This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA8824 (45-017)

for the current year.

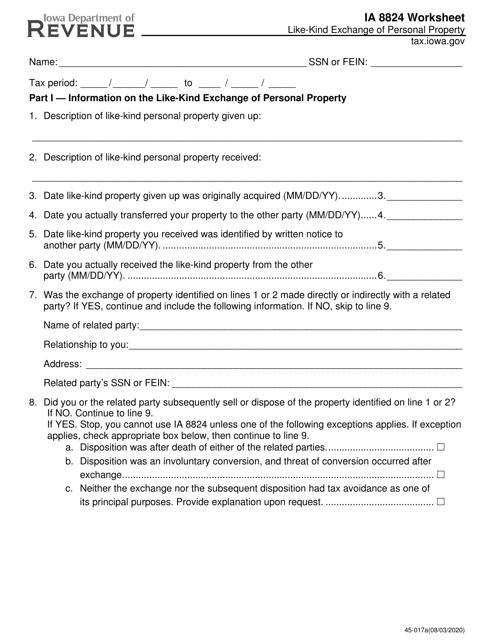

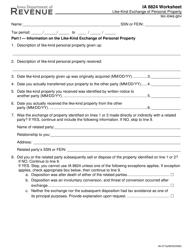

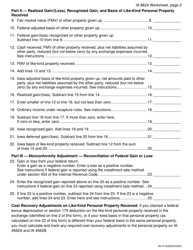

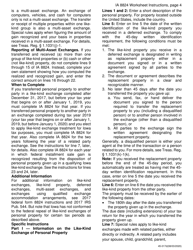

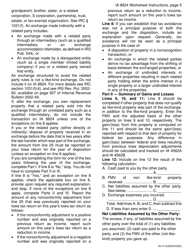

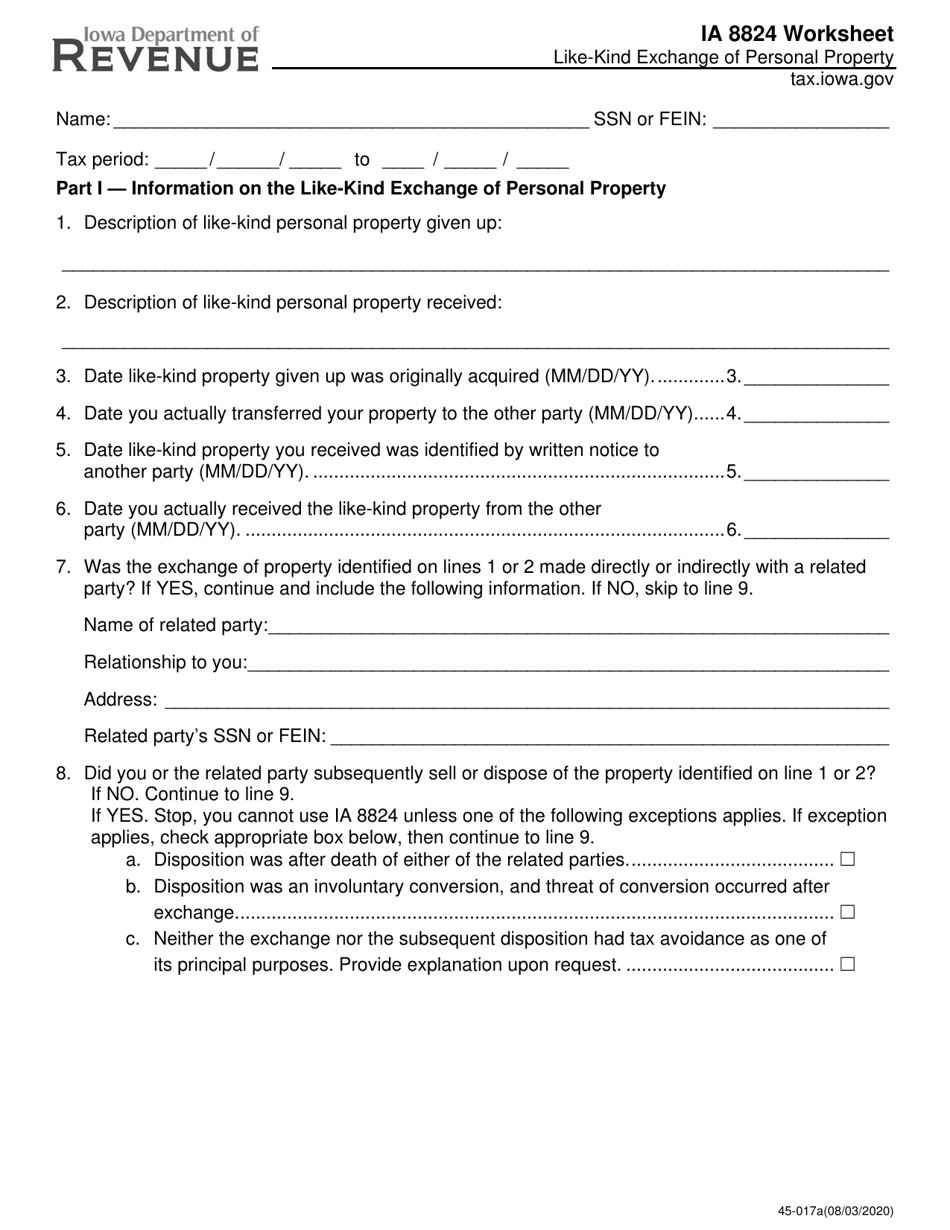

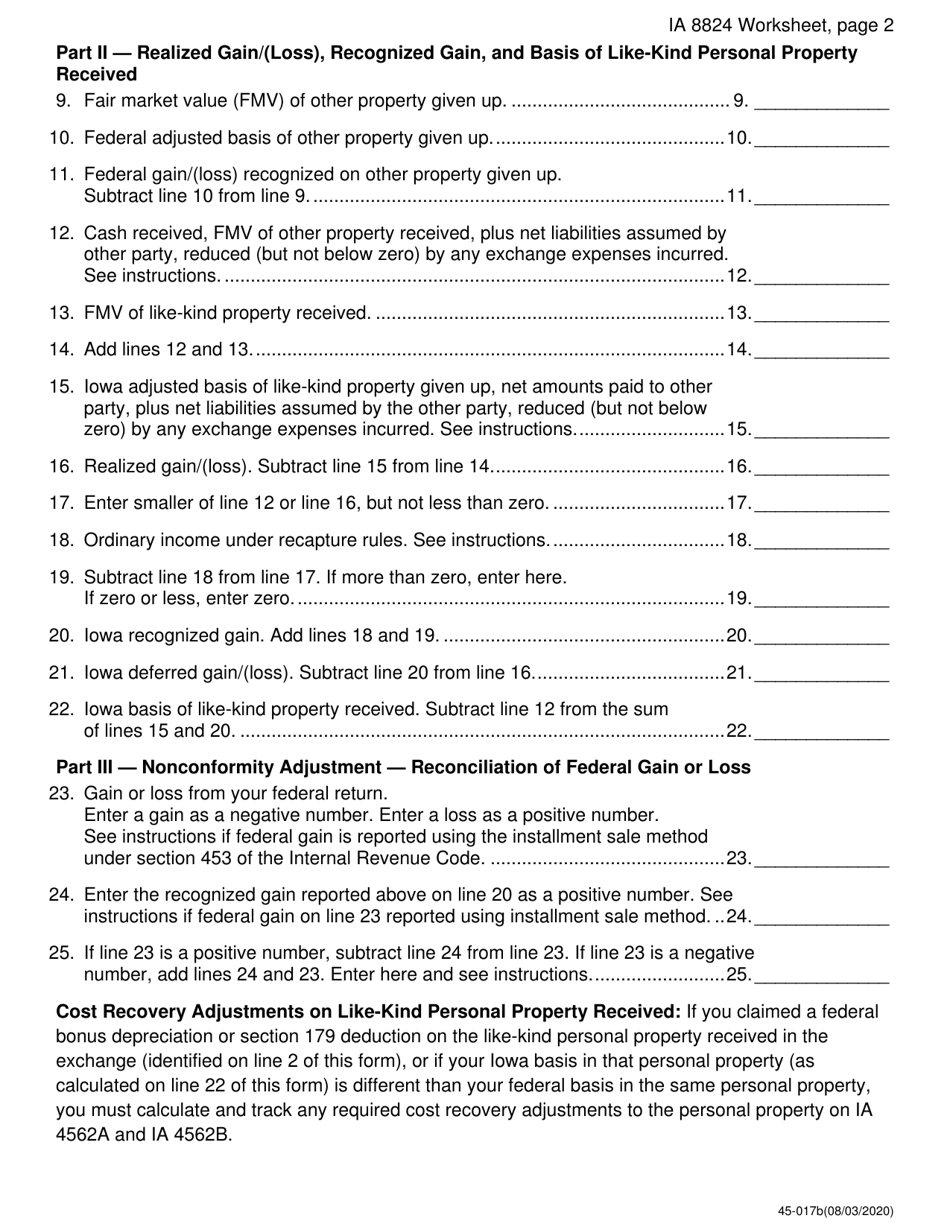

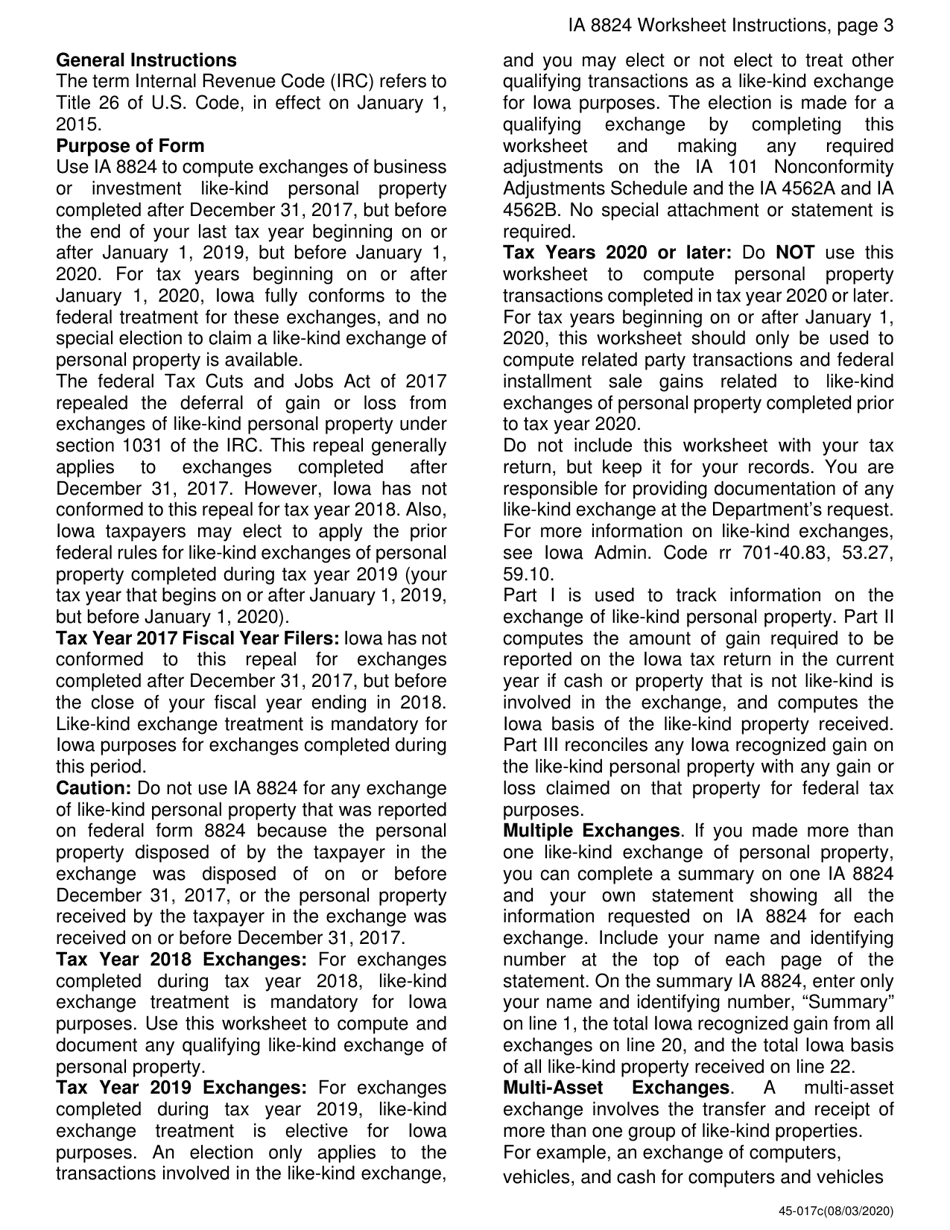

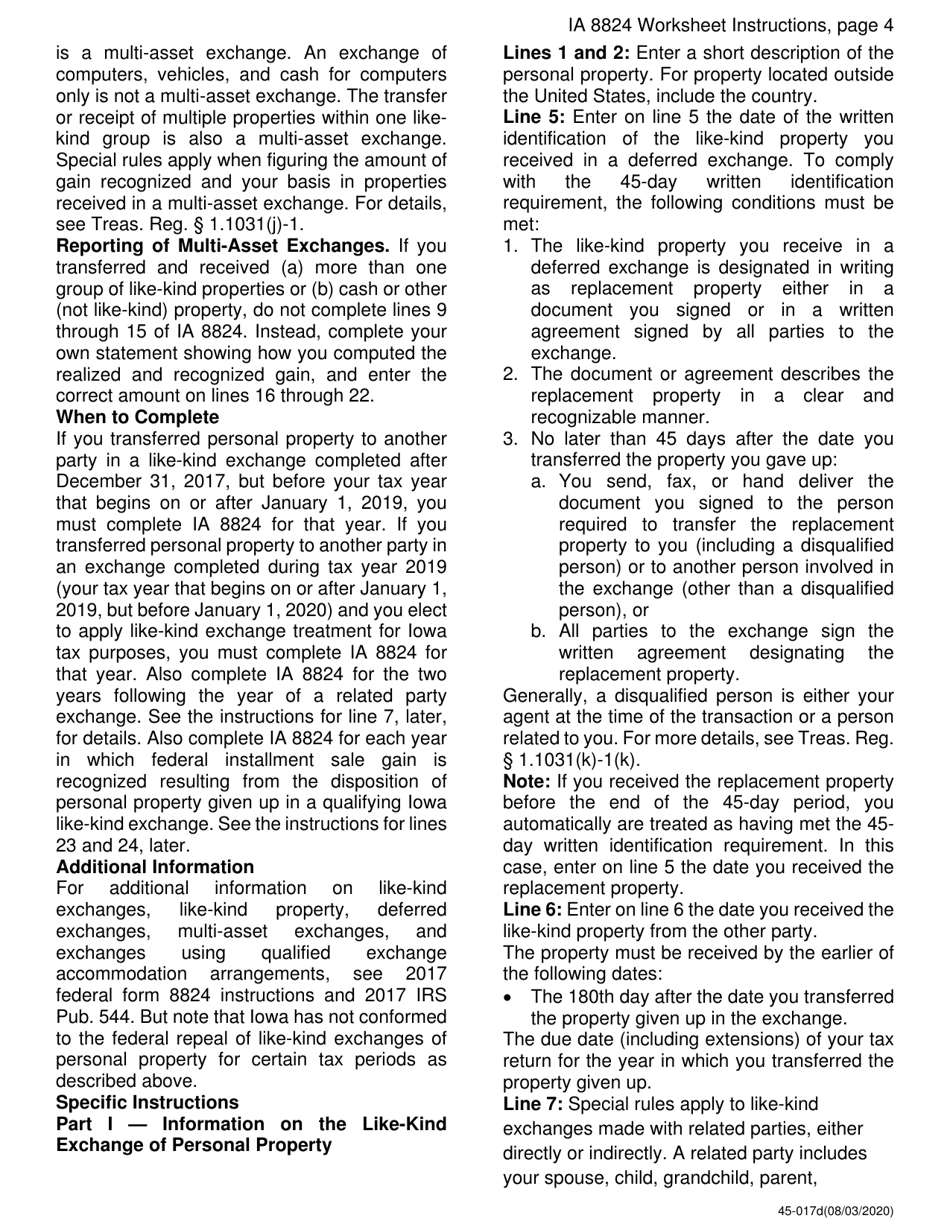

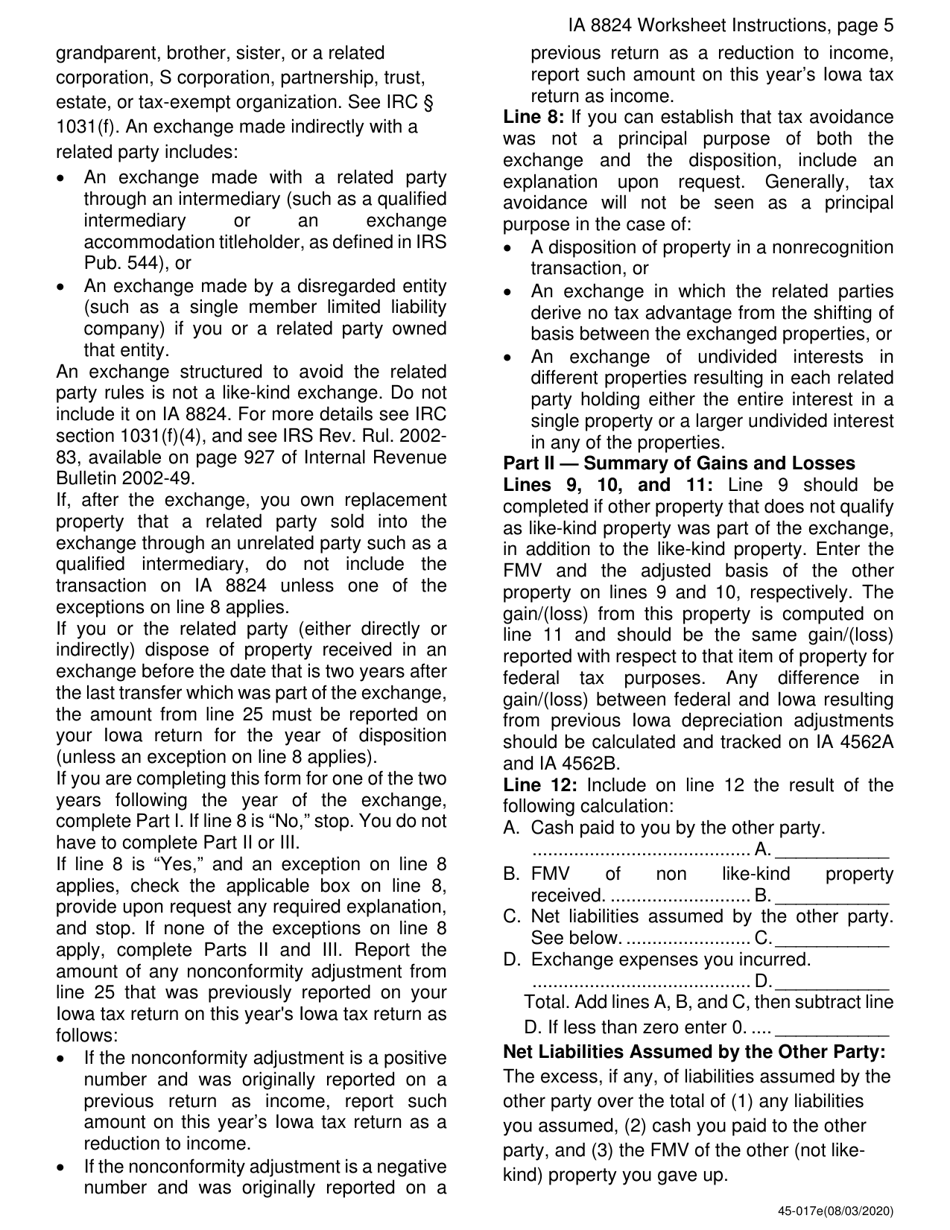

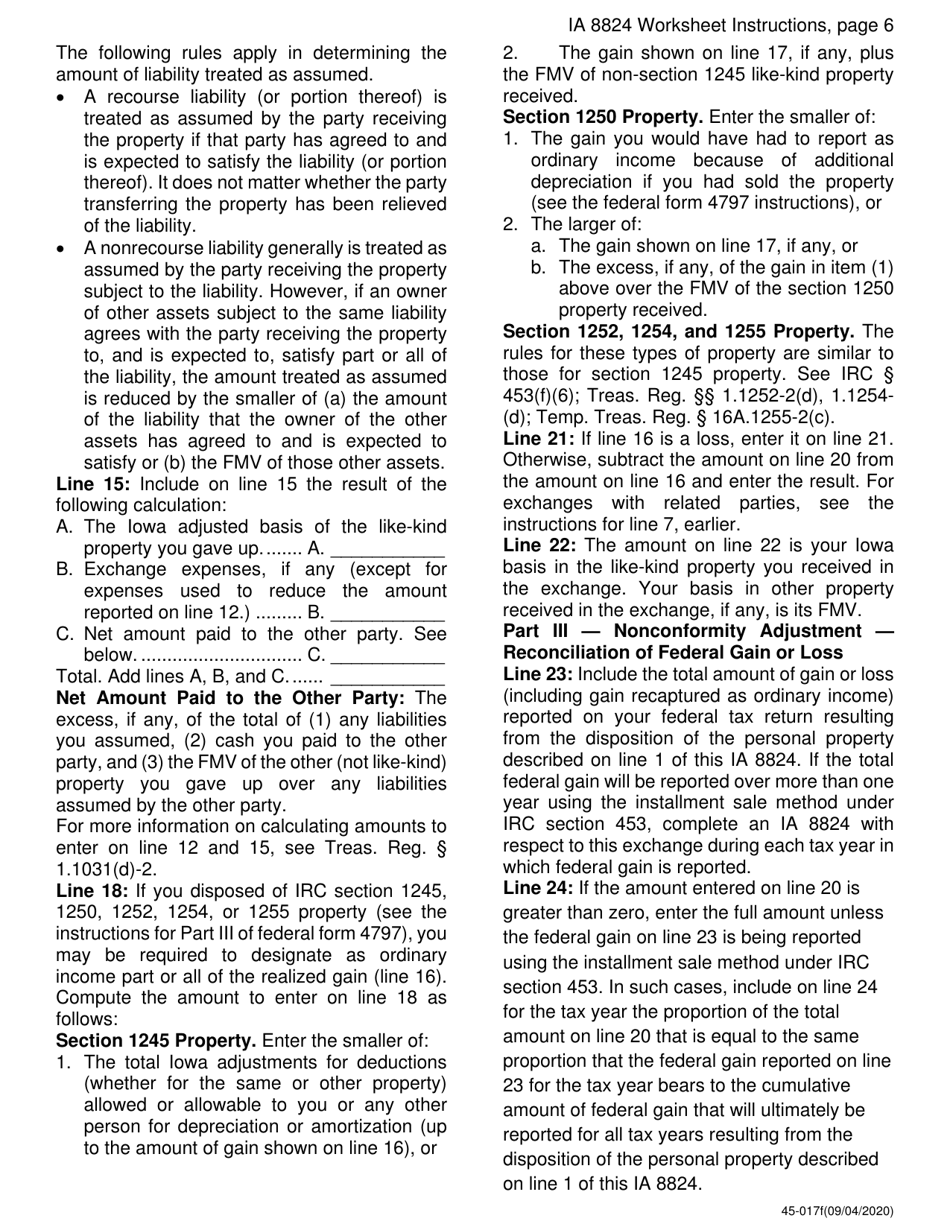

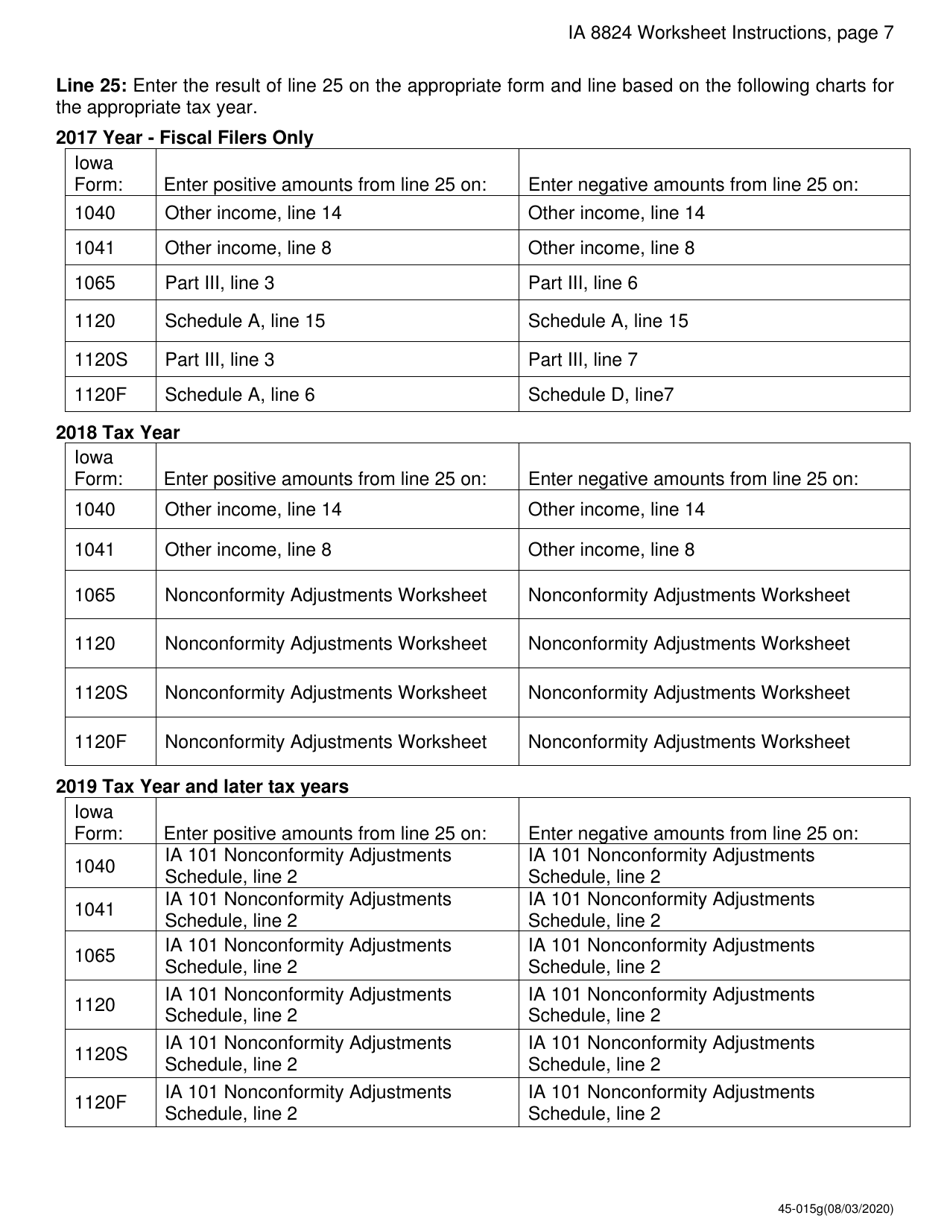

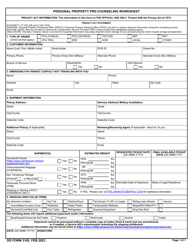

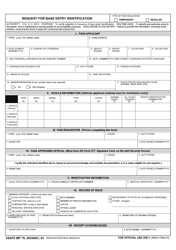

Form IA8824 (45-017) Like-Kind Exchange of Personal Property Worksheet - Iowa

What Is Form IA8824 (45-017)?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA8824?

A: Form IA8824 is used for reporting a like-kind exchange of personal property in the state of Iowa.

Q: Who should use Form IA8824?

A: Form IA8824 should be used by individuals or businesses in Iowa who have engaged in a like-kind exchange of personal property.

Q: What is a like-kind exchange?

A: A like-kind exchange refers to the exchange of property held for productive use in a trade or business for another property of a similar nature.

Q: What is the purpose of Form IA8824?

A: The purpose of Form IA8824 is to report the details of the like-kind exchange, including the properties exchanged and any gain or loss realized.

Q: When is Form IA8824 due?

A: Form IA8824 is generally due on the same day as your federal tax return, which is usually on April 15th.

Q: Are there any special rules or requirements for like-kind exchanges in Iowa?

A: Yes, there may be additional rules or requirements specific to Iowa. It is recommended to consult the Iowa Department of Revenue or a tax professional for guidance.

Q: What should I do if I have questions or need assistance with Form IA8824?

A: If you have questions or need assistance with Form IA8824, you can contact the Iowa Department of Revenue or seek help from a tax professional.

Form Details:

- Released on August 3, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IA8824 (45-017) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.