This version of the form is not currently in use and is provided for reference only. Download this version of

Form 41-164

for the current year.

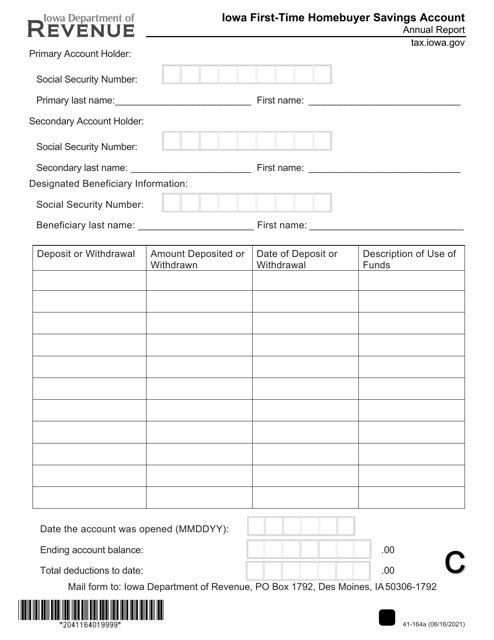

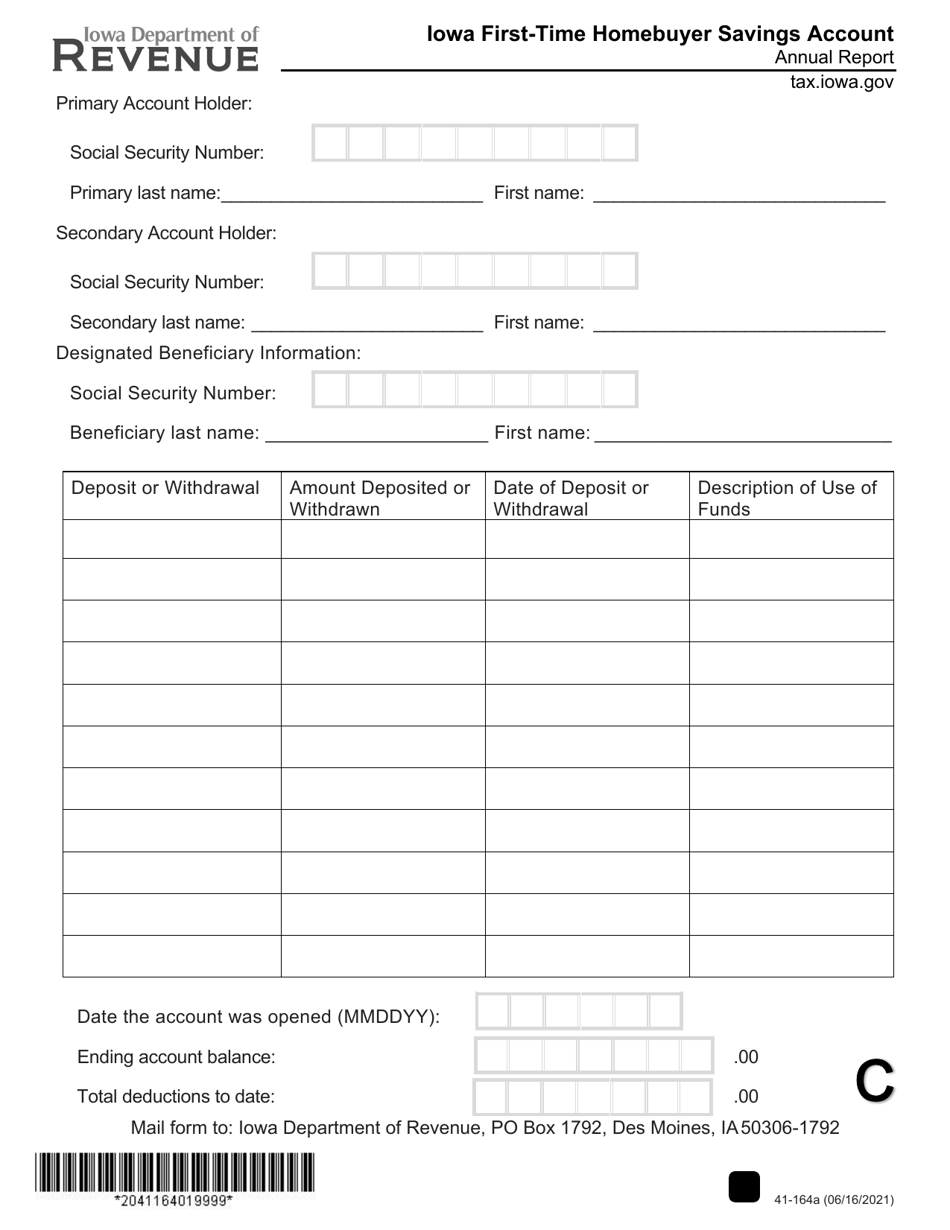

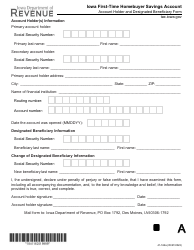

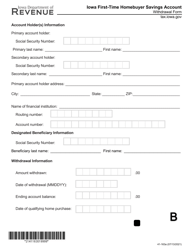

Form 41-164 Iowa First-Time Homebuyer Savings Account - Annual Report - Iowa

What Is Form 41-164?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41-164?

A: Form 41-164 is the annual report for Iowa First-Time Homebuyer Savings Account.

Q: Who is required to file Form 41-164?

A: Individuals or financial institutions that administer Iowa First-Time Homebuyer Savings Account are required to file Form 41-164.

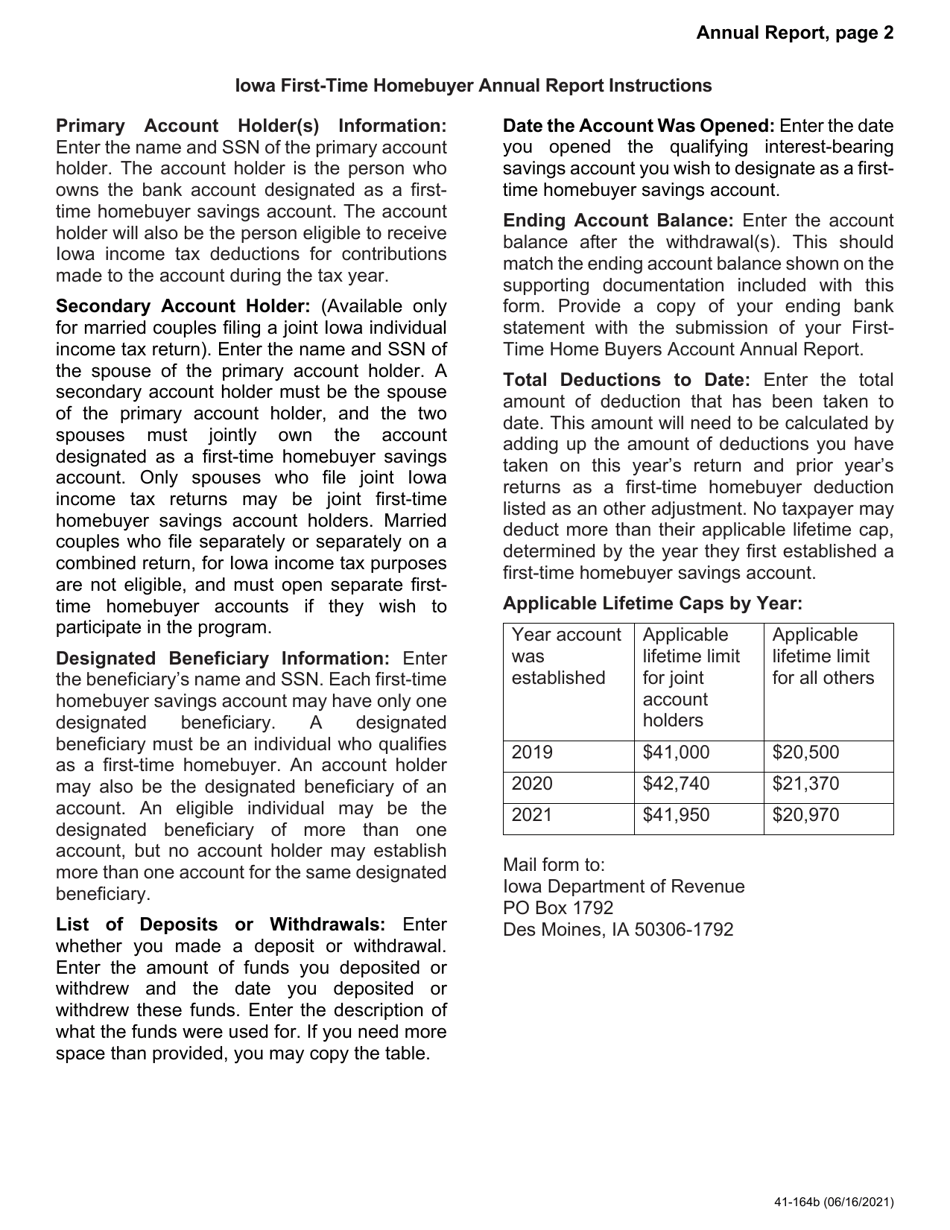

Q: What information is required in the Form 41-164?

A: Form 41-164 requires information about the account holder, account balances, and any distributions made during the year.

Q: When is Form 41-164 due?

A: Form 41-164 is due on or before March 1st of the following year.

Q: Are there any penalties for not filing Form 41-164?

A: Yes, failure to file Form 41-164 or filing it late may result in penalties imposed by the Iowa Department of Revenue.

Q: Can I file Form 41-164 electronically?

A: Yes, you can file Form 41-164 electronically through the Iowa Department of Revenue's eFile & Pay system.

Q: Is Form 41-164 specific to Iowa?

A: Yes, Form 41-164 is specific to Iowa and is used for reporting Iowa First-Time Homebuyer Savings Accounts.

Q: What is a First-Time Homebuyer Savings Account?

A: A First-Time Homebuyer Savings Account is a special savings account in Iowa that allows individuals to save money for their first home and receive certain tax benefits.

Q: What are the benefits of having a First-Time Homebuyer Savings Account?

A: The benefits of having a First-Time Homebuyer Savings Account include potential state tax deductions on contributions and tax-free earnings on the account's growth.

Form Details:

- Released on June 16, 2021;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41-164 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.