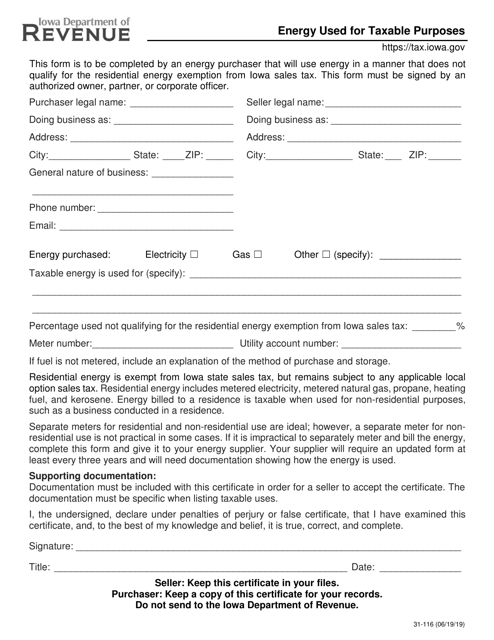

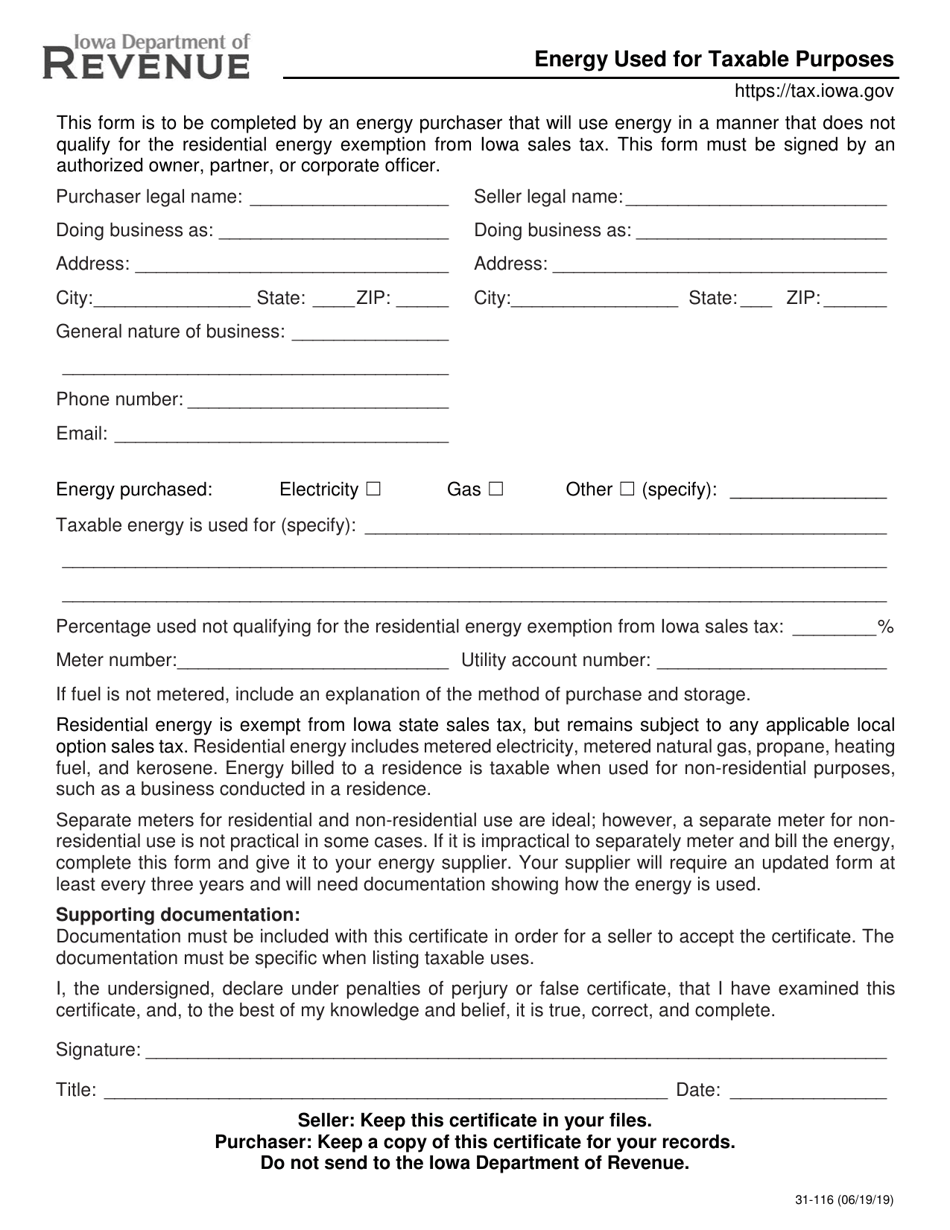

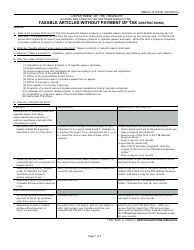

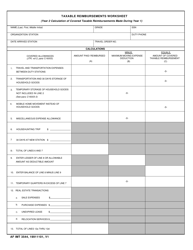

Form 31-116 Energy Used for Taxable Purposes - Iowa

What Is Form 31-116?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 31-116?

A: Form 31-116 is a form used in Iowa to report energy used for taxable purposes.

Q: Who is required to file Form 31-116?

A: Businesses in Iowa that use energy for taxable purposes are required to file Form 31-116.

Q: What is considered taxable energy use?

A: Taxable energy use includes energy used for manufacturing, processing, fabricating, or refining tangible personal property in Iowa.

Q: How often do I need to file Form 31-116?

A: Form 31-116 should be filed annually.

Q: Are there any penalties for not filing Form 31-116?

A: Yes, there are penalties for failure to file Form 31-116, including monetary fines and potential legal consequences.

Q: What information do I need to complete Form 31-116?

A: To complete Form 31-116, you will need information on the energy sources used, the amount of energy used, and the purpose for which it was used.

Q: When is the deadline to file Form 31-116?

A: The deadline to file Form 31-116 is typically on or before the last day of the fourth month following the end of the tax year.

Q: Can I claim any credits or deductions on Form 31-116?

A: No, Form 31-116 is used solely for reporting energy used for taxable purposes and does not provide for any credits or deductions.

Form Details:

- Released on June 19, 2019;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 31-116 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.