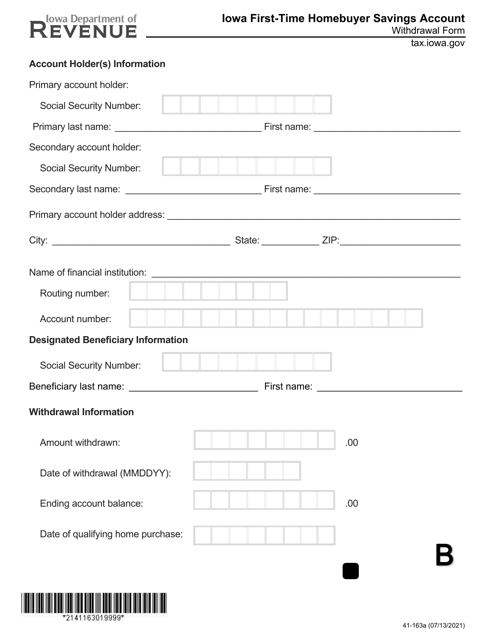

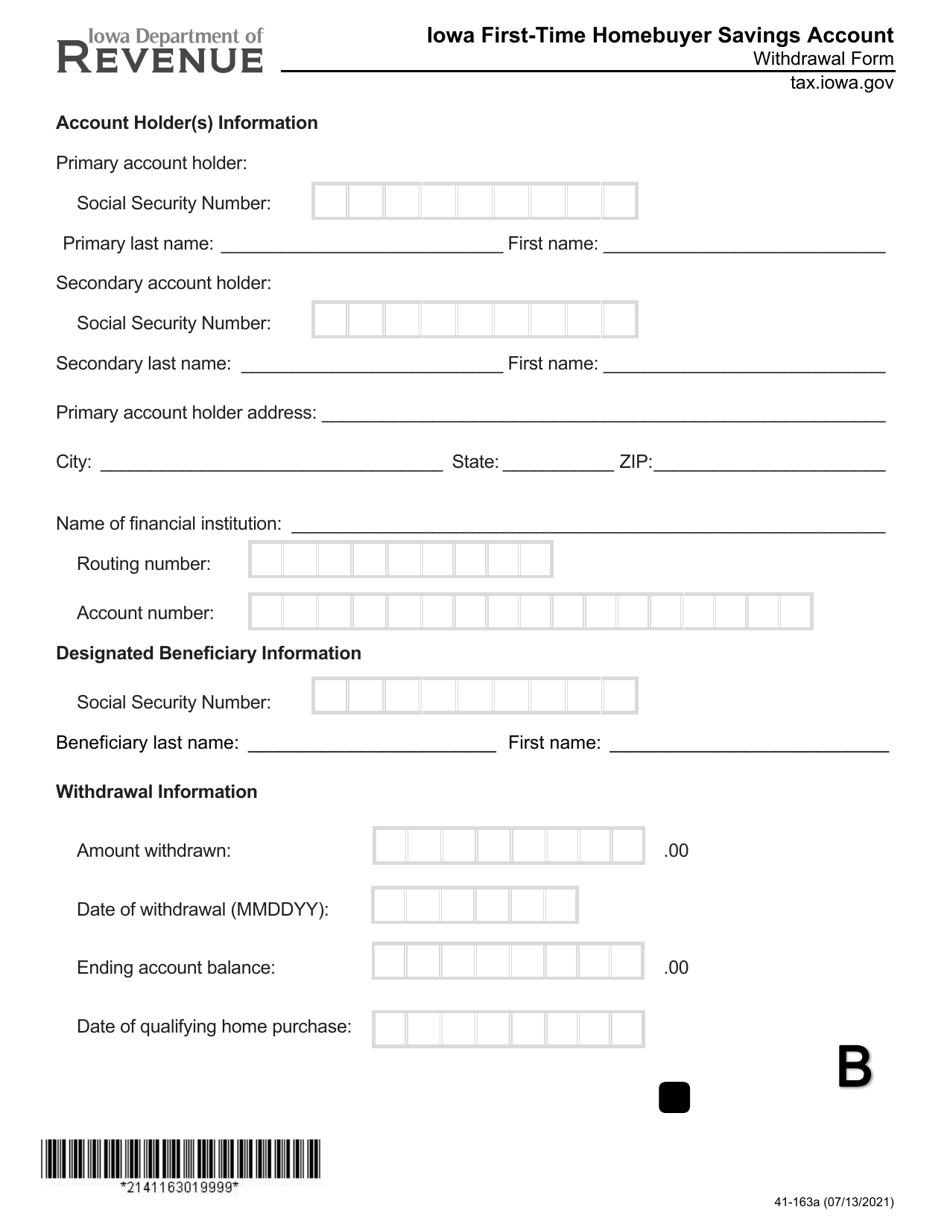

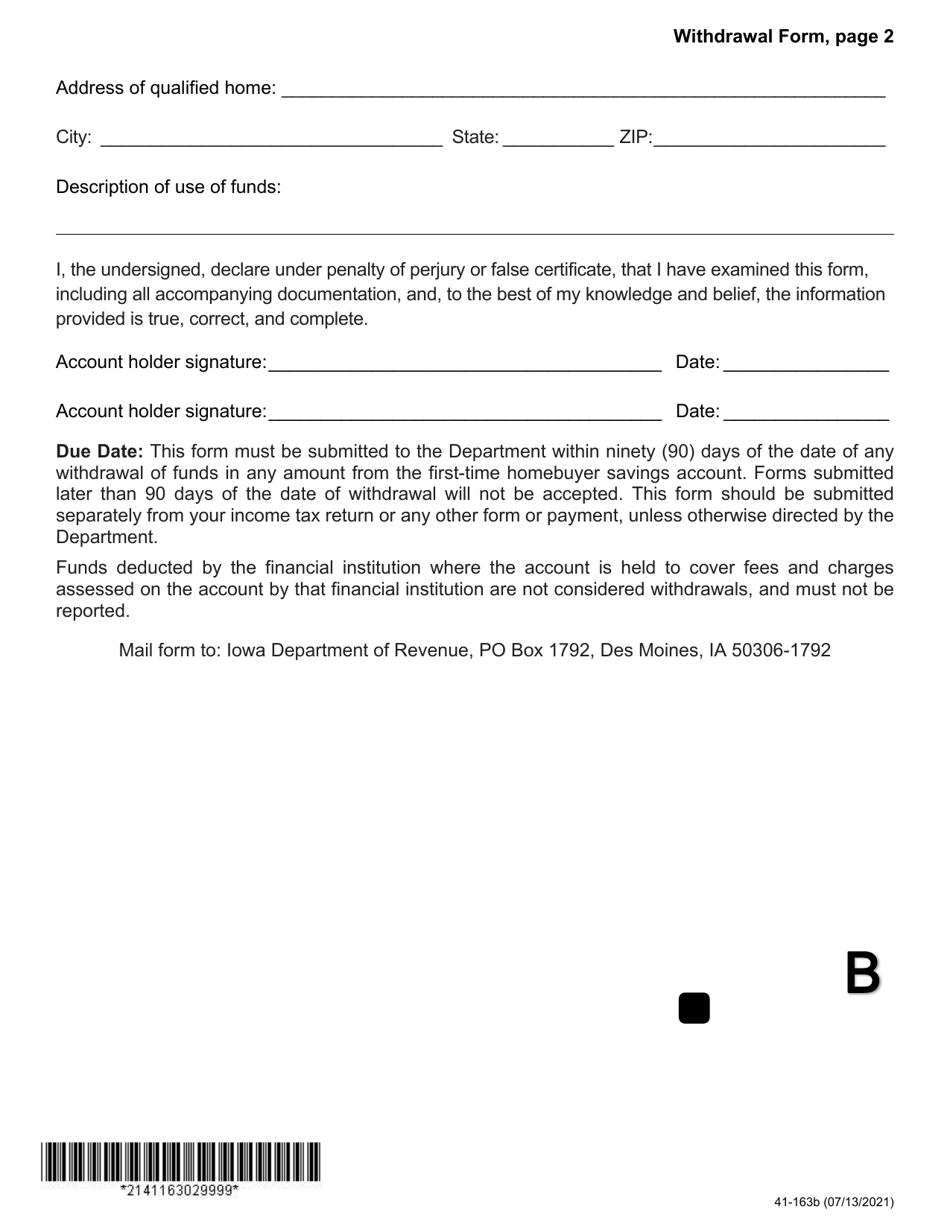

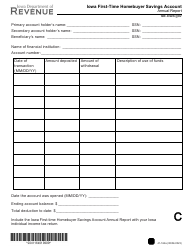

Form 41-163 Iowa First-Time Homebuyer Savings Account Withdrawal Form - Iowa

What Is Form 41-163?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41-163?

A: Form 41-163 is the Iowa First-Time Homebuyer Savings Account Withdrawal Form.

Q: Who can use Form 41-163?

A: This form is for individuals who have a First-Time Homebuyer Savings Account in Iowa and want to make a withdrawal.

Q: What is a First-Time Homebuyer Savings Account?

A: A First-Time Homebuyer Savings Account is a special type of savings account that allows individuals to save money for the purchase of a first home in Iowa.

Q: What is the purpose of Form 41-163?

A: The purpose of Form 41-163 is to request a withdrawal from a First-Time Homebuyer Savings Account.

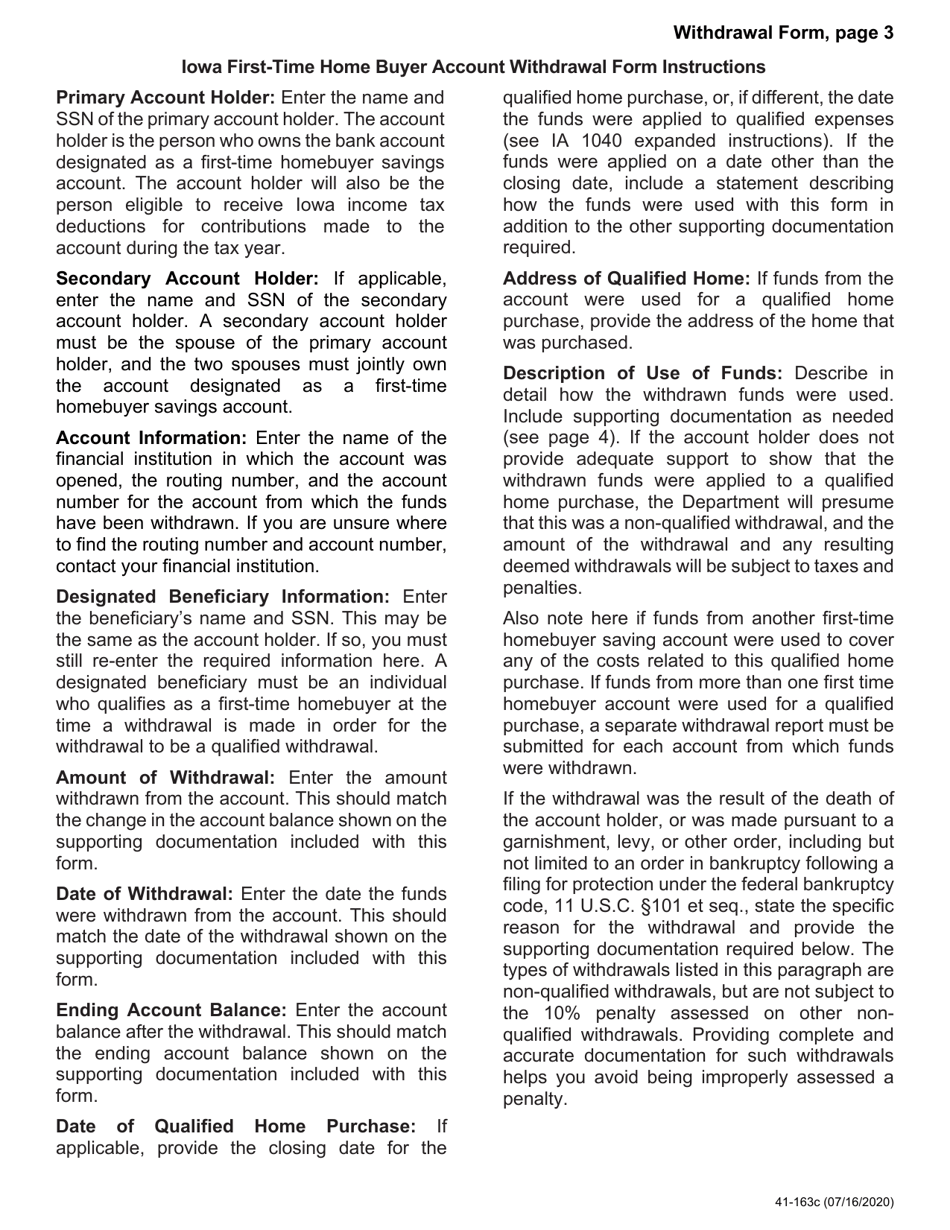

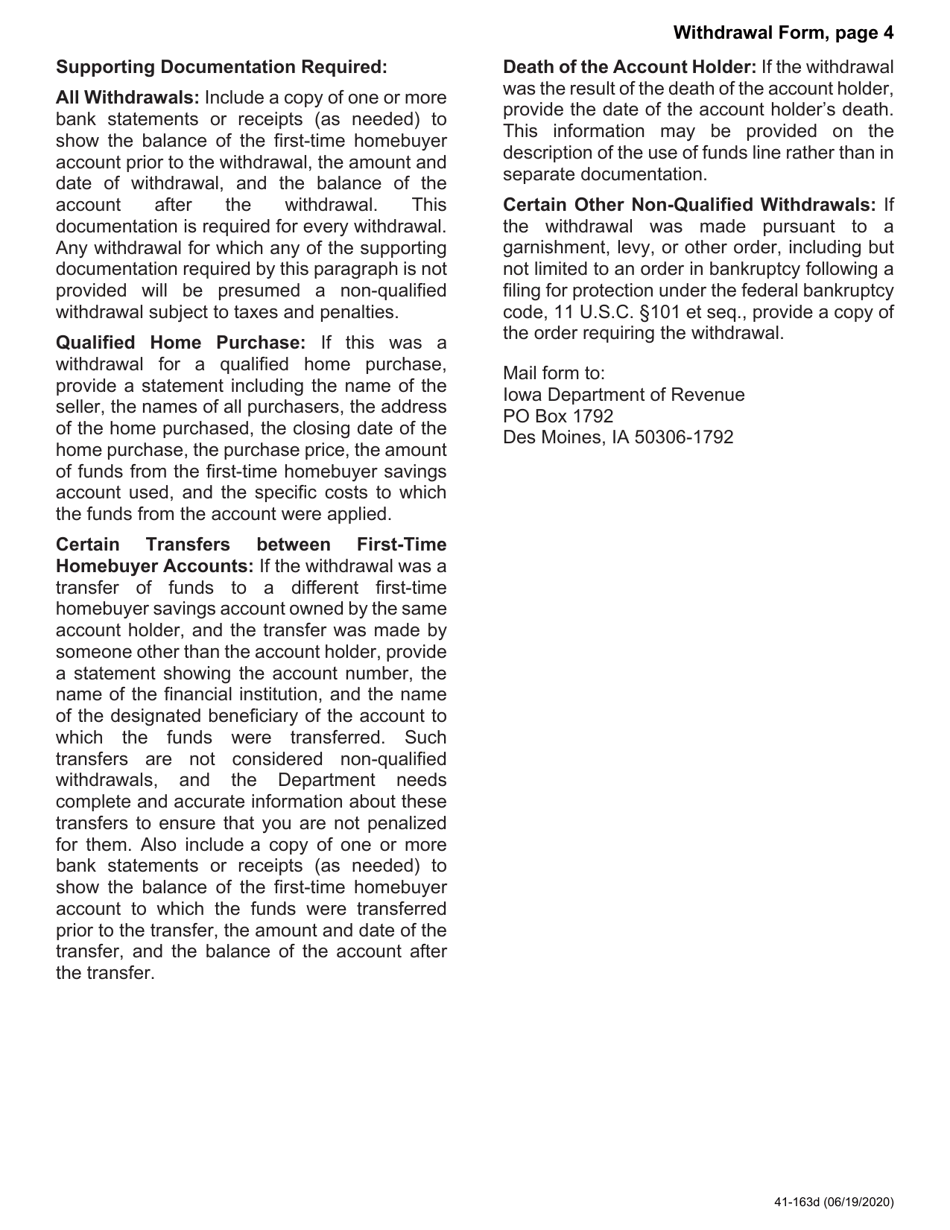

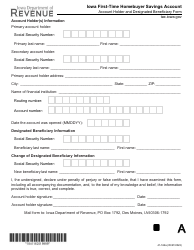

Q: What information is required on Form 41-163?

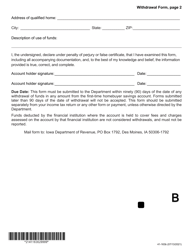

A: Form 41-163 requires information such as the account holder's name, account number, withdrawal amount, and the purpose of the withdrawal.

Q: Are there any fees or penalties for using Form 41-163?

A: There may be fees or penalties associated with the withdrawal from a First-Time Homebuyer Savings Account, depending on the specific account terms and conditions.

Q: Can I use Form 41-163 for multiple withdrawals?

A: Yes, Form 41-163 can be used for multiple withdrawals from a First-Time Homebuyer Savings Account.

Q: Is Form 41-163 only for Iowa residents?

A: Yes, Form 41-163 is specifically for residents of Iowa who have a First-Time Homebuyer Savings Account in the state.

Form Details:

- Released on July 13, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41-163 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.