This version of the form is not currently in use and is provided for reference only. Download this version of

Form 41-136

for the current year.

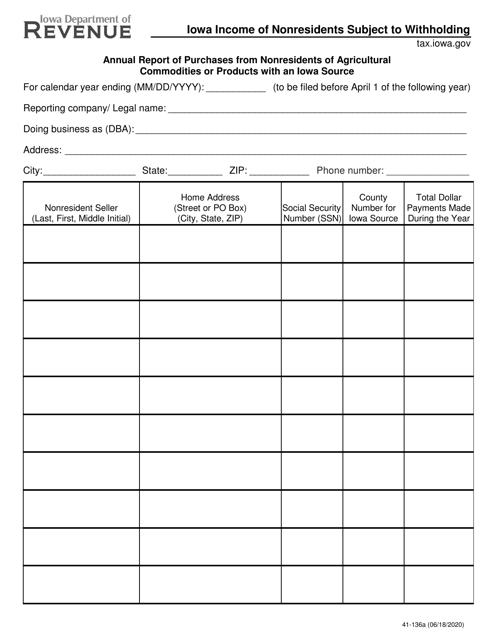

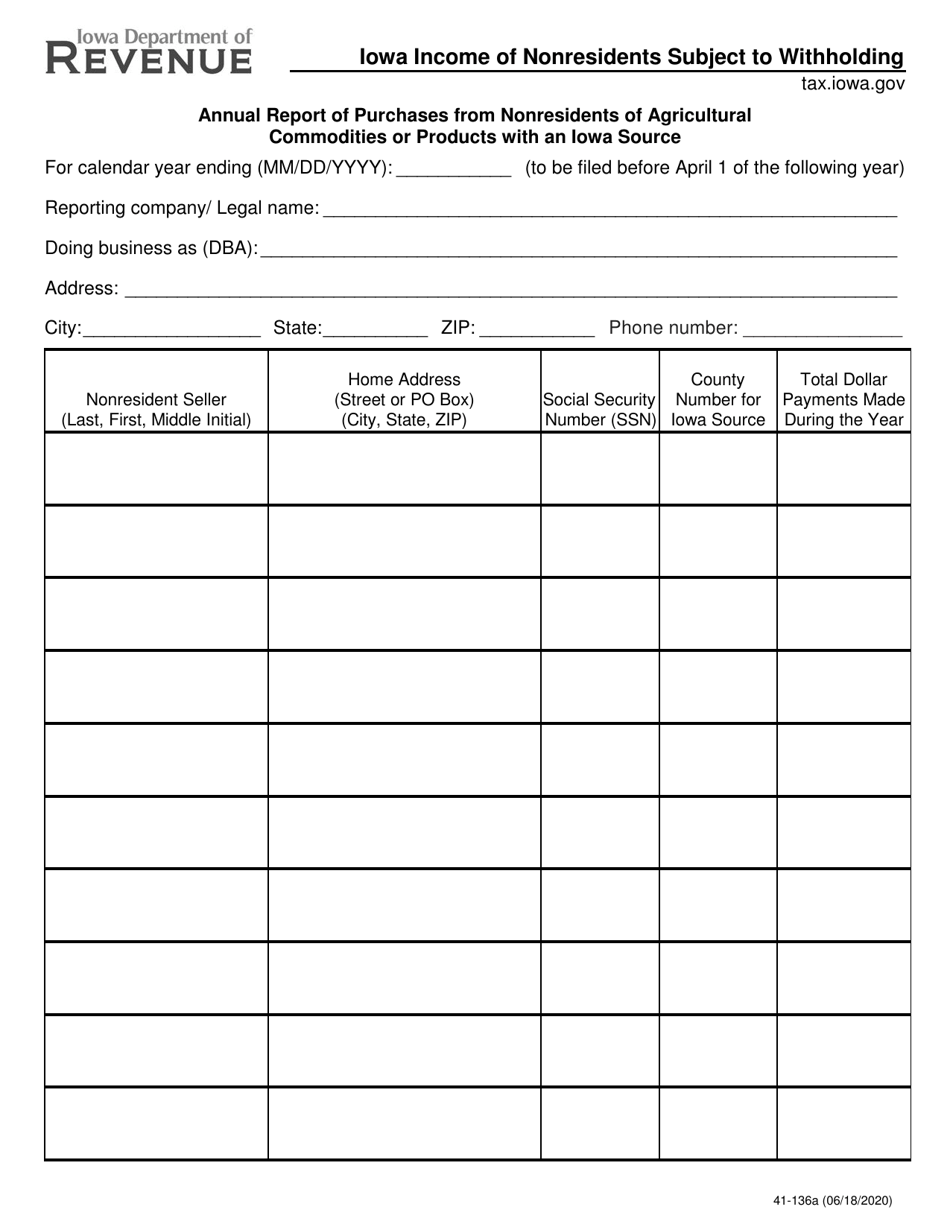

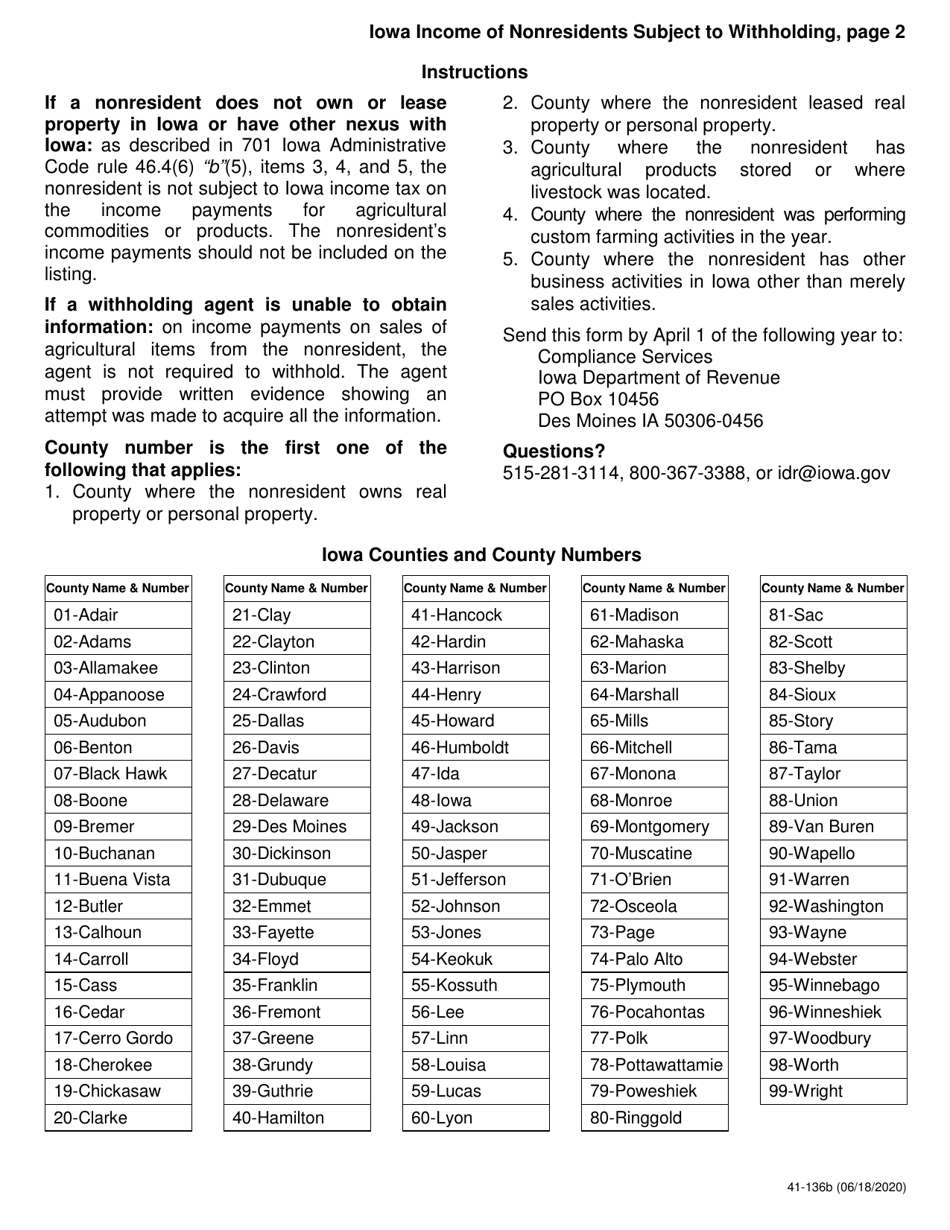

Form 41-136 Iowa Income of Nonresidents Subject to Withholding - Iowa

What Is Form 41-136?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41-136?

A: Form 41-136 is the Iowa Income of Nonresidents Subject to Withholding form.

Q: Who needs to file Form 41-136?

A: Nonresidents of Iowa who have income subject to withholding need to file Form 41-136.

Q: What is the purpose of Form 41-136?

A: The purpose of Form 41-136 is to report Iowa income and calculate the amount of withholding tax.

Q: What information do I need to complete Form 41-136?

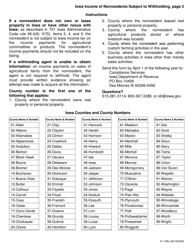

A: You will need to provide your personal information, the amount of Iowa income subject to withholding, and any applicable exemptions or deductions.

Q: When is the deadline to file Form 41-136?

A: Form 41-136 must be filed by the 30th day of the month following the end of the tax year.

Q: Is there an electronic filing option for Form 41-136?

A: Yes, you can file Form 41-136 electronically using the Iowa Department of Revenue's eFile & Pay system.

Q: What should I do if I have questions about Form 41-136?

A: If you have any questions or need assistance with Form 41-136, you can contact the Iowa Department of Revenue directly for guidance.

Form Details:

- Released on June 18, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 41-136 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.