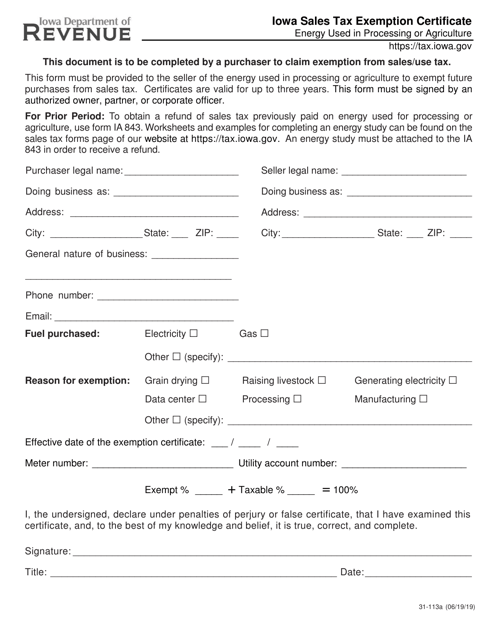

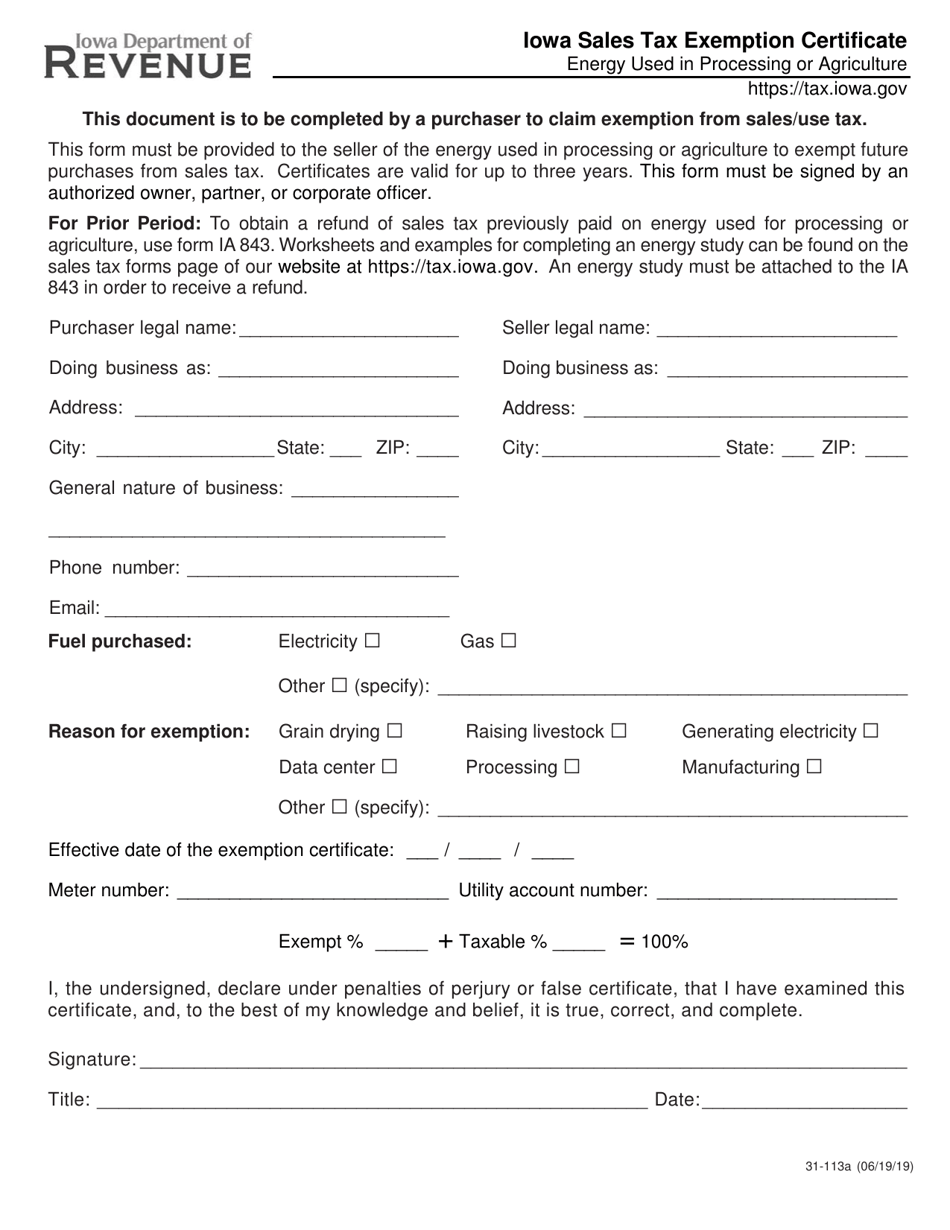

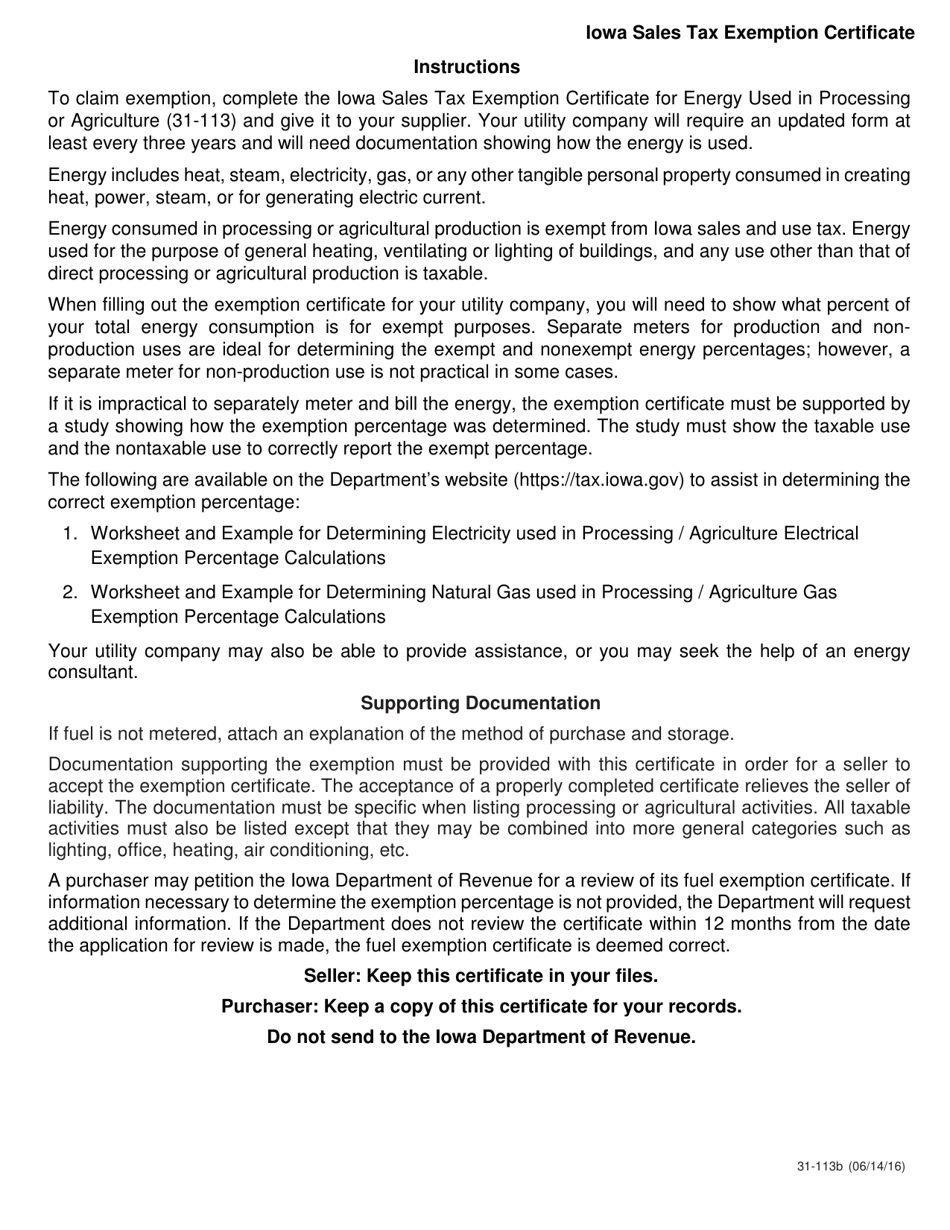

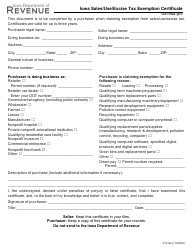

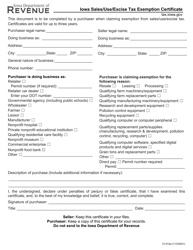

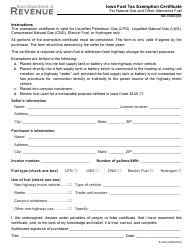

Form 31-113 Iowa Sales Tax Exemption Certificate - Energy Used in Processing or Agriculture - Iowa

What Is Form 31-113?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 31-113?

A: Form 31-113 is the Iowa Sales Tax Exemption Certificate for Energy Used in Processing or Agriculture.

Q: What is the purpose of Form 31-113?

A: The purpose of Form 31-113 is to claim an exemption from sales tax on energy used specifically in processing or agriculture in Iowa.

Q: Who can use Form 31-113?

A: Businesses and individuals engaged in processing or agricultural activities in Iowa can use Form 31-113.

Q: What type of energy is covered under this exemption?

A: The exemption covers energy sources such as electricity, gas, fuel oil, propane, coal, wood, and steam.

Q: How long is the exemption valid for?

A: The exemption is valid indefinitely until it is cancelled or revoked by the Iowa Department of Revenue.

Form Details:

- Released on June 19, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 31-113 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.