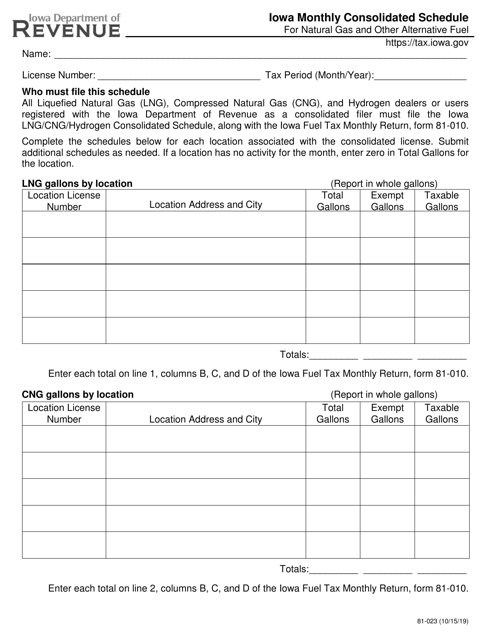

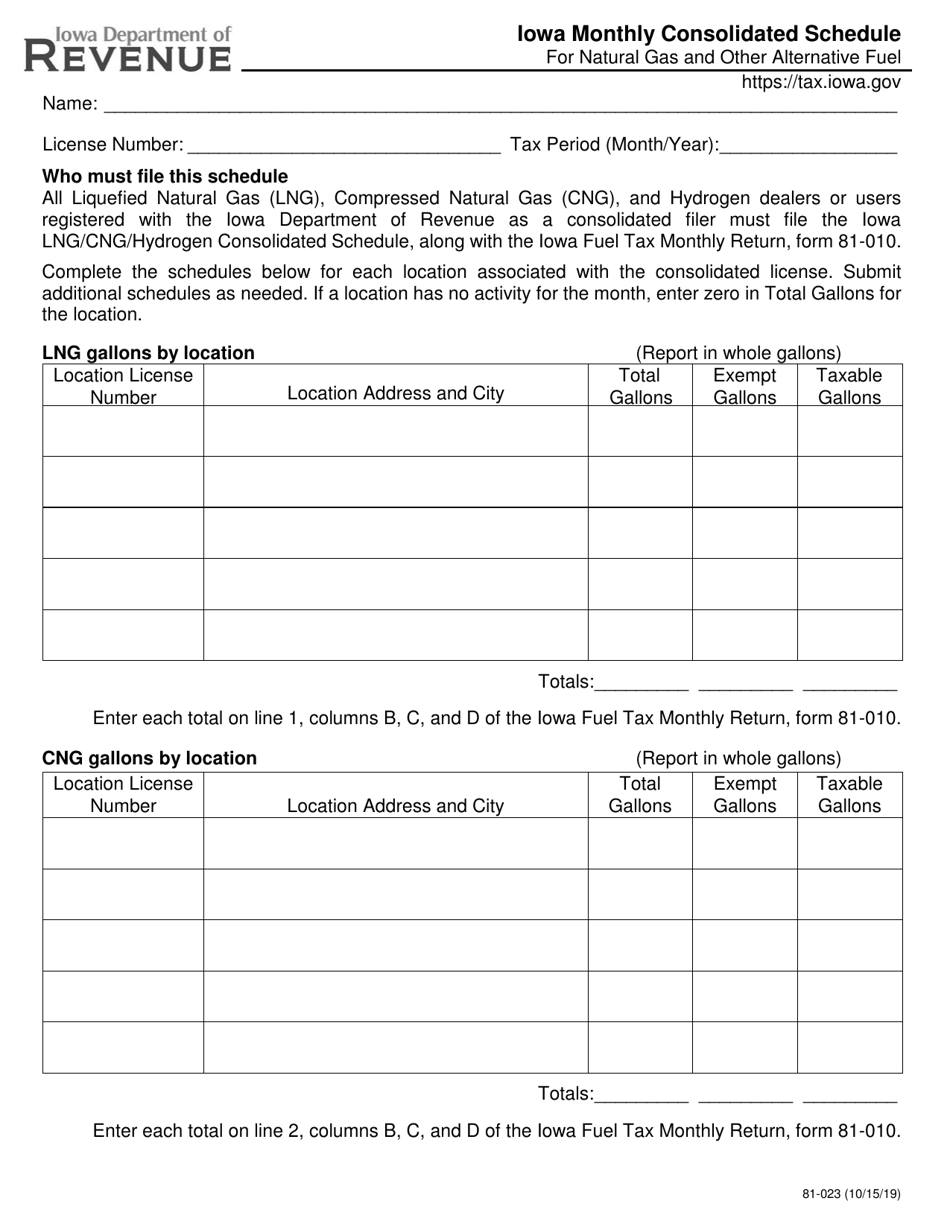

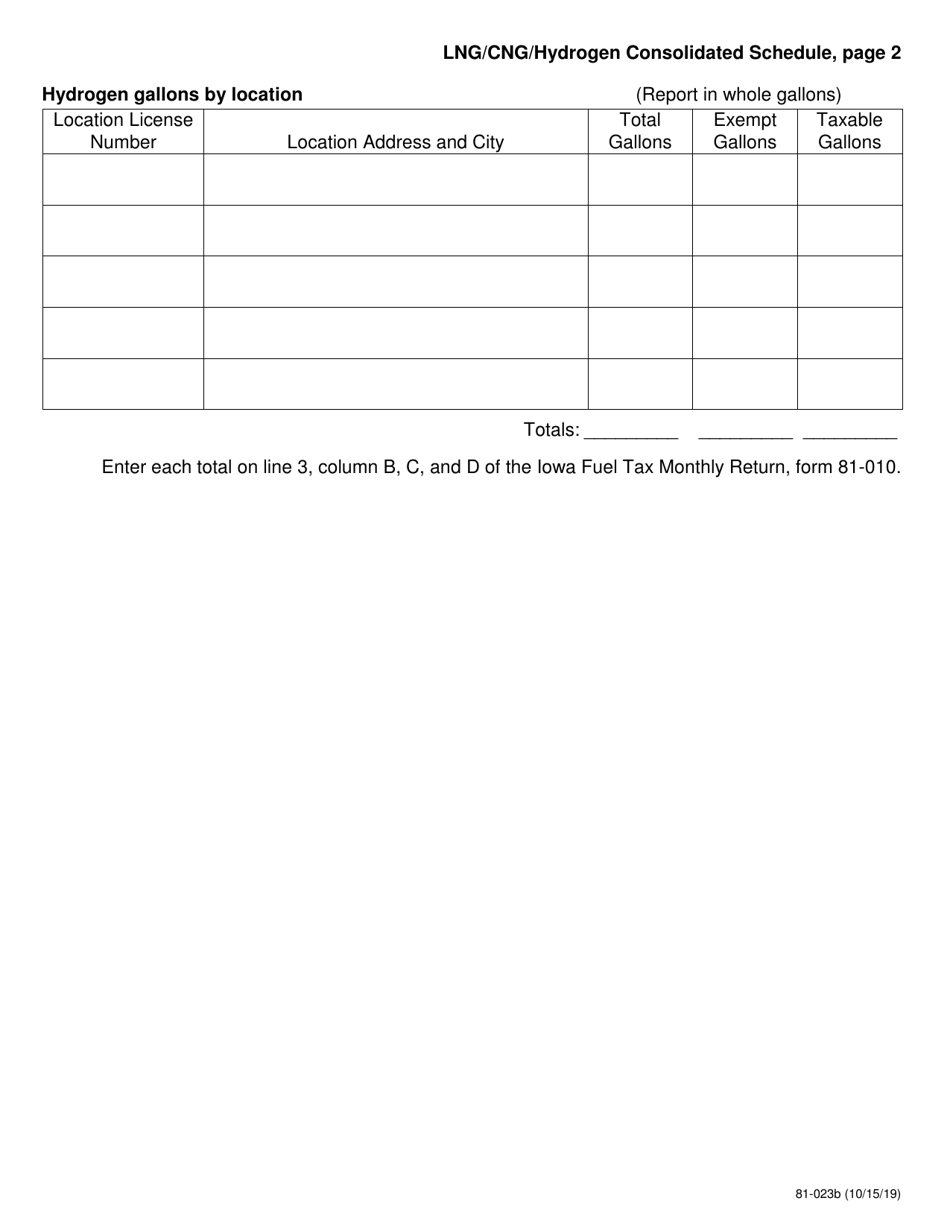

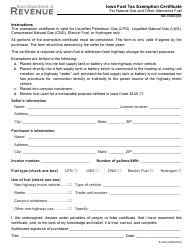

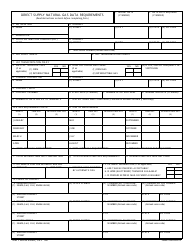

Form 81-023 Iowa Monthly Consolidated Schedule for Natural Gas and Other Alternative Fuel - Iowa

What Is Form 81-023?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 81-023?

A: Form 81-023 is the Iowa Monthly Consolidated Schedule for Natural Gas and Other Alternative Fuel.

Q: What is the purpose of Form 81-023?

A: The purpose of Form 81-023 is to report the usage and sales of natural gas and other alternative fuels in Iowa.

Q: Who needs to file Form 81-023?

A: Businesses and individuals who sell or use natural gas and other alternative fuels in Iowa need to file Form 81-023.

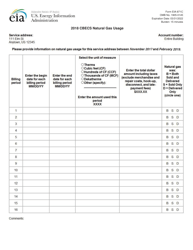

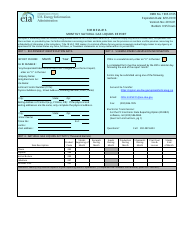

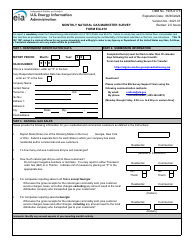

Q: What information is required on Form 81-023?

A: Form 81-023 requires information about the fuel sales and usage, including fuel type, quantities, and taxable gallons.

Q: When is Form 81-023 due?

A: Form 81-023 is due on the 15th day of the month following the reporting period.

Q: Are there any penalties for not filing Form 81-023?

A: Yes, failure to file Form 81-023 or filing a late or incomplete form may result in penalties and interest.

Q: Can Form 81-023 be filed electronically?

A: Yes, Form 81-023 can be filed electronically through the Iowa Department of Revenue's eFile & Pay system.

Form Details:

- Released on October 15, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 81-023 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.