This version of the form is not currently in use and is provided for reference only. Download this version of

Form 60-027

for the current year.

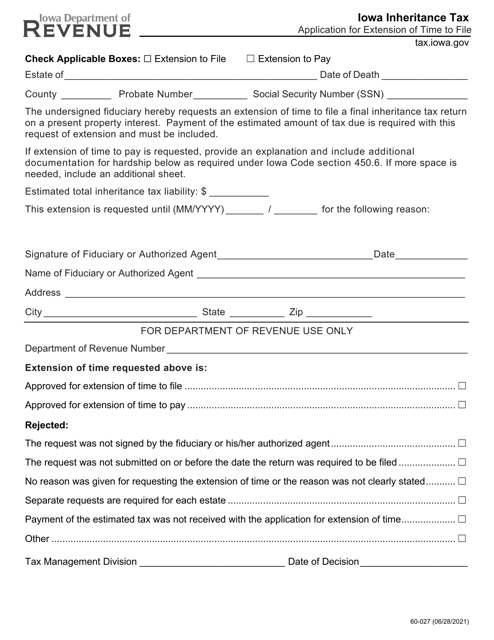

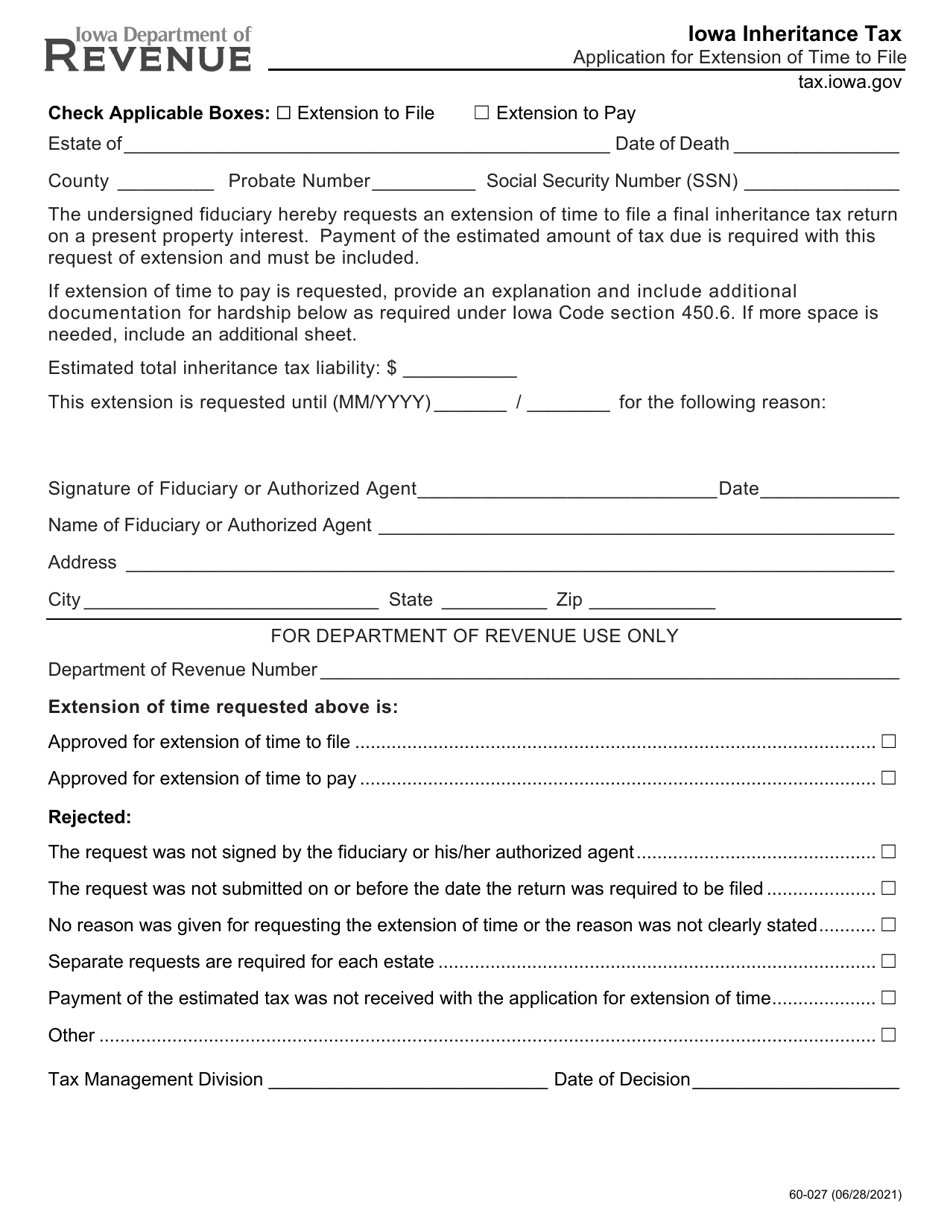

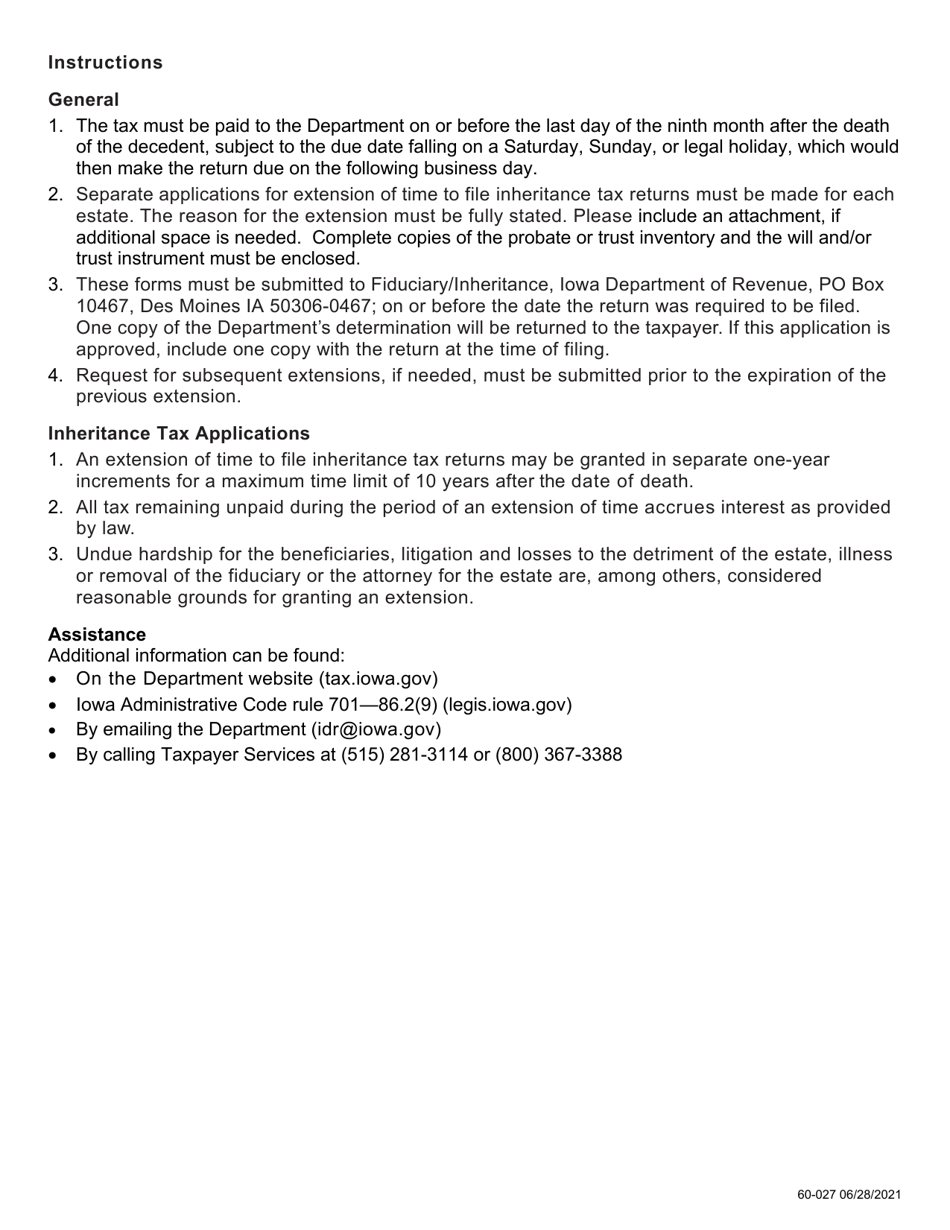

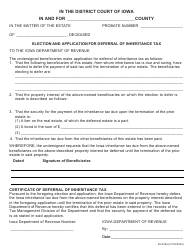

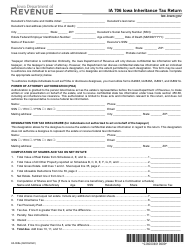

Form 60-027 Iowa Inheritance Tax Application for Extension of Time to File - Iowa

What Is Form 60-027?

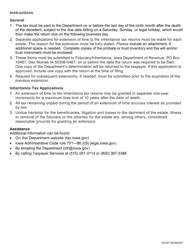

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 60-027?

A: Form 60-027 is the Iowa Inheritance Tax Application for Extension of Time to File.

Q: Who needs to file Form 60-027?

A: Anyone who needs an extension of time to file their Iowa Inheritance Tax return needs to file Form 60-027.

Q: What is the purpose of Form 60-027?

A: The purpose of Form 60-027 is to request an extension of time to file the Iowa Inheritance Tax return.

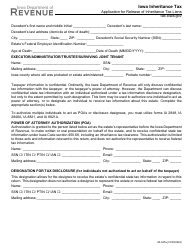

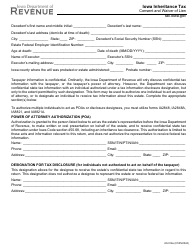

Q: What information is required on Form 60-027?

A: Form 60-027 requires you to provide your name, address, social security number or taxpayer identification number, and the reason for requesting the extension.

Q: When is Form 60-027 due?

A: Form 60-027 is due on or before the original due date of the Iowa Inheritance Tax return.

Q: Is there a fee for filing Form 60-027?

A: There is no fee for filing Form 60-027.

Q: Can I file Form 60-027 electronically?

A: As of now, Form 60-027 cannot be filed electronically. It must be submitted by mail or in person.

Form Details:

- Released on June 28, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 60-027 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.