This version of the form is not currently in use and is provided for reference only. Download this version of

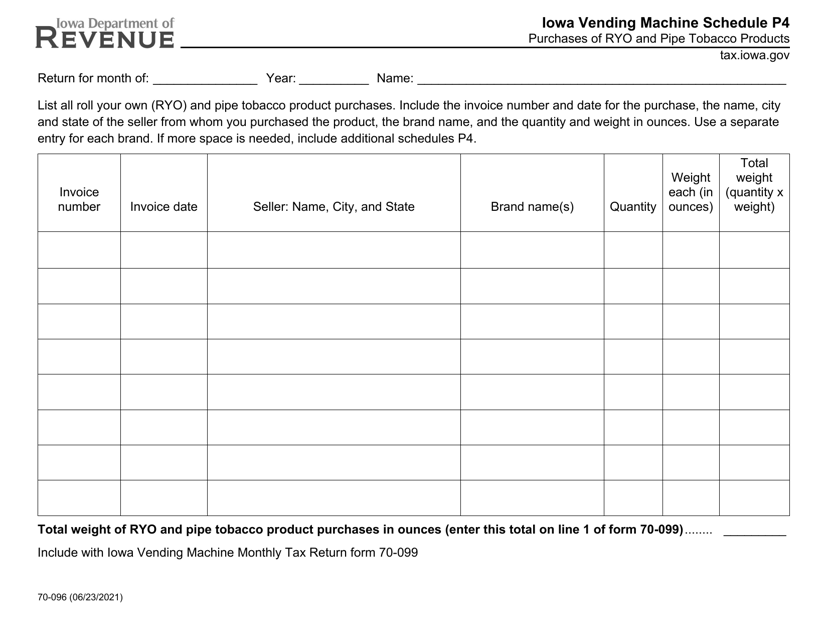

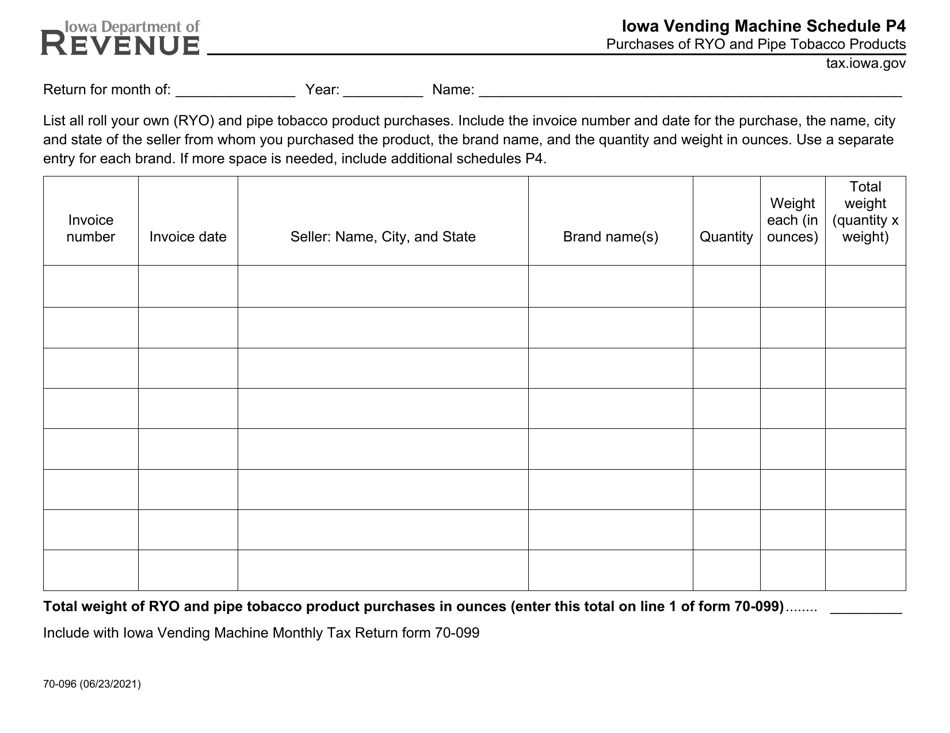

Form 70-096 Schedule P4

for the current year.

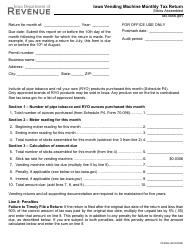

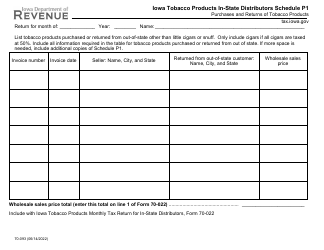

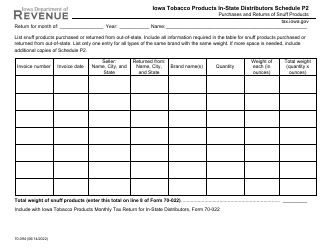

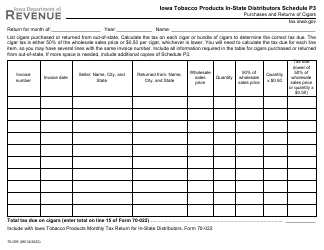

Form 70-096 Schedule P4 Iowa Vending Machine - Purchases of Ryo and Pipe Tobacco Products - Iowa

What Is Form 70-096 Schedule P4?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 70-096 Schedule P4?

A: Form 70-096 Schedule P4 is a reporting form used in Iowa for the purchases of Ryo and Pipe Tobacco Products.

Q: What does Ryo and Pipe Tobacco mean?

A: Ryo stands for Roll-Your-Own tobacco, which refers to loose tobacco that is typically used for rolling cigarettes. Pipe tobacco is a type of tobacco that is specifically made for pipe smoking.

Q: Who needs to fill out Form 70-096 Schedule P4?

A: Any individual or business in Iowa that purchases Ryo and pipe tobacco products is required to fill out Form 70-096 Schedule P4.

Q: What information is required to be included on Form 70-096 Schedule P4?

A: Form 70-096 Schedule P4 requires the individual or business to provide details about the purchases of Ryo and pipe tobacco products, including the quantity, supplier information, and purchase price.

Q: When is the deadline for filing Form 70-096 Schedule P4?

A: The deadline for filing Form 70-096 Schedule P4 in Iowa is typically the same as the annual income tax return filing deadline, which is April 30th.

Q: Is there a penalty for not filing Form 70-096 Schedule P4?

A: Yes, failure to file Form 70-096 Schedule P4 or providing false information can result in penalties and potential legal consequences.

Q: Are there any exemptions for filing Form 70-096 Schedule P4?

A: Exemptions may be available for certain individuals or businesses. It is recommended to consult the Iowa Department of Revenue or a tax professional for specific exemption eligibility.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-096 Schedule P4 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.