This version of the form is not currently in use and is provided for reference only. Download this version of

Form 56-069

for the current year.

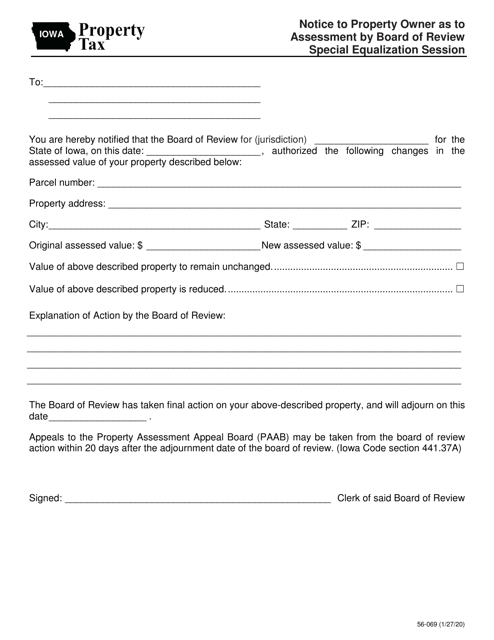

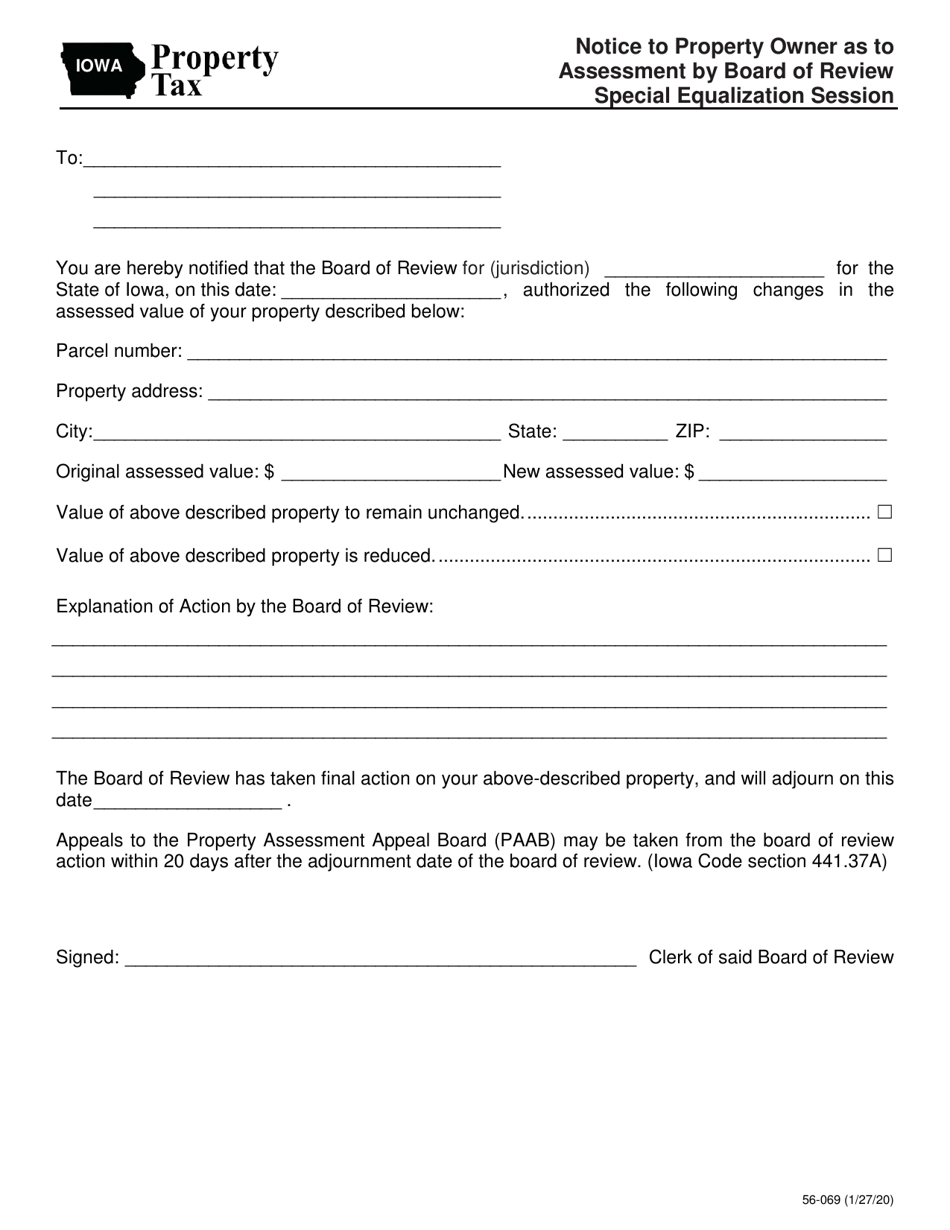

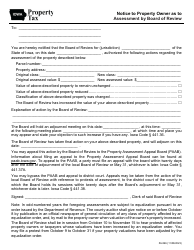

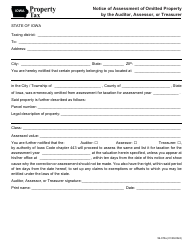

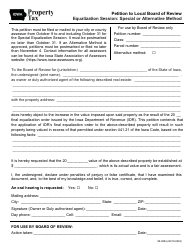

Form 56-069 Notice to Property Owner as to Assessment by Board of Review Special Equalization Session - Iowa

What Is Form 56-069?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56-069?

A: Form 56-069 is a notice to property owners in Iowa regarding assessment by the Board of Review Special Equalization Session.

Q: Who is required to receive this notice?

A: Property owners in Iowa are required to receive this notice.

Q: What is the purpose of this notice?

A: The purpose of this notice is to inform property owners about the assessment by the Board of Review Special Equalization Session.

Q: What is the Board of Review Special Equalization Session?

A: The Board of Review Special Equalization Session is a meeting where property assessments are reviewed and potentially adjusted based on evidence presented.

Q: Why is the assessment being reviewed?

A: The assessment is being reviewed to ensure that it is fair and accurate.

Q: What should property owners do if they disagree with the assessment?

A: Property owners who disagree with the assessment can provide evidence to support their position at the Board of Review Special Equalization Session.

Q: When is the Board of Review Special Equalization Session held?

A: The date and time of the Board of Review Special Equalization Session are specified in the notice.

Q: What happens after the Board of Review Special Equalization Session?

A: After the session, the Board of Review will make a decision regarding the assessment, and property owners will be notified of the outcome.

Q: Can property owners appeal the decision of the Board of Review?

A: Yes, property owners have the right to appeal the decision of the Board of Review.

Form Details:

- Released on January 27, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 56-069 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.