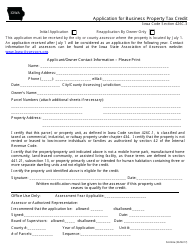

This version of the form is not currently in use and is provided for reference only. Download this version of

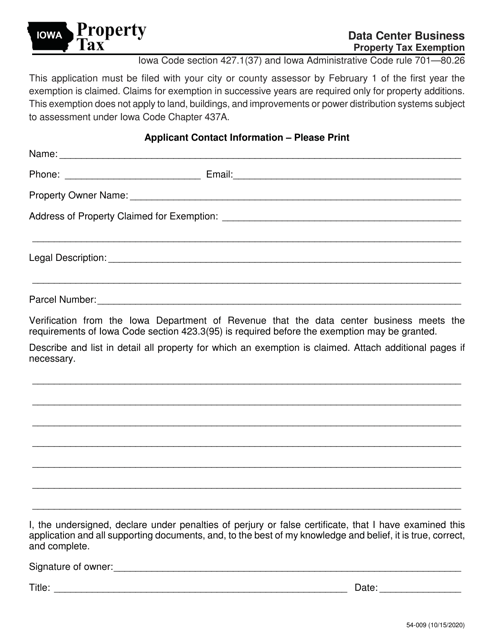

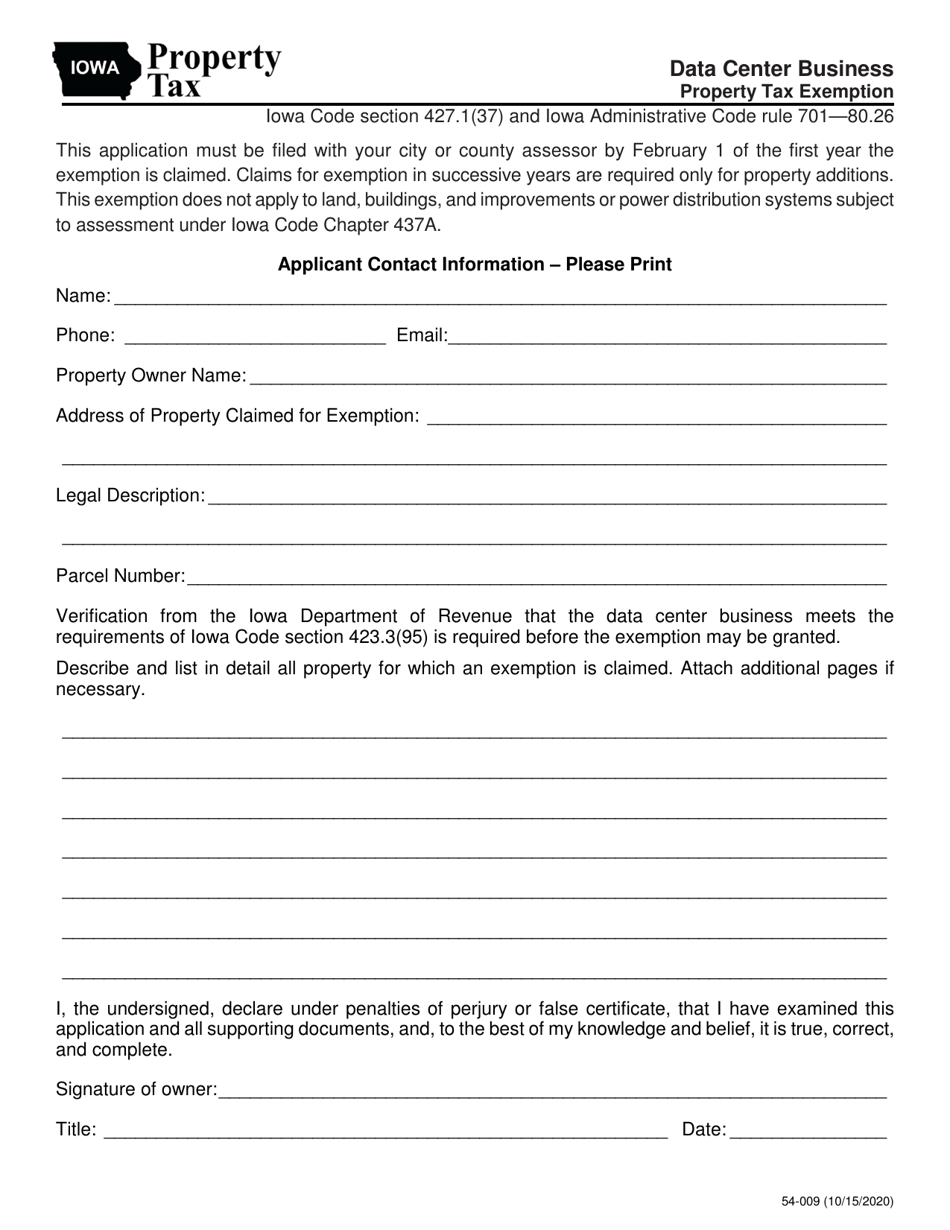

Form 54-009

for the current year.

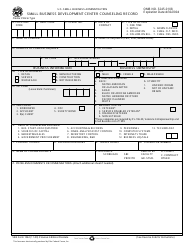

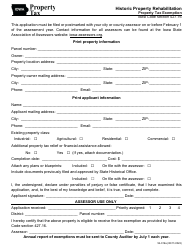

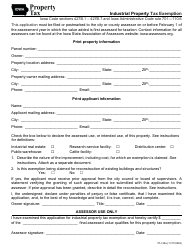

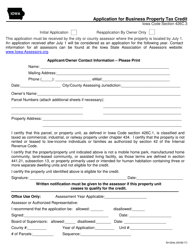

Form 54-009 Data Center Business - Property Tax Exemption - Iowa

What Is Form 54-009?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

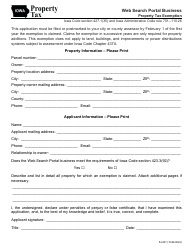

Q: What is Form 54-009?

A: Form 54-009 is a form used for applying for a property tax exemption for a data center business in Iowa.

Q: Who can use Form 54-009?

A: Data center businesses in Iowa can use Form 54-009 to apply for a property tax exemption.

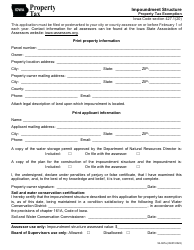

Q: What is the purpose of the property tax exemption?

A: The property tax exemption is designed to incentivize data center businesses to locate or expand in Iowa.

Q: How do I apply for a property tax exemption?

A: You can apply for a property tax exemption by completing Form 54-009 and submitting it to the appropriate authorities in Iowa.

Q: What are the requirements for eligibility?

A: To be eligible for the property tax exemption, your data center business must meet certain criteria, such as investing a certain amount of capital investment in Iowa.

Q: What is the benefit of the property tax exemption?

A: The property tax exemption can provide significant cost savings for data center businesses by exempting them from paying property taxes on qualifying property.

Q: Are there any limitations to the property tax exemption?

A: Yes, there are limitations to the property tax exemption, such as a maximum duration and certain restrictions on types of qualifying property.

Q: Are there any deadlines for submitting Form 54-009?

A: Yes, there are deadlines for submitting Form 54-009, so make sure to check the specific requirements and timelines provided by the Iowa Department of Revenue.

Q: What happens after I submit Form 54-009?

A: After you submit Form 54-009, the authorities will review your application and determine if your data center business is eligible for the property tax exemption.

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 54-009 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.