This version of the form is not currently in use and is provided for reference only. Download this version of

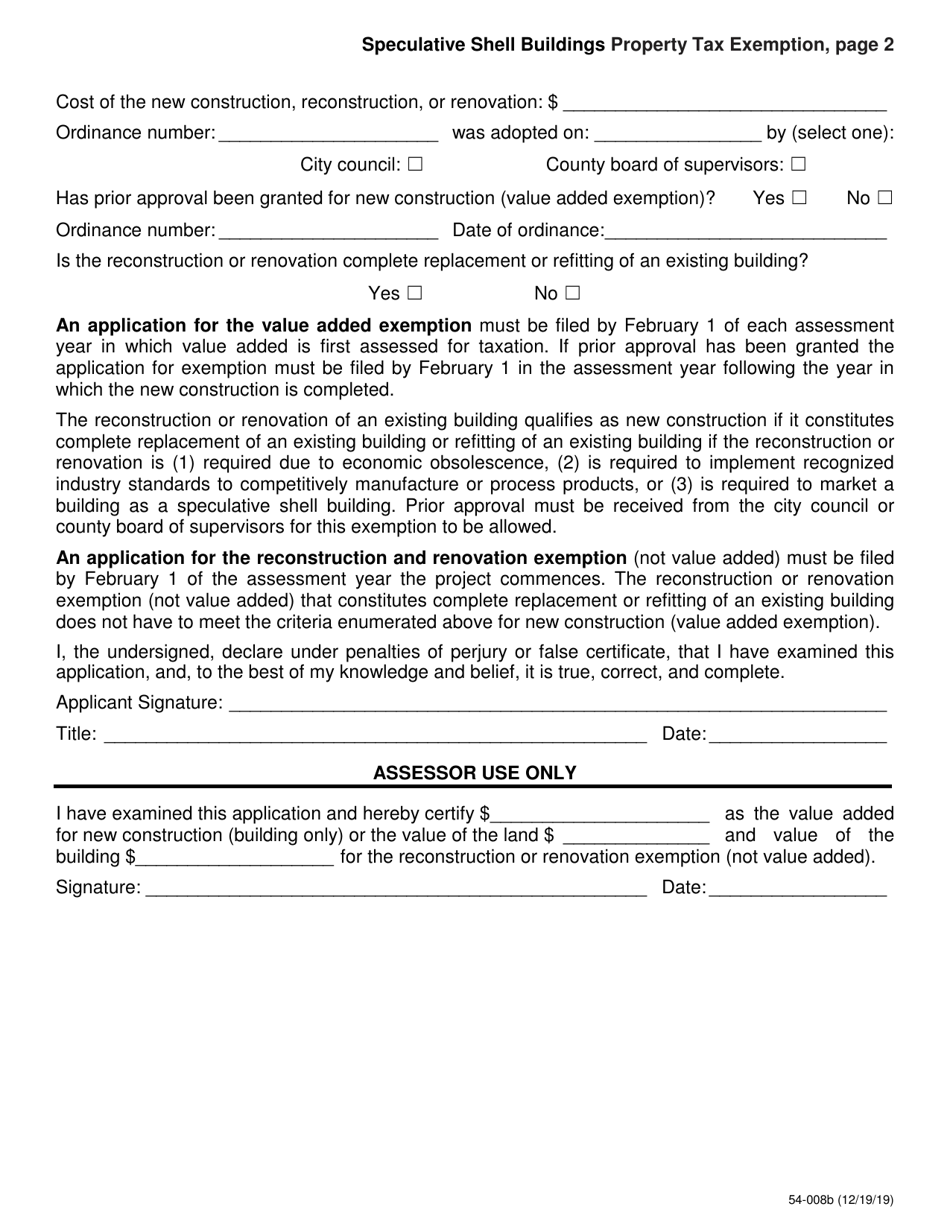

Form 54-008

for the current year.

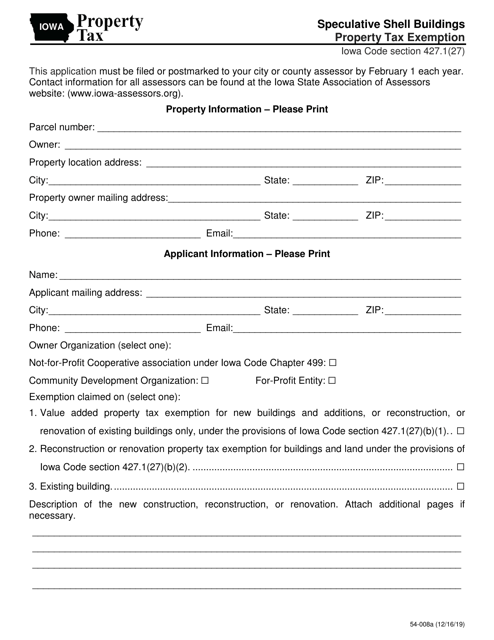

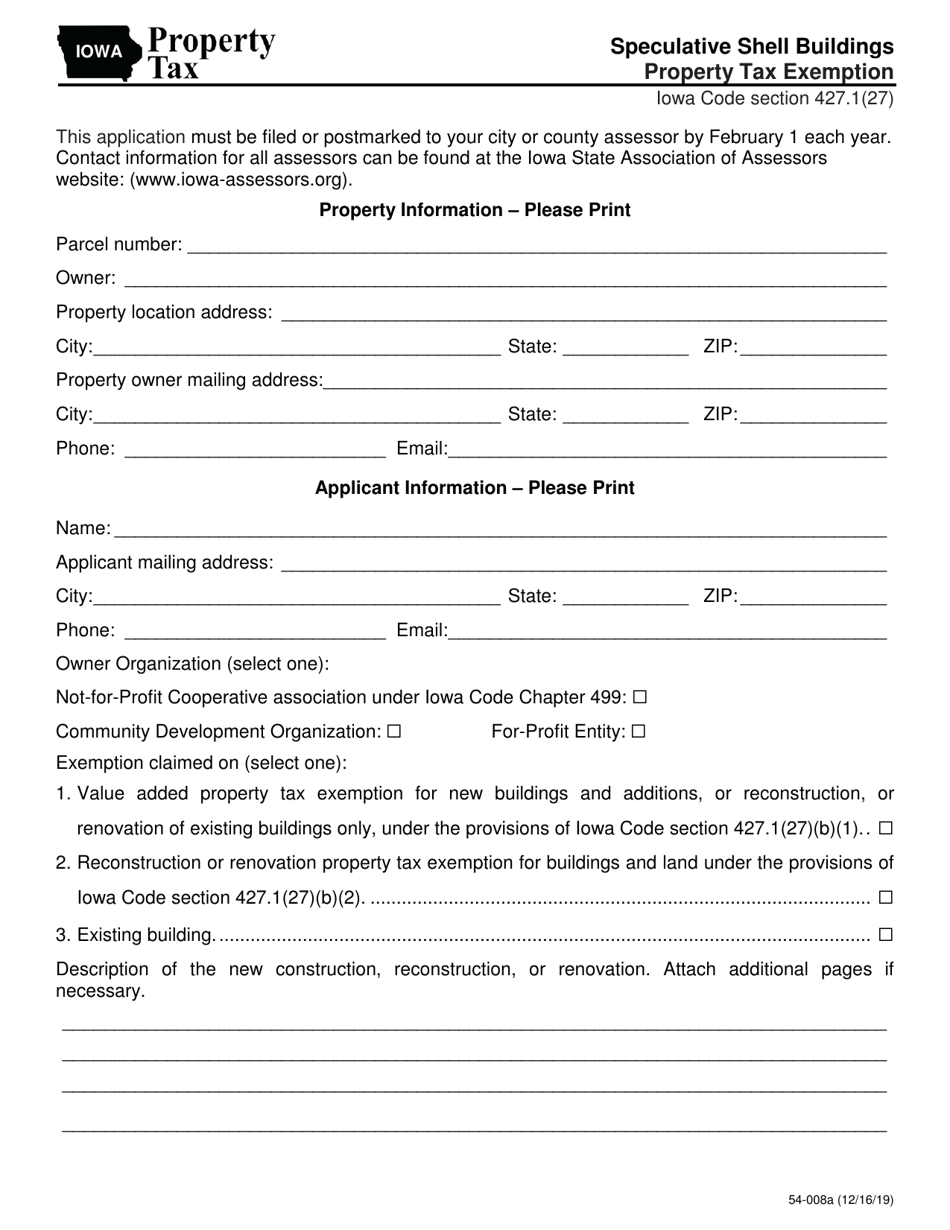

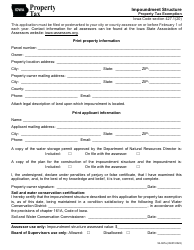

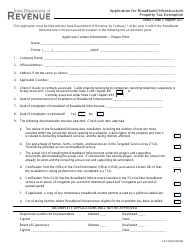

Form 54-008 Speculative Shell Buildings Property Tax Exemption - Iowa

What Is Form 54-008?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-008?

A: Form 54-008 is the Speculative Shell Buildings Property Tax Exemption form in Iowa.

Q: Who is eligible for the Speculative Shell Buildings Property Tax Exemption?

A: Developers or property owners who construct a new speculative shell building in Iowa are eligible for this tax exemption.

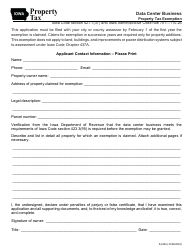

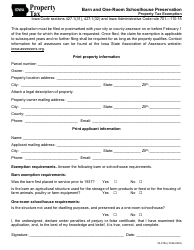

Q: What is a speculative shell building?

A: A speculative shell building is a building that is constructed without having a specific tenant or use in mind. It is built in anticipation of attracting future businesses or tenants.

Q: What is the purpose of the Speculative Shell Buildings Property Tax Exemption?

A: The purpose is to incentivize the construction of speculative shell buildings in Iowa by providing a tax exemption.

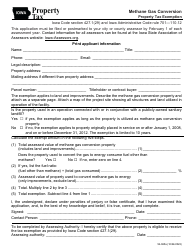

Q: What is the duration of the tax exemption?

A: The exemption lasts for five years from the assessment year in which construction was completed.

Q: Is the tax exemption transferable?

A: No, the tax exemption is not transferable to a subsequent owner.

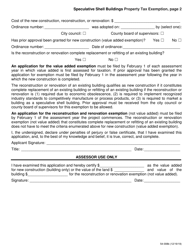

Q: How can one apply for the Speculative Shell Buildings Property Tax Exemption?

A: To apply for this tax exemption, one must complete and submit Form 54-008 to the local county assessor's office in Iowa.

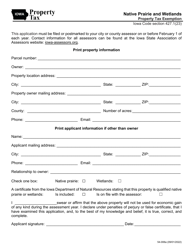

Form Details:

- Released on December 16, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 54-008 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.