This version of the form is not currently in use and is provided for reference only. Download this version of

Form 56-064

for the current year.

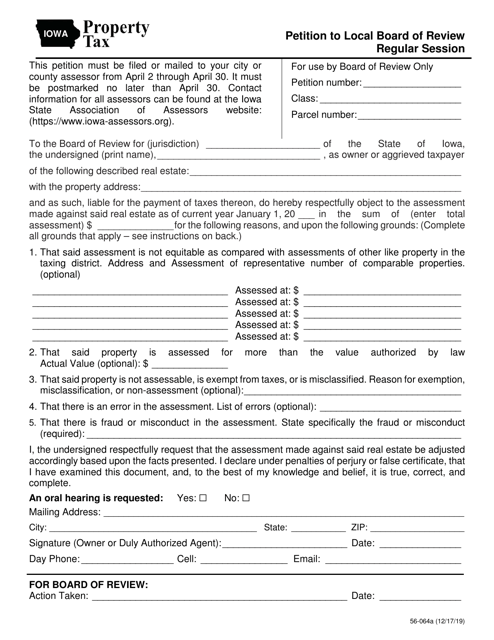

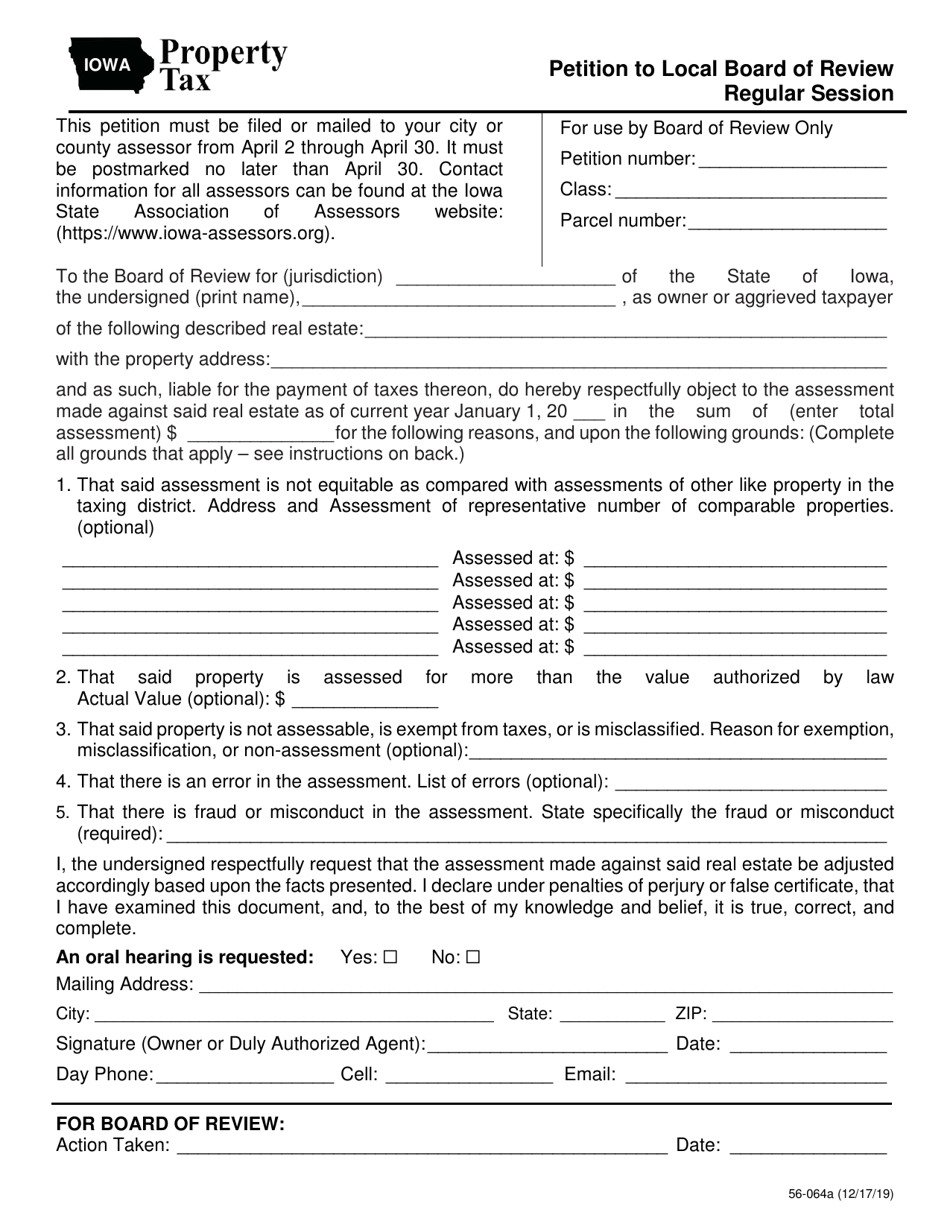

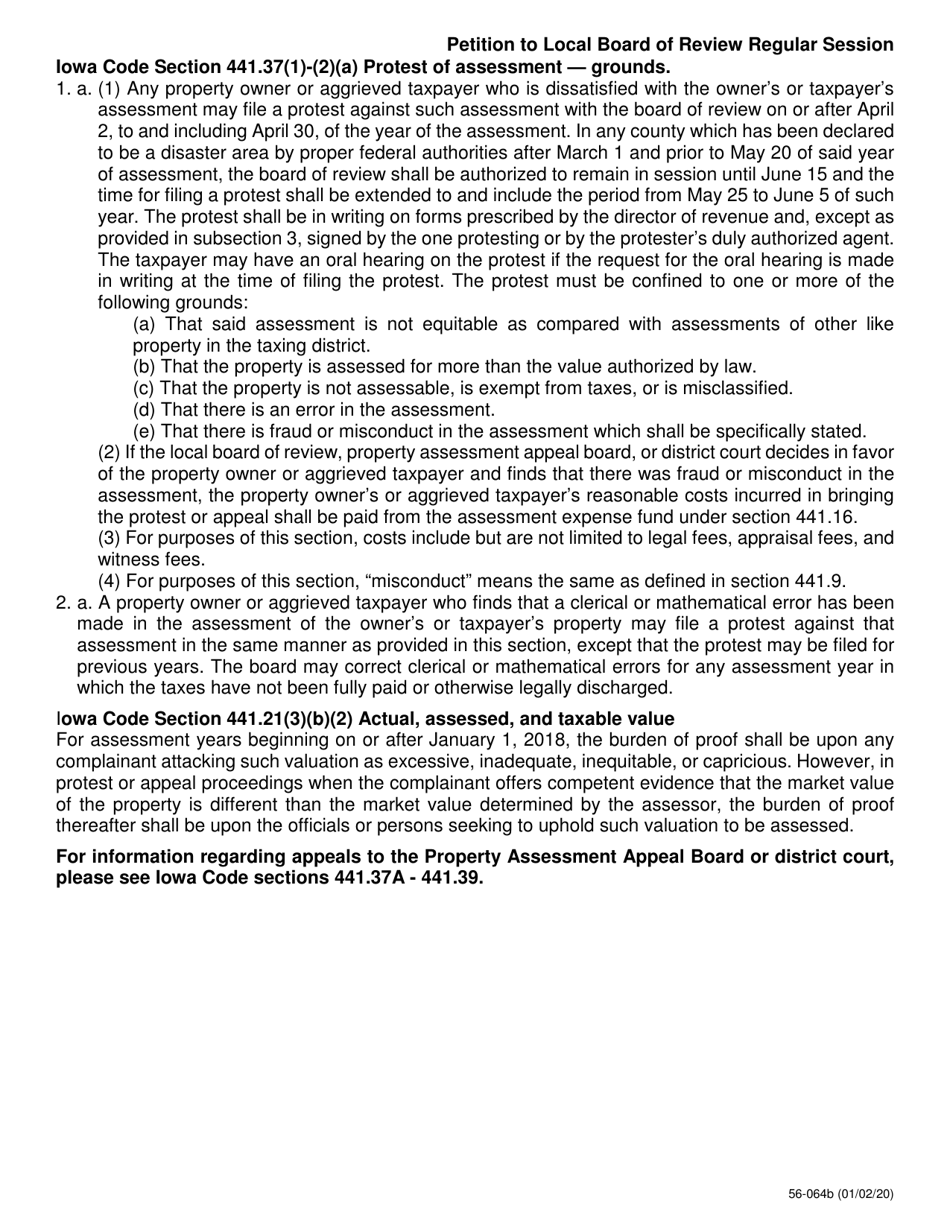

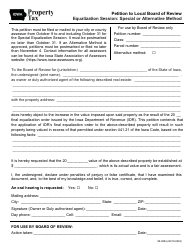

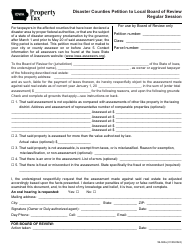

Form 56-064 Petition to Local Board of Review - Regular Session - Iowa

What Is Form 56-064?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56-064?

A: Form 56-064 is a petition to the Local Board of Review in Iowa.

Q: What is the purpose of Form 56-064?

A: The purpose of Form 56-064 is to request a review of a property assessment or property tax issue.

Q: Who can use Form 56-064?

A: Any property owner or person with a legal interest in the property can use Form 56-064.

Q: Are there any fees associated with filing Form 56-064?

A: No, filing Form 56-064 does not require any fees.

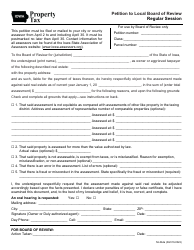

Q: What information is needed to fill out Form 56-064?

A: You will need to provide details about the property, the reason for the petition, and any supporting documentation.

Q: When should Form 56-064 be filed?

A: Form 56-064 should be filed within the designated timeframe set by the Local Board of Review.

Q: What happens after filing Form 56-064?

A: The Local Board of Review will review the petition and make a decision based on the provided information.

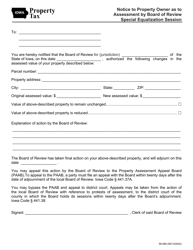

Q: Can I appeal the decision of the Local Board of Review?

A: Yes, if you are not satisfied with the decision, you may have the option to further appeal to a higher authority, such as the Iowa Property Assessment Appeal Board.

Q: Is legal representation required when filing Form 56-064?

A: Legal representation is not required, but you may choose to seek legal advice when filling out the form or during the appeals process.

Form Details:

- Released on December 17, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 56-064 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.