This version of the form is not currently in use and is provided for reference only. Download this version of

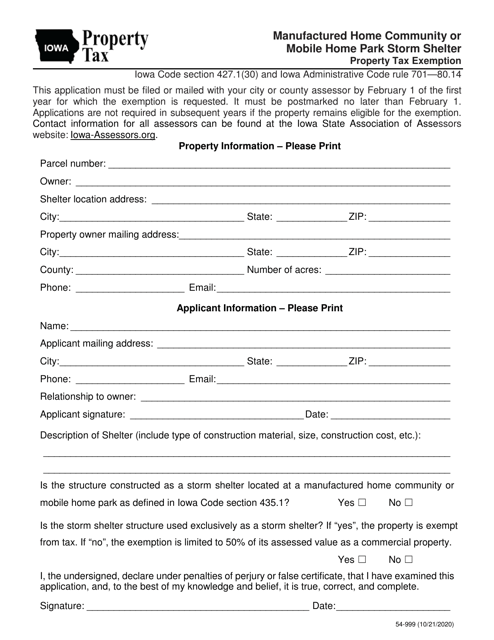

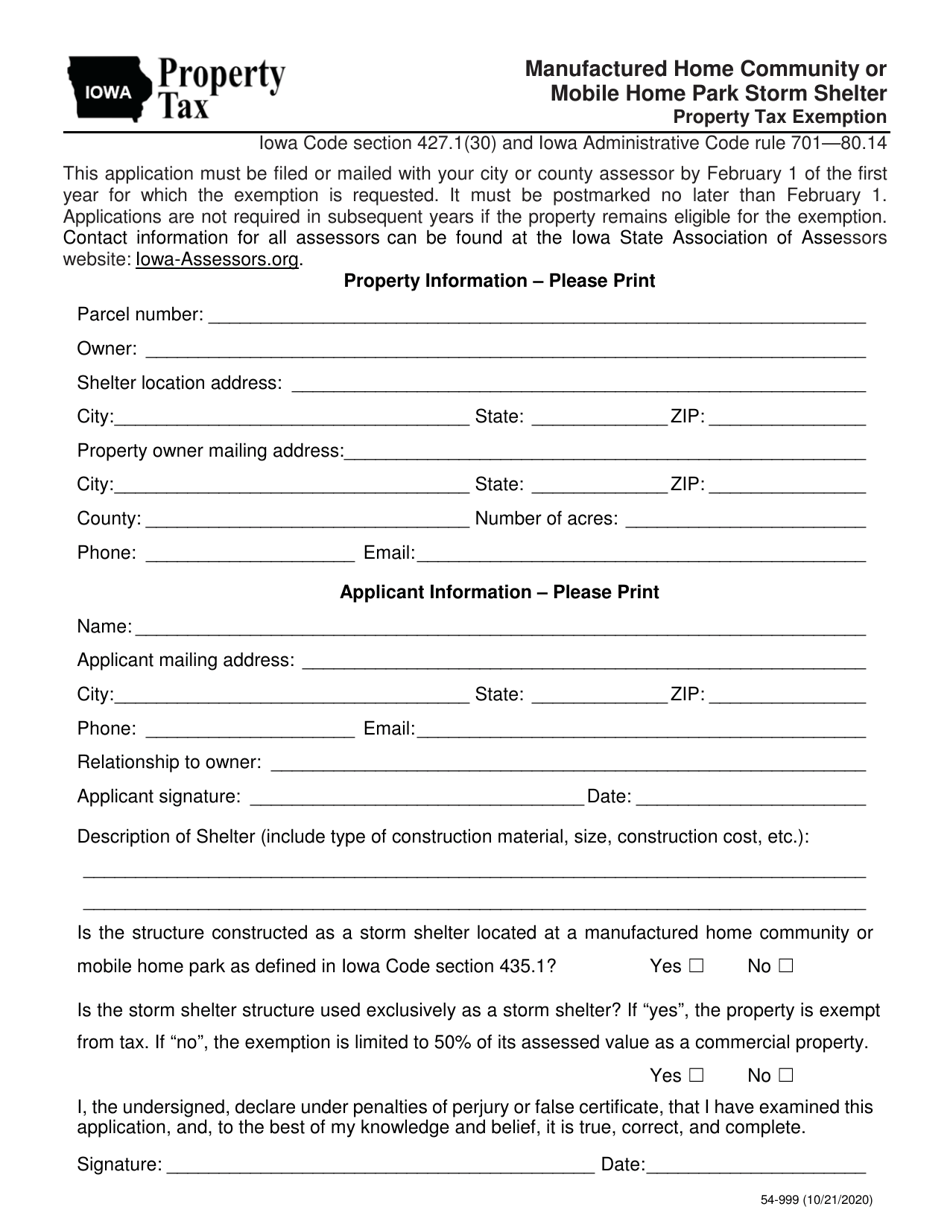

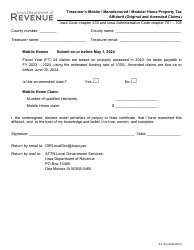

Form 54-999

for the current year.

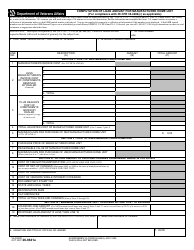

Form 54-999 Manufactured Home Community or Mobile Home Park Storm Shelter Property Tax Exemption - Iowa

What Is Form 54-999?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54-999?

A: Form 54-999 is the form used to apply for the Manufactured Home Community or Mobile Home Park Storm Shelter Property Tax Exemption in Iowa.

Q: What is the purpose of the Form 54-999?

A: The purpose of Form 54-999 is to apply for a property tax exemption for storm shelters in manufactured home communities or mobile home parks in Iowa.

Q: Who is eligible to apply for the property tax exemption?

A: Owners of manufactured home communities or mobile home parks in Iowa with storm shelters are eligible to apply.

Q: What is the deadline for submitting Form 54-999?

A: The deadline for submitting Form 54-999 is July 1st of each year.

Q: Are there any fees associated with the application?

A: There are no fees associated with the application for the property tax exemption.

Q: What documentation do I need to submit with Form 54-999?

A: You will need to submit supporting documentation, such as proof of ownership and documentation of the storm shelter construction costs.

Q: How long does it take to process the application?

A: The processing time for the application varies, but it typically takes a few weeks to several months.

Q: How long does the property tax exemption last?

A: The property tax exemption lasts for a period of ten years from the year the storm shelter is completed.

Q: Can I apply for the exemption if I already have a storm shelter in my manufactured home community or mobile home park?

A: Yes, you can still apply for the exemption if you already have a storm shelter in your community or park, as long as the shelter meets the requirements.

Form Details:

- Released on October 21, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-999 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.