This version of the form is not currently in use and is provided for reference only. Download this version of

Form 56-070

for the current year.

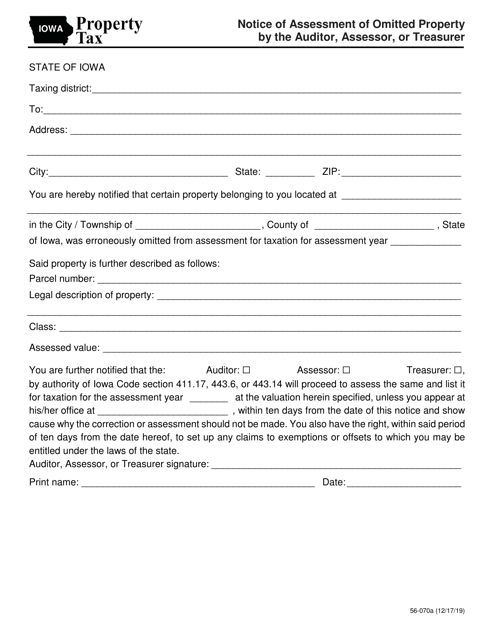

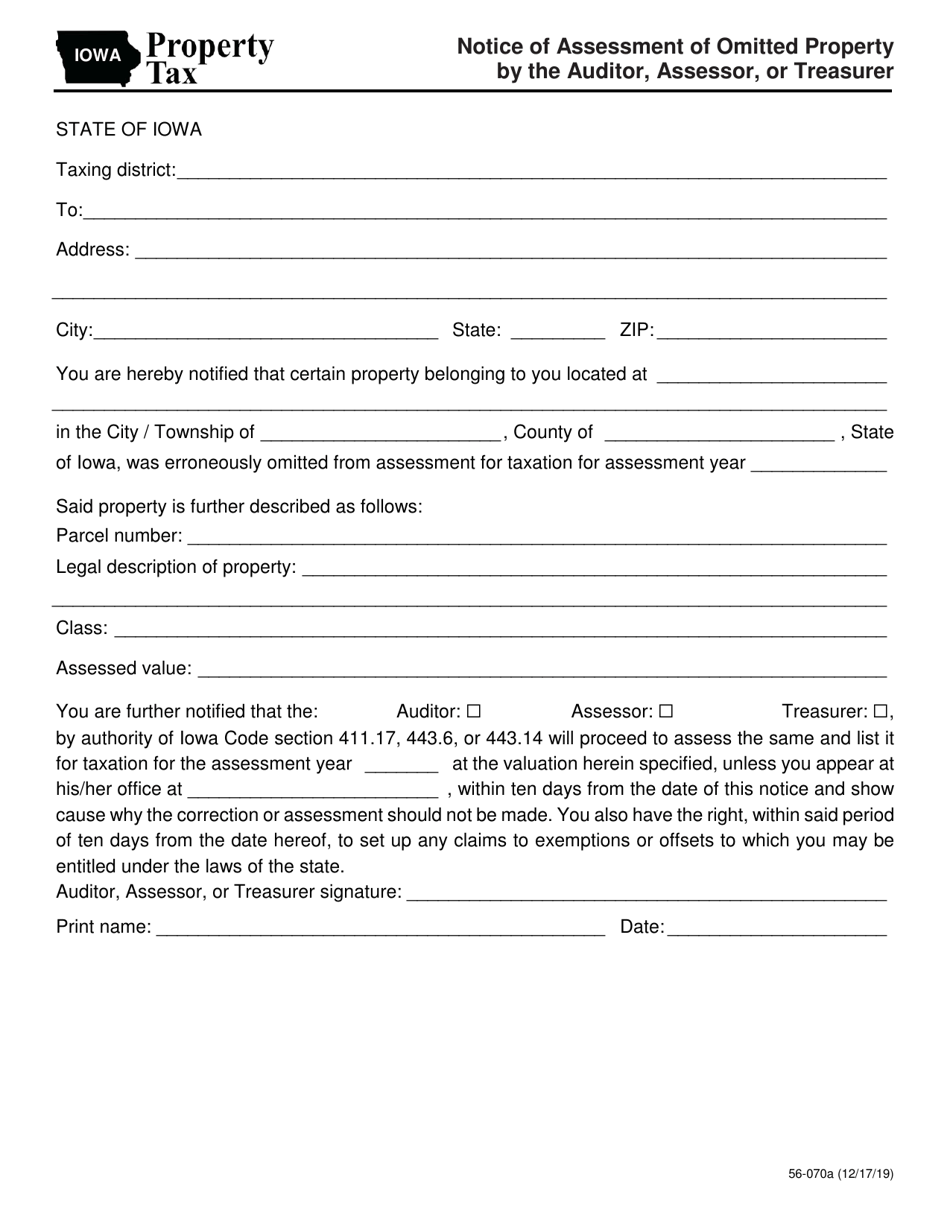

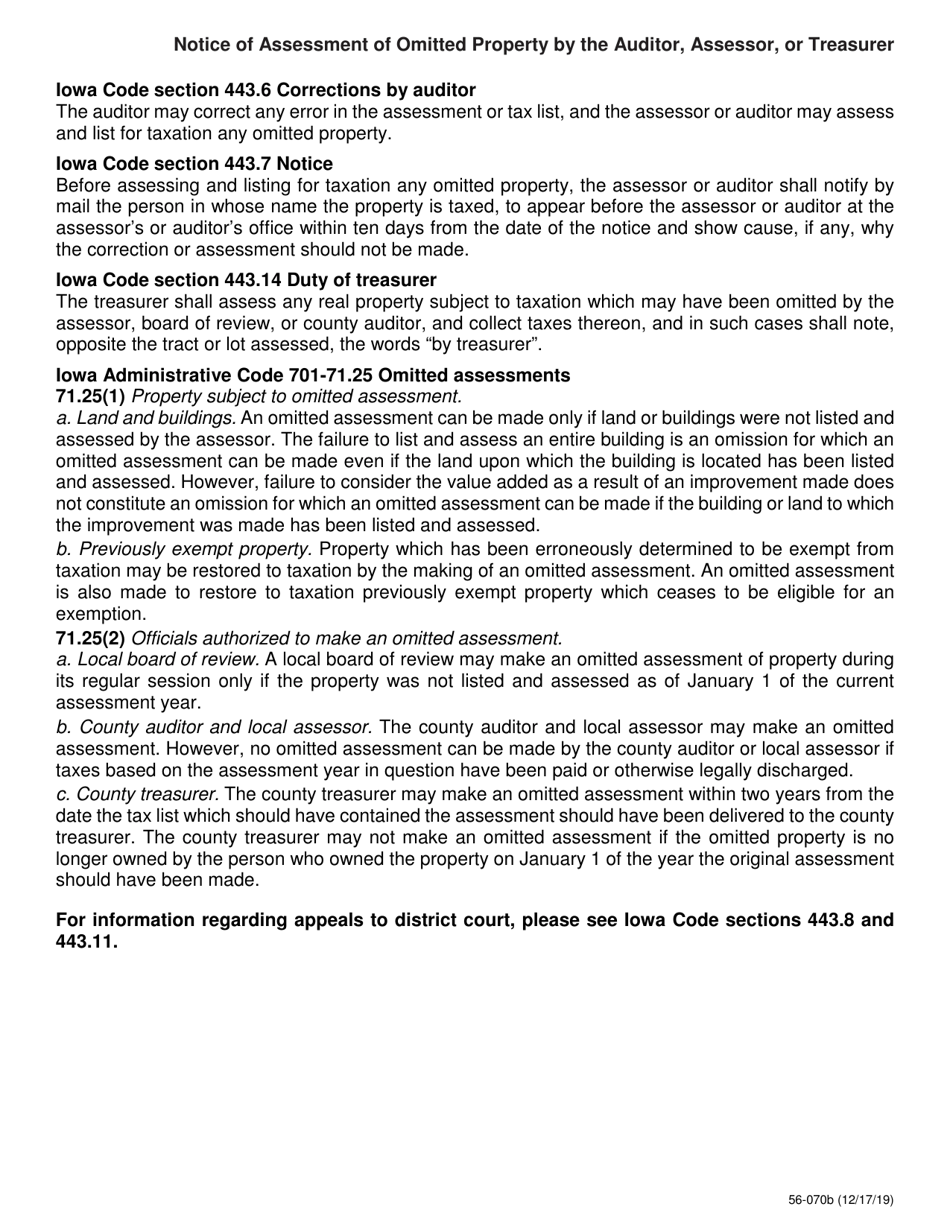

Form 56-070 Notice of Assessment of Omitted Property by the Auditor, Assessor, or Treasurer - Iowa

What Is Form 56-070?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56-070?

A: Form 56-070 is a Notice of Assessment of Omitted Property by the Auditor, Assessor, or Treasurer in Iowa.

Q: Who issues Form 56-070?

A: Form 56-070 is issued by the Auditor, Assessor, or Treasurer in Iowa.

Q: What is the purpose of Form 56-070?

A: The purpose of Form 56-070 is to notify the property owner of an assessment of omitted property.

Q: What is omitted property?

A: Omitted property refers to property that was not originally included in a tax assessment.

Q: Why would a property be assessed as omitted?

A: A property may be assessed as omitted if it was not properly reported or assessed in previous tax assessments.

Q: What should a property owner do upon receiving Form 56-070?

A: Upon receiving Form 56-070, a property owner should carefully review the assessment and follow the instructions provided.

Q: Can a property owner appeal a Form 56-070 assessment?

A: Yes, a property owner can appeal a Form 56-070 assessment by following the appeal procedures outlined in the notice.

Q: Are there any penalties for omitting property?

A: Yes, there may be penalties for omitting property, which can include fines and interest on the assessed amount.

Q: Is Form 56-070 specific to Iowa?

A: Yes, Form 56-070 is specific to Iowa and may have different counterparts in other states.

Form Details:

- Released on December 17, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 56-070 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.