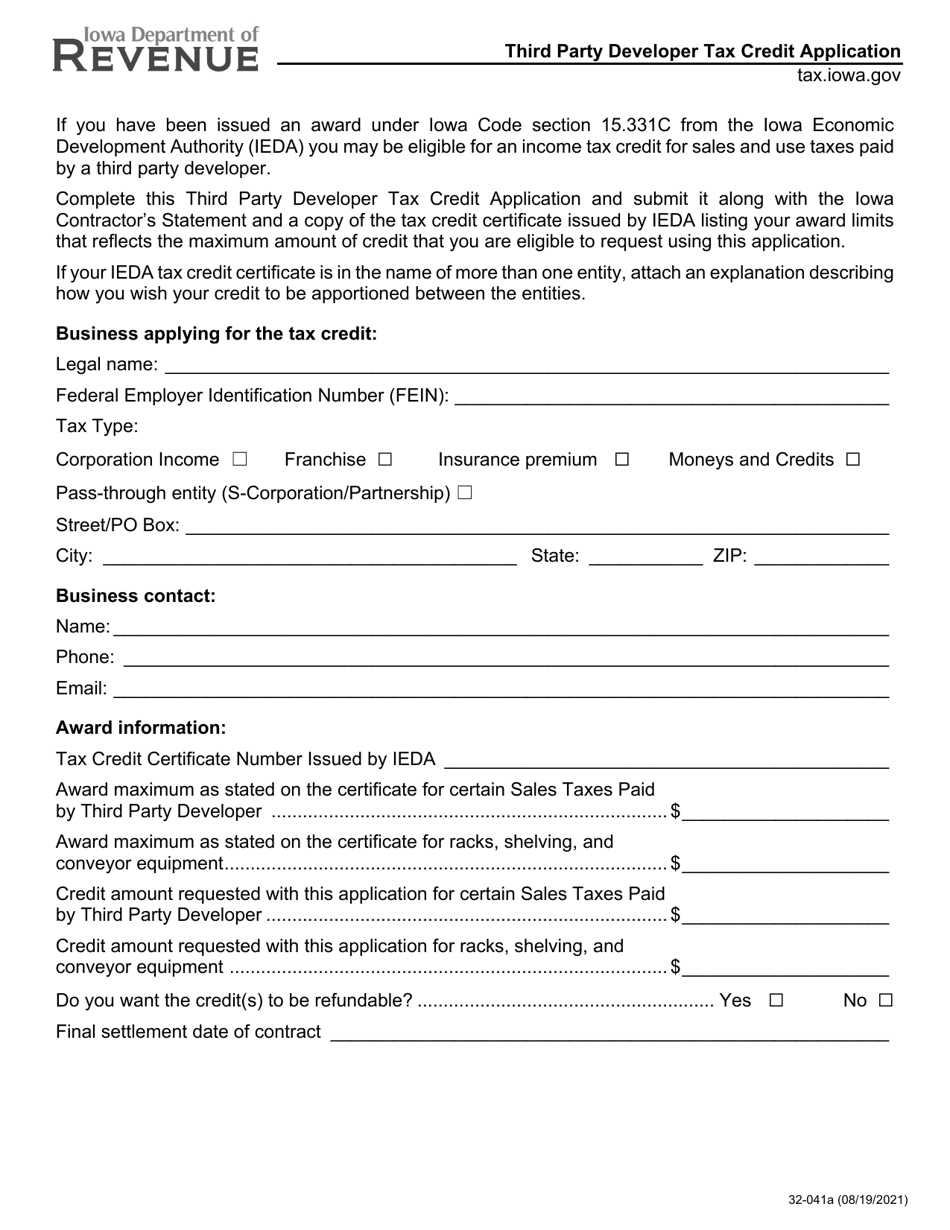

Form 32-041 Third Party Developer Tax Credit Application - Iowa

What Is Form 32-041?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

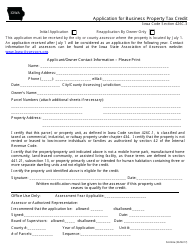

Q: What is Form 32-041?

A: Form 32-041 is the Third Party Developer Tax Credit Application specific to Iowa.

Q: Who can use Form 32-041?

A: Third-party developers who wish to apply for the tax credit in Iowa can use Form 32-041.

Q: What is the purpose of Form 32-041?

A: The purpose of Form 32-041 is to allow third-party developers to apply for a tax credit in Iowa.

Q: Is Form 32-041 specific to Iowa?

A: Yes, Form 32-041 is specific to Iowa and is used for applying for a tax credit only in Iowa.

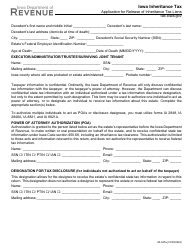

Form Details:

- Released on August 19, 2021;

- The latest edition provided by the Iowa Department of Revenue;

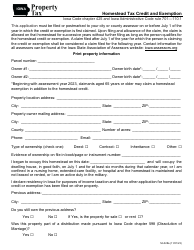

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 32-041 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.