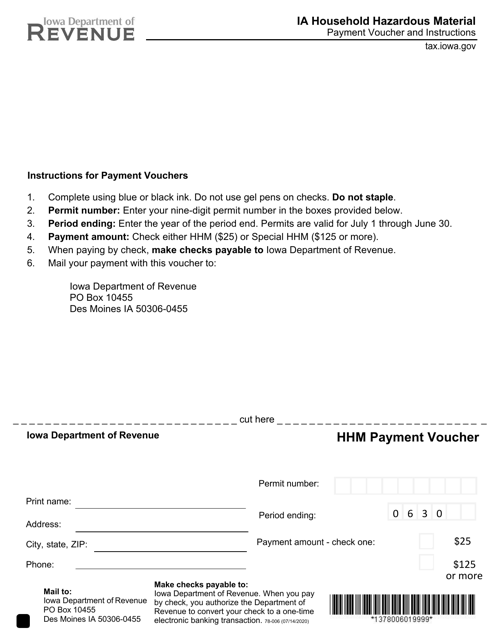

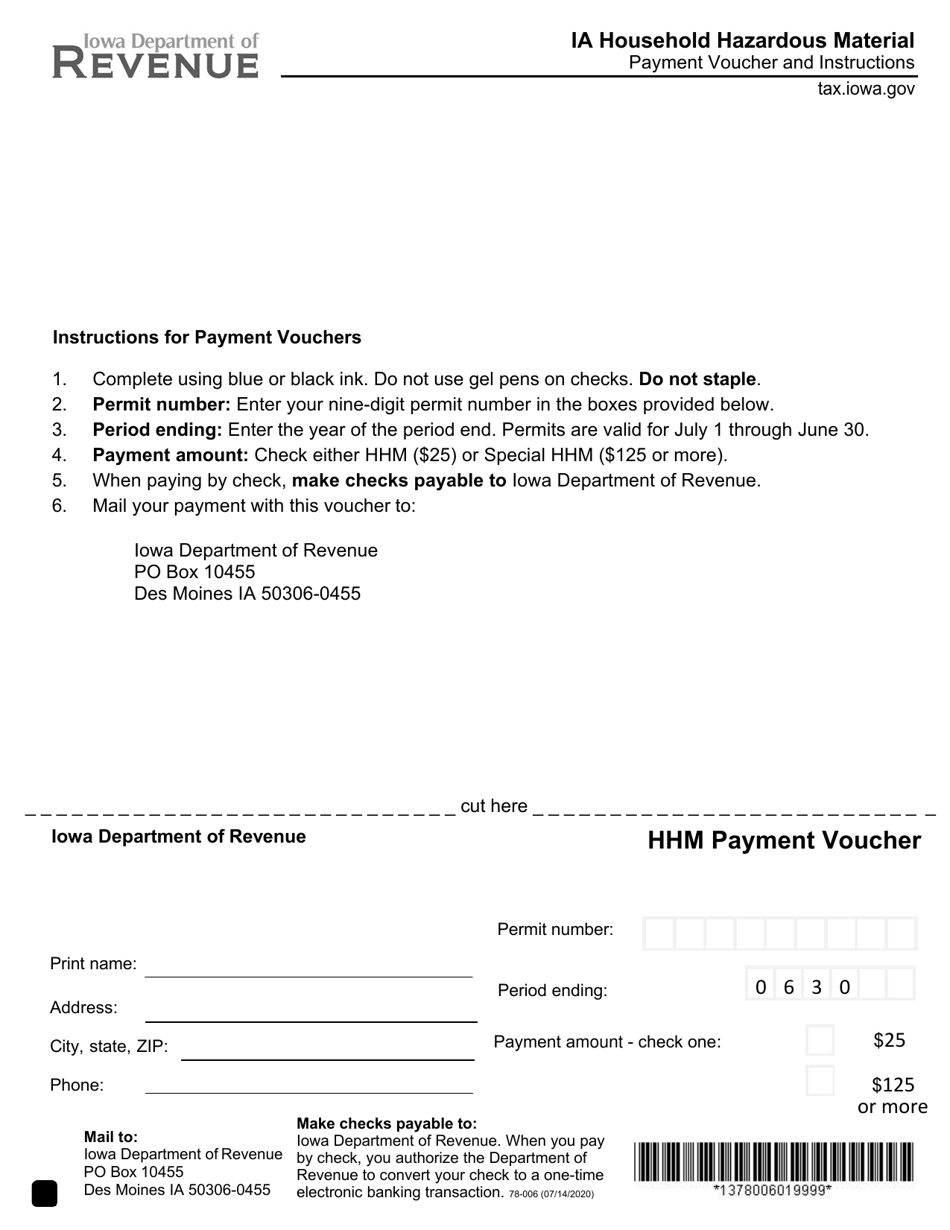

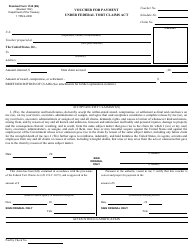

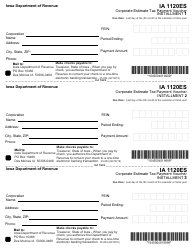

Form 78-006 Hhm Payment Voucher - Iowa

What Is Form 78-006?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 78-006 HHM Payment Voucher?

A: Form 78-006 HHM Payment Voucher is a payment voucher used in Iowa.

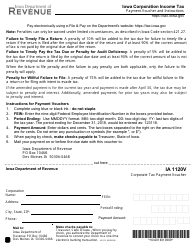

Q: How do I use Form 78-006 HHM Payment Voucher?

A: You can use Form 78-006 HHM Payment Voucher to make payments for various tax liabilities in Iowa.

Q: What types of payments can be made using Form 78-006 HHM Payment Voucher?

A: Form 78-006 HHM Payment Voucher can be used to make payments for individual income tax, corporate income tax, sales and use tax, and other taxes in Iowa.

Q: Do I need to include any additional documentation with Form 78-006 HHM Payment Voucher?

A: You may need to include a payment coupon or voucher with Form 78-006 HHM Payment Voucher, depending on the type of payment you are making.

Q: Are there any deadlines for using Form 78-006 HHM Payment Voucher?

A: Yes, you must submit Form 78-006 HHM Payment Voucher and make the payment by the specified due date for each tax liability.

Q: What if I have questions or need assistance with Form 78-006 HHM Payment Voucher?

A: If you have any questions or need assistance with Form 78-006 HHM Payment Voucher, you should contact the Iowa Department of Revenue.

Q: Can I file my taxes using Form 78-006 HHM Payment Voucher?

A: No, Form 78-006 HHM Payment Voucher is used for making tax payments only. You will need to use the appropriate tax return form to file your taxes in Iowa.

Q: Is Form 78-006 HHM Payment Voucher applicable to both individuals and businesses?

A: Yes, Form 78-006 HHM Payment Voucher can be used by both individuals and businesses to make tax payments in Iowa.

Form Details:

- Released on July 14, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 78-006 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.