This version of the form is not currently in use and is provided for reference only. Download this version of

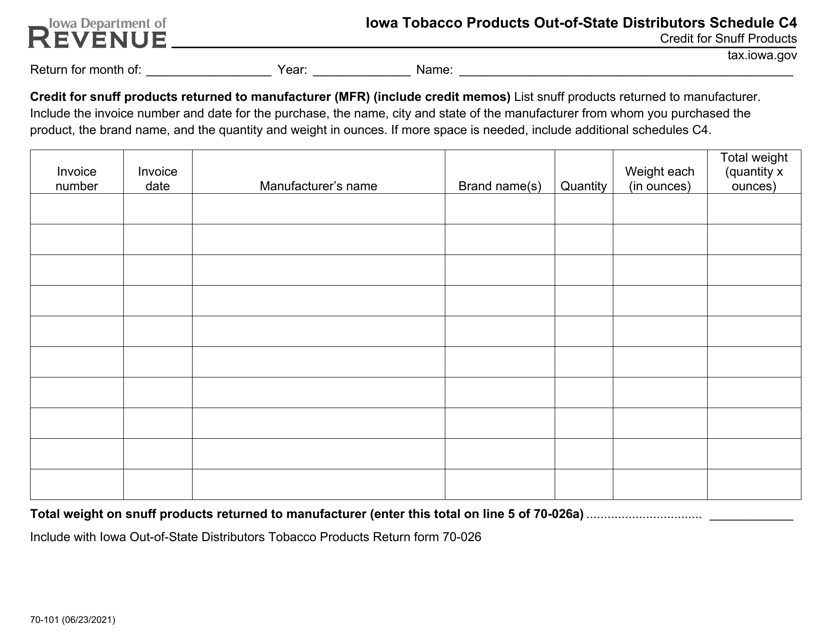

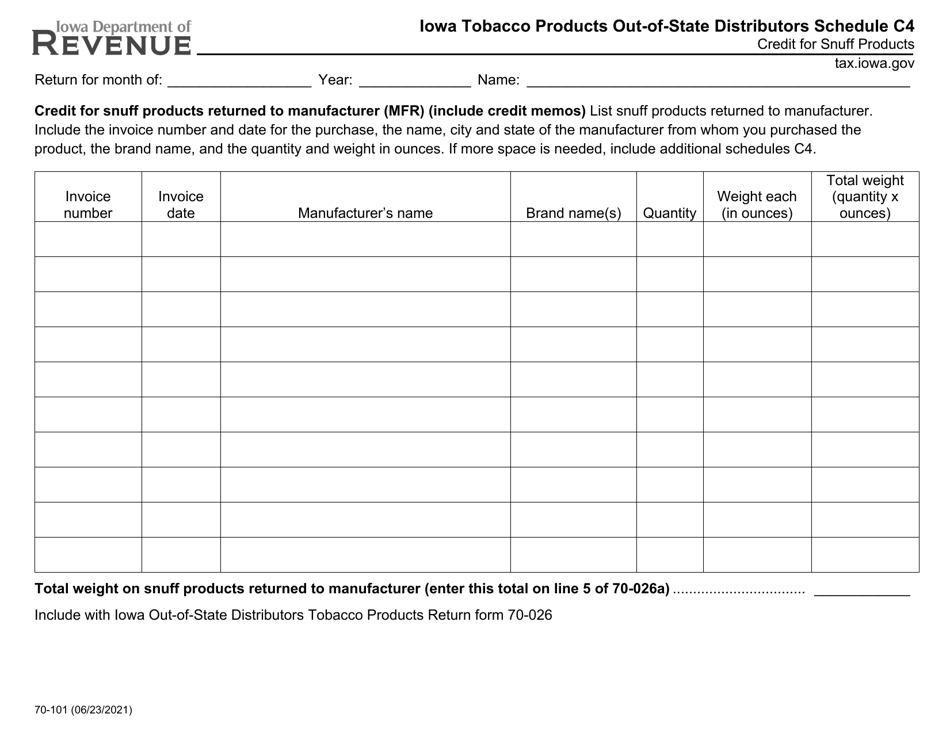

Form 70-101 Schedule C4

for the current year.

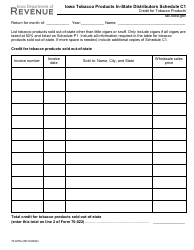

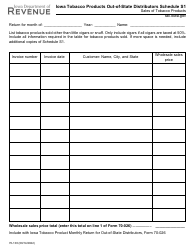

Form 70-101 Schedule C4 Iowa Tobacco Products Out-of-State Distributors - Credit for Snuff Products - Iowa

What Is Form 70-101 Schedule C4?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 70-101 Schedule C4?

A: Form 70-101 Schedule C4 is a tax form in Iowa used by out-of-state distributors of tobacco products to claim a credit for snuff products.

Q: Who can use Form 70-101 Schedule C4?

A: Out-of-state distributors of tobacco products who want to claim a credit for snuff products in Iowa can use Form 70-101 Schedule C4.

Q: What is the purpose of Form 70-101 Schedule C4?

A: The purpose of Form 70-101 Schedule C4 is to allow out-of-state distributors of tobacco products to offset their Iowa tax liability by claiming a credit for the sale of snuff products.

Q: What is the benefit of using Form 70-101 Schedule C4?

A: By using Form 70-101 Schedule C4, out-of-state distributors of tobacco products can reduce their Iowa tax liability by claiming a credit for snuff products sold in Iowa.

Q: Are there any eligibility criteria or requirements to use Form 70-101 Schedule C4?

A: Yes, to use Form 70-101 Schedule C4, you must be an out-of-state distributor of tobacco products and have made sales of snuff products in Iowa during the tax period.

Form Details:

- Released on June 23, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-101 Schedule C4 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.